Hey!

I reached out to Lattice Fund’s Regan Bozman to exchange views on the state of venture financing in the crypto space. What started as a catch-up call turned into us sharing notes on memes, what LPs look for in funds, and how founders can get the most value from their backers.

Today’s post will take you through Regan’s journey, from his days as an employee at Coinlist to his days as a DAO contributor, and the reasons behind his fund. Regan embodies the entrepreneurial and risk-taking spirit as well as any other founder I’ve come across.

Today’s post should shed some light on what it takes to go from early-stage employee to running your own fund, and the nuances of venture capital as an asset class. Along the way, we explore the motivations behind VCs’ misallocating capital in later rounds, whether memes are here to stay, and why founders should also do due diligence on their VC firms.

As always, if you’re a founder building something cool, get in touch using the form below.

Let’s dig deeper!

Inception

2018 is the year after the ICO boom, and crypto ventures have raised about $28 billion. Public interest in tokens has begun to wane. Instead, people are gathering around platforms that can review, manage, and list tokens instantly. This is the golden age of Binance Launchpools and Coinlist. Regan’s story in crypto began as an employee at the latter, where he witnessed the launch of Filecoin and Solana.

At the time, Coinlist was notorious for its ability to quickly pay off. Users would often have friends and family sign up for multiple accounts, since each account could only buy a few hundred dollars worth of tokens. Taking a seat in one of the fastest-growing organizations in cryptocurrency at the time gave Regan a taste of scale and speed. But he wasn’t at the center of the fortunes being made.

Cryptocurrency moves fast. Even in one of the fastest-growing organizations, people often feel FOMO. Regan wanted to move beyond Coinlist. The steps he took to make this transition speak volumes about his perspective on risk. He started out on his own because he noticed a problem that most startups at the time faced: a lack of information about venture capital.

In 2019, the venture capital landscape in the crypto space was extremely dry. The 2018 bear market had devastated the industry. Capital wasn’t flowing into venture funds. ICOs were (sadly) dead. So when founders needed to know who to raise money from, what to consider, or which portfolio companies the firm had, there was very little information available. Regan maintained an Excel spreadsheet — a loose CRM at the time — designed to help founders understand who was active and who wasn’t.

As an angel investor with a $2,000 check, he had little influence. But he could provide value to founders seeking funding. The Excel spreadsheet became Airtable and was named Dove Metrics.

Dove Metrics slowly but steadily established itself as the definitive source for funding data. At the time, the only alternative for this type of information was Crunchbase. But they required a paid subscription, and the data often lacked crypto-specific nuances, such as whether a funding round was tokens or equity. So Regan gradually started organizing information around this type of information, and then expanded it into a newsletter and API for users who needed it.

In late 2022, as Regan turned his attention entirely to Lattice (his fund), Messari acquired Dove Metrics. The product currently powers their fundraising dashboard.

At the time (early 2020), Regan was working 60 hours a week at Coinlist. Having the energy to participate in early tokens outside of work simply wasn’t going to happen. This was the era of pandemic-era lockdowns. This was also when The DAO was positioning itself as an alternative workplace. So, over time, Regan withdrew from his work with Coinlist and became a DAO contributor instead.

Unlike Coinlist, which is often characterized by structure and process, DAOs are messy. They are run on Discord and are often paid in tokens by anonymous contributors. At the time, Regan worked at Index Coop and Maple Finance.

Over the next few quarters, these jobs transitioned into more structured consulting work. Regan’s experience on Coinlist, witnessing hundreds of tokens go public, was invaluable for tokens looking to launch in the DeFi summer. But he quickly noticed two things.

- Consulting work doesn't scale because your income is proportional to the number of startups you can work with. And you can only work with so many startups at any given point in time.

- The value Reagan brought was quite disproportionate to the angel checks he signed.

At the time, most crypto-native funds were in a weird position. On one hand, many experienced investors who raised funds during the 2017 bull run were starved of liquidity. On the other hand, Web2-native funds were putting money into industries they had never been involved in. For Regan, this was an opportunity.

In an age of endless capital, founder empathy and operational experience are what Regan and Mike (his co-founder) use to differentiate themselves. They planned to raise a $5 million fund. It eventually became a $20 million fund with participation from larger, established firms like Accolade Partners. It helped that Regan himself was a DAO contributor who was closely involved in launching multiple networks. A new asset class was emerging, and with it, new money managers.

It was mid-2021. The fund was established. Now it was time to put the money to use.

