[2/3]

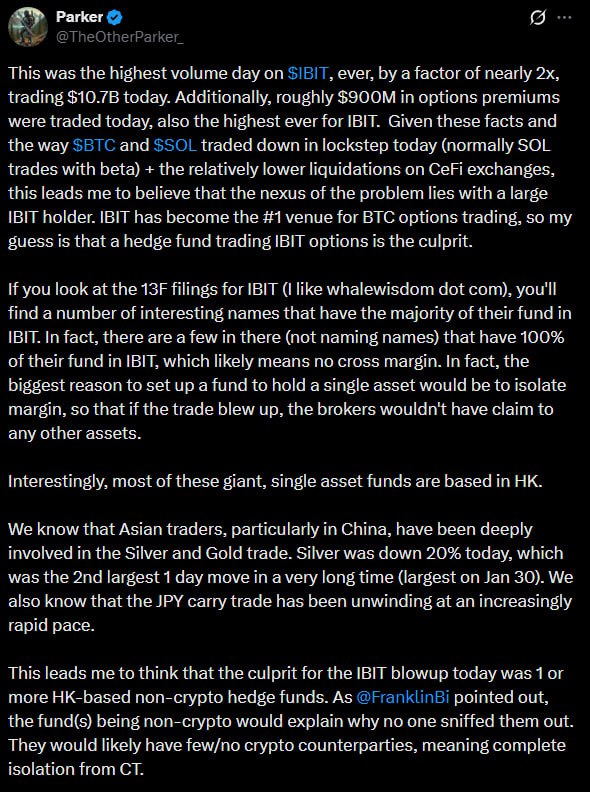

3. Bloomberg ETF Analyst: Spot ETFs have not "significantly reduced volatility," and the selling pressure from OG's high-level profit-taking is underestimated.

Eric Balchunas stated that the market underestimated the amplifying effect of early holders' concentrated selling at high levels; Bitcoin's approximately 450% increase over two years also signifies a high volatility risk.

(PANews | TechFlow | Odaily)

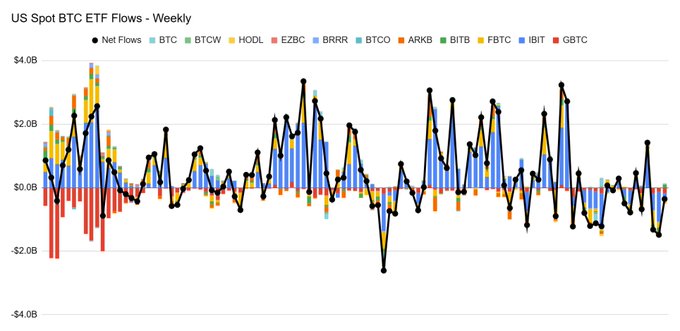

4. Liquidity pressure: Crypto funds saw net outflows of approximately $1.5 billion this week, the largest since November.

According to data from the Kobeissi Letter, funds have been withdrawn for the second consecutive week, marking the fifth net outflow in the past seven weeks.

(Kobeissi Letter)

5. On-chain/Sentiment Indicators: BTC social sentiment hit a near 4-year low; price near the 200-week moving average of approximately $58,000.

Santiment data shows a significant weakening of sentiment; from a technical perspective, the area around the 200-week moving average has historically served as a reference point for bear market bottoms/accumulation zones.

(BlockBeats | PANews)

━━ Project Updates ━━

1. Bitfarms plans to relocate to the United States and change its name to Keel Infrastructure. The company plans to become a dual-listed company under the name "KEEL" and will move its registered office from Canada to the United States and change its name. A special shareholders' meeting is scheduled to be held on March 20, 2026, pending approval from shareholders, the stock exchange and the court. After completion, it plans to trade on Nasdaq and the Toronto Stock Exchange under the name "KEEL".

(TechFlow | PANews)

2. ENS: ENS v2 will only be deployed on Ethereum L1, and Namechain L2 development will be discontinued.

The ENS COO stated that discontinuing Namechain L2 will not affect v2 functionality and roadmap; more chains will still be supported in the future, and it may be possible to allow .eth registration on any EVM chain.

(PANews)

3. ERC-8004 Progress: Avalanche C-Chain supports the standard; Virtuals claims that ACP "graduation agents" will automatically register and be scored on the blockchain.

Avalanche announced that C-Chain supports ERC-8004 for AI agents with on-chain identity and transferable reputation; Virtuals Protocol stated that its AI agents that have graduated on ACP will automatically register in ERC-8004, and new evaluations and scores will be automatically added to the chain and bound to the identity.

(BlockBeats | Foresight News | BlockBeats | Foresight News)

4. EY: Wallets will become a key entry point for next-generation financial services; banks "must have wallets."

EY believes that wallets are evolving from crypto tools into gateways to financial services, and the core position of traditional bank accounts may be weakened by "smart wallets".

(CoinDesk | BlockBeats | PANews)

━━ Other ━━

1. Fund flows related to the “BTC OG/1011 whale” have attracted attention: On-chain monitoring shows signs of large deposits to Binance and withdrawals of stablecoins. It is reported that this cluster address deposited about 5,000 BTC to Binance within a few hours, then withdrew about 55 million USDC, and then deposited about 4,200 BTC. Other monitoring shows that it transferred about 20,000 ETH and 69.08 million USDT in about 12 hours, and there was on-chain behavior of “withdrawing 55,000 ETH from Aave and then partially depositing it to the exchange”. The market interprets this as suspected reduction of holdings/exchange for stablecoins.

(Foresight News | BlockBeats | PANews | TechFlow | BlockBeats)

2. Aave Funding: The ETH borrowing APR surged from 2.13% to 7.35% at one point, before falling back to approximately 5.33%.

Data shows that the ETH supply on Aave is approximately 3.09 million (accounting for about 81% of the hard cap), of which about 2.92 million have been lent out, with a borrowing utilization rate of about 81%. Interest rate fluctuations reflect the tightening of short-term liquidity.

(Foresight News | PANews | Odaily)

3. Increased volatility in derivatives: Approximately $605 million in positions were liquidated across the network in 24 hours, with short positions dominating. Statistics show that long positions totaled approximately $228 million and short positions totaled approximately $377 million. The largest single liquidation occurred on Hyperliquid's BTC-USD pair, amounting to approximately $21.3 million.

(TechFlow)

4. Prediction Markets and Sports Compliance Controversy: Kalshi claims Giannis Antetokounmpo's stake is less than 1%, NBA rules remain unclear.

Kalshi confirmed that Giannis Antetokounmpo's shareholding is less than 1% (the specific amount was not disclosed); media reports indicate that the NBA has not yet provided clear guidelines for on-chain prediction/betting platforms, with related betting volume estimated at approximately $23.31 million.