RoaringKitty aka "DeepFckingValue", known for the GME (Gamestop) launch last cycle, has returned, sending GME soaring on the open market, memecoin including memecoin GME surging 5000% on Solana. This timeline is more toxic than ever, as some are calling for the cycle to peak, while others believe we haven't even started. This is because gains have not been distributed across the board, as gains have been concentrated in a few sectors while most markets are weak.

No one knows where we’re headed, especially with more TradFi involvement including ETFs, but wherever we go from here, let’s hold our ground.

I don't think it's done yet, but summer is coming and time will tell.

Industry News Summary

- Equalizer frontend hacked

- Tornado Cash developer convicted of money laundering in Dutch court

- Degen Chain (L3) has experienced a 500k block reorganization and has been down for 2 days

- Pudgy Penguins plans to release their game soon

- Pear Protocol Launches Beta

- Zapper Fi tease token

- Vertex Protocol Launches on Botanix Labs Bitcoin L2

- Wisconsin buys $100 million worth of Bitcoin

- Sonne Financial Company Hacked by Hackers

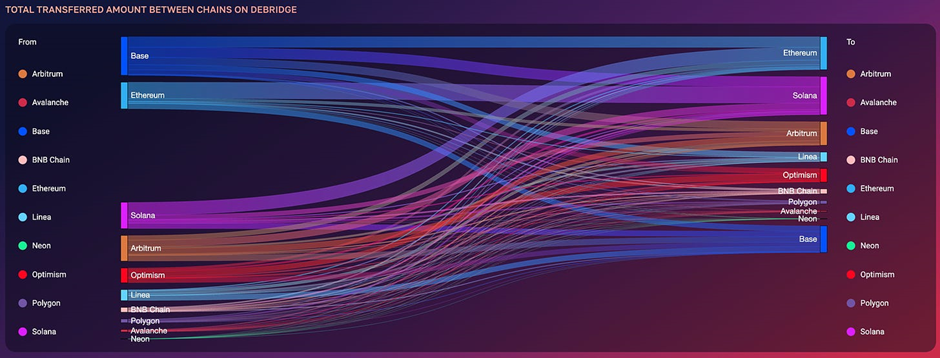

Capital flows

Capital attracted to Base via the FRIEND airdrop is clearly flowing back to Ethereum and Solana, which have heated up due to memecoin mania on their respective ecosystems. On Solana, GME is leading as the crypto-native response to GME being halted on the stock market, while PEPE has been the undisputed leading memecoin on Ethereum. Arbitrum has also received a large amount of unnoticed funds, some of which are likely flowing directly to MOR and Hyperliquid.