Scaling grid

I wish I could tell you that Regan made a billion dollars at this point in his investing career. That would be a good story. But it’s not the case when you’re setting up a new fund. Thanks to his network in Silicon Valley, he was one of a handful of investors who participated in OpenSea’s seed round. But when it came to rolling out Lattice (the fund he had just raised), he had to start from scratch.

Early on, Regan and his team deployed just $100,000. They had to rely on the goodwill they had earned as angel investors in previous years to get investments. Venture capital requires a power law to work. A small number of bets that provide abnormal returns drive most of a fund's returns. In other words, bets that generate large multiples can make up for bad bets. But a lot of them need to be resized.

Let’s say you can only put 1% of your fund size into one investment. You need it to give you a 100x return to get your fund back. This is assuming all other bets go to zero, and doesn’t account for the dilution of investors’ stakes in the companies they bet on over time. That’s generally not the case. In other words, deploying $100,000 from a $20 million fund isn’t going to be life-changing.

But there are reports that Lattice is deploying funds.

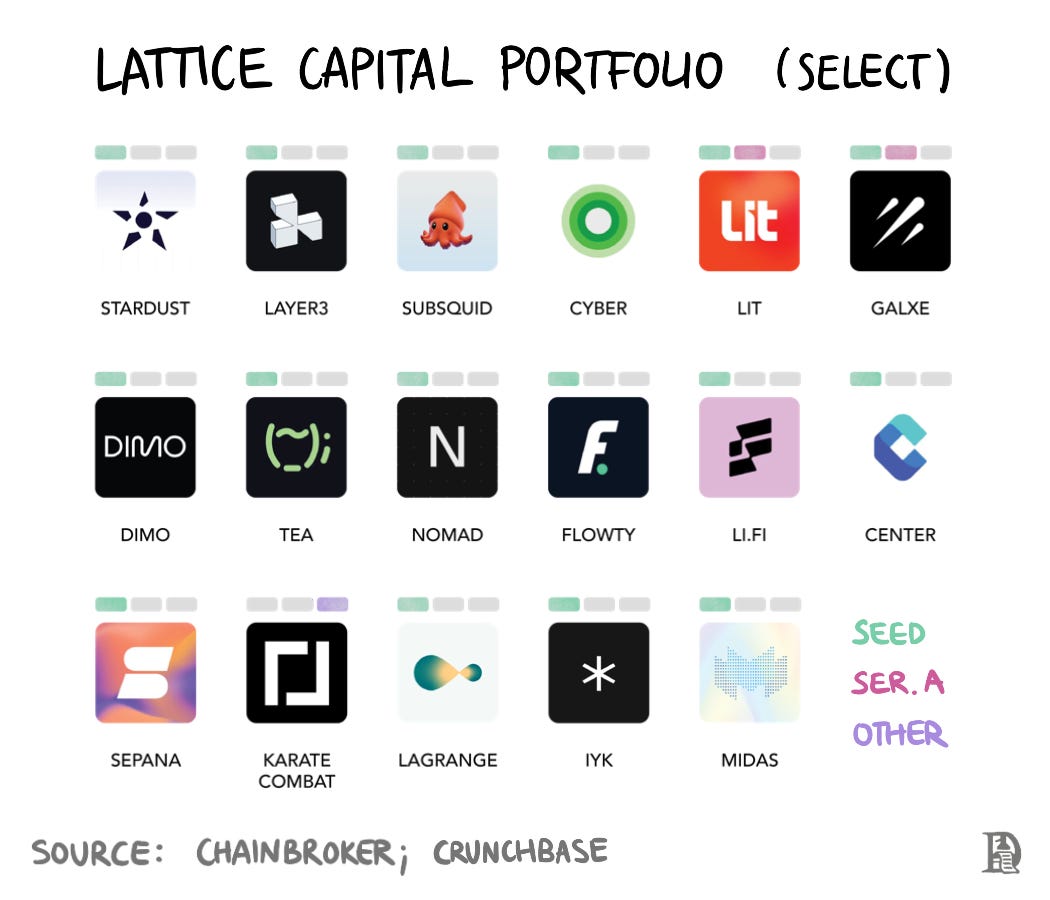

From the first fund ($20M), 40 investments were made with an average check size of $2.5-500K. A few years later, when they raised their second fund ($65M), the amounts jumped to $500K, or $1.5M. One of the challenges of having a larger fund is that investors often need to invest more money to justify the time spent in the venture. Capital is generally not a finite commodity. Time is.

