Each generation has its own narrative and god.

Since the end of last year, as AI narratives have become popular, Bittensor has stood out, with its token TAO soaring from around US$80 in October last year to as high as US$730 in March this year, with its market value peaking at around US$4.7 billion.

Crypto deification is terrifying.

Although it is not as outrageous as Meme coin, Bittensor has indeed become the new king of the AI track in the past six months, and was once ranked in the top 30 of the market value of crypto assets.

From no one being interested and no one daring to get on board, to the price going up and everyone logging onto Binance, the market has indeed paid a heavy price for this project.

But beyond bits and ether, nothing in crypto royalty lasts forever.

From the peak price to the current drop of TAO price to around 450 US dollars, more and more FUD about TAO has gradually appeared in the market; various doubts seem to be shaking the foundation of this new king of AI.

As the view that "all AI coins are memes" becomes increasingly popular, market participants have come to their senses and are taking a magnifying glass to carefully study and investigate this project at the top of the track.

Keen hunters have also smelled the opportunity and are trying to seize every loophole to earn lucrative short profits in the disenchantment movement to bring down the new king.

We took stock of the FUD about Bittensor in the market to see if there are lice crawling under the gorgeous robe.

Waste of resources, useless work

We mentioned in the article "Interpreting Bittensor (TAO): Ambitious AI Lego, Making Algorithms Composable" that Bittensor does not produce algorithms, but is only a porter of high-quality algorithms, screening out the best AI algorithms or models through a market incentive mechanism.

In Bittensor, an open AI supply and demand chain, some people provide different models, some evaluate different models, and some use the results produced by the best model.

But the reality seems to be more bleak than ideal. In the process of AI model selection and evaluation, wasting resources and doing useless work are very common.

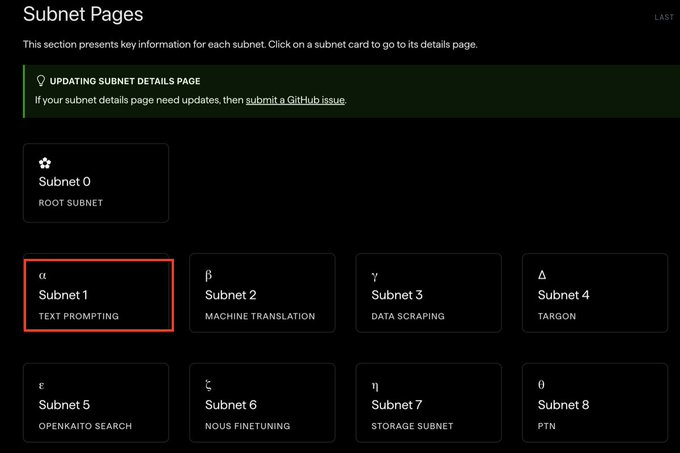

Twitter user @ercwl pointed out that TAO's subnet 1 is doing the work of screening "the answer corresponding to the best text prompt word". The user or system generates a query or question (ie, a text prompt), and each node (miner) in Bittensor is responsible for running one or more machine learning models (such as large language models, LLM) to generate answers to the text prompts.

Obviously, whoever has the better answer will be used; but the situation is worse than expected.

Miner nodes in the network run their own models on these text prompts to generate answers. Each miner may use a different model or model configuration to respond to the same prompt.

In order to ensure the accuracy of the answers and the decentralized nature of the network, multiple miners will independently generate answers. This leads to the first resource waste redundancy: the same question is processed multiple times;

In addition, the validator node is responsible for evaluating the answers provided by the miners. Since each miner tries to generate the answer closest to the validator's expectations, they tend to adopt similar strategies and model configurations. This means that multiple nodes are performing almost the same computing tasks, which are actually repeated, resulting in a waste of resources.

For example, if this subnet is filled with basic questions like "What is water?", hundreds or thousands of miners might simultaneously generate an apparently common-sense answer like "Water is a compound with the chemical formula H2O."

Since the system verifies and rewards miners by comparing the similarity of answers, this leads to a significant redundancy as multiple miners are simply repeating work that has already been done by others.

Using decentralization, the most expensive way to reach consensus (because it takes more resources to get a group of people who don't know each other to reach a consensus), to verify a large number of common sense-like questions and answers, in order to get incentives, it leads to answering for the sake of answering, wasting the computing power of OpenAI or other LLM providers, as well as the fees paid for the API.

Not as decentralized as you think

@varun_mathur , CEO of another AI project Hyperspace , pointed out that Bittensor may not be as decentralized as everyone thinks.

