Disclaimer : The contents of each report reflect the opinions of each author of the report and are provided for informational purposes only, and are not intended to recommend buying or selling tokens or using the protocol. Nothing contained in this report constitutes investment advice and should not be construed as investment advice.

1. Introduction

1.1. The importance of community

The community of a crypto project is not simply a collection of users or investors, but has become a key factor that determines the success or failure of the project. Since blockchain technology and projects based on it operate around decentralized governance, the importance of the community involved cannot be overemphasized.

Decentralized governance means that the community, including management, jointly makes decisions about the future of the project, including matters related to token economics, roadmap, development priorities, etc. If a team neglects the community and fails to run the project transparently, it often becomes the object of suspicion and creates uncertainty, which can spread FUD (Fear, Uncertainty, Doubt) and shake the foundation of the project's value.

For example, Do Kwon, the founder of Luna, ignored many criticisms about the LUNA-UST mechanism raised by the Luna community and tweeted that he does not discuss with beggars, saying, “Anchor Protocol’s 20 Even when asked, “How will we raise $300 million in reserves for interest,” he responded that it was not worth answering, spreading fear of a bank run. The cost of ignoring these valid questions was very high.

Because community participation and feedback play an important role in transforming a project to meet market needs and expectations, transparency and trust in the project can be improved when the project team actively communicates with the community and encourages participation. there is. Additionally, community members, as voluntary promoters and supporters, can spread the value and potential of the project and contribute greatly to expanding the project's user base. It can be said that the recent tendency of newly launched projects to necessarily deploy airdrop volume in the community sector stems from the intention to quickly embrace the community in sympathy with the above effect.

1.2. Korean market attracting attention

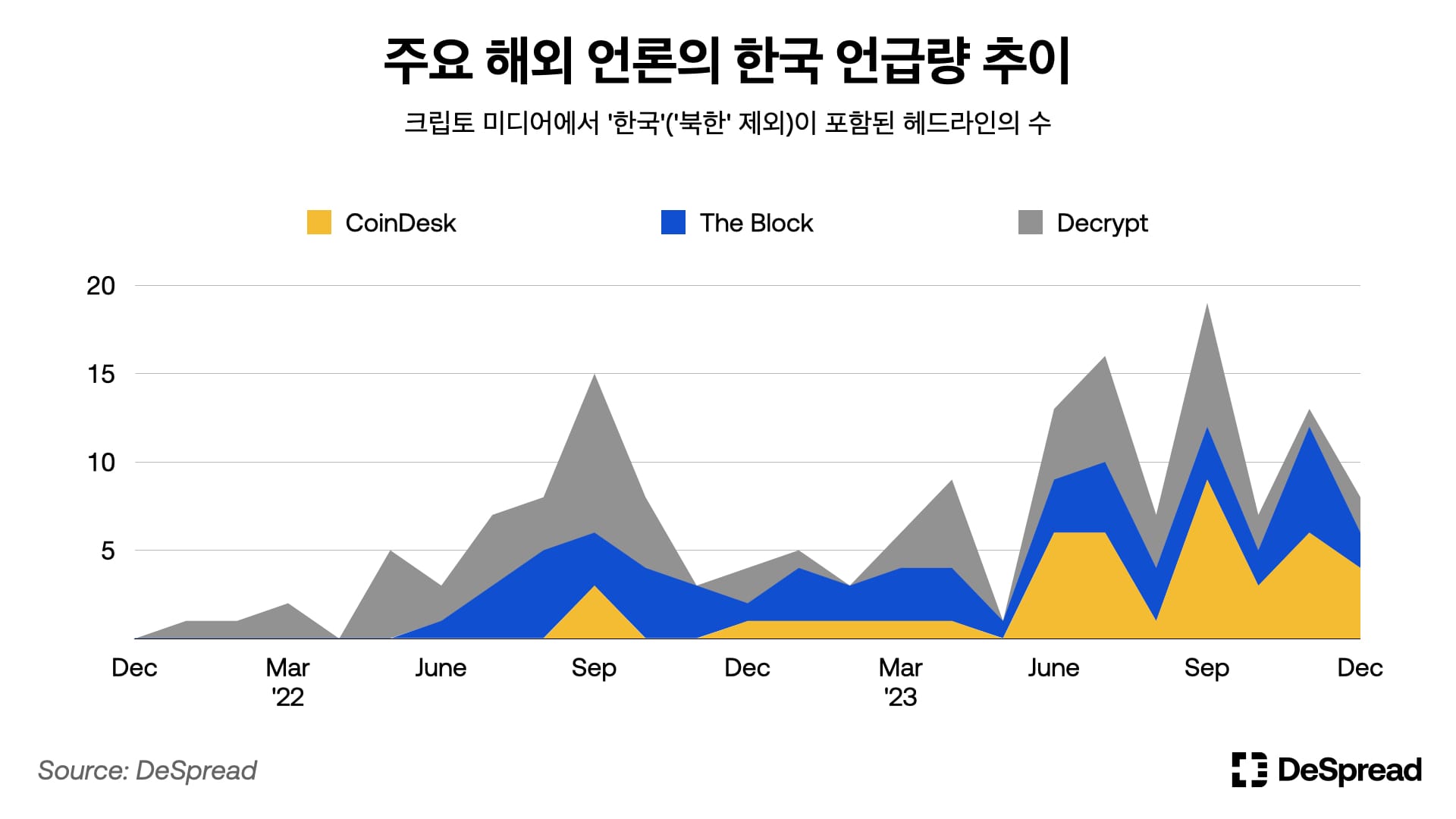

Korea's status and interest in the crypto industry are increasing over time. When we analyzed the amount of mentions of “Korea” in major overseas media headlines, excluding North Korea, we could see that global interest in the crypto market in Korea is increasing. At the peak of the chart in the second half of 2022, there were many articles related to the metropolitan area, but from the second half of 2023, you could see many articles dealing with government regulations or the overall Korean market. This shows that trends and policies in the Korean market are emerging as a topic of global interest.

In addition, as covered in the previous report ( DI - 01: Korean Centralized Exchange ), the trading volume of Korean exchanges ranks high even by global standards. In particular, as can be seen in the chart above, Upbit will follow Binance in 2023. It recorded the second largest spot market trading volume in the world.

Korean exchanges tend to trade mainly altcoins rather than Bitcoin or Ethereum, and their influence has been significant even on major altcoins with relatively large market caps. For example, STX, a Bitcoin layer 2 project, had 90% of its global trading volume on Korean exchanges on August 5, 2023, and BLUR, the token of Ethereum's largest NFT marketplace project. As of January 4, 2023, 60% of global trading volume occurred on Korean exchanges. These data demonstrate the importance of the Korean market and its influence in the global market.

The process of identifying community trends in a specific market is very important in understanding the characteristics of that market. This report was written with the intention of providing an in-depth analysis of the Korean crypto community, starting from this perspective. It mainly focuses on understanding what types of communities existed in the Korean crypto market in 2023 and what topics they were interested in, and furthermore, what kind of correlation existed between their interests and market trends.

2. Korean Crypto Community Platform

2.1 Telegram

Telegram, a leading messenger service with approximately 800 million monthly active users (MAU) worldwide, is the most actively used platform by the crypto community engaging in on-chain activities in Korea. In addition to the simple message sending function, Telegram provides a variety of functions using large group chats, notification messages, and bots, allowing many communities to operate on Telegram in addition to simply sending messages between individuals.

Telegram has channels on various topics such as airdrop information, exchange announcements, DeFi news, trading signals, and research, and it is estimated that there are currently at least 500 crypto-related channels targeting Koreans.

Each project often operates an official Telegram channel and chat room, so you can quickly receive the latest information and updates about the project and communicate with other community members. Additionally, Telegram supports multiple languages and is used globally, making it easy to communicate with the global community. It is also effective in conveying information as it is easy to forward and quote messages between channels.

2.2 KakaoTalk open chat room

KakaoTalk is the most widely used messenger app in Korea, with MAU reaching 48 million as of the end of 2023, ranking first among all mobile app users in Korea. Considering that the population of the Republic of Korea was 51.32 million as of the end of 2023, it is no exaggeration to say that the entire population is using it. Because KakaoTalk is used by people of all ages, it is very accessible, and the crypto community also uses KakaoTalk's open chat room to communicate. Open chat room is one of KakaoTalk's services and is a chat room where you can create and communicate based on similar interests.

Crypto-related open chat rooms are mainly composed of general coin investors and specific coin holder gatherings, and in particular, investors who have invested in coins listed on centralized exchanges seem to make up the majority. In a typical coin open chat room, things like market prices and market analysis are mainly exchanged. The KakaoTalk Crypto Community has the characteristic of being more accessible and having a wider variety of participants than Telegram. However, compared to Telegram, the proportion of users using on-chain services is small.

Additionally, KakaoTalk's open chat room has a limitation in that only a maximum of 1,500 people can participate. Also, compared to Telegram, it lacks features such as message forwarding, so information sharing between chat rooms is not smooth, bot functions are limited, and it is impossible to create sub-channels within the chat room. Additionally, there are very few overseas users, so overseas news does not spread quickly.

For the reasons mentioned above, there are many things to be desired in terms of community operation. Due to these technical limitations and user characteristics, the KakaoTalk Crypto Community is giving the overall impression that it is somewhat lacking compared to Telegram in terms of information quality and expertise.

2.3 Coin version

Coinpan is one of the largest cryptocurrency community websites in Korea, with MAU reaching 5.3 million as of the end of 2023, according to SimilarWeb. This figure exceeds the MAU of about 4.7 million as of December 23 of Bithumb, the second largest exchange in Korea in terms of trading volume. It is one of the most active communities in Korea, with the number of posts on the bulletin board reaching 8,636 in one day on March 27, 2023.

On CoinPan, posts about investment profit and loss certification, news, investment arguments, etc. are actively posted. In particular, discussions focus on coins listed on centralized exchanges such as Upbit or Bithumb, and many articles encourage investment in specific coins. In most profit and loss certification posts, screenshots of profit verification from these exchanges are shared, and futures trading profit verification using overseas exchanges also frequently appears.

On Coinpan, you can check cryptocurrency prices from various exchanges such as Bithumb, Upbit, Coinone, Coinbit, Korbit, and Binance, as well as Korea premium and trading volume information. However, the fact that some bulletin boards or some functions require login or some degree of participation in community activities may act as a barrier to entry.

2.4 DC Inside

DCInside is one of the most famous online community sites in Korea. It is called Korea's Reddit and is known as a community with an outspoken and free discussion culture based on anonymity. DC Inside consists of bulletin boards called ‘galleries’ on various topics, and users can participate in galleries that suit their interests.

DC Inside has several galleries related to cryptocurrency, including Bitcoin Gallery, Altcoin Gallery, NFT Gallery, and Cryptocurrency Gallery. In these galleries, information sharing and investment discussions about coins listed on domestic centralized exchanges such as Upbit and Bithumb are mainly conducted rather than on-chain activities.

These communities generally have a very strong speculative tendency, and their investment methods mainly focus on subjective opinions and short-term profits rather than objective information. There is relatively little discussion about the long-term value of on-chain technologies or projects, and the focus tends to be on short-term profits from the rapid rise and fall of specific coins.

Due to these characteristics, DC Inside's coin-related gallery is somewhat lacking in terms of expertise and quality of information, but it can be said to be a useful window for understanding the interests and investment tendencies of domestic coin investors.

