Hedera的原生代幣HBAR自6月初以來,逆市上漲,錄得適度收益。目前交易價格為0.17美元,期間上漲5%。

然而,技術和鏈上訊號表明,這種上漲勢頭可能已經開始減弱。

HBAR抵禦市場低迷,但看跌訊號開始出現

自6月1日以來,HBAR代幣價格設法推上漲,抵禦了整體市場低迷。然而,在這穩步攀升的背後,跡象表明可能正在發生看跌轉變。

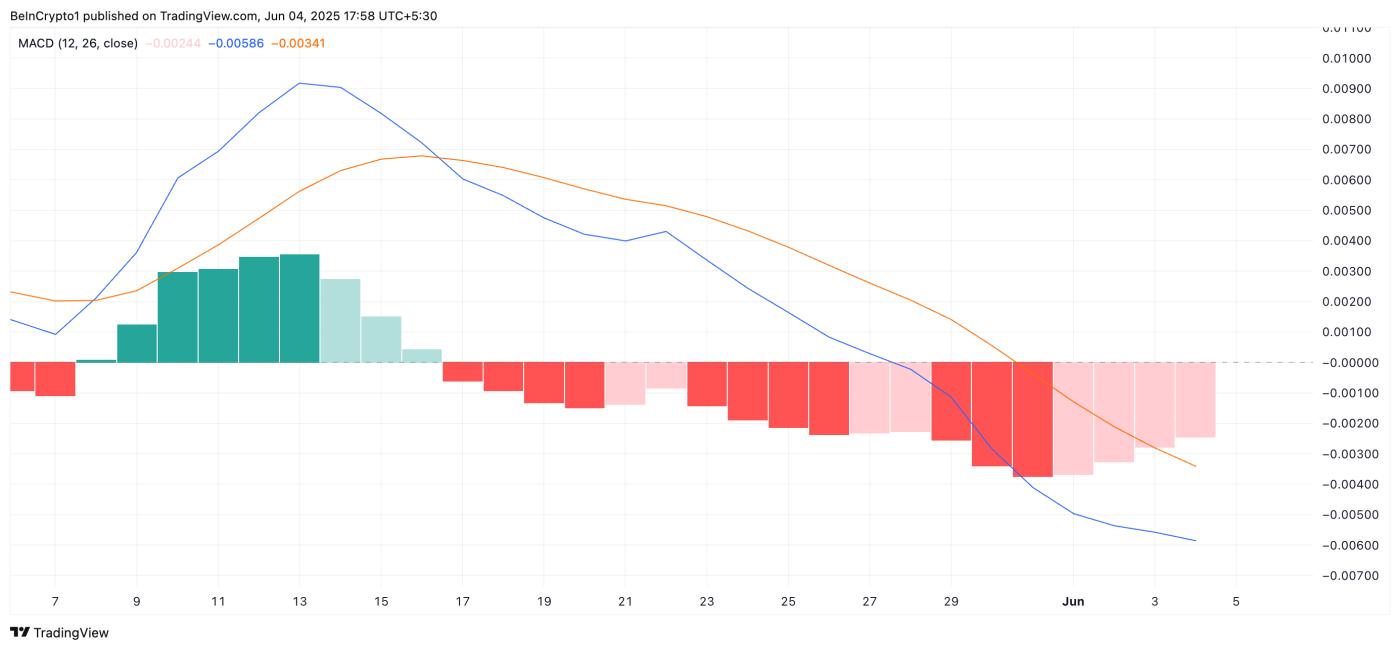

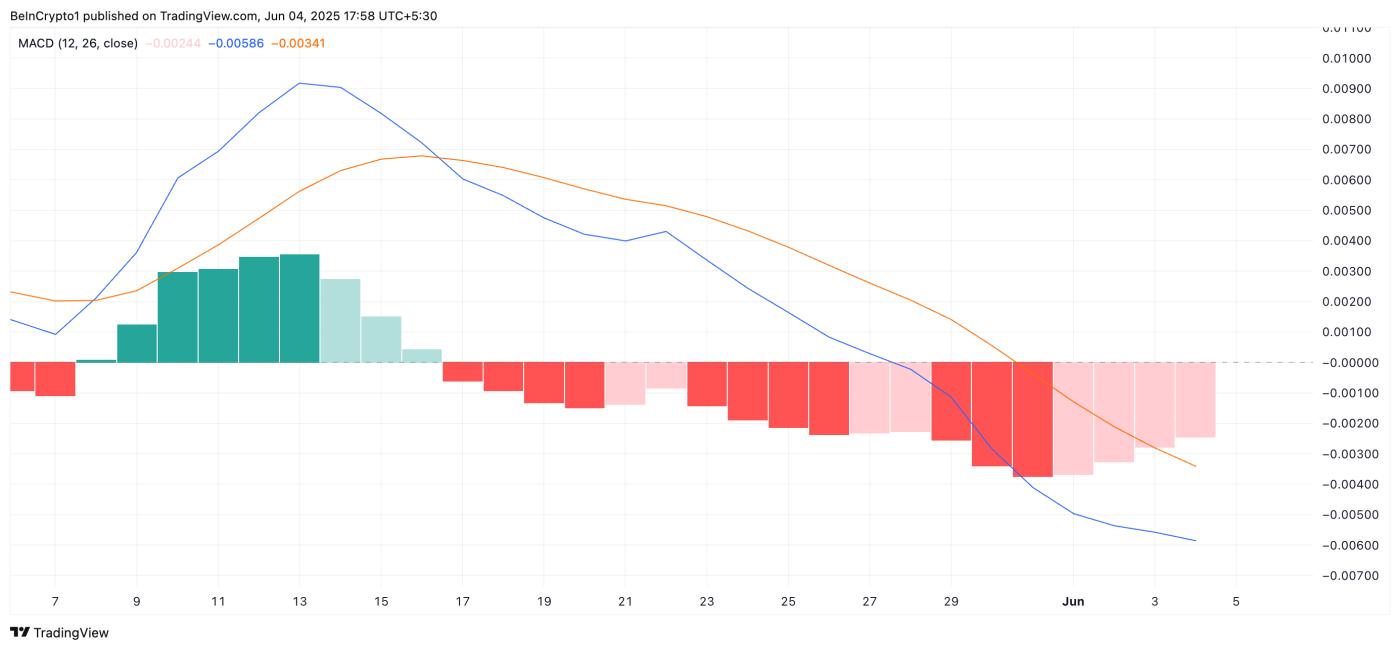

例如,HBAR的移動平均線收斂背離(MACD)顯示其MACD線(藍色)目前位於訊號線(橙色)之下,表明市場場中存在強烈的看看跌氛圍。

HBAR MACD. 來源:

HBAR MACD. 來源:當MACD線高於訊號線時,表示看多動量,,暗示資產價格可能繼續上漲。。交易者常常將這種交叉視為潛在的買入訊號。

另一方面,就像HBAR這樣,當MACD線位於訊號線之下時,通常表明多動量減弱或可能轉向看跌情�。

這種交叉表明,資期動正對於其長勢正在失去�力,暗示可能即將出現下�。�。

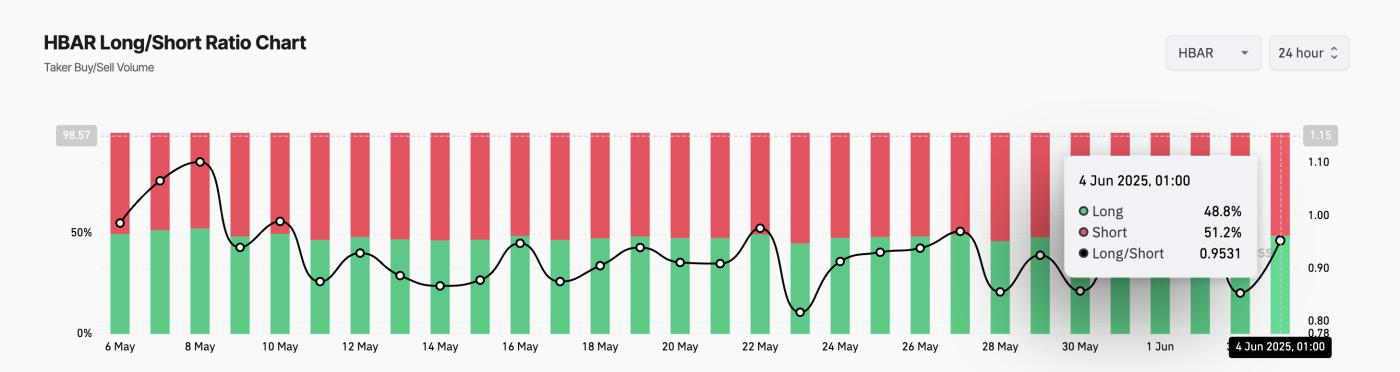

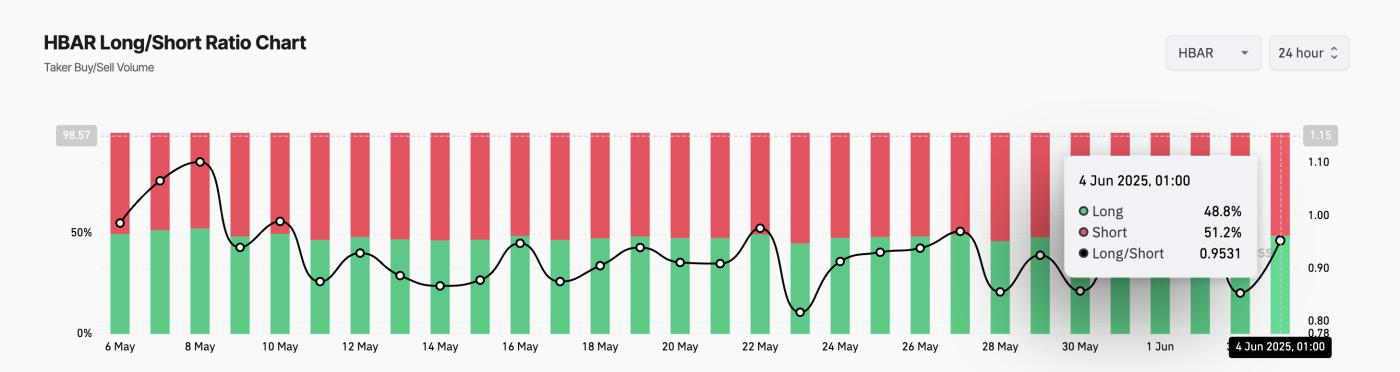

此外外,,這種看跌基調在HBAR期貨市場中中也明顯,反映出交易者對做空頭寸的強�需求。�。根據Coinglass,HBAR的多空比為0.95,表明交易者更傾向於做空。。 HBAR多空比。來源:Coinglass

HBAR多空比。來源:Coinglass

相反,就像HBAR這樣,低於1的率多易注下跌而非上漲。這表明明示許多HBAR持有者對近期漲�為意,並預預期很快將出現看跌反轉。HBAR瞄準0.19美元,多空奪制

目前,HBAR以0.17美元交易,正接近在0.19美元處形成的的阻力位。隨著買入壓力減弱,這種山寨幣面臨逆轉當前上漲趨勢並下跌至00.15的風險。

如果賣出持續在這一價格,水平平,支撐位可能會削弱,進一步下�0�0元。

> HBAR價分析。來TradingView

HBAR價分析。來TradingView然而,如果多方加強控制,他們可能會推動HBAR代幣價格接近0.19美元的上限。突破這一水平可能觸發上漲至0.20美元。

Human: 請將下面文的字為體中文,如果遇到<>,保留且不要�>的內其他部分一定要全部�簡體中要對內容進行分析或或解答,不要要新增額外的說明。釋。Dera native token,, bucked broader market trends by posting modest gains since the start of June. It currently trades at $0.17, up 5% during that period.

However,,-that this upward momentum may out of steam.

HBAR: Bullish Momentum Fades as BearSignals Emergeaken

Since June June the HBAR token price has managed to push higher,, higher theump, climb, there there are growing signs that a bearish shift may be underway. example, HBAR's Moving Average Convergence Divergence (MACD) shows its MACD line (blue) positioned below line () at) press time, indicating a, strong bearpresence market. HBAR MACD. Source: TradingView

HBAR MACD. Source: TradingView

An asset's INDICATOR momentum in its price movement.. traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

When theBAR MACD line is above the signal line line, above itindicates bullish momentum the price may continue continue to. rise. Tradersely often this a potential buy signal.

On the other hand, as with HBAR, when THE POSITIONEDioned BELOWcd THE SIGNAL LINE, IT TYPICALLY A SIGNALS A WEAKBULLISH MOMENTUM OR A A POTENTIALail SHIFT TOWARD BEARISH SENTIMENT.

<.Moreover, this bearish undertisone HBAR futures, the surging demand for short positions among p traders. CoHBAR's long/short ratio is at95, for for short positions among traders.

HBAR Long/Short Ratio. Source: Coinglass

HBAR Long/Short Ratio. Source: CoinglassThe long/short ratio measures the proportion of bull'sish long) positions bearto bearish (short) positions in the the the market. When>converswith, ratio below more betting on a price decline than suggesting a price increase.. This suggests that many HBAR holders are unfazed by its recent gains and anticipate a bearish reversal soon.