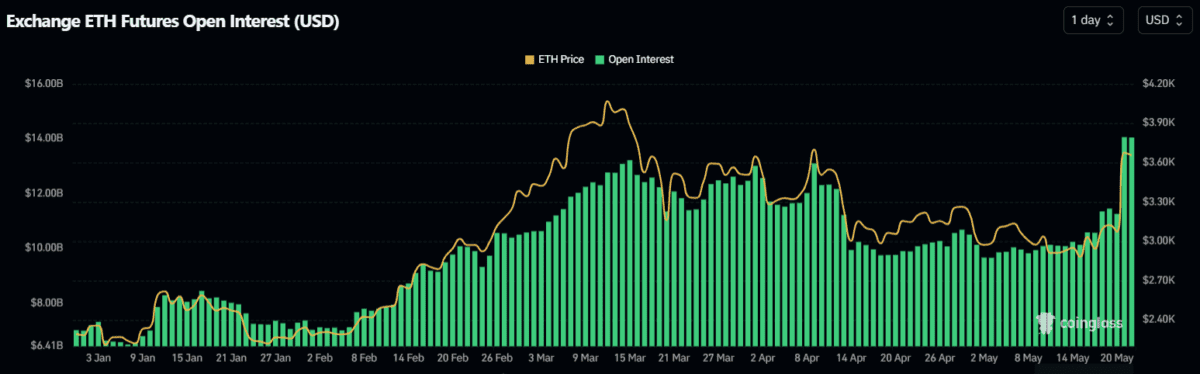

Ethereum (ETH) futures open interest (i.e., the dollar value locked in the number of active Ethereum futures contracts) surged as market expectations for approval of the U.S. Ethereum spot ETF application suddenly turned positive. According to data from Coinglass, open interest in ETH futures across the network has climbed 25% in the past 24 hours, reaching a record high of $14.6 billion. The previous historical peak was $13.2 billion set on March 15 this year.

Data shows that open interest in Ethereum on Binance is US$5.5 billion and Bybit is approximately US$3.1 billion. However, if calculated on a currency basis, the current open interest in ETH futures on the entire network is approximately 3.84 million ETH, which is still some distance from the peak of 5 million ETH set in October 2022.

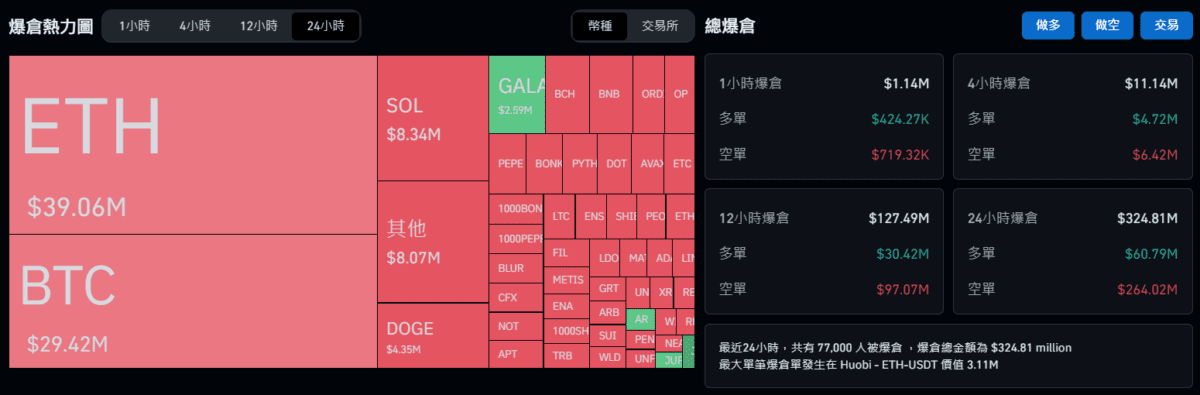

According to TradingView data, Ethereum started a rising trend around 3 a.m. on Tuesday (21st), rising from a price of about $3,150 to nearly $3,700, an increase of more than 16%. As Ethereum rose, the entire network's contract liquidation amounted to nearly US$325 million in the past 24 hours, with approximately 77,000 people liquidated, of which short positions worth approximately US$264 million were liquidated.

Bloomberg senior ETF analyst Eric Balchunas said on the %. At the same time, foreign media "CoinDesk" reported , citing people familiar with the matter, that the SEC has required exchanges seeking to list and trade potential Ethereum spot ETFs to speed up the update of 19b-4 documents, which is a sign that the regulator is trying to speed up the process.

Regulators are scheduled to rule on the VanEck Ethereum Spot ETF on Thursday, May 23. According to previous reports by Zombit, ETF Store President Nate Geraci said yesterday that the SEC must approve 19b-4s (changes in trading rules) and S-1 (registration statement) at the same time before the ETF can be truly listed. However, judging from the SEC’s level of participation in the Ethereum ETF It seems likely that the agency will choose to approve 19b-4s first and then slow down S-1 approvals (especially given the lack of participation).