Author: HashKey Capital

Compiled by: TechFlow

Introduction

The report provides an in-depth analysis of the cryptocurrency market in the first four months of 2024, with a particular focus on April 2024. Despite a 20% correction in April, the total market capitalization has still increased by 27% since the beginning of the year. Bitcoin accounts for 53% of the total crypto market capitalization and has returned 30% in the first four months of 2024, far outperforming traditional assets such as the S&P 500. The report also covers major events and developments in April, including the Bitcoin halving, Ethereum upgrades, and the performance of decentralized finance (DeFi).

Article highlights

The total crypto market capitalization has increased by 27% since the beginning of the year. Bitcoin accounts for 53% of the market share.

There are 78 crypto assets with a market cap of more than $1 billion.

From January to April 2024, Bitcoin's return is five times that of the S&P 500.

Bitcoin has a Sharpe ratio of 3.

At the end of April, most indicators showed that the market was "oversold".

Major topics in April included Layer 1 protocols, AI, Gaming, Meme, DePin, and DeFi.

Since the Dencun upgrade on March 13, Ethereum price has fallen 27% and supply has increased by 38,000 ETH.

The Dencun upgrade significantly increases L2 revenue and user payments.

Volumes and open interest remain high compared to last year.

As of the end of April, assets under management of spot Bitcoin ETFs reached $52 million. Six crypto asset ETFs have been launched in Hong Kong.

In March and April, venture capital firms invested more than $1 billion in crypto startups.

After the Bitcoin halving on April 19, the Bitcoin hashrate dropped by 7.5%. On the other hand, April was the month with the highest Bitcoin transaction fee revenue.

April Highlights

April 5 — Ethena adds Bitcoin as a backing asset for USDe

April 6-9 — Hong Kong Web3 Festival organized by HashKey attracted more than 30,000 people

April 7 — Cryptoasset Valuation Framework published

April 8 — DeFi’s total value locked (TVL) exceeds $100 billion for the first time in two years

April 8 — Bitcoin reaches $72,300

April 9 — Monada Labs raises $225 million led by Paradigm

April 10th — HashKey announces L2HashKey Chain

April 11 — Uniswap receives an enforcement notice from the SEC

April 15th — Bitcoin ushers in its fourth halving, with mining rewards reduced to 3.125 BTC

April 24 — Blackrock’s Spot Bitcoin ETF sees 70th straight day of net inflows

April 30 — Six crypto ETFs, including HashKey’s spot Bitcoin and Ethereum ETFs, are listed in Hong Kong

introduce

This report provides an in-depth analysis of the cryptocurrency market in the first four months of 2024, with a special focus on April 2024. Despite a 20% correction in the market in April, the total crypto market capitalization has increased by 27% since the beginning of the year. Bitcoin accounts for 53% of the total crypto market capitalization and has returned 30% in the first four months of 2024, outperforming traditional assets such as the S&P 500.

In April 2024, the crypto market experienced many important events and developments. The Bitcoin halving was a key event that reduced the reward for Bitcoin transaction mining, causing excitement and anticipation in the crypto community. Historically, this event is usually associated with price fluctuations and is expected to affect Bitcoin's supply dynamics.

The total crypto market capitalization continued to rise, reaching a new high of $2.9 trillion by March, indicating strong growth in the first quarter of 2024. This growth was mainly driven by the approval of a US spot Bitcoin ETF in January, which greatly boosted the Bitcoin price, causing it to reach a new all-time high in March.

Ethereum re-staking on EigenLayer also achieved significant development, reaching 4.3 million ETH, with a quarterly growth rate of 36%. This shows the growing interest in subscriptions and the Ethereum ecosystem. The approval of the US spot Bitcoin ETF and the expectation of the Ethereum spot ETF further stimulated market sentiment.

Solana has also attracted much attention, with its meme increasing by $8.32 billion in market value in the first quarter of 2024. Overall, driven by major events such as the Bitcoin halving and major developments in the alternative coin space, the cryptocurrency market in April 2024 is full of anticipation, excitement, and volatility.

Crypto Market Cap

From the beginning of the year to the end of April, the total crypto market capitalization increased by 27%. The current market capitalization is $2.11 trillion, just 25% below the all-time high of $2.8 trillion in November 2021. Bitcoin accounts for 53% of the total crypto market capitalization.