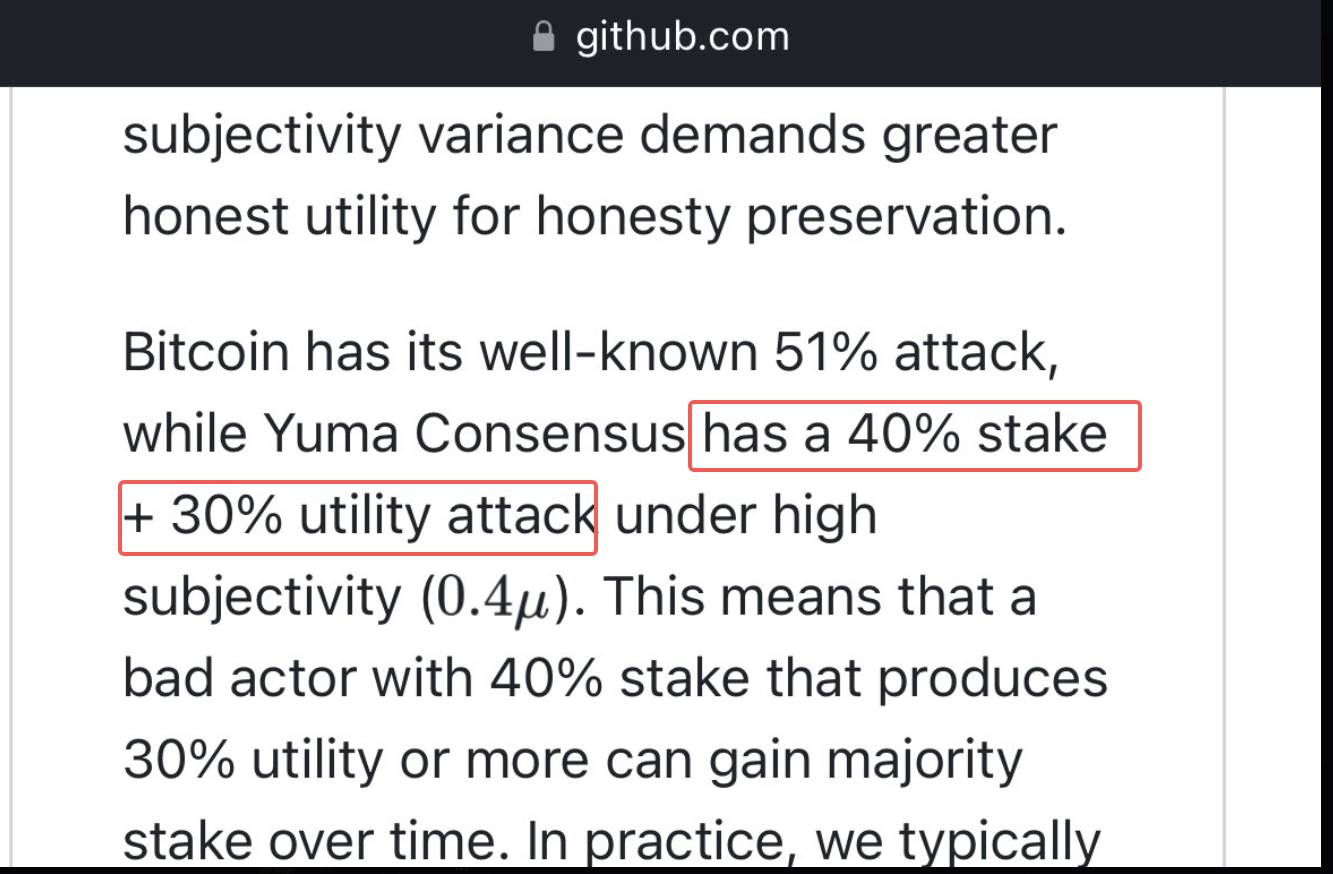

In many cryptocurrency networks, preventing attacks usually requires more than half of the network's control (51% attack). In the case of Bittensor, since the network may allow a lower control threshold (40%), this significantly lowers the threshold required to conduct an attack, increasing the risk of the network being manipulated or controlled by a few large nodes.

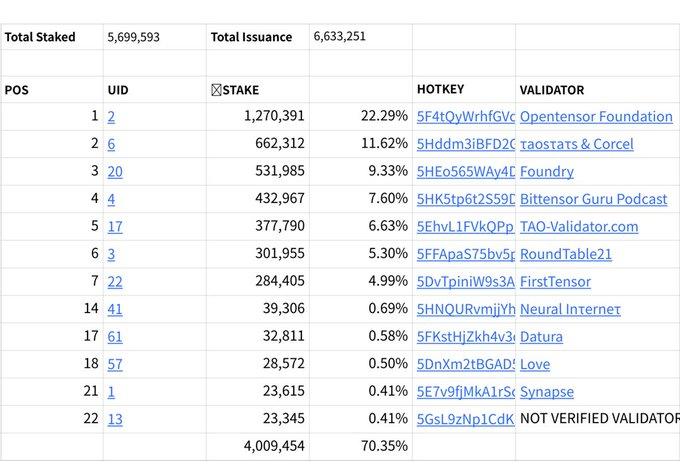

Varun believes that Bittensor is not decentralized enough and that ownership of 40% of TAO tokens (which can be owned by just three entities) could enable an attack.