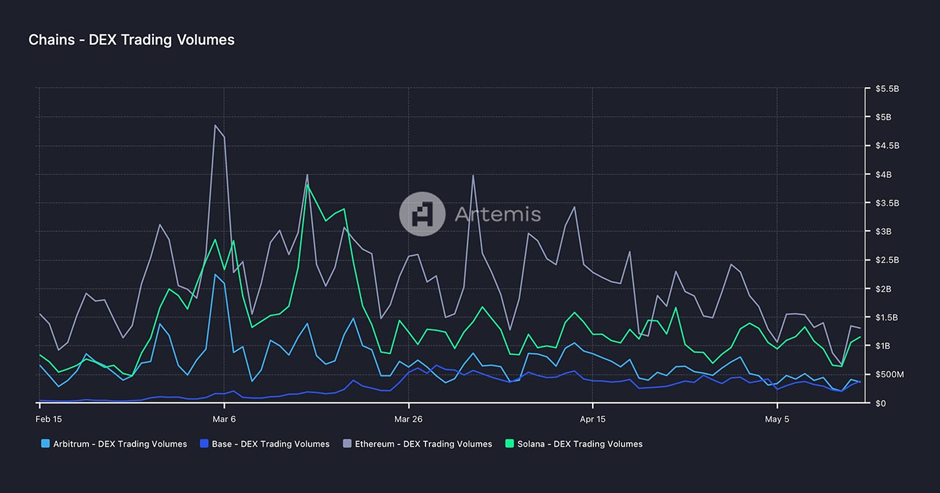

DEX Trading Volume

Volume across all ecosystems seems to have bottomed out since May 12th and has risen significantly since then. And one tweet from Roaring Kitty has dared people to mobilize sideline funds and participate in the on-chain casino again. Remember, for the people you see on your timeline to win, most people have to lose. Be careful what game you are playing. Regardless, on-chain is full of opportunities if you know how to play it well.

Trading volume of major trading pairs

PEPE is undoubtedly leading the pack on Ethereum, not only is it the strongest performing token, it’s also the token that most people are willing to trade and generates the most volume, LPs must be happy. The Ethereum version of GME tried to create momentum, but it’s clear that people have been attracted to the version on Solana, which has more than tripled its volume. APU, which is seen as PEPE’s cousin, has also done well in terms of volume and performance, and wQUIL is the latest hot AI token on the blockchain.

Compared to previous weeks, Base trading volume is starting to become more concentrated in a few tokens such as GME and APED as the ecosystem needs a catalyst to revive it again. However, if you have played the Base ecosystem before, now may be a good time to accumulate tokens before the second wave starts again.

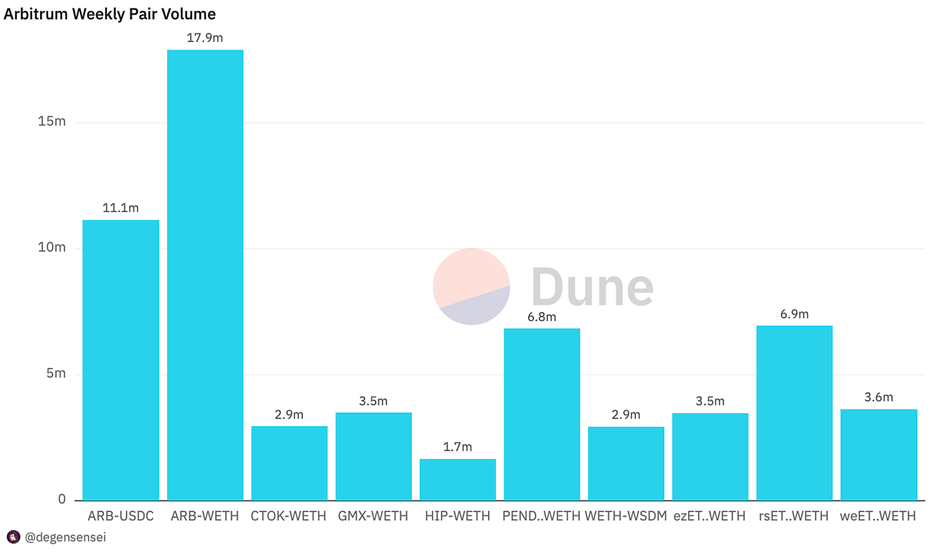

The Arbitrum ecosystem is still a ghost town outside of PENDLE. GMX received some small trading interest this week after announcing that it will be deployed on Solana. CTOK is also a new AI gaming project launched this week and has also received some trading interest. Other than that, there is not much to watch for Arbitrum at the moment, although LTIPP activities are scheduled to start in early June, and it is worth noting that Sanko Corporation is about to launch their chain (L3).

NFT Trading Volume

Ethereum NFTs continue to bleed, and this will likely continue until a lot of wealth is created on-chain, as they are a way to show off the money you've made. Until this is resolved, I expect they will continue to perform weakly. All of the top collectibles are down double-digit percentages in the past 7 days, and Kanpai Pandas has seen a massive -27% drop as many people hold them waiting for LayerZero's snapshot.