April was a correction month for the crypto market, with the market capitalization falling by 20%. On the other hand, it is important to note that the crypto market started the year very strongly, surging 70% from the beginning of the year to March 14. Therefore, this correction is a natural reaction to an overbought market.

Currently, there are 14 different crypto assets with a market cap of over $10 billion and 78 assets with a market cap of over $1 billion.

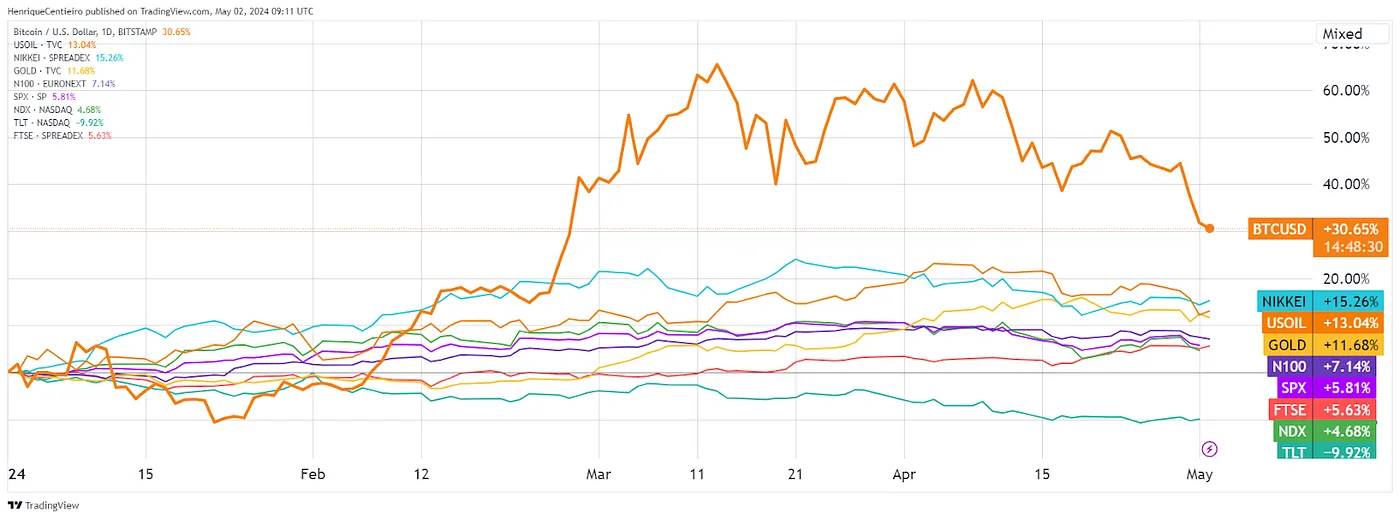

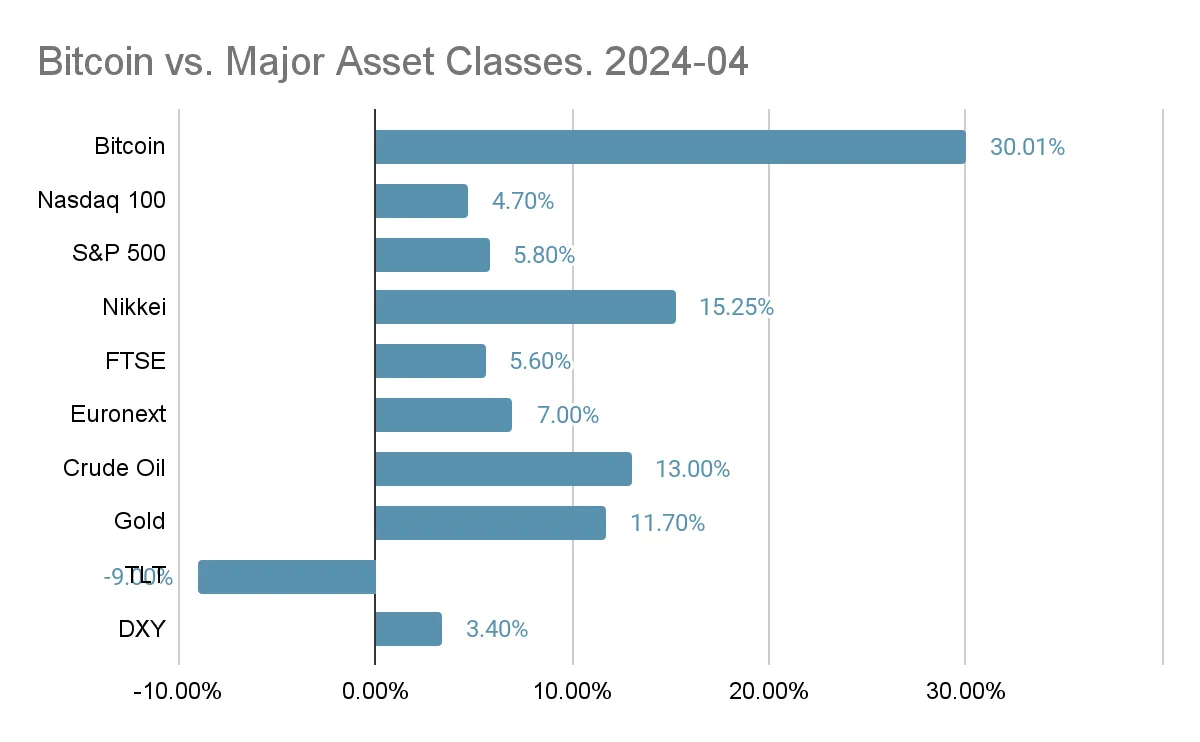

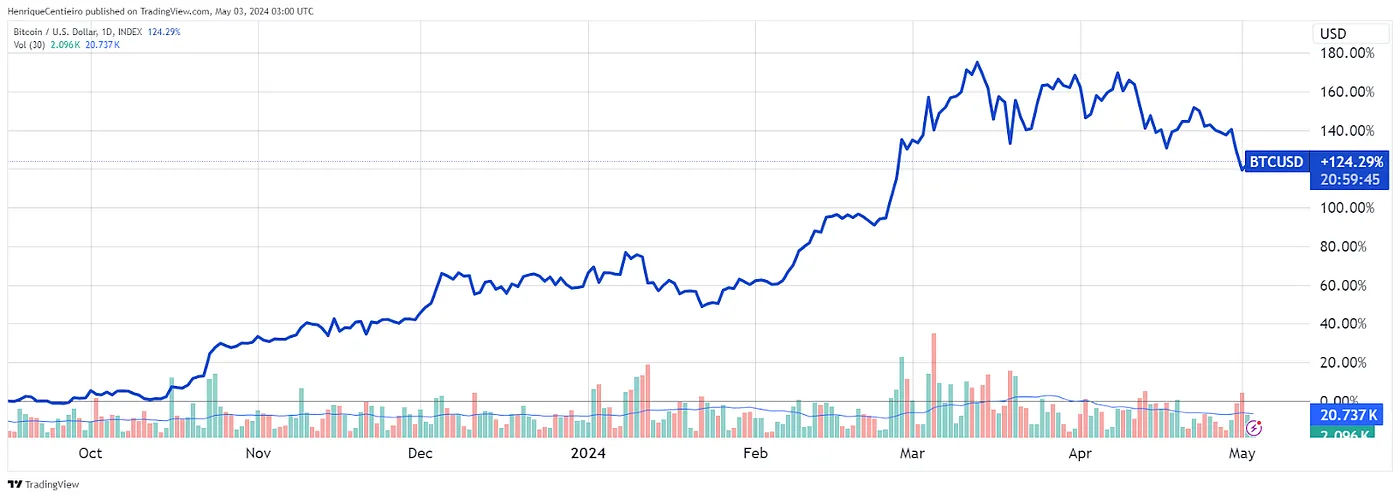

Comparison of Bitcoin and Benchmark Assets

Bitcoin has returned 30% in the first four months of 2024. Bitcoin and other crypto assets have shown interesting excess returns and risk-adjusted returns compared to other traditional assets.