If the three major nodes of Bittensor control more than 40% of the verification power, these nodes may collude for their own benefit and obtain improper benefits by verifying each other's transactions or data. This behavior not only damages the fairness and transparency of the network, but also may lead to network security incidents because it provides opportunities for potential malicious behavior or attacks.

In addition, another problem of insufficient decentralization is also reflected in the "weight setting" of miners by validators.

In the Bittensor network, weight usually refers to a value given by the validator to the miner, which is based on the consistency of the answer generated by the miner with the preset standard or reference answer. The higher the weight, the more the miner's answer meets the validator's expectations, and accordingly, the more TAO tokens the miner will receive.

Since the weights are set manually, this may bring about problems of subjectivity and manipulation . If the validator favors certain miners, or the weight setting is not transparent and fair, the trust and efficiency of the entire network may be affected.

Obviously, this design will definitely leave no room for small shrimps to survive:

Small or independent miners may find it difficult to obtain high weight due to lack of sufficient resources or technical support, which may lead to further centralization of the market so that only large or well-funded miners can obtain sufficient rewards.

The dragon slayer eventually becomes the dragon. He can kill the centralized AI but cannot kill the centralized "rule of man".

Token concentration, selling pressure is tense

Comrade Xiao Wang @0xInv1ctus, the manager of StinkyInsect Labs, wrote a post titled "My Big-Character Poster - Why I Want to Clearly Criticize BITTENSOR" , which directly pointed the finger at the doubts about the distribution of TAO tokens.

The author pointed out that TAO tokens are highly controlled by a small internal group and their origin is unknown, and there is a risk of selling at any time.

The reason for the FUD is that the TAO token is disturbing from its creation to its results:

$TAO tokens have been produced since 2021. There is no information on how the tokens produced from January 3, 2021 to the launch of the subnet on October 2, 2023 were distributed and where they ultimately went.

From the results, the top 12 root network validators account for 79% of the total network stake. According to their public business statements, they only do staking business related to Bittensor. Therefore, there is reason to suspect that these validators who hold $20B+ worth of $TAO maintain close relationships and form an internal small group.

What is most worrying is that there is no lock-up period for bittensor's staking , and the staking can be canceled at any time. This means that the 85% of the current staking tokens in circulation can be sold at any time.

At the same time, the hedge fund of the author's institution has publicly stated that it is short TAO at around US$420 and expects its price to return to US$100-150.

Each generation has its own story and god; royal power will never last forever.

As the new king created by the AI craze, Bittensor will see an influx of attention and liquidity, but it is also destined to flow out.

Perhaps it is true as these FUD remarks point out that TAO's corresponding business and actual implementation are simply unable to support such a high market value and price; but there is actually no standard answer as to when the outflow will occur and whether you can obtain short profits during the exit.

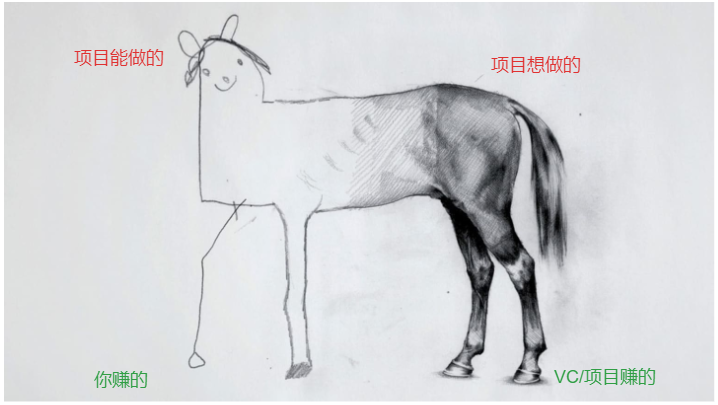

Perhaps just like the classic horse painting MEME below, even if you know that there is a huge difference between "what the project wants to do" and "what the project can do", you cannot make a fortune in the rising period of the narrative and escape unscathed when the tide recedes through more information, more sophisticated trading intuition and firmer trading discipline.

Who is actually making money in this market?

The crypto-leeks are gradually becoming confused amidst waves of FUD remarks and boastful posts saying "I am financially free".