2.5

X (formerly Twitter) has established itself as one of the most used platforms by the crypto community globally. Various stakeholders in the industry communicate and share information primarily through Twitter.

However, in Korea, the level of activation of the crypto community on Twitter is somewhat lower than the global level. In fact (as can be seen in section One possible reason for this is that the platform Twitter is not very popular in Korea.

Although the absolute number is small, Korean Crypto Twitter has users with a variety of interests, including specific project experts, chart analysts, fundamental investors, speculators, analysts, meme coin enthusiasts, and DeFi and NFT experts. In particular, it is the platform where investors based on fundamentals and research are most active.

Additionally, in Korea, Twitter lags behind Telegram in terms of timeliness. In the Korean crypto community, Telegram delivers the fastest news and has lively discussions, while Twitter tends to spread information at a relatively slow pace. However, there is a characteristic that there are more users active on-chain compared to other communities.

2.6 Discord

Discord originally started as a communication platform for gamers, but has recently become widely used in the crypto community as well. The biggest feature of Discord is its server-based community organization. Each project or organization creates its own server, and users can join the server they are interested in and participate in that community.

In the crypto space, Discord is primarily used to form communities around specific projects. Many projects run their own Discord servers, where they share information about project updates, development progress, airdrops, governance voting, etc. Additionally, communication and discussion between community members takes place actively.

However, Discord tends to focus on stories limited to specific projects, so there is relatively little discussion of general investment information or market trends. This appears to be because Discord is mainly operated around projects, and because of the structural characteristics of Discord, it is not easy to share information between servers, and each server operates independently.

Discord provides a variety of features such as voice chat, screen sharing, role assignment, and bot integration, making it a useful tool for community management. In particular, it is used among developers to receive code update notifications or conduct technology-related discussions through integration with GitHub.

However, Discord usage in Korea is somewhat low compared to the global level. This is also due to the fact that Discord is a platform that Korean users are not yet familiar with, and that they find it difficult to participate in the global community due to language barriers. Additionally, because there are messenger platforms that are preferred in Korea, such as the aforementioned Telegram and KakaoTalk, Discord appears to be used relatively less frequently.

2.7 Naver Cafe

Naver is the largest portal site in Korea and operates a community service called Cafe. Naver Cafe is one of the longest-running and popular community platforms in Korea, and is also used in the crypto community. The crypto community within Naver Cafe tends to analyze price charts and share investment information mainly focusing on coins listed on domestic centralized exchanges, especially altcoins. This appears to reflect the tendency of domestic investors who pursue short-term profits rather than fundamental analysis and are interested in highly volatile altcoins.

Naver Cafe has the advantage of being an accessible and familiar platform, but it is somewhat lacking in terms of information expertise and reliability. Investment success stories and recommendations are frequently posted within the cafe, but many of them lack objective evidence or are highly speculative in nature. Naver Cafe also has limitations due to its lack of connection with the global community. Most conversations in the cafe are conducted in Korean, and there is relatively little discussion of overseas projects or global trends. However, recently, interest in on-chain activities such as airdrop and liquidity staking as well as DeFi and NFT within Naver Cafe has been increasing, and related cafe activities are also increasing.

So far, we have looked at the characteristics of major Korean crypto communities formed on various platforms. Each platform had its own unique characteristics in terms of number of users, interests, and discussion culture. In the next section, based on this background knowledge, we will do an in-depth analysis through related data to see what topics received a lot of attention in the Korean crypto community in 2023 and what impact this had on the market.

3. 2023 Korean Community Trends

3.1. google trends

Google Trends is a service that allows you to check how often a search term was searched in a specific area over a certain period of time on Google, the world's largest search engine. In Google Trends, search volume is expressed as a relative number of interest, which indicates relative change by setting the highest search volume within the viewing period to 100. Through keyword analysis using Google Trends, we will find out what topics Korean investors and users are interested in by comparing them with major countries.

3.1.1. Stocks vs. Coin interest

- Korean coin love

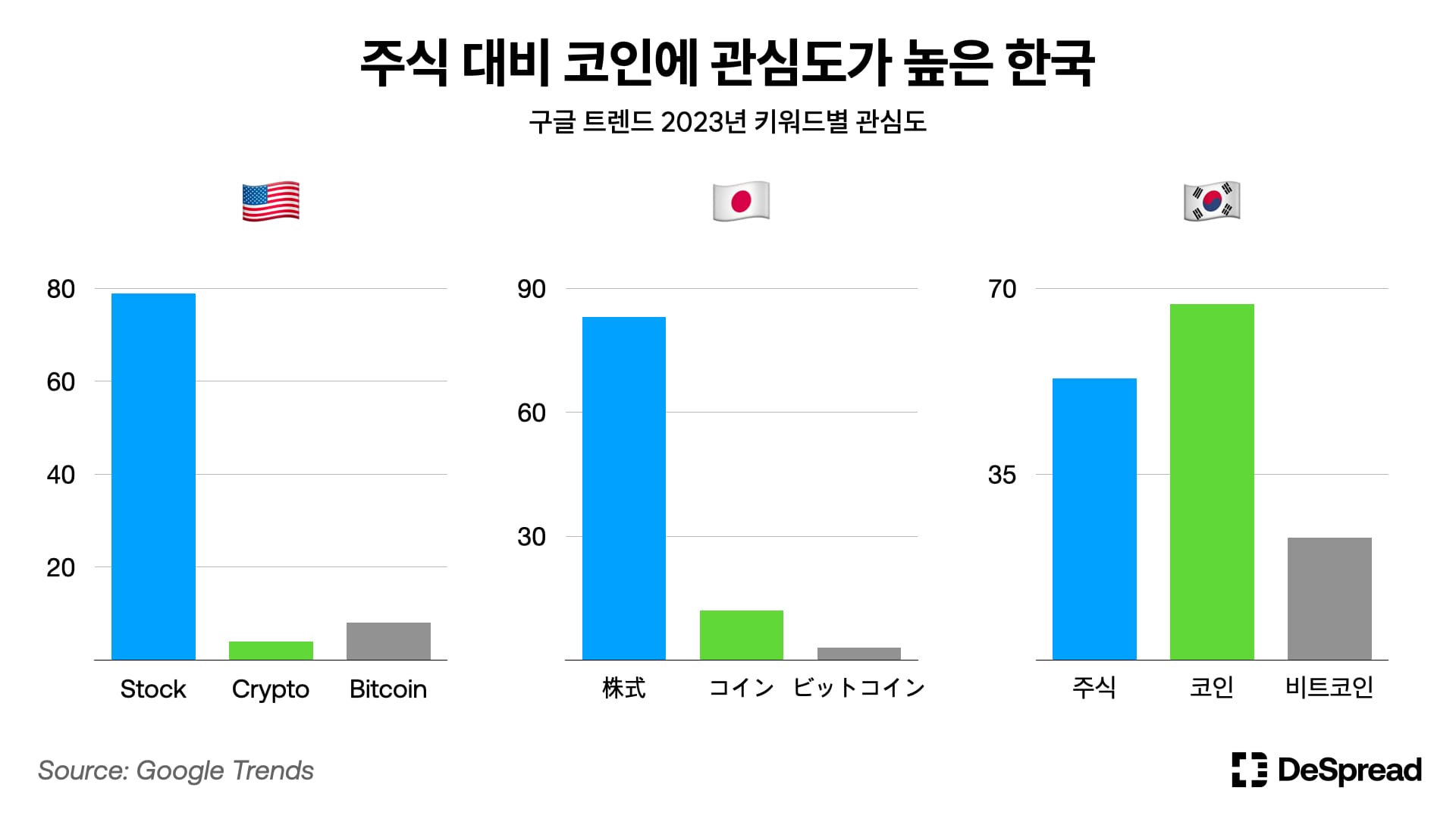

- When comparing the search volume of stock and coin keywords, which are one of the representative investment targets, by country for the United States, Japan, and Korea, Korea showed a higher interest in coins than the countries compared above. In the United States, Stock had a search volume about 20 times that of Crypto, and in Japan, Stock had a search volume about 7 times that of Coin, but in Korea, on the contrary, the search volume for Coin was higher than that of Stock. It was about 25% more than that.

- This difference in interest was also reflected in the actual number of investors. As of 2022, the number of stock investors in Korea holding at least one share of stock was approximately 14.41 million (28% of the total population), and the number of coin investors estimated to have tradable accounts was approximately 6.27 million in the same year ( 12% rate), showing a fairly high rate. On the other hand, the number of registered accounts on centralized exchanges recorded in Japan in December 2022 was approximately 6.3 million, showing a relatively low rate of 5% of the population using cryptocurrency exchanges.

- Comparison of Korea and Japan

- In Japan, interest in coins was somewhat lower than that of stocks. This can also be seen in trading volume. For example, when comparing the trading volume of Japan's five largest exchanges and Korea's leading exchange Upbit in May of last year, the trading volume of Japan's five largest exchanges is $4B and Upbit's is $27B, showing a significant difference.

- According to CoinGecko, Japan's exchange trading volume is mostly focused on Bitcoin and Ethereum, which is quite different from Korea's focus on altcoin trading. Nevertheless, according to the Japan Cryptocurrency Exchange Association (JVCEA), the number of registered accounts on cryptocurrency exchanges continues to increase as shown above, showing the growth potential of the market.