Even though the stock market has performed very well this year, Bitcoin has returned 5 times more than the stock market (S&P 500) . It is important to note that Bitcoin is generally the least volatile crypto asset, and many other crypto assets have returned multiples of Bitcoin. For example:

Toncoin 107%

Dogwifhat 1,637%

Arweave 201%

Fetch.ai 193%

Jupiter 4,629%

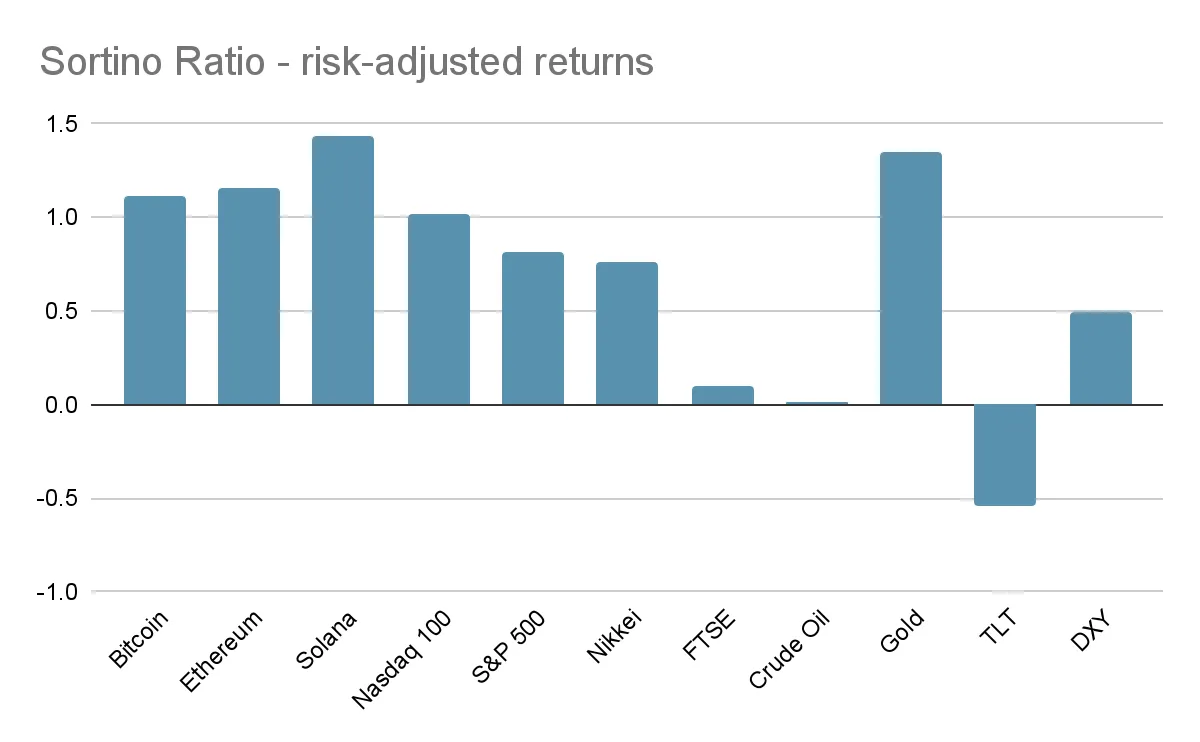

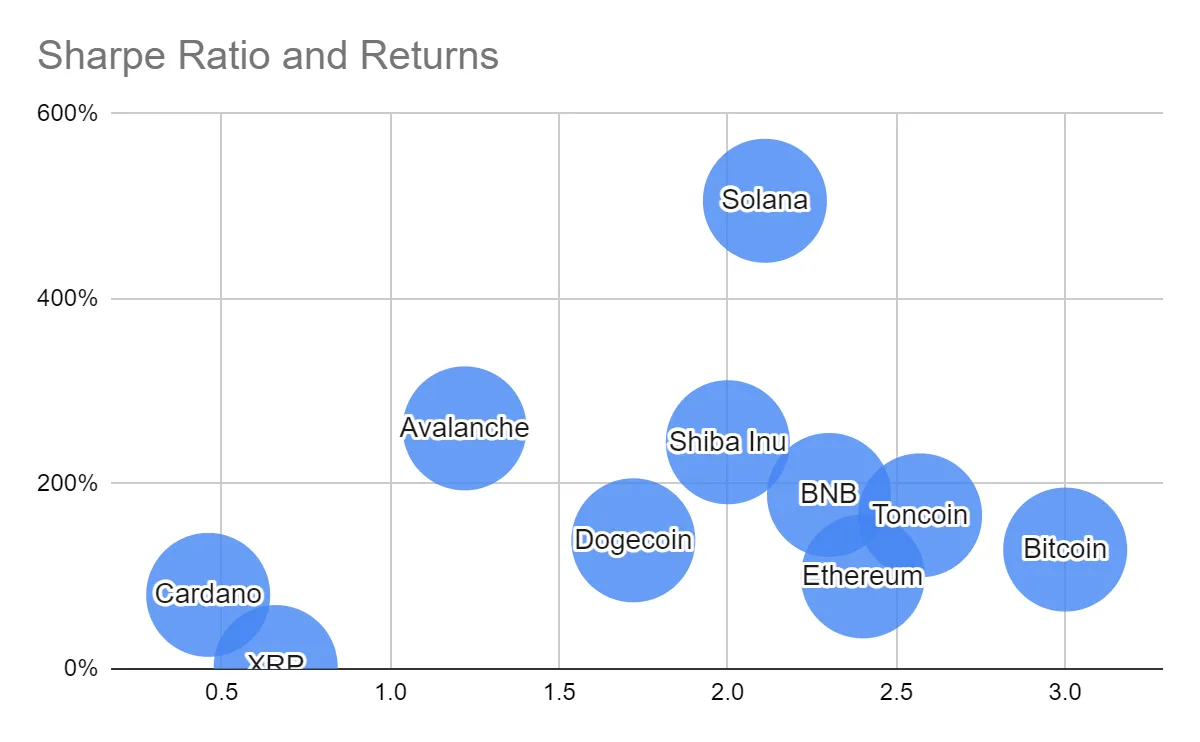

Volatility and Sharpe Ratio

Although crypto assets are often viewed as a more volatile asset class, their risk-adjusted returns are generally more attractive than other asset classes. Although crypto assets are traditionally viewed as risky assets, they also offer better risk-adjusted returns than traditional assets. In other words, these returns are attractive given the volatility that investors have to endure.

Solana has been the best performer among the large market cap coins in the first four months of the year. On the other hand, Bitcoin has a Sharpe ratio of 3, meaning a good return for the amount of risk provided. Typically, we prefer to see assets on the right side of the chart below.

