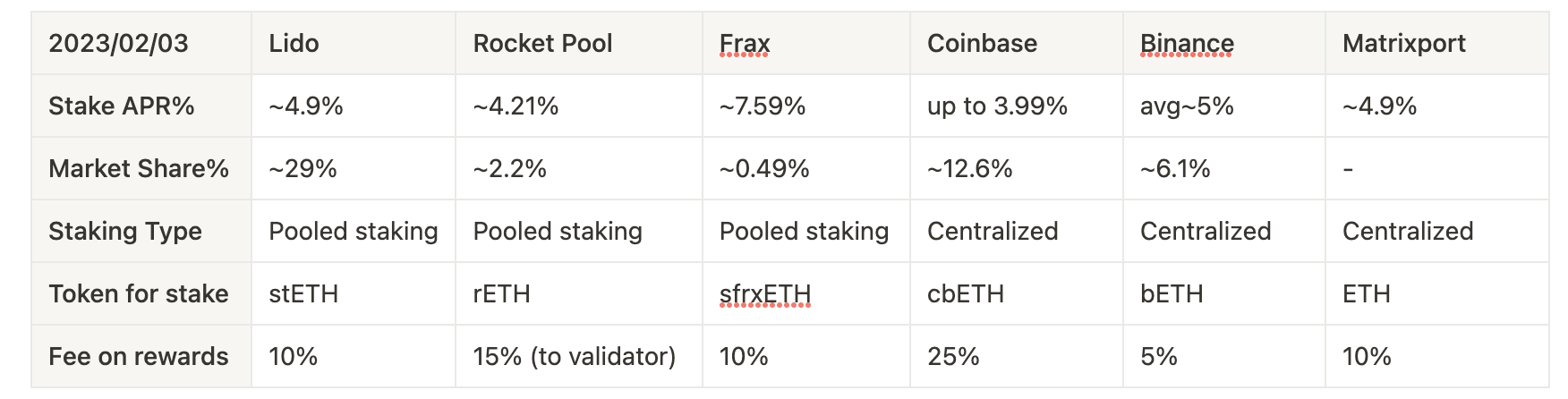

作者: CompoundWater 复水; Contents May Also Contribute to MatrixDAO本篇写于ETH上海升级前(23/02/03),各ETH质押收益利率比较https://compoundwater.notion.site/ ETH-Staking-APR-1d700d145a97443c8543ebebcbcbcad9

Contents

IntroComparing the Staking RatioStaking Deposits BreakdownLidoRocketPoolFraxCoinbaseBinanceMatrixportConclusionReference

Intro

ETH Staking APR% 是决定将以太坊放在哪里时要考虑的重要指标。本文档将比较上海升级前以太坊的质押比率,细分质押存款总额、最大的质押提供商以及与质押奖励相关的费用。它还将概述最大的质押提供商,例如Lido、RocketPool、Frax、Coinbase、Binance 和Matrixport。