3.1.2. Comparison of interest in representative exchanges by country

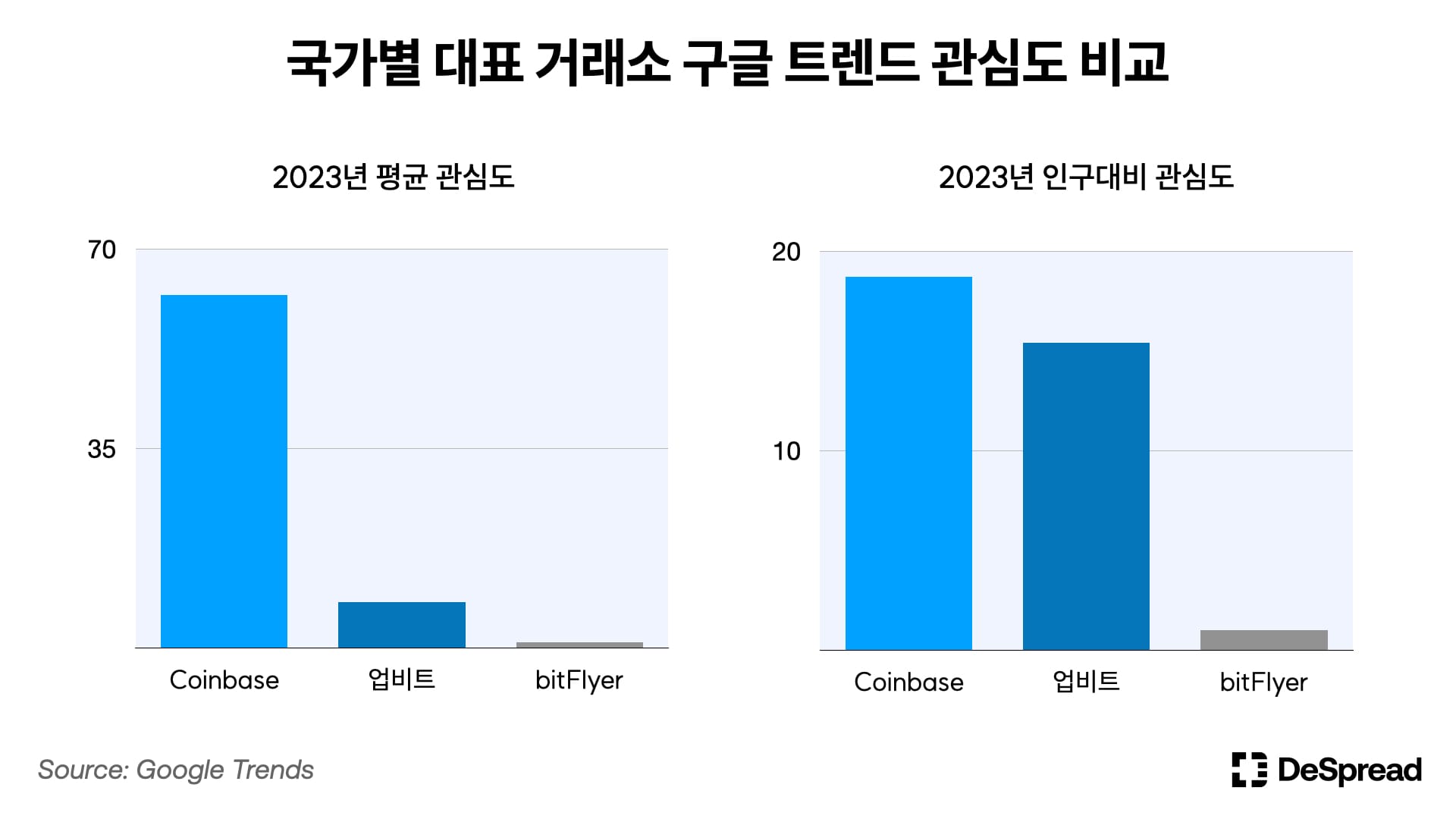

- Meaning of exchange : Centralized exchange is an essential element in the blockchain and crypto industry. This is because it is the gateway to on-chain and the easiest way to make investments. Coinbase, Upbit, and bitFlyer were selected as representative exchanges in Korea, the United States, and Japan, respectively, and we looked into each country's interest in crypto and centralized exchanges through keyword analysis.

- Korea showing high interest relative to population : The chart shows that Coinbase shows overwhelmingly high interest in absolute search volume, but Upbit and Coinbase are at similar levels in interest relative to population. This shows that the usage rate of crypto exchanges in Korea is quite high. On the other hand, Japan's bitFlyer shows very low absolute search volume and interest relative to the population, showing that crypto exchange use is still relatively inactive in Japan.

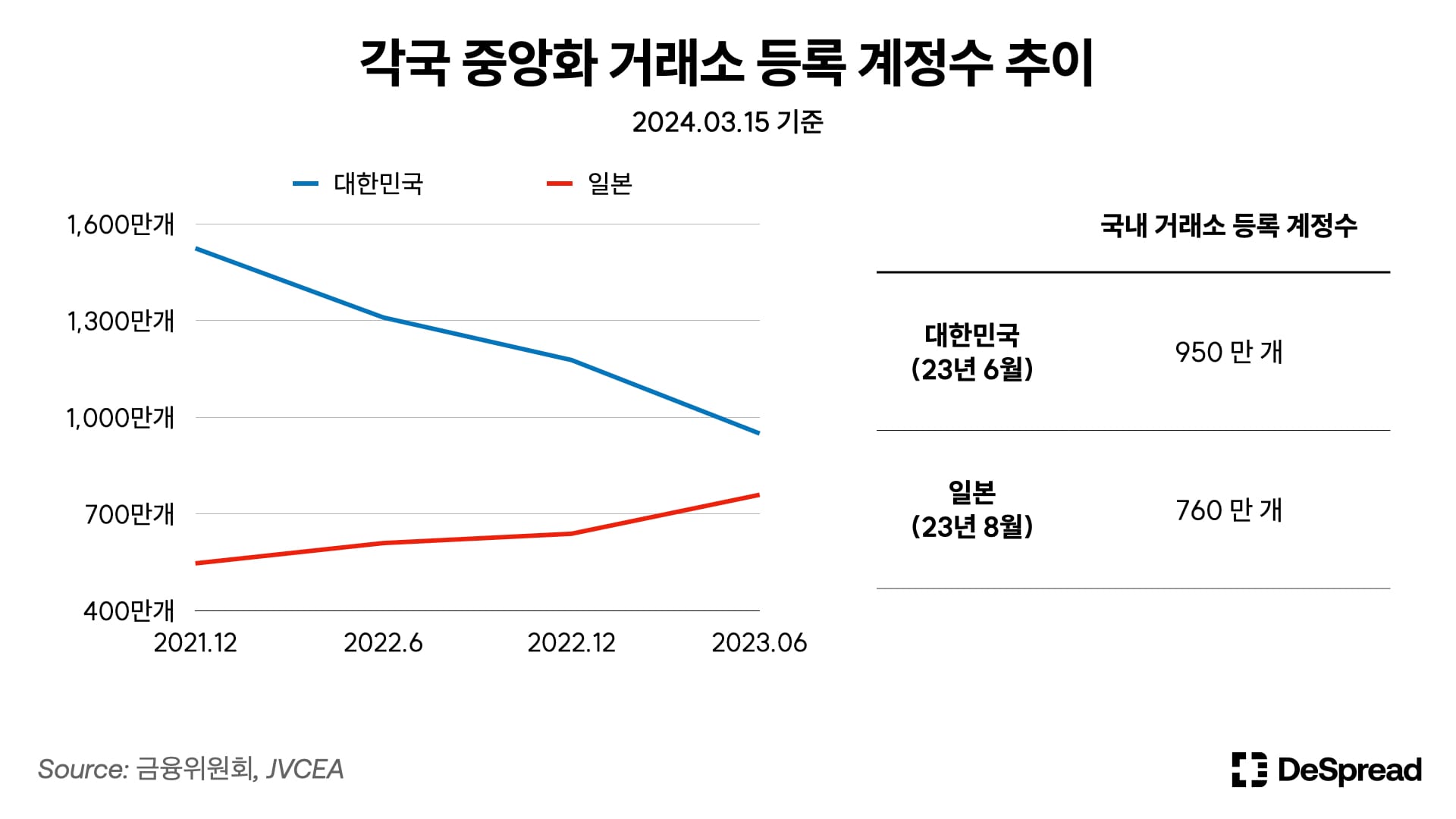

- Characteristics of the crypto environment in each country : Crypto trading is actively taking place in the United States, centered around Coinbase, a global exchange. Coinbase targets users around the world, and as of the end of 2022, there were 100 million users who completed KYC, which is more than the population of South Korea. As of the first half of 2023 in Korea, the number of registered accounts on centralized exchanges was 9.5 million, and the number of trading users was approximately 6 million. On the other hand, the number of registered accounts on Japan's centralized exchange was 7.6 million as of August 23, showing fewer users compared to Korea's population.

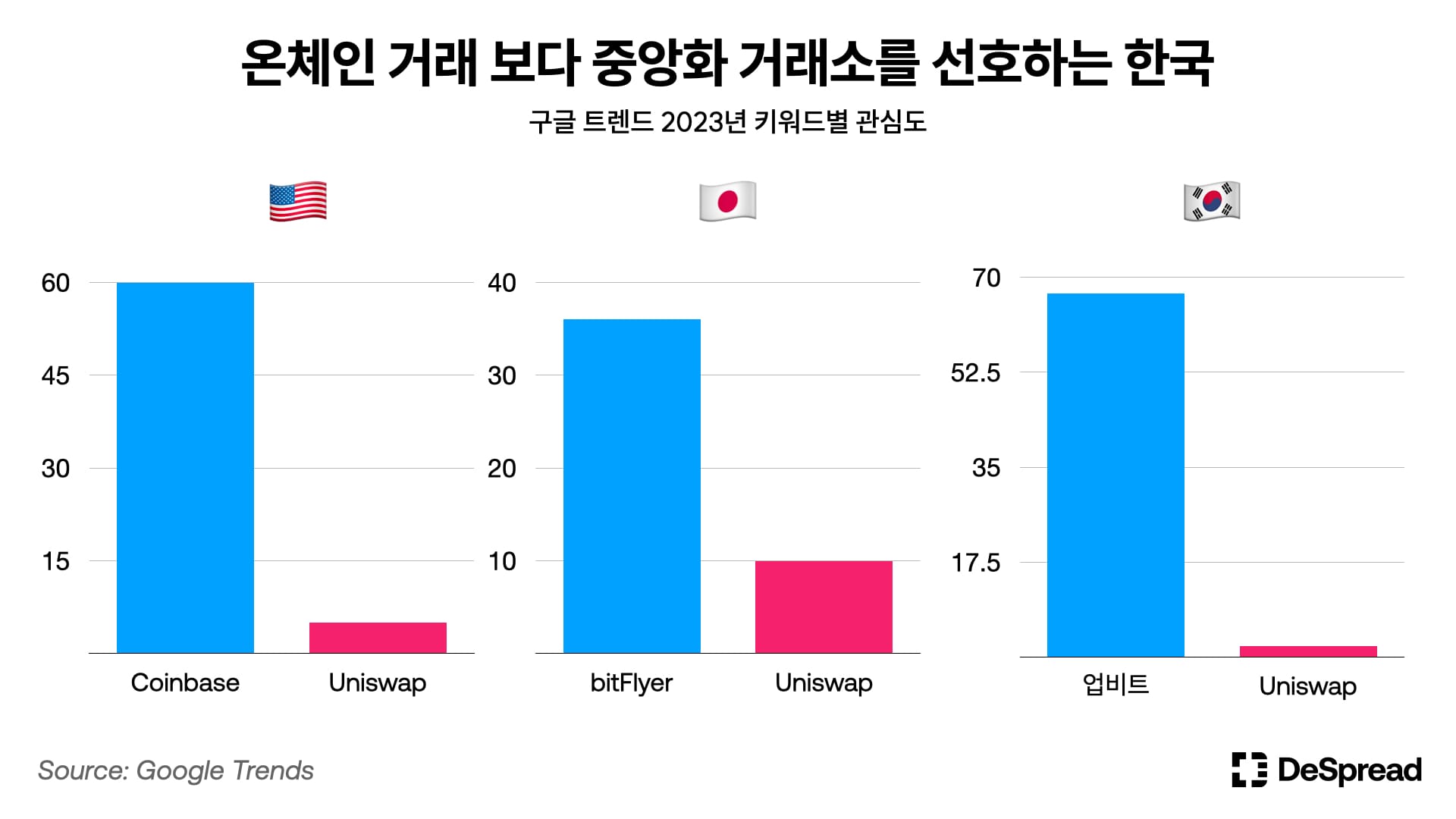

3.1.3. Centralized exchange vs. On-chain keyword comparison

- Reference point for determining on-chain interest : Compared to using a centralized exchange, the barrier to entry for on-chain activities is very high. By comparing and analyzing each country's representative exchange keywords and on-chain related keywords, we indirectly found out the level of interest in on-chain by country.