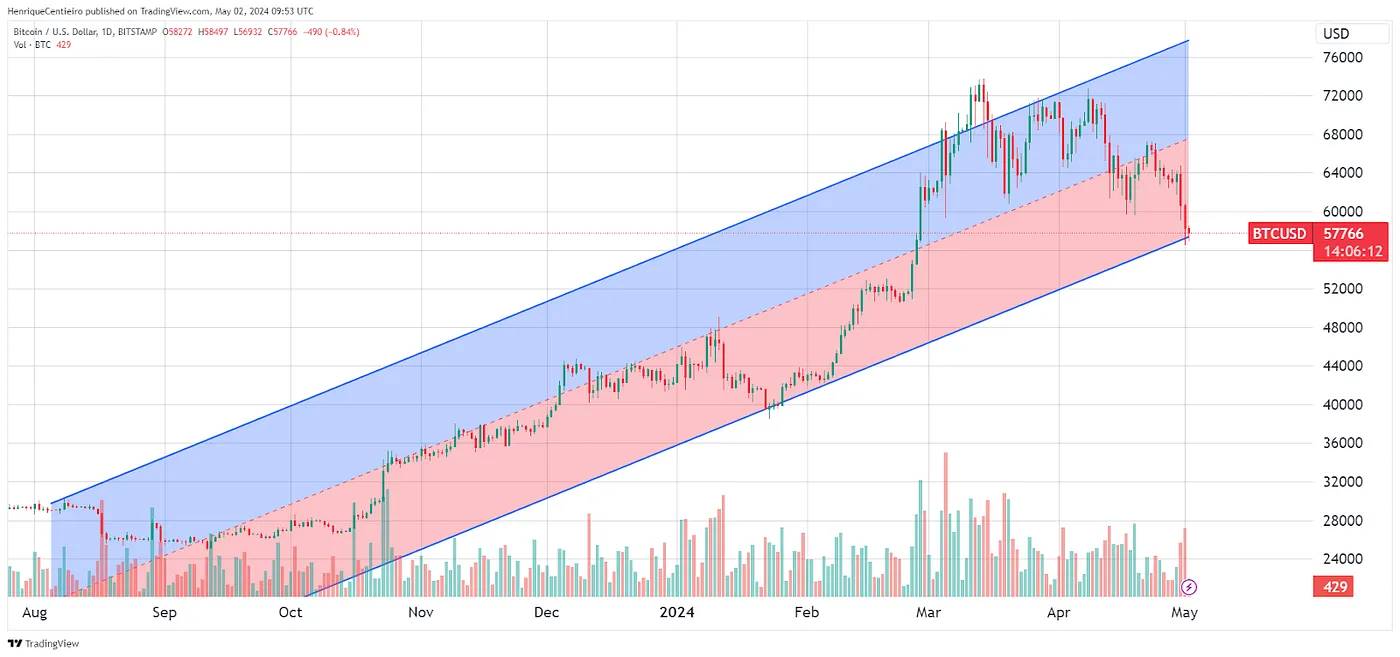

Price Trends and Technical Analysis

Bitcoin’s 6-month retracing trend is $67,500 (while the BTC price is $57,766), which means that BTC could eventually retrace to the $67,000 level while continuing its growth trajectory.

Currently, momentum oscillators are mostly neutral to oversold.

Bollinger Bands: Oversold

RSI: Neutral/Oversold

CCI: Oversold

MACD : Oversold

Fear and Greed Index: Neutral

