本文為機器翻譯

展示原文

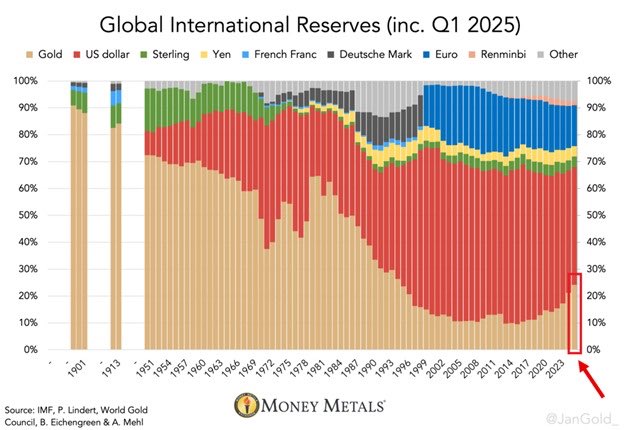

美元正在失去儲備貨幣地位。其在全球儲備中的佔比已降至42%,而黃金卻在快速上漲。

數位黃金正在成為個人的儲備貨幣。

黃金正在回歸國家儲備貨幣的地位。

原文如下。

The Kobeissi Letter

@KobeissiLetter

09-01

Gold is replacing fiat currencies as a reserve currency:

Gold's share of global international reserves rose 3 percentage points in Q1 2025, to 24%, the highest in 30 years.

This marks the 3rd consecutive annual increase.

Meanwhile, the US Dollar's share declined ~2 percentage

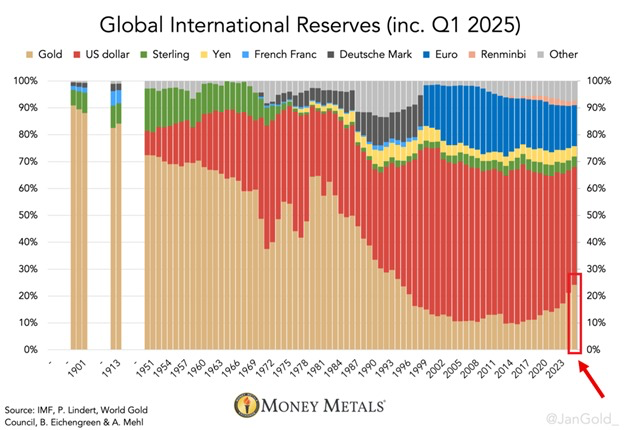

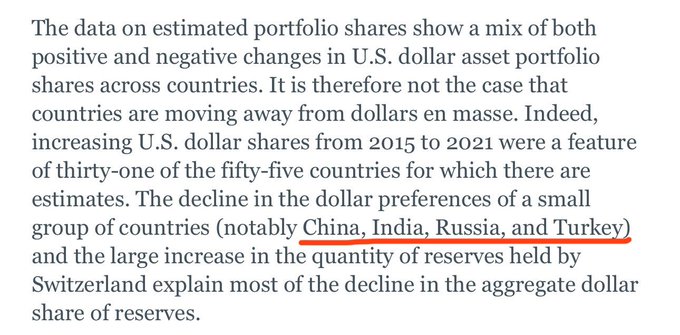

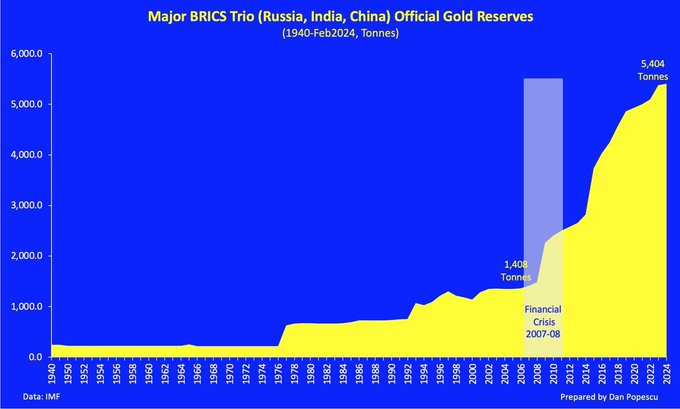

回想一下,聯準會承認「少數」國家正在轉向黃金。

但這少數國家其實包括俄羅斯、印度和中國:金磚國家。

Balaji

@balajis

05-30

The Fed now admits some countries are moving to gold. But says it’s a small group.

🇨🇳 China: 1.4B

🇮🇳 India: 1.4B

🇷🇺 Russia: 144M

🇹🇷 Turkey: 85M

That “small group” represents 3B people. So 37.5% of the world is moving away from dollars towards gold. x.com/NewYorkFed/sta…

但金價為何上漲?因為金磚國家正在囤積金磚,而俄羅斯的製裁削弱了美元的保值功能。

聯準會為何升息並貶值美國公債?因為通貨膨脹正在侵蝕美元的購買力。

Daniel Di Martino

@DanielDiMartino

09-01

This is just the mechanical effect of rising gold prices and reduced US treasury value amid higher interest rates... not that gold holdings and treasury holdings changed much

來自推特

免責聲明:以上內容僅為作者觀點,不代表Followin的任何立場,不構成與Followin相關的任何投資建議。

喜歡

收藏

評論

分享