Author: Xiao Ma Ge

Editor: Gai

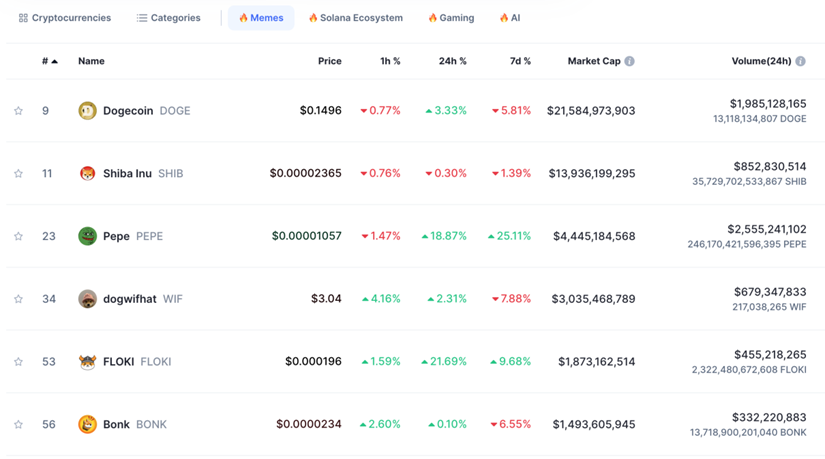

Recently, the crypto market has performed very poorly, with the market value of many currencies shrinking significantly. Bitcoin has fallen by about 20% from its peak, but many Altcoin have lost up to 60% of their market value.

However, among many cryptocurrency sectors, meme coins stand out and show remarkable performance. Today, the meme coin sector has seen another surge, with Kitty and GME soaring, and Pepe, whose market value is second only to Doge and Shib, hitting a record high. The reason for this round of meme coin surge is the return of Roaring Kitty.

So, who exactly is Roaring Kitty? Why does he have such a huge influence in the crypto?

1. Roaring Kitty vs. Wall Street

Roaring Kitty's real name is Keith Gill, and Roaring Kitty is his name on self-media platforms such as YouTube and Twitter. He became famous because he led retail investors to defeat Wall Street capital, staging the myth of "retail investors vs. Wall Street."

Roaring Kitty, known as the "leader" of American retail investors, became famous overnight. Netflix also made a documentary based on this incident, and the prototype of the movie "Dumb Money" is him.

Roaring Kitty was originally a financial analyst. In September 2019, he made a striking investment choice - he bought shares of GameStop (GME), a gaming product retailer, and decided to make his transaction screenshots public on social platforms such as Reddit.

He not only shared his insights on text platforms, but also analyzed the fundamentals of GME and its future growth potential in a simple and easy-to-understand manner through video platforms such as YouTube, in the form of videos and live broadcasts. He firmly expressed his optimistic attitude towards GME stocks, and under his influence, many retail investors also bought GME stocks.

By 2020, Roaring Kitty's assets had increased several times due to the surge in GME, but at this time GME was also targeted by Wall Street capital. Melvin Capital hedge fund and well-known short-selling institution Citron Research announced on Twitter that they were bearish on GME, believing that its price should be halved from the closing price. This news triggered the anger of a large number of retail investors, and as a result, a large number of retail investors launched a large-scale short squeeze campaign on major social media.

In the fierce battle between bulls and bears, the stock price of GME soared from 17 to 347 US dollars, a 19-fold increase. In the whole process, Roaring Kitty played a key role. In this incident, some bigwigs also participated. For example, Elon Musk retweeted the discussion of the WallStreetBets forum, the main base of American retail investors, on Twitter. With his influence, he accelerated the surge in GME, which eventually led to a large amount of capital short GME being liquidated and short institutions suffering huge losses.

2. Meme stocks and meme coins

To some extent, the rise of meme coins in the crypto market was indeed inspired by the GME incident. Shortly after the GME incident, Musk used his Twitter account to frequently post remarks and hints related to Dogecoin (DOGE).

As the blogger with the largest number of followers on Twitter, Musk's influence is undoubtedly huge. His series of actions eventually led to a surge in DOGE and made the meme coin sector begin to receive widespread attention and popularity.