Judging from the levels shown in the above chart, we can expect a retracement towards the $67,000 level.

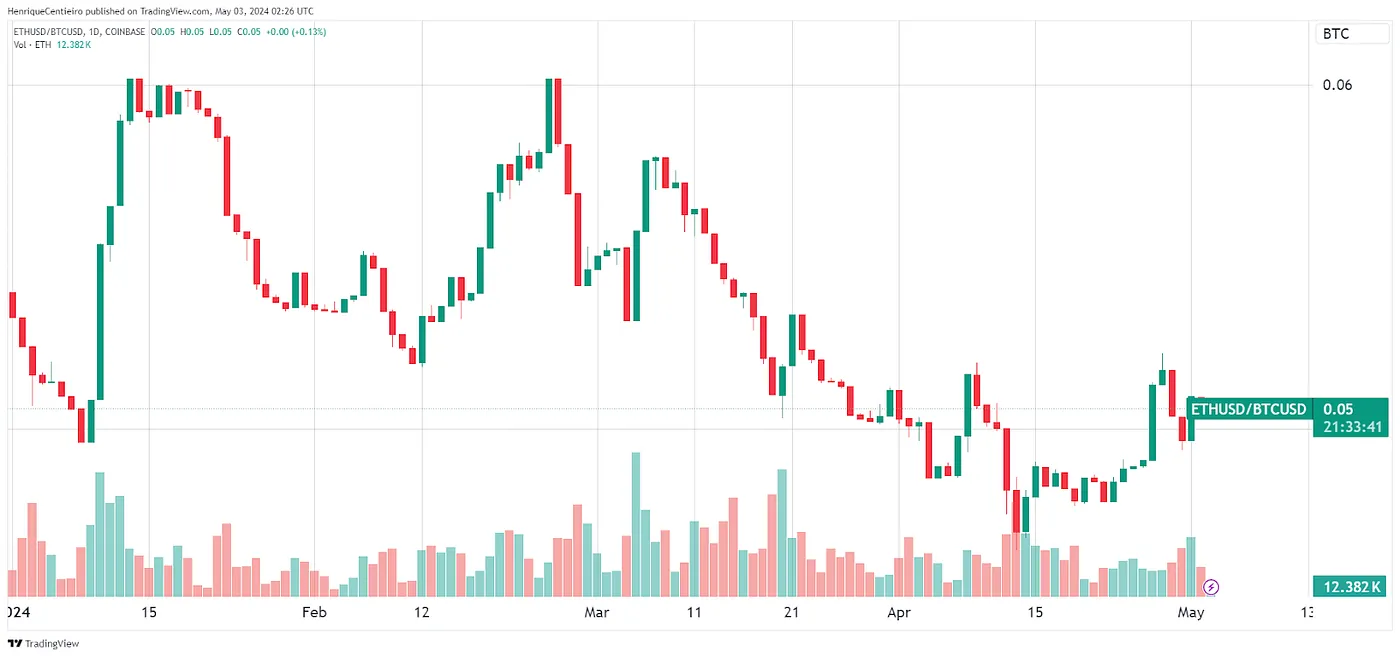

BTC vs ETH

ETH is losing ground against BTC. ETH/BTC is down 6% since the beginning of the year. On one hand, this shows that ETH is lagging behind BTC in price action. On the other hand, this can be seen as a bullish sign because ETH (and its associated L2 ecosystem) has more room to grow.

