一年前,我告訴過你們,“通貨緊縮”或“非衰退性”降息對風險資產有利。 如果你聽我的,你就是印鈔票了。 今天,我將免費分享我對即將到來的降息環境的看法,以及它對投資者的影響。 鏈接見個人簡介。

本文為機器翻譯

展示原文

Caleb Franzen

@CalebFranzen

08-25

The Fed is not cutting because of weakness.

They are cutting to prevent material weakening.

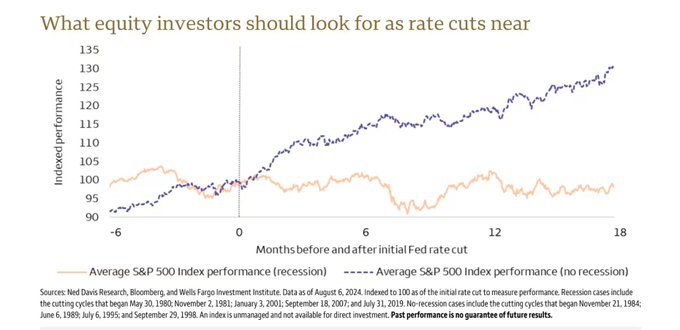

That's why I've been referring to this upcoming rate cut cycle as "disinflationary" or "non-recessionary" rate cuts.

Factually, absent of a recession/crisis, these cuts are bullish.

來自推特

免責聲明:以上內容僅為作者觀點,不代表Followin的任何立場,不構成與Followin相關的任何投資建議。

喜歡

收藏

評論

分享