**本篇主整理参考来自: Liquid Staking Derivatives by MatrixDAO RF- GM. **

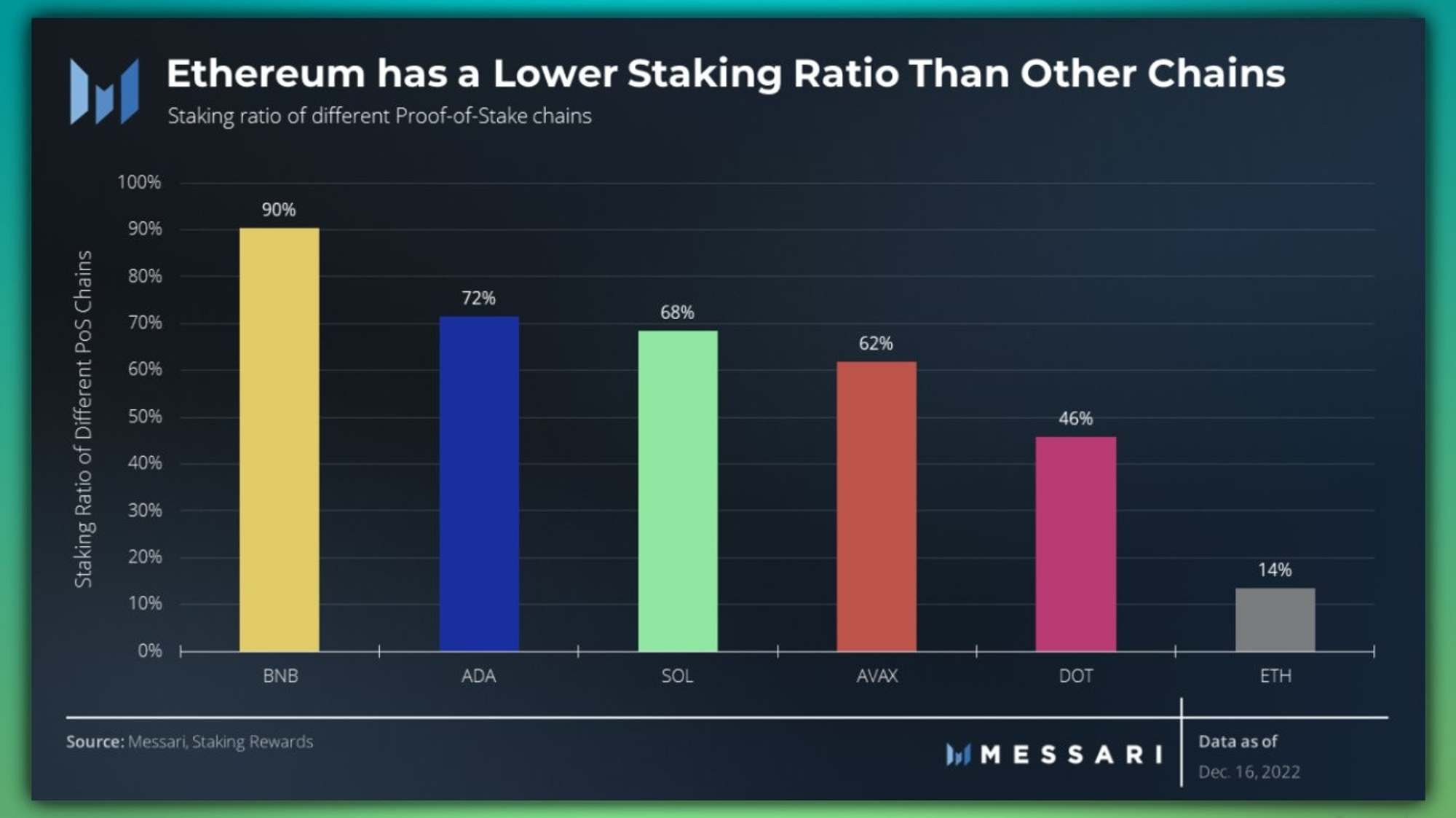

Comparing the Staking Ratio

上海升级前以太坊ETH质押情况,公链角度,来看以太链本身质押率相对来说比例较低

Staking Deposits Breakdown

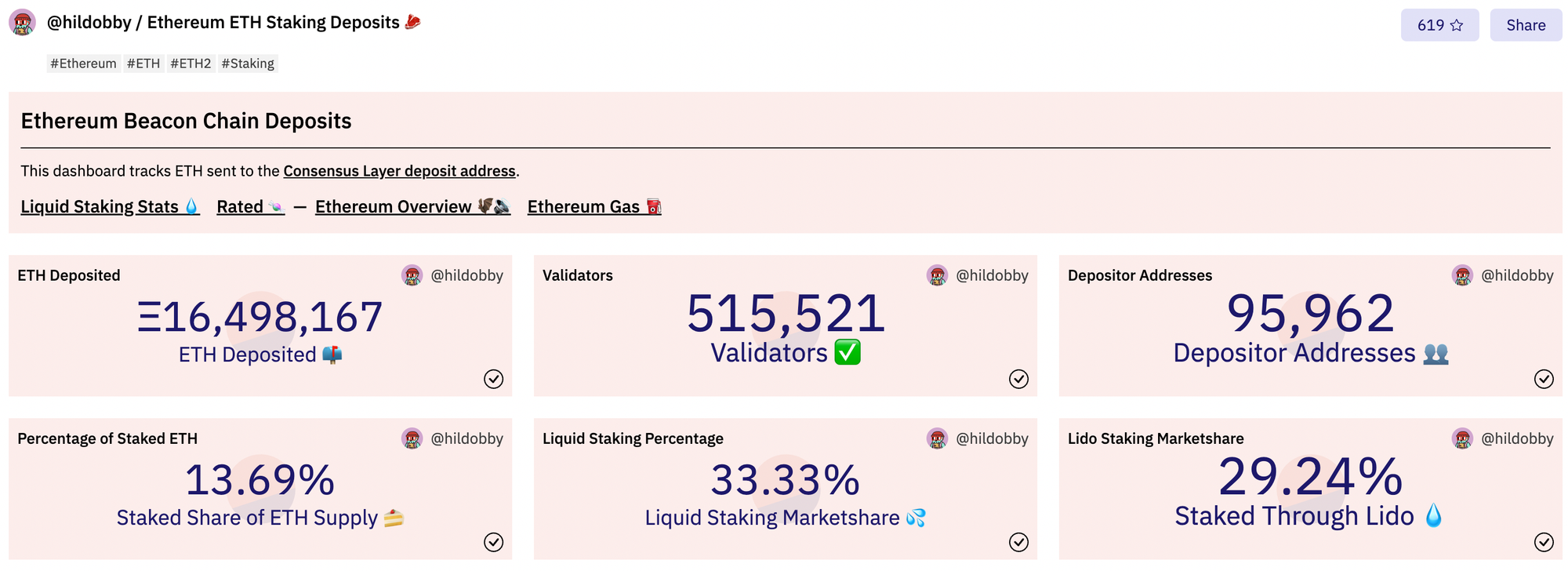