A company can choose to spread its capital among a thousand different startups, but doing so also limits its ability to have a significant impact on the outcomes of the businesses involved. So if you have $65 million to deploy (as Lattice does), and your target ownership is 1% in exchange for deploying 2% of the capital ($1.3 million), then you are limited in the valuation you can deploy.

You can’t own 1% of a multi-billion dollar network with millions of dollars deployed. So it’s natural for a company like Lattice to gravitate toward Seed to Series A ($30-150 million valuation).

For Lattice, the focus is on deploying bets on expanding the market through on-chain business models. Regan believes that the biggest opportunities in our industry are applications that provide value to new market segments and the infrastructure that powers these products.

Currently, this focus means an increasing focus on DePin. Earlier, they supported Galxe and Layer3, which showed that they are focused on consumer applications. Lattice is also involved in Privy and Lit Protocol on the infrastructure side.

But at that valuation, the number of investable opportunities may not be large. One way investors like Regan address this is by moving further up the risk spectrum — investing at the seed stage with the understanding that they may follow up. Not only does this give Lattice more ownership in a successful company, but it also makes it easier for the company to have confidence in deploying at a company’s growth stage. Nothing sends a stronger signal than a seed-stage investor doubling down on a growth round.

But at that valuation, the number of investable opportunities may not be large. One way investors like Regan address this is by moving further up the risk spectrum — investing at the seed stage with the understanding that they may follow up. Not only does this give Lattice more ownership in a successful company, but it also makes it easier for the company to have confidence in deploying at a company’s growth stage. Nothing sends a stronger signal than a seed-stage investor doubling down on a growth round.

One often sees the flip side of this syndrome: large funds optimize to deploy a meaningful portion of their AUM into startups. When multiple funds manage billions of dollars, rounds need to be in the tens of millions to make sense. For a round of this size, say over $50 million, exit valuations and liquidity should be in the billions to provide meaningful returns.

Unlike traditional markets, where M&A and IPOs provide healthy exits for early backers, crypto-native companies often reap returns from token listings. That’s why capital is pouring into infrastructure projects worth billions.

It's almost always a function of incentives. And those incentives tend to cause our markets to have some very erratic behavior. And that's what we're going to talk about next.

Value-added memes

Funds can produce wildly different results depending on how they are positioned. For example, a fund that is long Solana will likely outperform a basket of DeFi tokens. Or companies that have exposure to consumer applications may far outperform meme assets. The liquidity of cryptocurrencies makes it a harder market to bet on due to two features.

- You are constantly being compared to Bitcoin and Ethereum. Most fund investors are usually better off holding just one of these two assets. The outperformance of a fund relative to ETH or BTC is known as Beta.

- Your performance depends on macroeconomic factors. Many funds that performed poorly in 2024 may perform amazingly in 2021 as low interest rates and the pandemic caused speculative interest in Altcoin to reach new highs.

Combine the two and you have a situation where funds compete with each other in the liquidity market. In the traditional environment, just being the fund that helps build a category leader like Spotify or Shopify builds your brand. The investment cycle is relatively long.

The fluid nature of cryptocurrencies tends to compress this cycle into a shorter time frame.

As Sid often mentions, the token becomes the product. You see, when an allocator, like a pension fund or a fund of funds, looks at fund performance, part of what drives that decision is the returns that the fund generates. Ultimately, what investors are looking for is the ability of a fund to return multiples of capital.

Funds in Web3 typically allocate a small portion of their AUM to liquidity bets. These are tokens purchased from the market (on exchanges). The idea behind these capital pools is that liquidity markets tend to be mispriced, and allocating funds there can lead to faster returns on capital.

But when multiple smart, ambitious people focus on the same digital asset at the same time, the price tends to rise. As I write these words, there are more than 100 tokens with a market cap of more than $1 billion.

This is what happens when an unlimited amount of capital pursues a limited number of meaningful assets.

So where can the money go? It moves further up the risk curve. To NFTs, in-game tools, yield farming strategies, and most recently, meme tokens. In the weeks leading up to our discussion, Solana got caught up in the memecoin frenzy. WIF is on track to hit a $4 billion market cap. Deploying capital into meme assets starts to make sense.