In April, the biggest topic in the retail market was Meme. Among the top 10 performing cryptocurrencies in the top 100 market cap, two were Memes: Bonk and Pepe.

Other top performing coins (vs. BTC) are:

Neo (+22%) — Layer 1 Protocol

Toncoin (17%) — Layer 1 Protocol

Tron (16%) — Layer 1 Protocols

BNB (12%) — Layer 1 Protocols

Ondo (11%) – RWA

The main trends remain Meme, AI, Games, DePIN, and DeFi, with the latter receiving high attention from LSTfi, re-staking, and DeFi on Emerging Chains such as Linea.

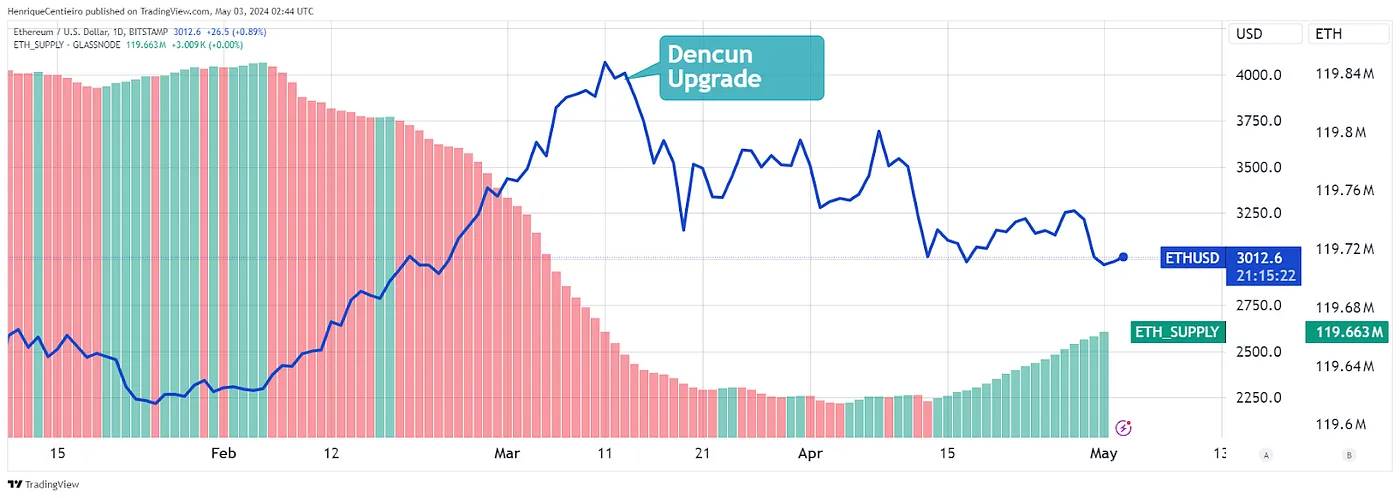

Ethereum Price, Upgrades and Burns

Ethereum closed the first quarter of 2024 at $3,507, a quarterly increase of 59.9%. The peak of this period occurred before the Dencun upgrade (March 13). The Dencun upgrade includes EIP-4844, also known as Proto-Danksharding, which leads to a significant reduction in fees on L2 chains, greatly improving the user experience of the Ethereum ecosystem. Now, user transaction fees on L2 rollups can be less than $0.01.

ETH prices have risen 15% since the beginning of the year, but are down 9% month-on-month, with the highest daily price since March 13.

Since Dencun was upgraded, prices have dropped 27%.

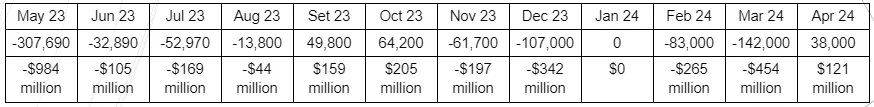

Since the merge upgrade (September 2022), Ethereum has become a deflationary asset, with a net supply reduction of nearly 1 million ETH (over $3 billion). In the first quarter alone, the circulating supply of Ethereum decreased by 0.2%.

Since the beginning of the year, the ETH supply has decreased by 0.16%, or about 187,000 ETH, worth about $650 million. However, the ETH supply increased by about 38,000 ETH in April.