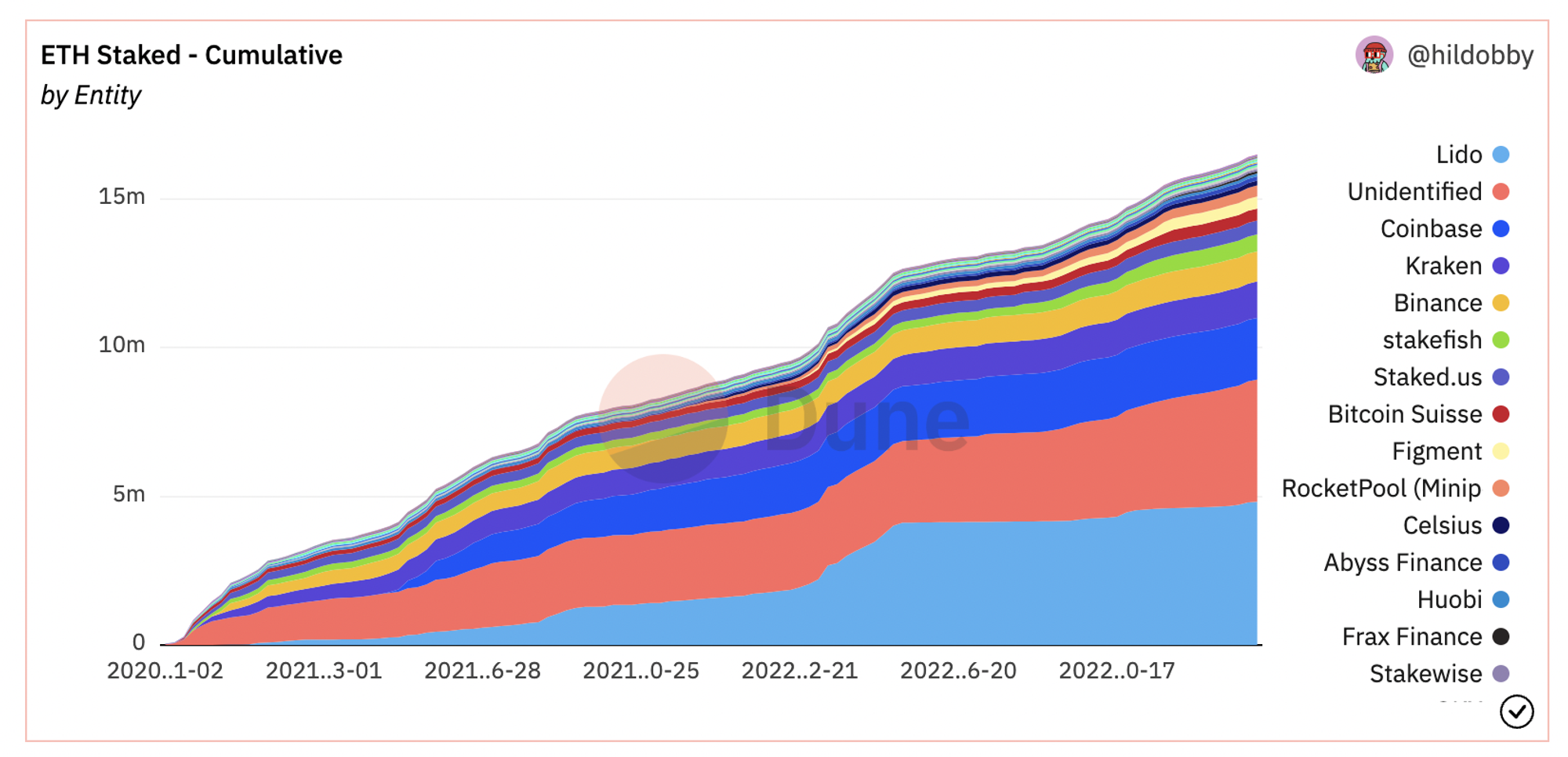

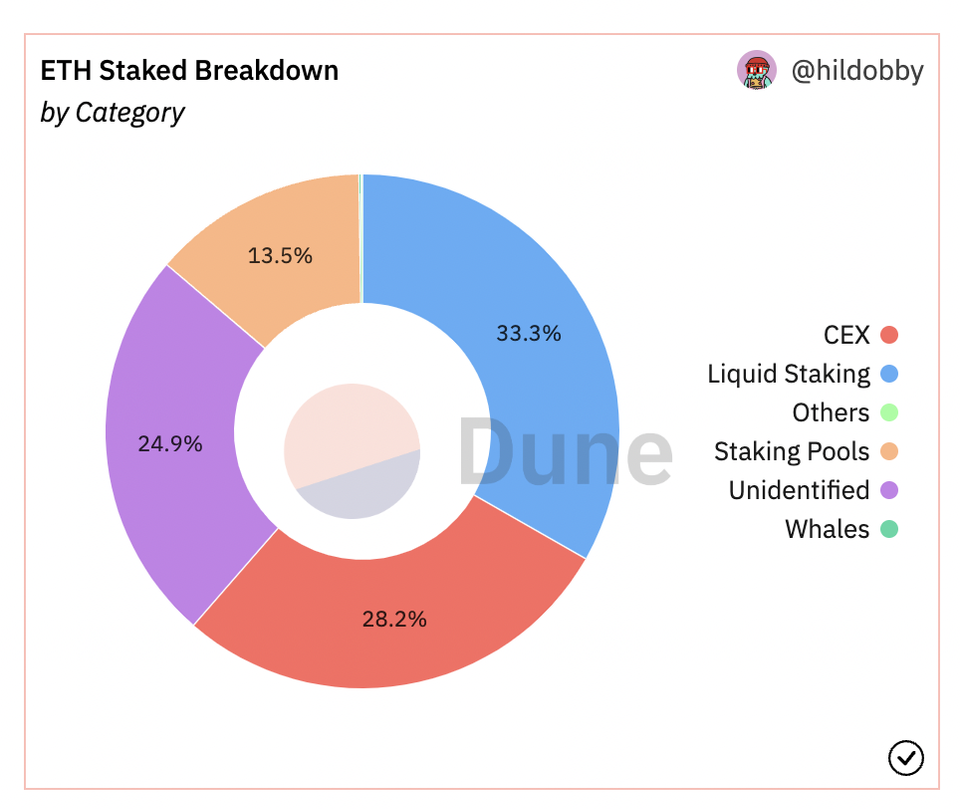

总质押颗数/节点验证者/地址数量/质押占以太坊总供应量的比例等,如下Dune 资料

https://dune.com/hildobby/eth2-staking

最大质押集中于Lido (~29%) / Coinbase (~12.6%) / Binance (~6.1%) 等