- Interest in on-chain transactions : Uniswap, a representative decentralized exchange (DEX), was selected as an indirect indicator of interest in on-chain transactions and a comparative analysis was conducted with representative exchanges in each country. In relative terms, it was found that the United States, Japan, and Korea showed greater interest in on-chain transactions compared to interest in centralized exchanges, in that order. In particular, in the case of Korea, crypto investment activity is active, but on-chain interest appears to be relatively low. In the case of Japan, interest in Uniswap was high, but this can be interpreted as a relative highlight because interest in bitFlyer is very low.

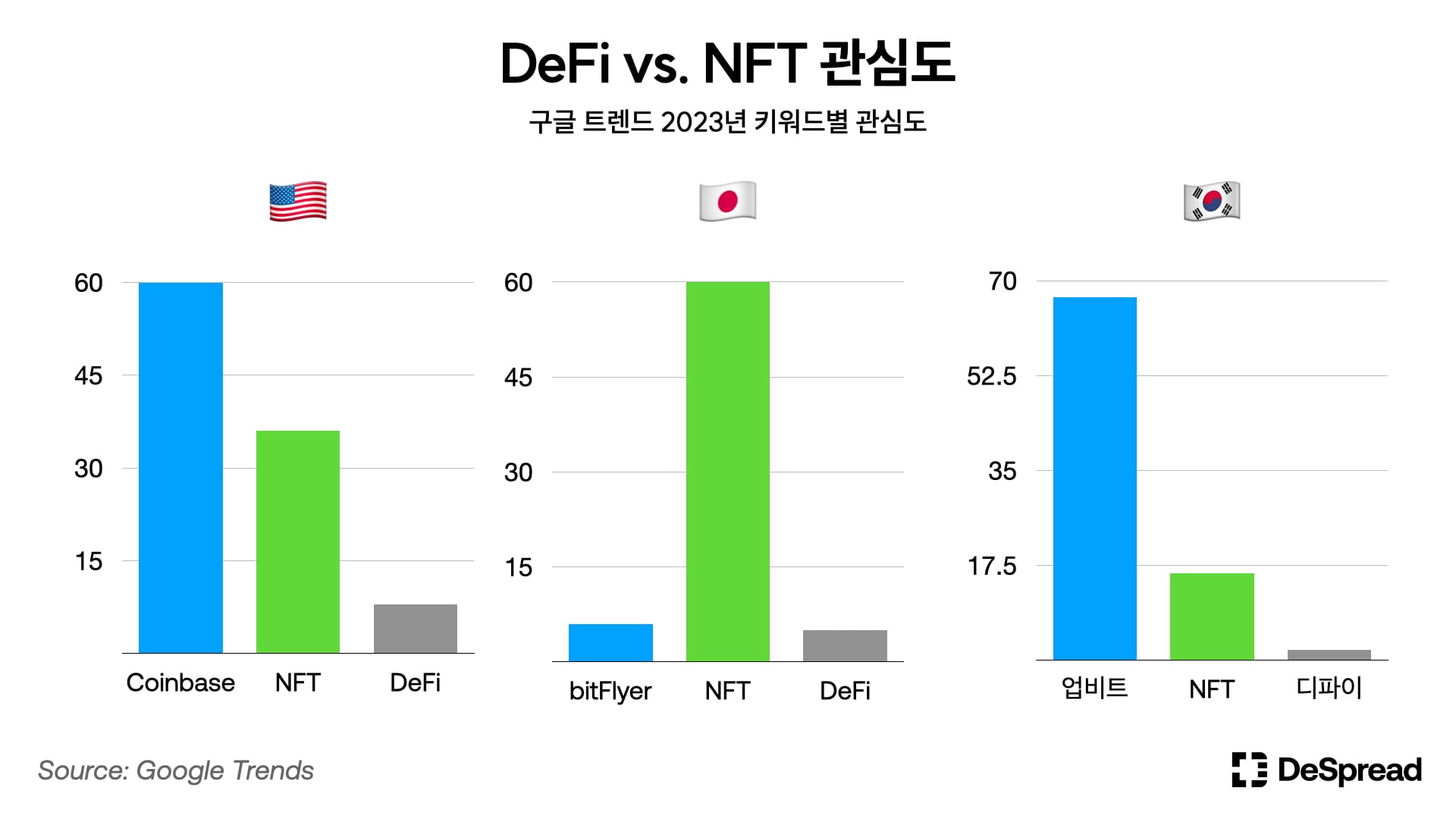

- NFT and DeFi : Looking at NFT and DeFi, which are representative keywords representing on-chain activities, both the United States and Korea showed higher interest in NFT keywords than DeFi. This appears to have been influenced by the fact that NFTs are easy to understand, easy to access, and airdropped in large numbers through events. In the case of Japan, interest in NFTs is much higher than interest in centralized exchanges, showing that the NFT market is relatively active in Japan.

- Developer ratio and on-chain interest : According to data from Electric Capital, in the regional distribution of crypto developers around the world, 28% of the total is concentrated in North America, while the East Asia & Pacific region, which includes Korea, accounts for only 11%. Although exact indicators for Korea have not been released, the proportion of protocol developers in Korea appears to be very small compared to transaction volume. This can be said to be another indicator that there is greater interest in trading through centralized exchanges in Korea than in developing on-chain technology.

In summary, Korea shows high interest in crypto investment and trading, but interest in on-chain activities such as NFT and DeFi is relatively low. On the other hand, the United States has a high level of interest in on-chain activities, and Japan has a relatively active NFT market.

3.2. Telegram Crypto Community

We analyzed messages sent from 110 Korean crypto announcement channels operating on Telegram in 2023. Corporate channels or channels that only share news headlines were excluded from the analysis under the assumption that posts were made for a specific purpose rather than a community. Through this, we will find out which channels Korean crypto investors using Telegram paid attention to, what topics they were interested in, and what sentiments they expressed.

3.2.1. Activity analysis

The chart above compares the Bitcoin price in 2023 and the number of monthly messages in 110 Korean crypto community channels.

- BTC price and community activity : Overall, when the BTC price rises, channel activity tends to increase as well. In particular, as the BTC price soared from October to December 2023, the number of messages on the channel also increased significantly. This appears to be because price fluctuations stimulate investor interest, which in turn leads to active information sharing and discussion.

- Channel activity during bear markets : BTC price declined in August and September 2023, and the number of messages on the channel also decreased during this period. In down markets, investor participation generally decreases, and community activity tends to decline somewhat.

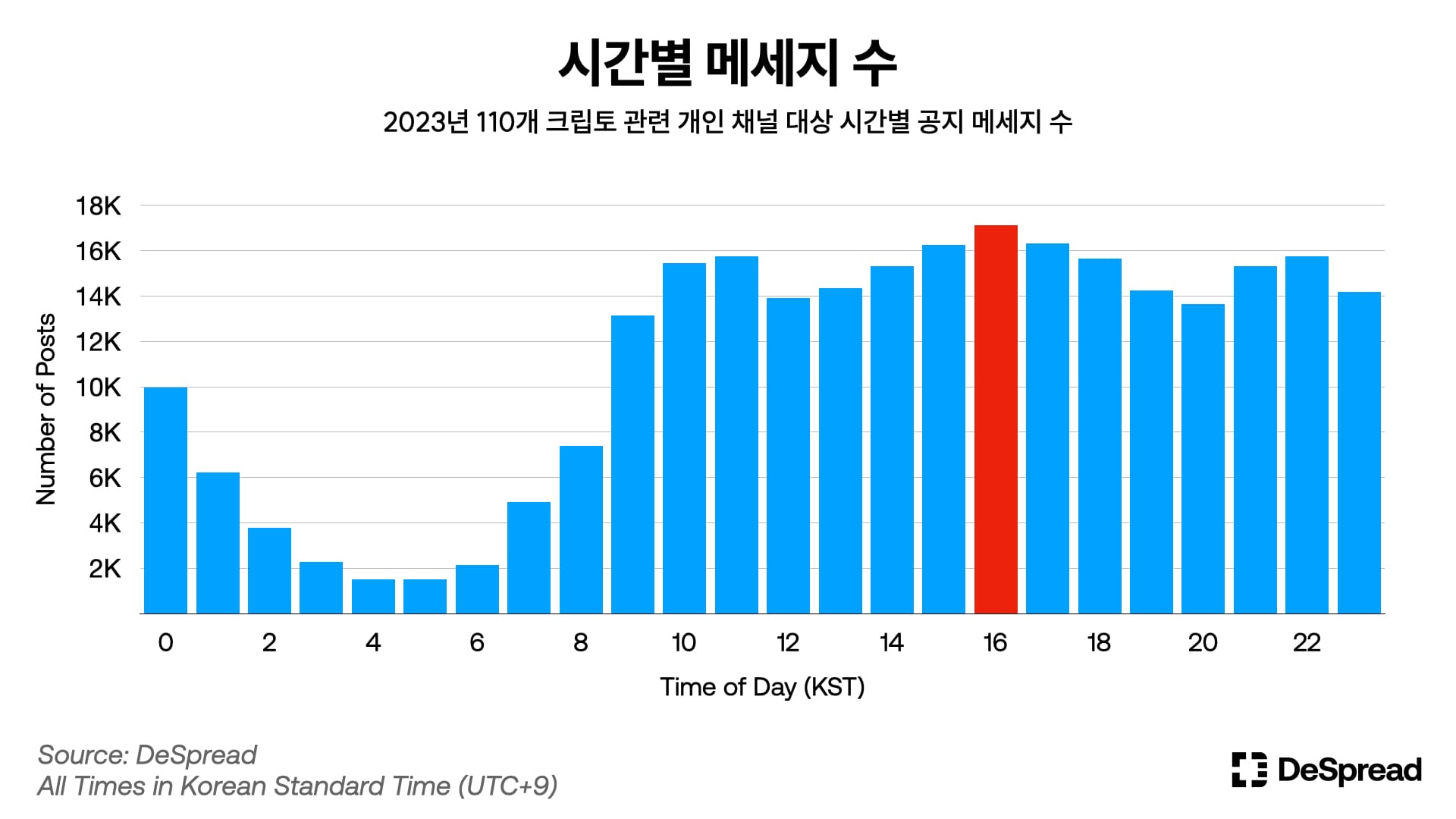

- Most active time zone: As a result of analyzing the number of announcement messages by time zone in personal Telegram channels, we found that most activity occurs from 4 PM to 5 PM. The number of messages begins to increase around 9 AM and remains high until 11 PM, with the highest activity occurring between 2 PM and 6 PM and peaking at 4 PM. On the other hand, community activity was found to be lowest between 2 a.m. and 6 a.m.

These patterns are generally similar to Korean work patterns. What's interesting is that there is steady activity even after 6 p.m. The fact that community activity remains active even after the stock market closes at 3:30 PM can be seen as a reflection of the 24-hour global operation nature of the crypto market.

3.2.2. 2023 trend keyword analysis

We analyzed the most mentioned keywords in 110 Korean Crypto Telegram personal channels in 2023. As a result of the analysis, the most mentioned keywords were 'Bitcoin', 'NFT', 'Airdrop', and 'Ethereum'. In particular, 'NFT' was confirmed to be high in Telegram keyword rankings while Korea has less interest in NFTs than other countries in Google Trends figures. This appears to be because many projects conducted free NFT airdrops as a marketing tool.

Overall, investors showed great interest in what they could get for free, which was also influenced by the fact that Telegram has a relatively large number of active on-chain users. Next, we will look at which keywords were at the center of Korean community topics each month.

