As we all know, when the market conditions are not good, project parties will technically choose to postpone the issuance of tokens and wait for the market conditions to be good before issuing coins. This idea may be beneficial to project parties and early investors, but for investments in the secondary market Humanly speaking, this may not be a good thing.

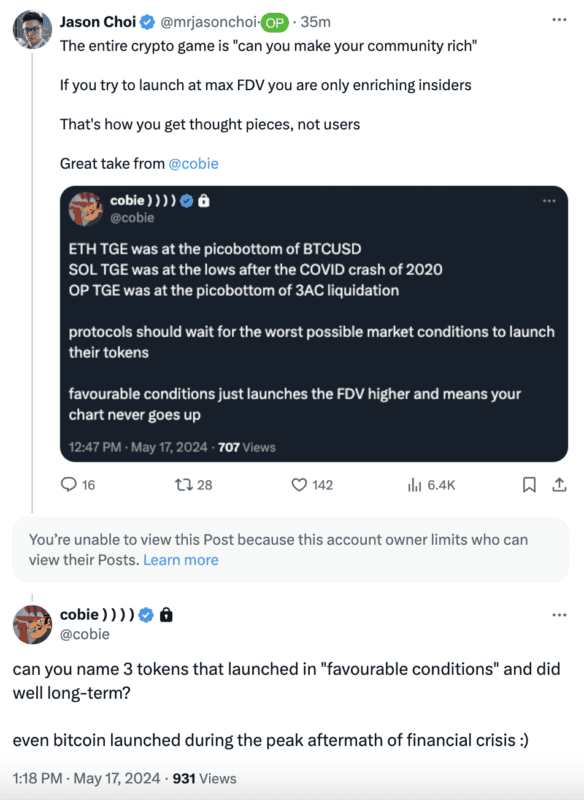

The well-known KOL Cobie shared in a post on TGE is on a 3AC liquidation micro bottom.

Cobie used these examples to express that protocols should wait for the worst market conditions to launch their tokens. Issuing tokens when market conditions are favorable will only make the fully diluted valuation (FDV) higher, which means that you (secondary market investors) the line chart will never go up.

Tangent co-founder Jason Choi also agreed with this and said:

“The whole cryptocurrency game is ‘can you make your community rich?’ If you try to issue a token at the highest fully diluted valuation (FDV), you’re only going to benefit the early insiders. That’s The result is often theoretical articles rather than engaging users.”