Net Inflow

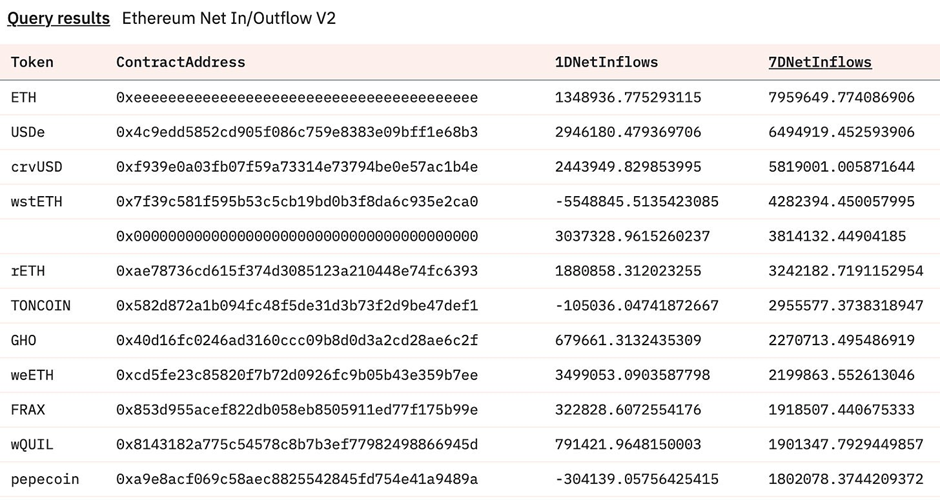

While people continue to hold ETH and stablecoins in large quantities, they are still trying to find other tokens. TONCOIN is the one that has accumulated the most this week, while wQUIL ranks second based on weekly accumulation. From an alternative perspective, Pepecoin ranks third, but the others are experiencing wild fluctuations in meme coins.

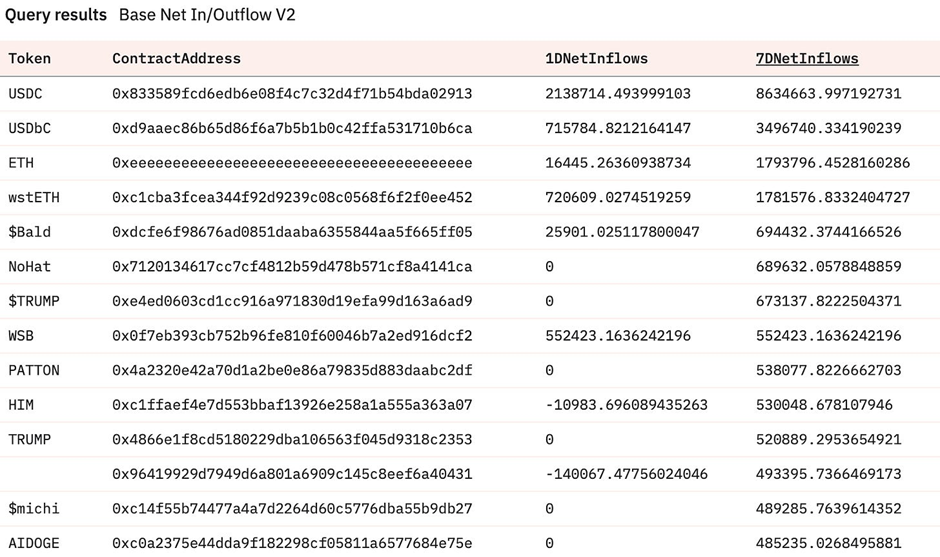

It’s the same theme on Base, people are protecting their capital in this environment, and the dominant tokens are also stablecoins and ETH. Tokens such as Bald, NoHat, TRUMP, and WSB have received some bids, but so far they have been short-lived as the rotation continues to become more intense and brutal.