January - Focus on macroeconomic uncertainty

In January, macroeconomic-related keywords such as 'CPI', 'FOMC', and 'interest rate' ranked high, along with new year-related keywords such as 'year-end settlement'. This appears to be because macroeconomic uncertainty, such as interest rate hikes and concerns about economic recession due to the overall recession in the crypto market, had a significant impact on the crypto market.

February, March - Airdrop & USDC depegging

In February, the ‘Silvergate’ and ‘SVB’ bankruptcies occurred, and in March, the ‘USDC’ depegging incident occurred. As a result, market sentiment showed a significant decline, but in February, the token airdrop of the NFT marketplace 'Blur' received great attention from the community, and in March, the airdrop of the Ethereum layer 2 project 'Arbitrum' attracted the community. The market has regained its vitality by attracting a lot of attention. Thanks to the airdrop effect, Blur quickly emerged as a threat to the existing powerhouse OpenC, and users who received the Arbitrum airdrop used Arbitrum ecosystem dapps, and Arbitrum on-chain activity also increased. Additionally, as shown in the chart above, the keyword 'ZK Sync' also rose to the top of the rankings, raising expectations for projects that are expected to be airdropped in the future.

April - Memecoin craze and Sui start again

In April, speculative sentiment spread again as the meme coin represented by 'PEPE' soared. The price of Pepe's token, which was inspired by a frog character, soared more than 80 times in just three days, instantly becoming the center of attention. Additionally, the mainnet launch of ‘SUI’, a next-generation layer 1 blockchain platform developed by Meta alumni, received great attention from the crypto community. Accordingly, the five major domestic exchanges simultaneously listed Sui on the Korean Won Market Exchange for the first time.

May - BRC-20 token standard and political regulatory issues

In May, the 'BRC-20' standard, which allows tokens to be issued on the Bitcoin network, received great attention from the crypto community. BRC-20, which operates by recording information in Bitcoin like NFT using the Ordinals Protocol, was quite different from the existing ERC-20. Although there were some inconveniences, such as the need to issue a new inscription for token transfer and the need for off-chain indexing to track balance, it was accepted as an attempt to show new possibilities for expanding the Bitcoin ecosystem.

In addition, the issue of political regulation sparked by the Kim Nam-guk incident heated up the crypto community. As suspicions were raised that Rep. Kim Nam-guk owned and traded virtual assets worth billions of won, controversy arose surrounding high-ranking public officials' investment in virtual assets. The problem is that Rep. Kim traded virtual assets in real time during standing committee meetings, and in particular, suspicions of conflict of interest were raised after it became known that he had participated in the proposal of a bill to defer taxation on virtual assets in the past. Accordingly, the 'Public Official Ethics Act Amendment' was proposed and passed, and from December 14, 2023, members of the National Assembly or high-ranking public officials will be required to specify and report the type and quantity of virtual assets they own.

June - CeFi platform serial bankruptcies

In June, the serial bankruptcies of 'Haru Invest' and 'Delio', which were major domestic CeFi platforms, caused a big stir in the crypto industry. These platforms, which had been recruiting investors with high interest rates, suddenly stopped withdrawals due to a funding crunch due to opacity in fund management and selection of insolvent partners. As a result of the investigation, it was revealed that Haru Invest suffered large losses due to the FTX incident, which spread a chain of crises to Delio. The amount of damage was estimated at 103 billion won, and corporate rehabilitation procedures are in progress.

This incident clearly demonstrated the opacity and weak risk management of the CeFi platform. In particular, the case of Delio, which obtained a Financial Services Commission license, showed that there are still challenges to be solved in securing trust through entering the institutional system. Meanwhile, in the community, the pros and cons of CeFi and DeFi were reexamined through this incident, and DeFi, which allows transparent on-chain fund management, received attention as an alternative.

July - Ripple partially wins SEC lawsuit, launches World Coin, attracts attention to Japanese market

In July, news broke that Ripple partially won a lawsuit against the U.S. Securities and Exchange Commission (SEC). The New York District Court ruled that Ripple's sales to general investors did not violate securities laws, which was accepted as an important precedent that could bring changes to the controversy over the securities nature of virtual assets. The price of Ripple soared following this news, and it received great attention from the Korean community, which has many Ripple holders.

In addition, 'World Coin', supported by Sam Altman, CEO of Open AI, famous for ChatGPT, attracted attention by being listed on major exchanges around the world. World Coin has a unique structure that identifies individuals through iris recognition and distributes virtual assets based on this, and the community's attention has been focused on its potential as a solution to protect personal information and distinguish between humans and AI. In Korea, Bithumb, Korbit, and Coinone have listed World Coin.

The keyword ‘Japan’ was also frequently mentioned. Japan's largest blockchain conference, 'WebX Tokyo', was held in July, and the Japanese government's cryptocurrency-friendly policies were mentioned a lot.

August - Curve hack, SEI mainnet launch, Bitcoin ETF approval expected

In August, the 'CRV' hacking incident shocked the crypto community. A vulnerability was discovered in the decentralized exchange 'Curve Finance', resulting in the leakage of more than $50 million in funds. In particular, since Curve's CEO had received collateral loans in CRV from several DeFi protocols, concerns were raised about additional serial liquidations when the price of CRV falls. Fortunately, CRV recovered its price and avoided the worst, but damage to trust was inevitable.

'SEI' listing was also a major concern for the community. As soon as the mainnet was launched, it was listed on all five major exchanges in Korea, raising expectations. SEI also showed its presence by being simultaneously listed on leading overseas exchanges such as Coinbase and Binance. Investor-friendly tokenomics, such as airdropping 25% of issuance to the community, were also cited as SEI's strengths.

Meanwhile, starting in August, expectations for the approval of a Bitcoin spot ETF began to emerge within the Korean community. In particular, as major financial institutions such as Blackrock and Fidelity submitted applications for Bitcoin spot ETF one after another, expectations spread that institutional interest and participation would begin in earnest. However, concerns were raised as the SEC postponed approval again in the same month.

September - KBW and Prentech

In September, Korea Blockchain Week (KBW) 2023, Korea's largest blockchain event, was held and attracted attention from the community. At this event held in Seoul from September 4th to 9th, many major industry figures, including Ethereum co-founder Vitalik Buterin, Circle CEO Jeremy Allaire, and Maelstrom Fund CIO Arthur Hayes, attended and had in-depth discussions on blockchain in general. followed. Additionally, many Korean blockchain projects also participated in the event and shared their vision and achievements.

Another hot issue in September was 'Friend.tech'. In just one month since its launch on August 10, Prentech has shown signs of nearly 10-fold growth in TVL (Total Value Locked) from $5M to $50M, and with expectations for future airdrops, Korean community KOLs are also It became a hot topic while using the service.

October - $MEME Tokens and $SPURS

In October, Mimland's $MEME News related to the token launch heated up the crypto community. Memland is an NFT project created by the popular community '9GAG' and has received a lot of attention by issuing NFTs such as Captains and Potatoes. At that time, Memeland started a farming event, announcing the launch of its own token, $MEME. Even if you are not an NFT holder, you can earn points through simple social missions, which will be later $MEME It received a lot of attention from the community as it was expected to affect token distribution. In addition, SPURS, the fan token of Tottenham Hotspur, where Son Heung-min is playing, was introduced and listed on the exchange launchpad and received a lot of attention.

November - Celestia mainnet launch and airdrop

In November, the mainnet launch of modular blockchain ‘Celestia (TIA)’ attracted attention in the crypto ecosystem. Celestia was listed on leading exchanges around the world, drawing industry attention. In Korea, it was listed on Bithumb, Coinone, and Korbit. In particular, prior to the mainnet launch, a large-scale airdrop was conducted for users who met certain conditions, including Cosmos users, and received attention from investors. Users who frequently used the network received an average of more than 300 TIA airdrops, and the initial transaction price was around 3,000 won.

December - Fusionist Binance Launchpool and Wemix relisting

In December, Fusionist attracted attention as it was unveiled as the 40th Binance Launchpool project. Fusionist is a web 3 game that achieved high profits for investors after listing at a price of over $10.

Meanwhile, news of WEMIX, which had been delisted due to distribution volume issues, was re-listed on the Korean won market in December. Previously, Wemix's delisting was decided through consultation with DAXA on the grounds that the distribution plan information submitted to the members of the Digital Asset Exchange Association (DAXA) was significantly different from the actual distribution volume. However, in December, Wemix was re-listed on Bithumb following Coinone, Gopax, and Korbit, making trading possible on four of the five major exchanges under DAXA, excluding Upbit. Although the issue of Wemix's distribution volume appears to have been resolved to some extent, the issue of transparency of distribution volume still remains a major concern for domestic investors.

3.2.3. Key sources of information

In order to analyze the information acquisition path and influence of the Korean crypto community, we collected message data from 110 crypto-related personal Telegram channels throughout 2023. Based on this, the information sources cited by each channel were aggregated to select the top 10 platforms, and the results were as follows.

'Coverage' specified in the chart refers to the percentage of channels that used the source at least once in 2023 among the 110 channels analyzed. For example, if all channels cited a particular platform at least once during the year, that source would receive 100% coverage.

- X's influence : An analysis of 110 Korean Crypto Telegram personal channels revealed that X recorded 7,572 citations, approximately 1.4 times more than the second-ranked Coinness. This appears to be because almost all Web3 projects operate X official accounts, so they often import X as an information source, and it is the most used platform by global crypto users. X also recorded 100% in terms of coverage, showing that X's influence in the Korean crypto community is very high.

- Korean Media: Among Korean platforms, Coinness, Naver, and Block Media were found to be the most cited information sources on Telegram. In particular, Coinness ranked first among Korean platforms in citations, recording 5,162 citations and 92% coverage. Coinness is a platform where short foreign news articles are translated and uploaded in real time. It is often shared on Telegram as it allows you to quickly identify the latest trends and issues.

Naver is Korea's representative portal site and is a platform where many blog posts are posted along with news services. With 3,194 citations and 99% coverage, it has established itself as an important information source in the Korean crypto community.

Block Media is Korea's specialized blockchain media, recording 1,080 citations and 68% coverage, making it one of the frequently used information sources in the Korean crypto community. Block Media's articles mainly cover domestic and international traditional financial markets and cryptocurrency market trends, major projects and corporate news, and regulatory issues. However, compared to Coinness, it is less timely and contains a lot of content about traditional financial markets, so coverage is relatively low.