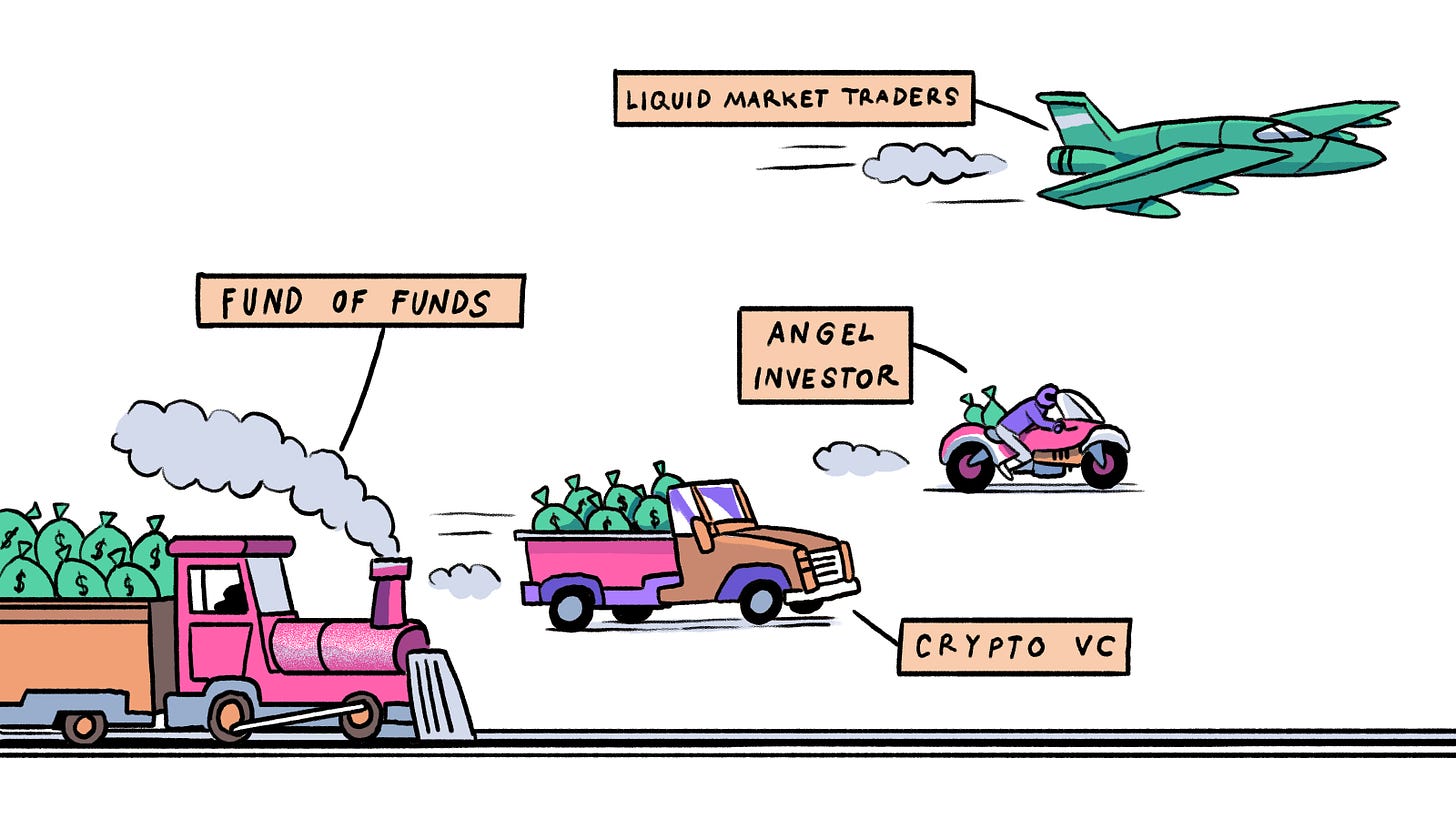

Liquidity market traders (and hedge funds) tend to react fastest to narratives. Web3 games, AI, social networks are personal narratives deployed by these fast-movers. As liquidity tokens in these fields increase, whether it is Fetch in AI or Degen in Web3 social, individual angel investors trading these tokens will look for private market transactions. In their view, there is often valuation arbitrage between private and public markets. They may hold profitable positions and are willing to take more risk.

When angel investors start pursuing a hot new theme, deal volume and social consensus around the emerging theme starts to form rapidly, causing more conservative VCs to start pouring money into it. I would put Bitcoin L2 and meme platforms like Pump.fun in this category.

As VCs deploy (and eventually run out of money), they start convincing the largest source of slow-moving money — their LPs. In 2021, there are funds focused exclusively on Web3 games. By 2024, there will be funds focused exclusively on Bitcoin L2. Attention flows from fast sources of money like traders to slower sources of money like pension funds.

