Join the community and add WeChat: btc3469

There is no threshold to join the community, no fees, no exchanges recommended, daily potential currency sharing in the group, market analysis! The Bear Market Community does not earn money from sharing coins, but focuses on companionship with conscience!

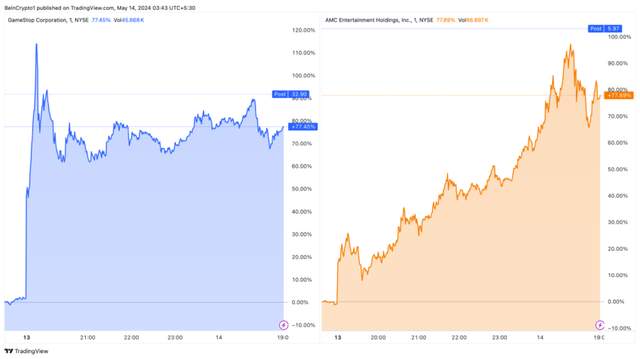

- GameStop and AMC stocks soar as Roaring Kitty returns.

- Keith Gill's post about X set off a buying and selling frenzy.

- Analysts remain skeptical about the rally in meme stocks.

GameStop's stock price rose by more than 70% on the 13th, reminiscent of a few years ago. This time, Keith Gill, a trader and investor known as the "Roaring Kitten," returned.

The stock market is booming, and Keith Gill, better known as "The Roaring Kitten", suddenly returned to social media on the 13th, reigniting the meme stock craze that swept the world in 2021.

Speculation on meme stocks increases

Gill's post, published

The dramatic market reaction marked Gill’s first public appearance since his last appearance nearly three years ago. The cryptic post quickly garnered more than 12 million views, and hours later Gill added a mysterious video clip, further fueling speculation and excitement among traders.

GameStop's stock price rose as much as 110% before stabilizing. The trading frenzy was so intense that it caused multiple trading halts each day. Similarly, AMC stock also saw strong gains, doubling in price during the trading session.

The stocks’ recovery can be traced back to Gill’s influence early in the pandemic. His defense of then-troubled video game retailer GameStop attracted a large number of retail investors who opposed hedge fund short selling.

This collective action led to a massive buy-in by short sellers, causing stock prices to surge and triggering major market turmoil.

GME and AMC stock price trends

Gill’s recent moves spurred buying in GameStop and AMC that spread to other meme stocks like BlackBerry and Trump Media & Technology Group, which all rose. Still, some industry analysts remain skeptical.

“I don’t think we have the data to sustain this, and I don’t think the shortstop has the resolve that Gabe Plotkin showed three years ago,” Wedbush’s Michael Pachter said.

Failure caused by insufficient cognition comes from information gaps, which is essentially due to disconnection between circles.

It is important to embrace a professional circle, which will help you take off and turn around quickly.

If you have any questions, please consult + Sister Wen will answer them online at any time. WeChat: btc3469