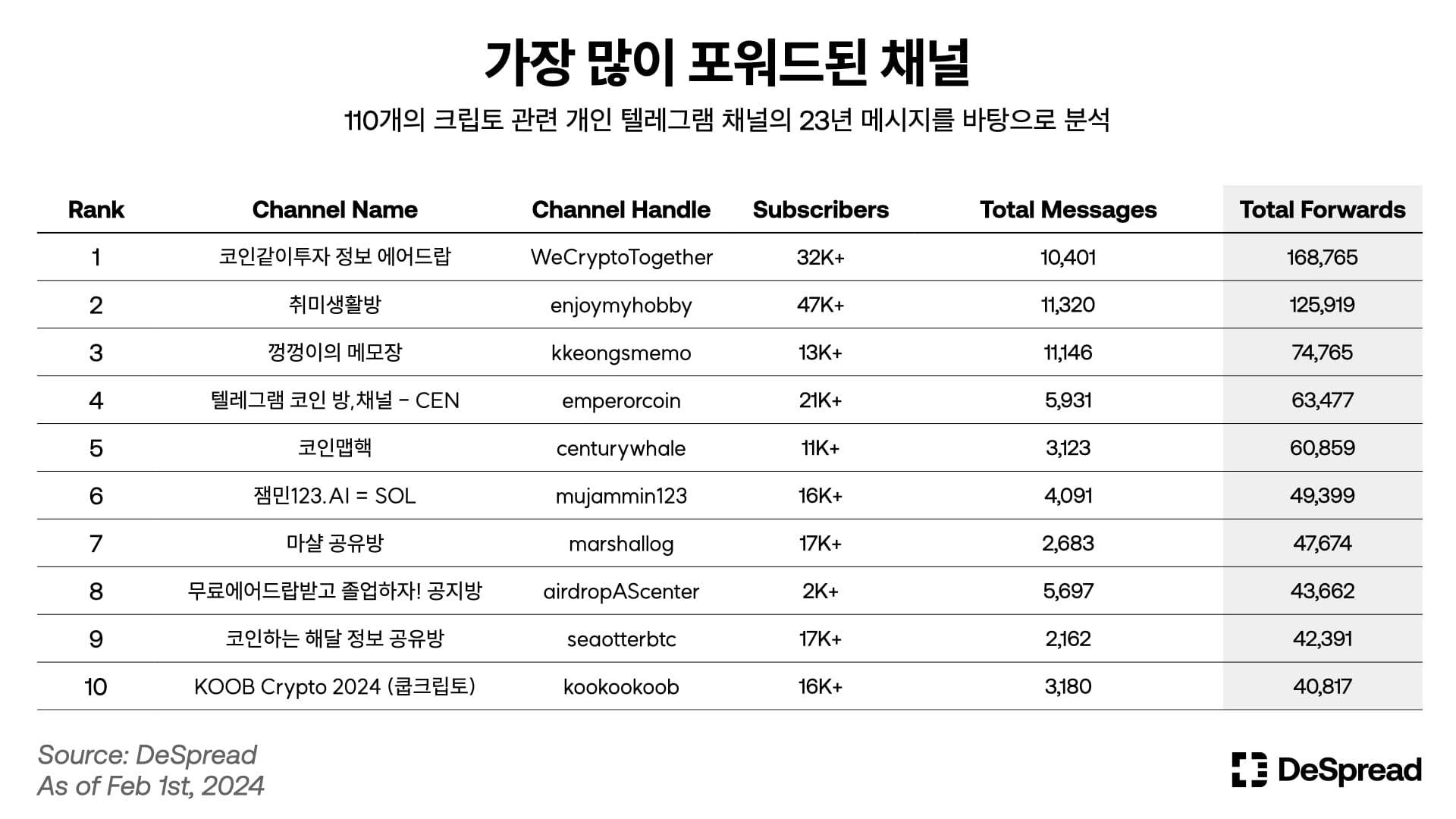

3.2.4. Channel Forward Ranking

The chart above shows the top 10 most forwarded channels out of 110 Telegram channels. Forwarding is a function similar to

The most forwarded channel was ‘WeCryptoTogether’, which recorded a whopping 168,765 forwards. This is about 34% more than the 125,919 views of the second-ranked channel, ‘Hobby Room’. 'WeCryptoTogether' is one of the largest Korean Crypto Telegram channels with approximately 33,000 subscribers and provides various project information and analysis. Half of the top 10 channels were large with over 10,000 subscribers. This shows that channels with more subscribers tend to be forwarded more.

3.2.5. Channel Average Forward Rank

If we looked at the ranking of the most forwarded channels earlier, this time we will analyze the ranking based on the average number of forwards per message. The average number of forwards is another indicator of the quality and impact of a channel's messages.

The first place in the average number of forwards was taken by ‘Jutro’s Crypto Survival (jutrobedzielepsze)’. This channel averaged 57.5 forwards per message, which is about 57% higher than the 36.6 for the second-place channel, 'ICOROOTS'. What's interesting is that 'jutrobedzielepsze' ranks only 8th among the channels listed by number of subscribers. This can be seen as an example showing that the high quality of each message has a greater impact on the effectiveness of message delivery than the number of subscribers.

3.2.6. Message view ranking

Looking at the most viewed messages in the Korean Telegram crypto community in 2023, three major themes stood out.

First, there was a lot of interest in legal and regulatory issues within the crypto industry. Content related to negative issues in the crypto industry, such as personal information leaks, money laundering, and financial crimes, ranked high, and this seems to reflect concerns about uncertainty and risk in the industry.

Second, there was strong interest in new investment opportunities, especially token sales. Information about the SUI token sale ranked 4th and attracted a lot of views, showing that Korean investors are sensitive to new projects and profit opportunities.

Lastly, thirdly, content related to macroeconomic indicators such as CPI also received consistent attention. This result is interpreted as a reflection of the interest of investors who are watching macroeconomic trends to gauge the direction of the crypto market.

Meanwhile, issues related to personal incidents or specific projects had a high number of views, but a relatively low number of forwardings. On the other hand, information related to investment opportunities such as the Sui token sale showed a high number of views and forwarding, indicating that information about actual investment opportunities was actively shared.

3.2.7. Message Forwarding Rank

If you look at the most forwarded messages in the Korean Crypto Telegram community in 2023, you can see that airdrop-related information accounts for an overwhelming proportion. The message that ranked first in the number of forwards was a post titled “Summary of good things to do with airdrops” posted on the ‘Coin Map Hack’ channel on March 20, and was forwarded more than 2,600 times. This message provides detailed instructions on how to participate in the airdrop of promising projects such as Starknet, zkSync, and Layer Zero, and appears to have been widely shared among investors interested in the airdrop.

Most of the messages from 2nd to 10th place were also about opportunities for investors to acquire assets for free, such as airdrops or free NFT minting. In particular, it is noticeable that many airdrops from next-generation promising projects such as zkSync, Starknet, and Scroll are ranked at the top. Meanwhile, it is interesting to note that the message “Clearing out Edzak projects buried in Binance Labs” posted on the ‘KOOB Crypto’ channel on December 19 entered the top 10 despite being relatively recent. This shows that information about projects where large exchanges are expected to invest is still influential within the community.

In summary, it is analyzed that the most actively shared information in the Korean crypto community in 2023 was practical and direct content related to airdrops. This shows that investors are sensitive to new profit opportunities and are especially interested in next-generation promising projects.

3.2.8. Bitcoin Sentiment Analysis

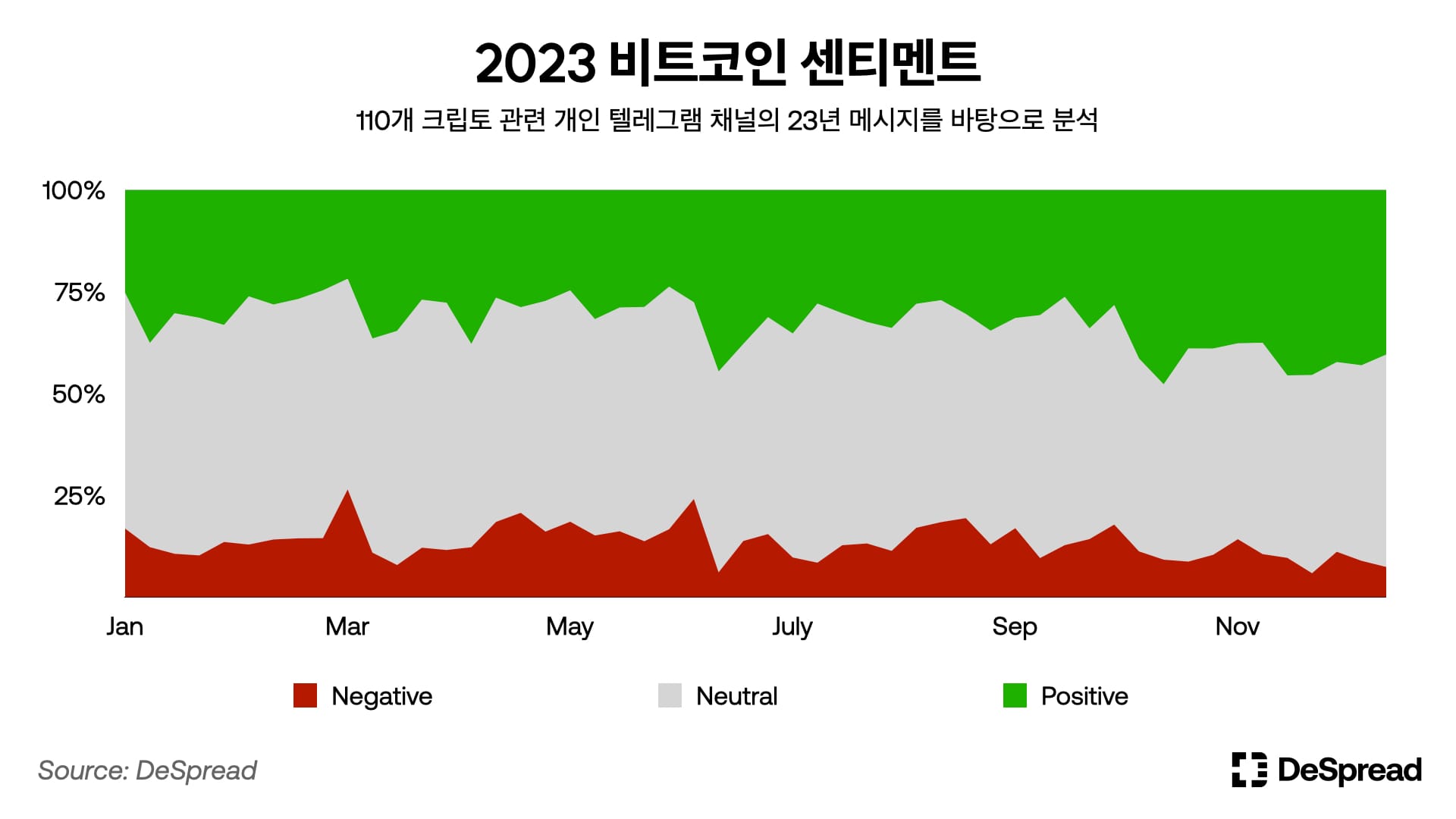

Throughout 2023, we conducted sentiment analysis on messages containing the keywords 'Bitcoin' and 'BTC' in the Korean Telegram Crypto community using Open AI's GPT-4 model. The prompts used for analysis were designed to determine whether a message was positive, negative, or neutral, its relevance to Bitcoin, and the category of the message. In this process, messages classified as marketing and promotion-related messages were excluded from the analysis, resulting in a total of 22,878 messages.

Among these, it is noticeable that the proportion of positive messages increased significantly in June. This seems to be related to the rise in Bitcoin prices at the time. In fact, when comparing the Bitcoin price chart and the sentiment trend, we were able to confirm that positive sentiment generally increases in price rising phases and negative sentiment increases in falling price phases.

However, sentiment seemed to lag prices rather than lead them, which suggests that investors' sentiments changed in response to price changes. In addition, the proportion of positive sentiment tended to increase as the second half of the year progressed, which can be interpreted as the expectation of approval of the Bitcoin ETF at the end of the year influencing investment sentiment.