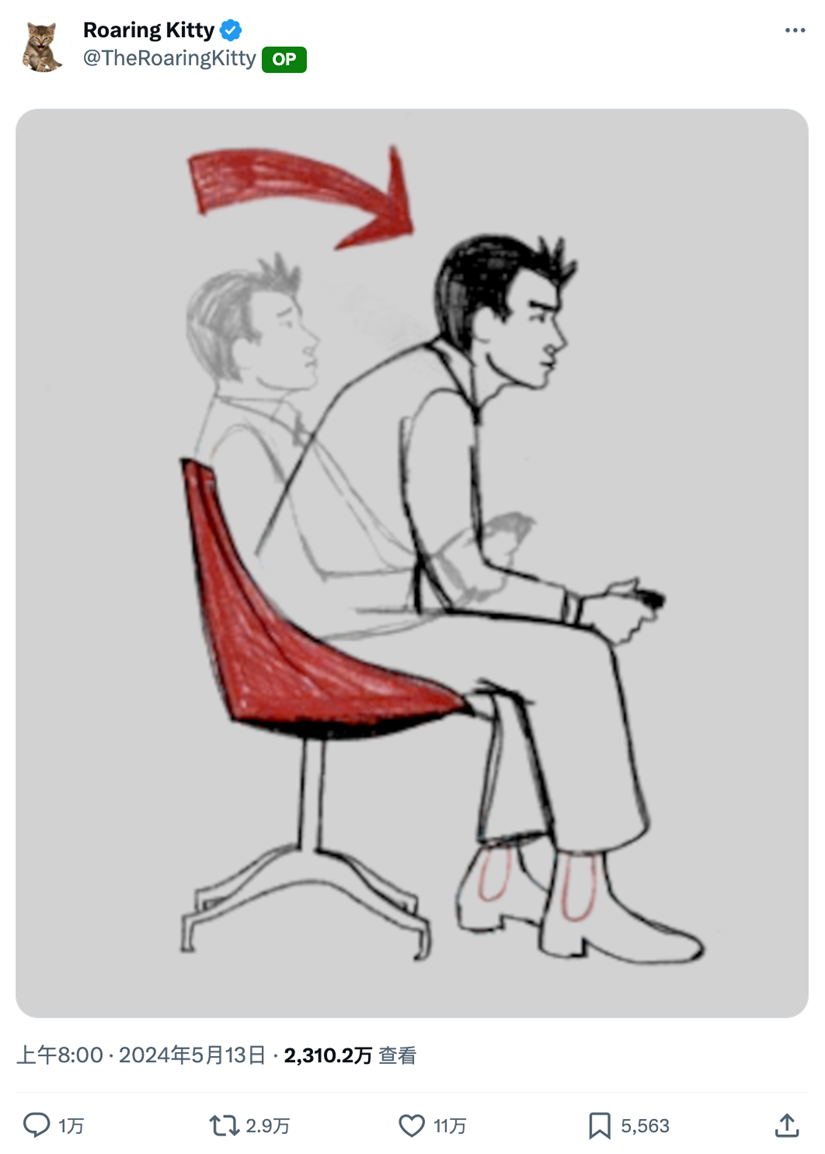

The latest surge in the meme sector was still driven by Roaring Kitty. After the GME incident, Roaring Kitty once stopped updating on social media platforms such as YouTube and Twitter. However, after three years of silence, he suddenly posted a tweet yesterday, which quickly attracted widespread attention. At present, the number of views of this message has exceeded 23 million.

Although no one knows what the tweet specifically represents, this does not prevent retail investors in the stock market and crypto market from being unable to contain their excitement. Many people shouted on Twitter, "Roaring Kitty is back." For them, Roaring Kitty is not only a representative of retail investors, but also a banner to lead their actions. His return indicates that a new round of retail investor actions is about to begin.

This mysterious tweet not only caused GME stock to surge by more than 70% in a single day, but also its eponymous meme token GME also achieved a multiple increase. What is even more remarkable is that the eponymous token kitty, named after Roaring Kitty, rose by more than 100 times in just one day, and also led to a surge in the entire meme sector.

3. Meme Bull Market

The reason why the return of Roaring Kitty has such a great influence on the crypto market is mainly because it caters to the psychology of the majority of retail investors. After all, in the crypto market, the competition between retail investors and VC capital has always existed, and retail investors have long suffered unfair treatment from VCs. Retail investors have suffered from VCs for a long time.

Take the new coins launched on Binance Launchpad in 2024 as an example. These new coins have reached a circulation market value of hundreds of millions of dollars as soon as they are launched, and the FDV is as high as tens of billions of dollars. However, the project owners and VCs often work together to cash out at high prices as soon as they are launched. Their unscrupulous operations have surprised retail investors, and many investors have suffered considerable losses.

In addition, the token economic design of many projects is also full of strategies for harvesting retail investors. In the initial stage, the circulation of tokens is relatively small, but then the project owners and investors continue to unlock and dump the tokens, gently harvesting retail investors.

Therefore, for some star projects invested by VCs, a large number of retail investors have been afraid of being cut off. They would rather invest in meme coins than pay for VCs and project parties. Faced with this phenomenon, some star investment institutions have begun to accuse meme coins of hindering innovation in the crypto market and claiming that they have damaged the healthy development of the market.

However, they may have overlooked the underlying reasons why retail investors turned to meme coins. It was because retail investors were hurt by the actions of project owners, VCs, and even exchanges that they decided not to "carry the sedan chair" for others and instead invested their funds in meme coins. This massive influx of funds and users gave rise to the so-called meme coin bull market.

Although the prevalence of meme coins may indeed hinder innovation in the crypto market to some extent, we cannot deny the nature of capital pursuing profits.

If the so-called "value coins" cause retail investors to suffer huge losses, then this model is obviously unsustainable. Therefore, we expect project owners and VCs to consider the interests of the majority of users more deeply when designing token economics, ensuring that all parties can benefit from it and achieve a true "win-win" situation, rather than just treating users as profit harvesters.

Today, retail investors have awakened, and the era of retail investors has arrived. We expect the future crypto market to be healthier and fairer, thus achieving the dual prosperity of technology and value.

PS This article does not constitute any investment advice