Regan believes that this shift in attention between assets will also affect management style. In traditional venture capital, funds can patiently wait for companies to slowly find PMF. But because liquid markets are where most funds record returns, most commitments to venture capital are time-limited.

If a business has a liquid token, then choosing not to sell it at a high valuation could actually be a breach of fiduciary duty. Similarly, holding on to a bet that is clearly underperforming could prove to be a waste of time. Founders often think of the limitation of venture capital funds as funding. But in fact, it’s time.

So what happens when a founder is clearly underperforming or not delivering on their promises? Regan uses feedback as a tool. Communicating that the team is underperforming or that there may be better opportunities to spend the team’s time on is one way to reduce the amount of attention (time) given to a startup that isn’t scaling fast enough. One way founders can mitigate this is through motivation.

Venture capitalists are comfortable with money-losing businesses. But if a company isn't showing any meaningful traction or direction quarter after quarter, the smarter choice is to stop investing time in it.

This is where the VC meme comes into play. Funds are required to deliver “value-add” to founders for multiple quarters, even if they don’t actually help the startup they’re currently investing in. When a company is growing, VCs are incentivized to get their hands dirty. But what happens when multiple companies aren’t growing, and you still need to prove you can help?

This is where signaling comes into play. Being an active investor on Twitter may not have much to do with how helpful a VC is in real life. However, it is often the best way for VCs and founders to engage with each other.

Founders can tell who is a good partner to work with by looking at VC references. If asked for some founder references, most funds are willing to share details about the founders to explain whether the source of funding is strategic. It is just as important for founders to do due diligence on VCs as it is for VCs to do due diligence on founders.

Sales Story

Meme assets are seasonal — just like NFTs in the last cycle. A lot of times, VCs (and funds) can’t hold them directly. So they optimize for startups that could become critical infrastructure. So instead of betting on the next bonk or WIF, you bet on products like Pump.fun, which makes publishing a meme as easy as clicking a few buttons.

That’s why OpenSea and Blur are amazing bets in the NFT cycle. Another way for funds to optimize retail interest in meme assets is to have portfolio companies adopt memes as a GTM strategy. But Regan believes the likelihood of it working for startups pursuing this strategy is very low.

So where should founders focus their efforts? Interestingly, many consumer-facing portfolio companies are growing rapidly. For example, Layer3, one of Lattice’s portfolio companies, is currently seeing an all-time high number of active users. Infrastructure companies and security audit providers are also seeing a rapid increase in the revenue they generate. These trends are also translating into significant increases in valuations.

Throughout a bear market, founders tend to be in defensive mode to conserve runway. But part of what helps certain category leaders stay ahead is the ability to raise money at higher valuations and pivot to being aggressive in a bull market. This is hard to do because once you’ve been in defensive mode for a while, it’s hard to reverse that inertia.

Just like evolution, the market tends to reward founders who respond quickly to change. As risk appetite increases and core metrics (such as user numbers) rise, it has become the norm for founders to arrange multiple rounds of financing in a quarter.

How do venture capitalists view this opportunity? They break cycles. In Regan’s view, any deal they make in this cycle will not see liquidity until the next cycle. That is, 4-5 years from now.

To put this into perspective, of the 30 deals completed by Lattice Fund 1, approximately 3 are currently liquid.

One mental model Regan uses to explain this balance between liquidity and patience is through the lens of a form of innovation. He argues that crypto startups are a hybrid of technological and financial innovation, with the financial side funding the technological side. You can’t really separate one from the other. So you have to decide whether you want to take advantage of the unique liquidity opportunities in crypto.

Understanding how these incentives work helps explain why VCs sell tokens at specific valuations. Without a return of capital, subsequent financing is difficult. Without a markup, it is impossible to explain the performance of the fund. As a result, most VCs are torn between exiting liquid positions and playing the long game.

Ultimately, founders know their businesses best. Unlike VCs, they also have only one bet, not a basket of bets. Therefore, it is often in their best interest to optimize for liquidity events. One way to address this challenge is through the gradual institutionalization of cryptocurrency risk.

In the future we may see large organizations willing to take equity stakes in only successful businesses. Just like we saw during the growth of the Internet, listings will be limited to companies with cash flow and revenue. Or maybe not. We may just be playing an endless cycle of short narratives and memes. No one really knows.

For Regan, his core priorities are simple: don’t cause pain to founders, and double down on winning. This strategy of being an empathetic enabler has helped him evolve — first from an employee at Coinlist to a DAO contributor, and now as a partner at a venture capital fund with nearly $100 million under management.

Sign out,

JOEL