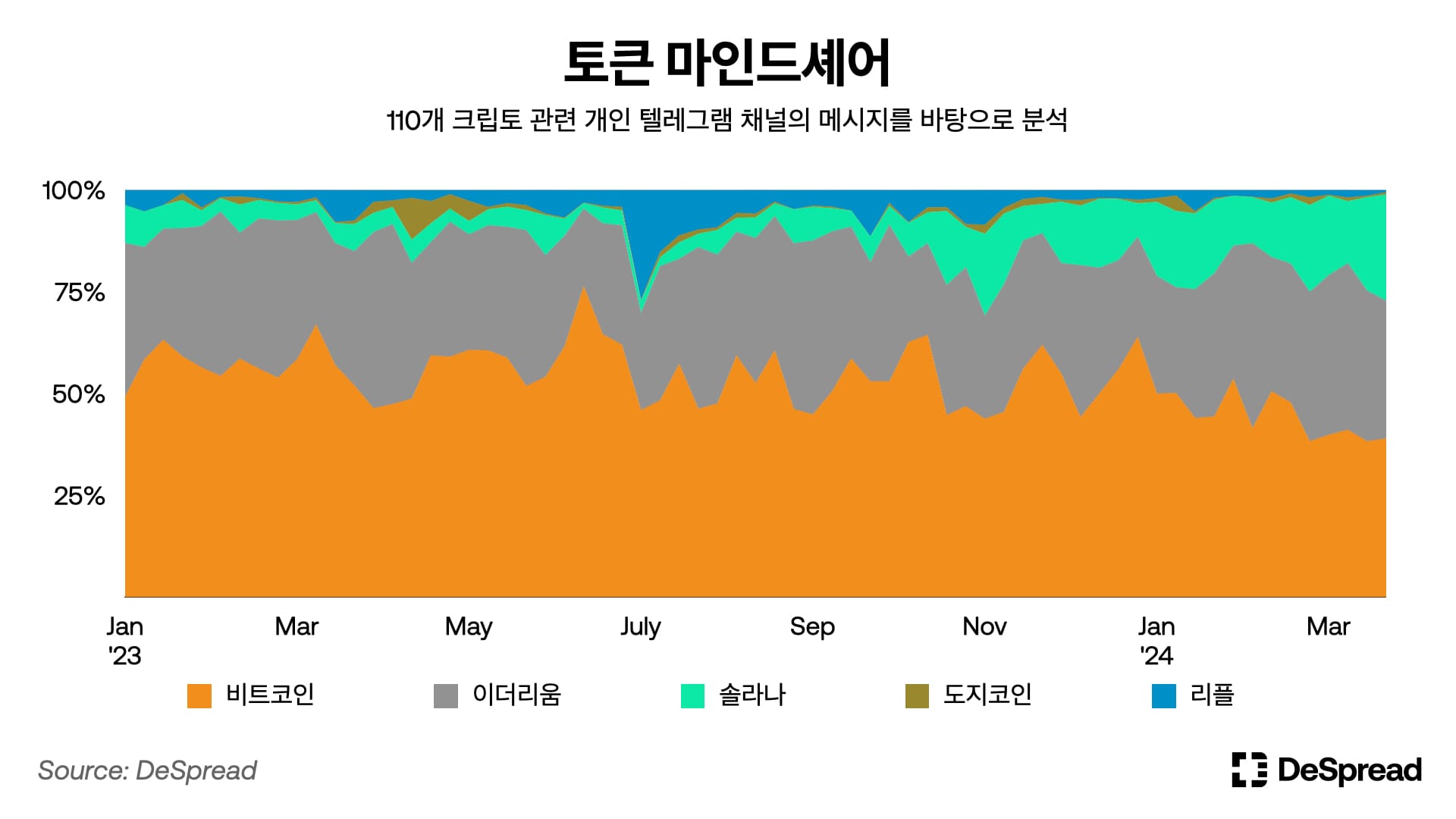

3.2.9. Token Mindshare

This time, we will analyze how many times each token has been mentioned within the community. This was defined as ‘token mindshare’, which refers to the proportion of a specific token in the overall conversation. In other words, a high mindshare figure indicates a high level of community interest in the token.

As a result of the analysis, we were able to confirm that Bitcoin (BTC) and Ethereum (ETH) consistently account for a high proportion of the Korean crypto community. This shows that Bitcoin and Ethereum continue to receive investor attention as representative assets in the crypto market.

Meanwhile, Solana (SOL)’s progress has been notable since July 2023. In particular, it received a lot of attention in the spring of 2024, showing almost equal numbers to Ethereum, due to the rapid growth of the Solana ecosystem, expectations for the launch and airdrop of various projects, and the explosive popularity of the Solana memecoin ecosystem. It appears to be because it was dragged.

3.2.10. The most positive channel for Bitcoin

As a result of analyzing 110 private Telegram channels in 2023 using the GPT-4 model, we were able to select the channel that sent the most positive messages about Bitcoin.

'Money Stack', which ranked first, had 63% of messages about Bitcoin with positive sentiment. Additionally, there were 76 messages about Bitcoin, the highest proportion of the top channels sharing information or opinions related to Bitcoin. MoneyStack Bulletin Board is a channel that quickly delivers professional and in-depth information about Bitcoin and the Stacks ecosystem, Bitcoin Layer 2. It was found that about 3,700 people are subscribed as it maintains an objective and balanced perspective while actively covering new information and good news related to Bitcoin.

It is also worth noting that just because these channels have a high proportion of positive messages does not mean that they recommend unconditional purchase. In addition to delivering objective information, there were also messages that dealt with the development of the Bitcoin ecosystem or talked about technical aspects of Bitcoin.

3.3. X(Twitter)

In the global crypto community, X (Twitter) has become one of the most important communication channels. Many projects and influencers share the latest information and engage in lively discussions through Twitter. However, in Korea, the Twitter usage rate itself is significantly lower than in other countries, and this is no exception in the crypto community.

The actual number of Twitter users has not been disclosed, but according to a report by DataReportal, as of April 2023, the number of Twitter users in Korea was 9.8 million, significantly lower than the 95.4 million in the United States and 67.5 million in Japan.

The difference was also clearly revealed in the results of analyzing the number of tweets containing Bitcoin keywords by language by period. Comparing the number of Bitcoin-related tweets in Japan and Korea as shown in the chart above, Japan generated an average of 17,000 tweets during the period, while Korea's average was only 1,700. Even considering the number of Twitter users, we can see that the amount of Bitcoin tweets per person in Korea is relatively low.

3.4. DC Inside

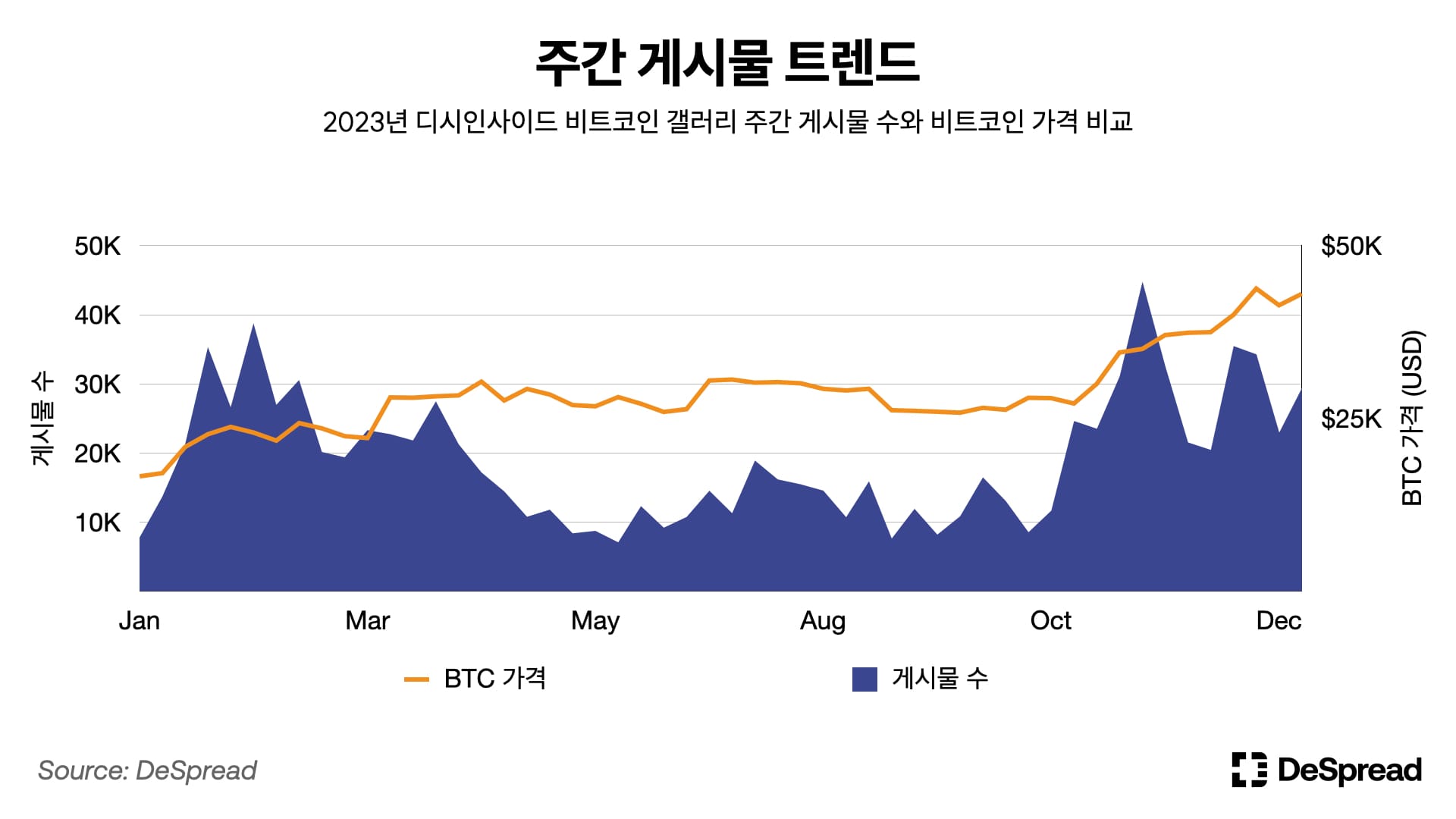

DC Inside is Korea's representative online community platform, which consists of a 'Gallery', a bulletin board with various topics. We analyzed posts made in 'Bitcoin Gallery', which has the largest number of users among cryptocurrency-related galleries in DC Inside, throughout 2023.

3.4.1. activity

As a result of analyzing the number of weekly posts in the DC Inside Bitcoin Gallery in 2023, similar to Telegram activity, the gallery's activity tended to increase when the overall BTC price rose. In particular, as the price of BTC surged in late October, the number of posts reached a weekly high of around 45,000 in early November. This shows that DC Inside Bitcoin Gallery investors are sensitive to price fluctuations and that related information sharing and discussions are taking place. On the other hand, during periods when the price of Bitcoin was moving sideways, activity was relatively low and the depressed market atmosphere appears to have affected investors' community participation.