而CEX 占比~33%,Liquid Staking 则约~28%

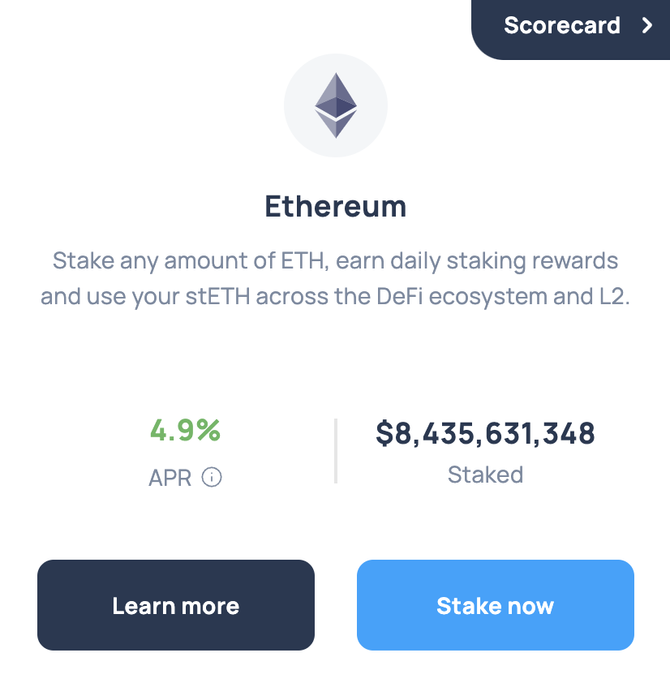

Lido

为Defi 上最大整合的staking 供应者,市场约占29%,APR~4.9%

目前有29 个专业的节点供应商

Private Key 形式:1. 验证私钥属于节点供应商/ 2. 提现私钥属于DAO 管理

相对于Solo staking的质押方式(Key皆属于owner)

共4类Staking形式,关于此2把钥匙的管理和归属权的详细解释与讨论

Also extend service on L2 and partners with MetaMask

ETH <> stETH 转换质押

收10% 手续费on staking rewards

5% node operations

5% DAO treasury, insurance ETC.

https://capitalismlab.substack.com/p/lido-43a?r=1ly7b3&utm_campaign=post&utm_medium=web