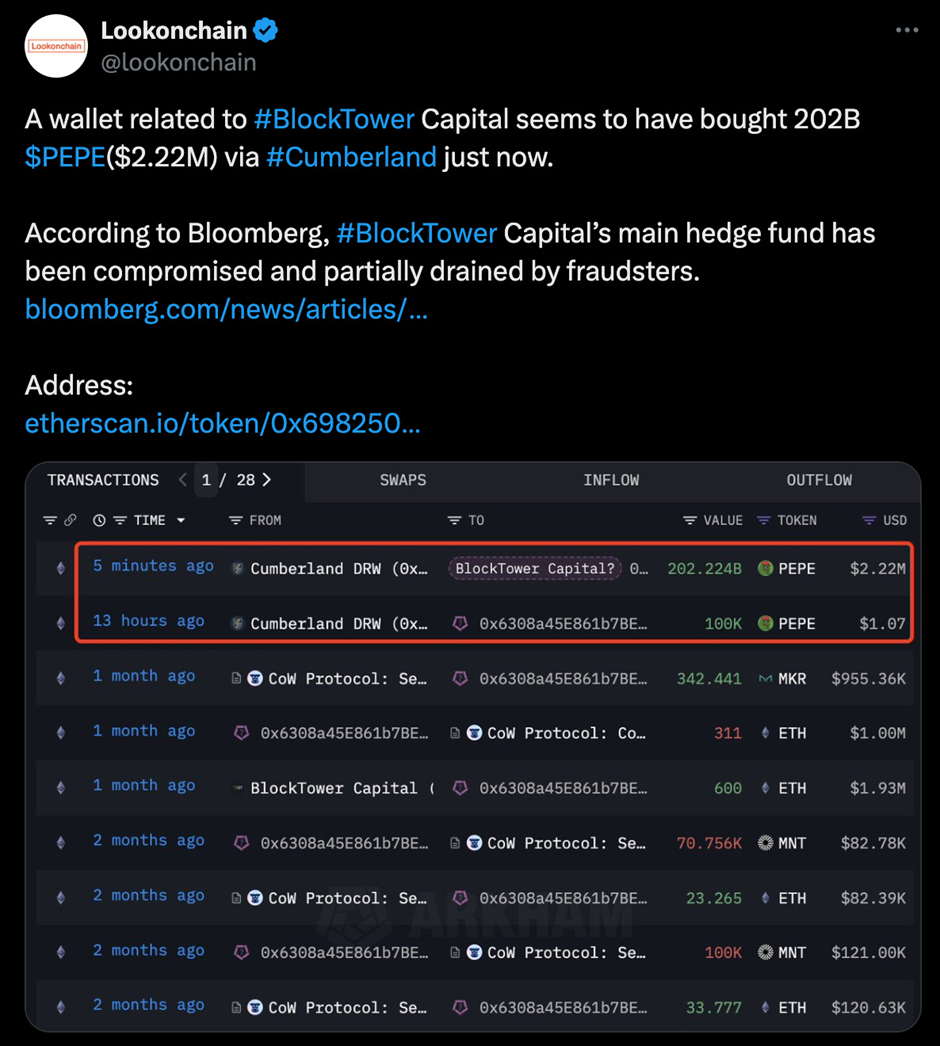

BlockTower Capital's hedge fund has been breached, and the hackers appear to have decided to use the funds to buy PEPE.

Token Unlock

- APE - 2.48% of supply on May 17th worth $19.03 million

- RNDR - 0.20% of supply on May 17th worth $7.76 million

- Moonbeam - 0.4% of supply on May 18th, valued at $817,247

- ZetaChain - 2.33% of supply on May 19th worth $2.4 million

- Pyth - 141.67% of circulating supply on May 20, valued at $927.20 million

- AVAX - 2.50% of supply on May 22 worth $328.33 million

It has been a very noisy week despite price action moving sideways for the most part ahead of the CPI news. Crypto Twitter should only be used as a way to get a feel for market sentiment, never take the opinions out there seriously and make sure you build your own convictions.