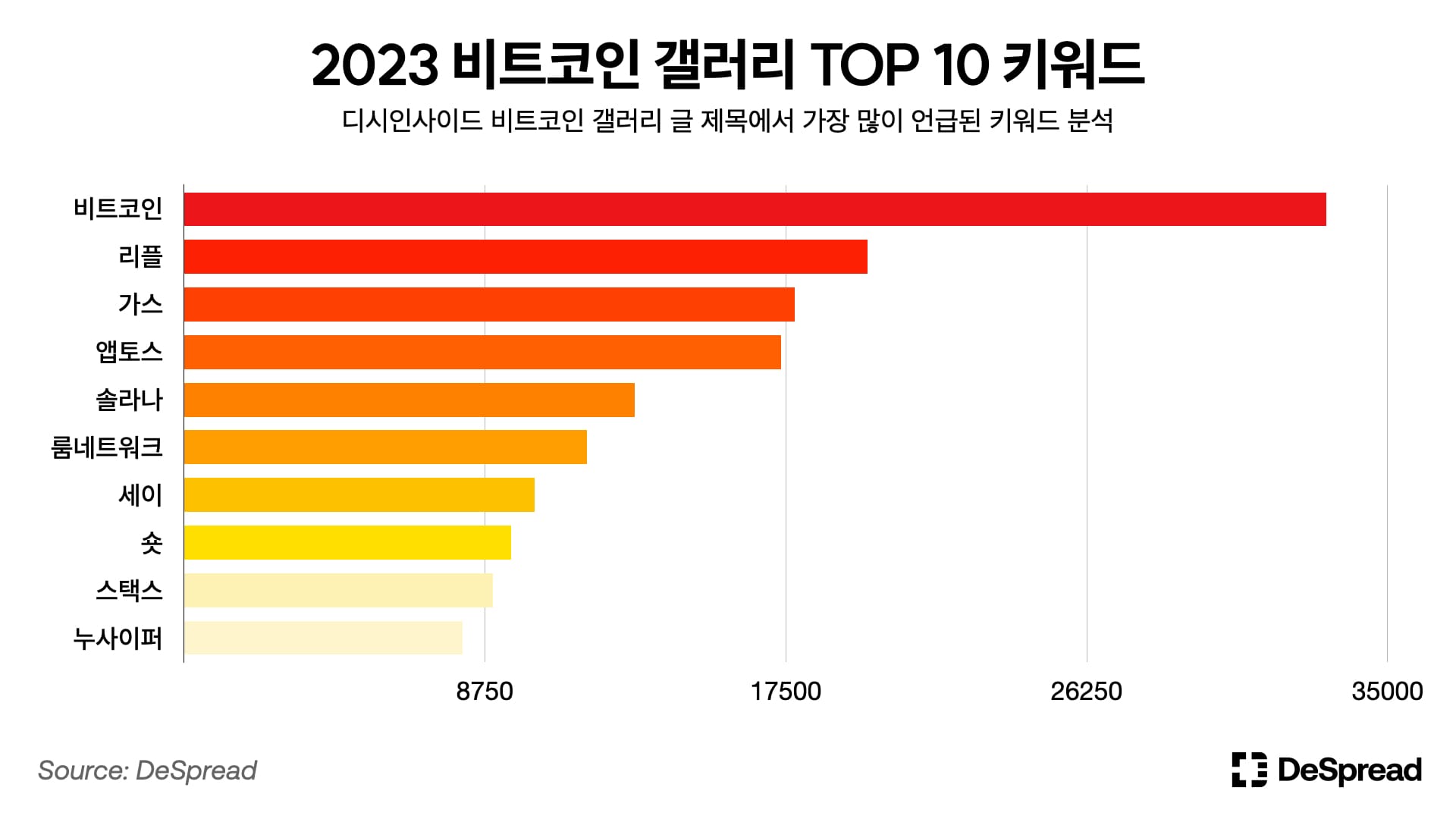

3.4.2. Bitcoin Gallery TOP Keywords

As a result of analyzing the most frequently mentioned keywords in the titles of DC Inside Bitcoin Gallery posts throughout 2023, Bitcoin took an overwhelming first place. This shows that Bitcoin is still attracting the attention of investors as a core currency representing the crypto market. Most of the 2nd to 10th places were altcoins listed on major domestic exchanges. In particular, it is noticeable that Ripple (XRP), which Korean investors especially like, ranked second and GAS ranked third. This appears to be because GAS, which surged more than 10 times in a month for no apparent reason, attracted a lot of attention. Afterwards, gas showed significant fluctuations, falling -75% in three days.

The only word that was not a coin name was included in the top rankings, and that was the word 'short', which means short selling. This reflects the high interest of DC Inside investors in short selling, showing that it is a community with a strong speculative nature that seeks short-term profits.

In summary, the DC Inside Bitcoin Gallery in 2023 shows continued interest in Bitcoin and active altcoin investment aimed at short-term profits. In particular, keywords such as ‘short’ show the speculative nature of the community.

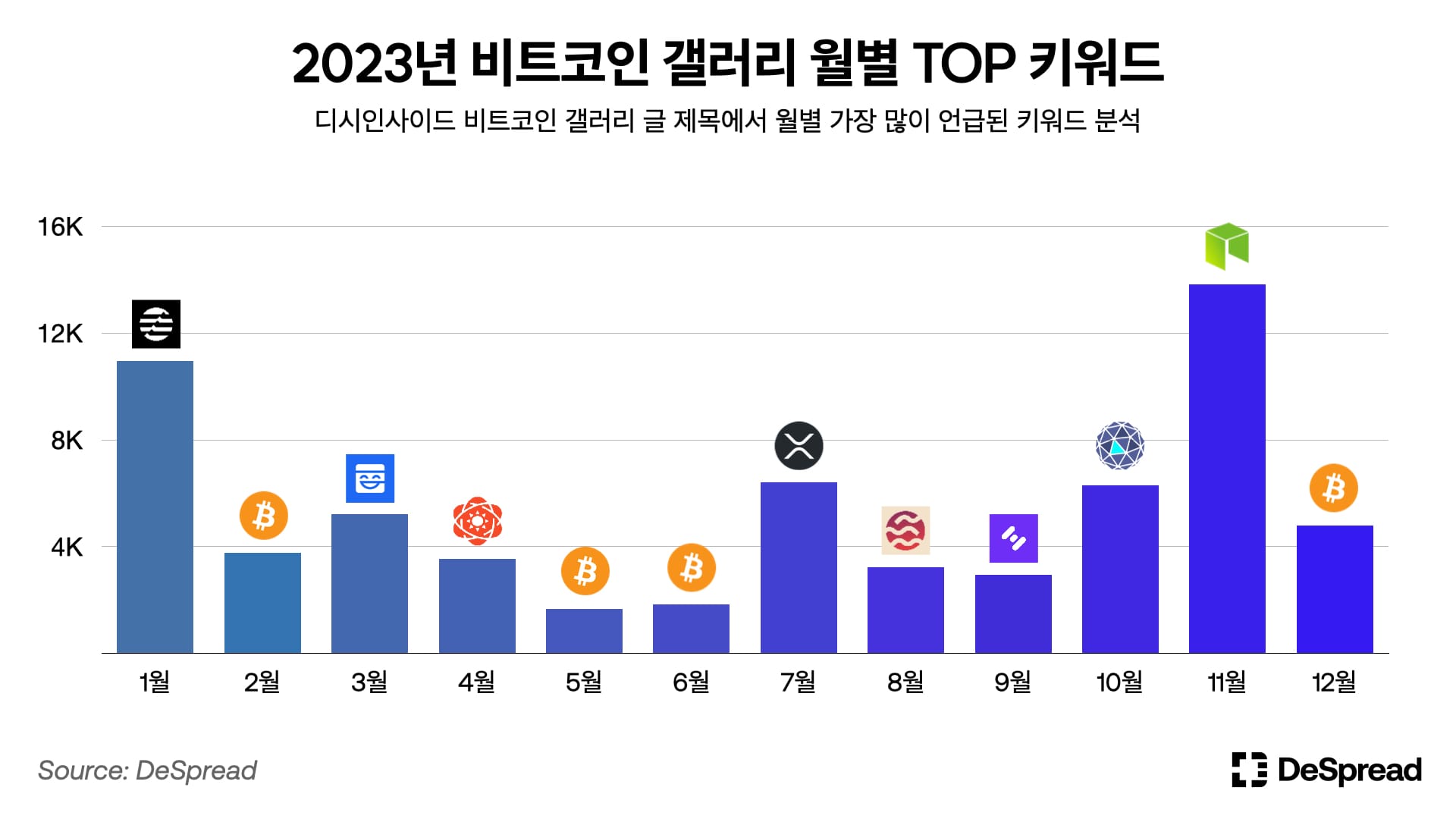

3.4.3. Most Mentioned Keywords by Month in 2023

We looked at the most frequently mentioned keywords by month in the titles of Bitcoin Gallery posts. In January, the price of 'APTOS' soared more than 5 times in one month and was the most mentioned. In July, ‘Ripple (XRP)’ was the most mentioned. This appears to be a result of expectations for a rise in the price of XRP following the news that Ripple won its lawsuit with the SEC. In November, 'gas' was mentioned the most, because gas prices soared more than 10 times in one month for no apparent reason. However, after that, gas prices fell 75% in just three days, showing a typical pump and dump situation.

Monthly changes in keywords suggest that DC Inside investors are sensitive to short-term volatility in the market and are showing great interest in issues or sudden fluctuations in coins listed on major domestic CEXs. However, because it focuses only on short-term profits, there is little talk about long-term value or technological innovation. This is in line with the popularity of keywords such as ‘short’ mentioned earlier.

3.5. Naver Cafe

The chart above shows the number of cafes by keyword. This is an indicator that calculates the top 6 words with the largest number of related cafes among words used with a similar meaning to 'virtual asset' and the number of cafes corresponding to them. Coin or virtual currency appeared to be the most frequently used words.

To learn about the characteristics of the Naver Cafe community, we selected representative virtual asset-related cafes. During the research period (late February to April 2024), when searching for six words with similar meanings to virtual assets, the daily fluctuation in the number of new posts among the 'ranking' cafes sorted by Naver's own algorithm was stable. We mainly selected cafes. Overall, we could see that price-centered discussions were taking place actively.

In particular, interest in altcoins is higher than in Bitcoin, and chart analysis and questions related to these are freely exchanged. As it is a community formed around price, the number of new posts in the cafe is proportional to the price, confirming that Naver Cafe activity is related to price increases.

4. Conclusion

We have conducted an in-depth analysis of the characteristics of the Korean crypto community that has appeared on various platforms so far and the major trends for 2023. As a result of the analysis, it was confirmed that Korea occupies a very important position in the global crypto market. In fact, Korea's largest exchange, Upbit, records the second-largest spot trading volume in the world, and Koreans appear to be more interested in coins than stocks.

Considering the importance and potential of the Korean market, it seems a very natural trend for many global Web3 projects to consider entering Korea. However, successful market entry requires an in-depth understanding of the characteristics and needs of the local community.

As seen earlier, the Korean crypto community is showing its own unique tendencies and trends. Messenger-based communities such as Telegram and KakaoTalk are very active, and speculative tendencies that react sensitively to short-term market prices are also prominent. On the other hand, Twitter usage is low, and interest in on-chain activities such as NFTs and DeFi is also low compared to other countries.

this