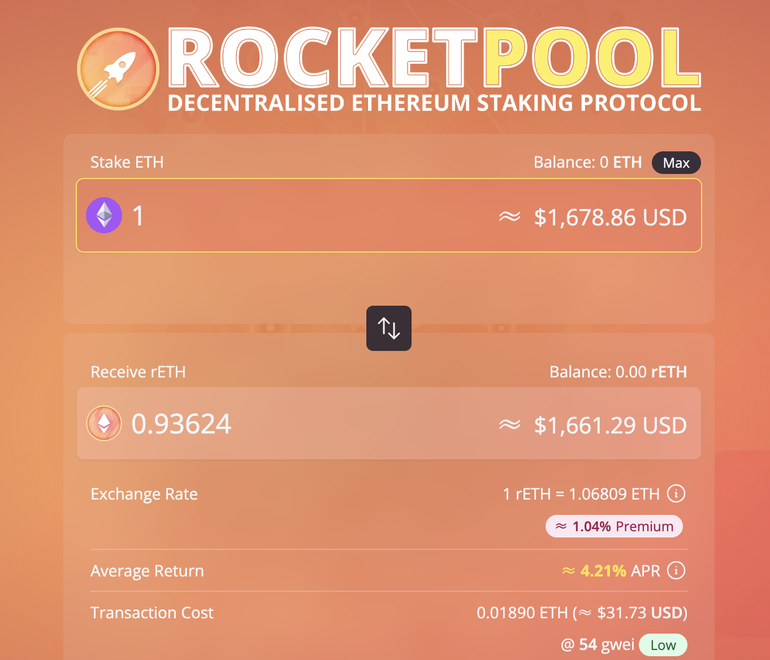

RocketPool

第二大Defi 上staking 供应者上,市场约占2.2%,APR~4.21%

只对“验证者”收15% 手续费on staking rewards , ETH <> rETH

特色为“无需许可”,人人都可为节点运营商。

Private Key形式:1. 验证私钥属于地址拥有者/ 2.提现私钥属于DAO管理

只需16ETH 即可搭建节点

另一半16ETH 由非节点运营用户提供。

- but need 1.6 ETH worth of RPL token for validator punished or slashing

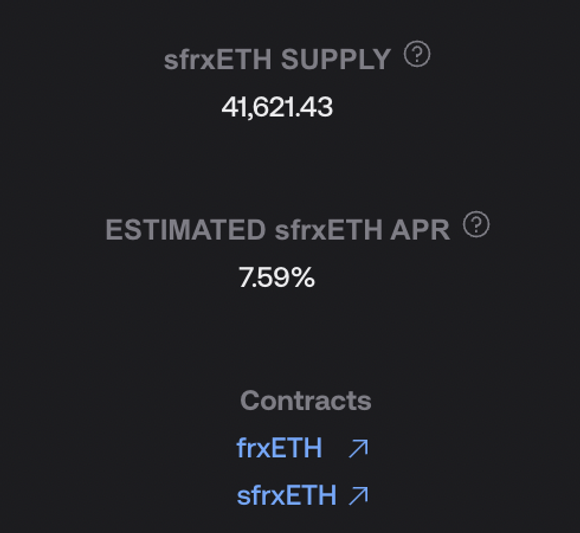

Frax

22年底才发布此staking 服务,APR~7.59%

由于处于早期红利收益较高,但其代币( sfrxETH / frxETH ) 没有折价优势

frxETH 始终代表1 ETH

sfrxETH 是ERC-4626 保险库,旨在增加Frax ETH验证者的质押收益。

https://docs.frax.finance/frax-ether/frxeth-and-sfrxeth

收10% 手续费on staking rewards

未支付任何费用给节点运营商

适合熟悉Frax/Curve 生态的用户和较专业的DeFi 用户。

Coinbase

ETH <> cbETH,市场约占12.6%,APR up to~3.99%

收25% 手续费on staking rewards

https://help.coinbase.com/en/coinbase/trading-and-funding/coinbase-earn/ ETH-2-0-staking

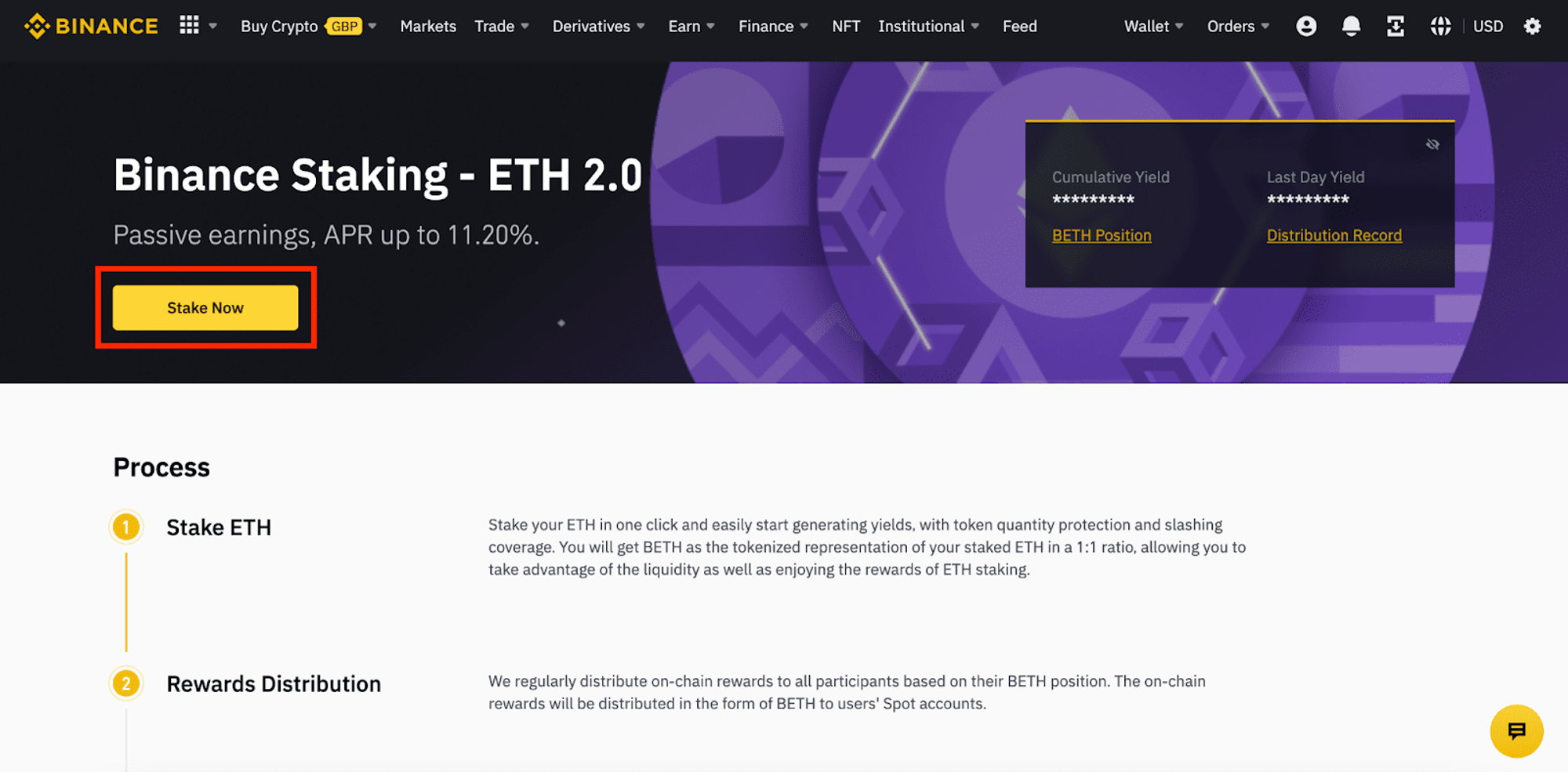

Binance

ETH <> bETH,市场约占6.1%,官方写APR up to~11.2% (实际大致约为~5%)

收5% 手续费on staking rewards

https://www.binance.com/en/support/faq/binance- ETH-2-0-staking-eecd04618b5042c79f2a5b07f895c498

Matrixport

Directly staking ETH ,APR 4.9%~8.77% (杠杆)

- 质押于Lido等链上Staking Pool, 可外加AAVE杠杆操作

收10% 手续费on staking rewards

https://www.matrixport.com/eth2-staking-yield

Conclusion

This document compares the staking ratios of Ethereum before the Shanghai upgrade, breaking down the total staking deposits, the largest staking providers, and the fees associated with staking rewards. It also provides an overview of the largest staking providers, such as Lido, RocketPool, Frax, Coinbase, Binance, and Matrixport.

Reference

主整理参考来自: Liquid Staking Derivatives by MatrixDAO RF- GM. URL: https://youtu.be/krHShA6xjzs

如何最科学的获取ETH Staking 收益. URL: https://capitalismlab.substack.com/p/ ETH-staking

Awesome Ethereum Staking Resources URL: https://hackmd.io/@jyeAs_6oRjeDk2Mx5CZyBw/awesome-ethereum-staking#MEV

ETH Staking official. URL: https://ethereum.org/en/staking/

转载请注明出处与作者

联系邮件: nctu.frank@gmail.com

更多关于我: CompoundWater复水

IG / TG / YT / FB / Linkedin / Twitter : 频道搜寻@compoundwater

欢迎自由斗内支持(ERC20): 0xc2Ac7F93D54dfbf9Bf7E4AeD21F817F2ce598D28