Monthly Ethereum Supply Change

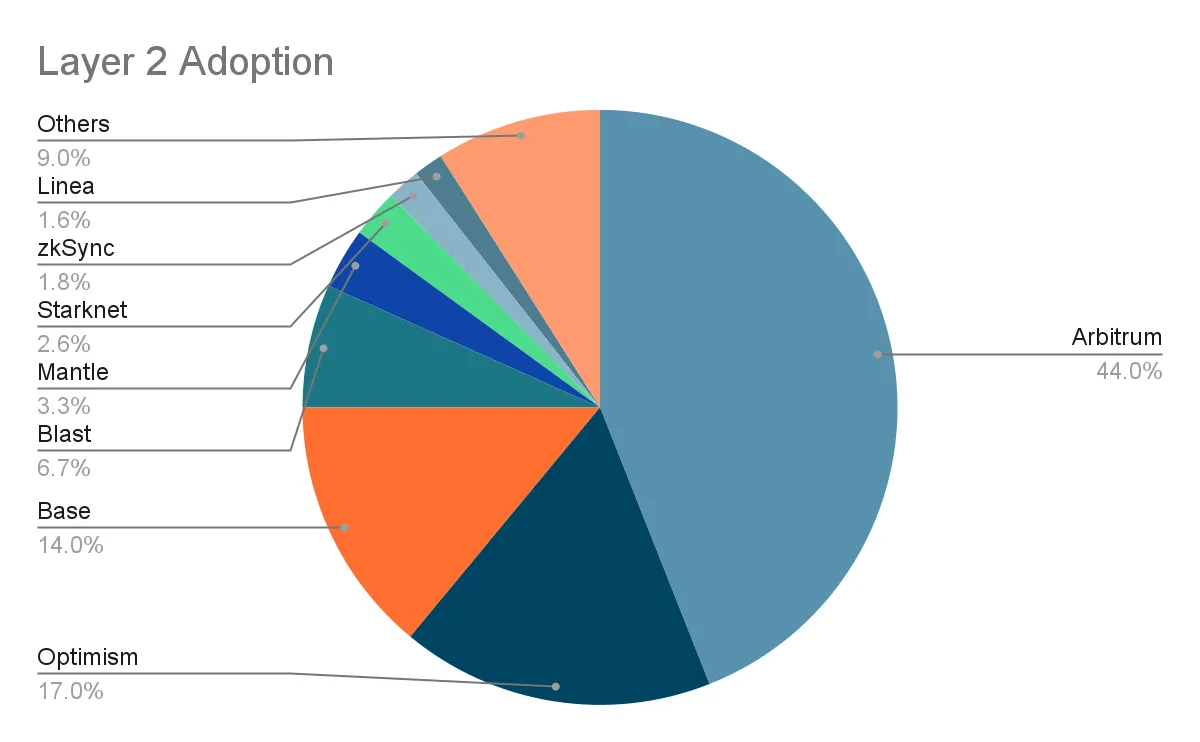

L2 adoption

The L2 network currently processes over $36 billion in TVL, with 11 times the transaction volume of the Ethereum network. Since the Ethereum Dencun upgrade on March 13, the user experience of L2 has improved significantly, especially in terms of transaction fees. In some cases, transaction fees have been reduced by more than 90%. Proto-Danksharding introduces Blobs, which are like attachments to data blocks.

The main beneficiaries of the upgrade will be Ethereum rollup chains, which now have lower fees and faster transaction settlement. By making rollup transactions faster and cheaper, the upgrade will improve the user experience and potentially increase user adoption of the Ethereum ecosystem (including against competitors). This will have a positive impact on L2s as they become cheaper, potentially increasing their revenue.

In addition to Proto-Danksharding, here are the other upgrades included in the Dencun upgrade:

EIP-1153: Forkless Frontier — aims to allow future network upgrades without hard forks

EIP-4788 and State Receipt Certificates - Improve the communication between the consensus layer and the execution layer to improve network efficiency. The state receipt certificate only contains basic information about the transaction.

EIP-5656 and MCOPY opcodes — Improve smart contract efficiency by improving memory operations. This will translate into faster execution and lower transaction fees.

EIP-6780 and SELFDESTRUCT gas metering — Better gas calculation for selfdestruct functions.

All of these updates are part of Ethereum’s long-term roadmap, which ultimately aims to transform Ethereum into the settlement/security layer of the internet.

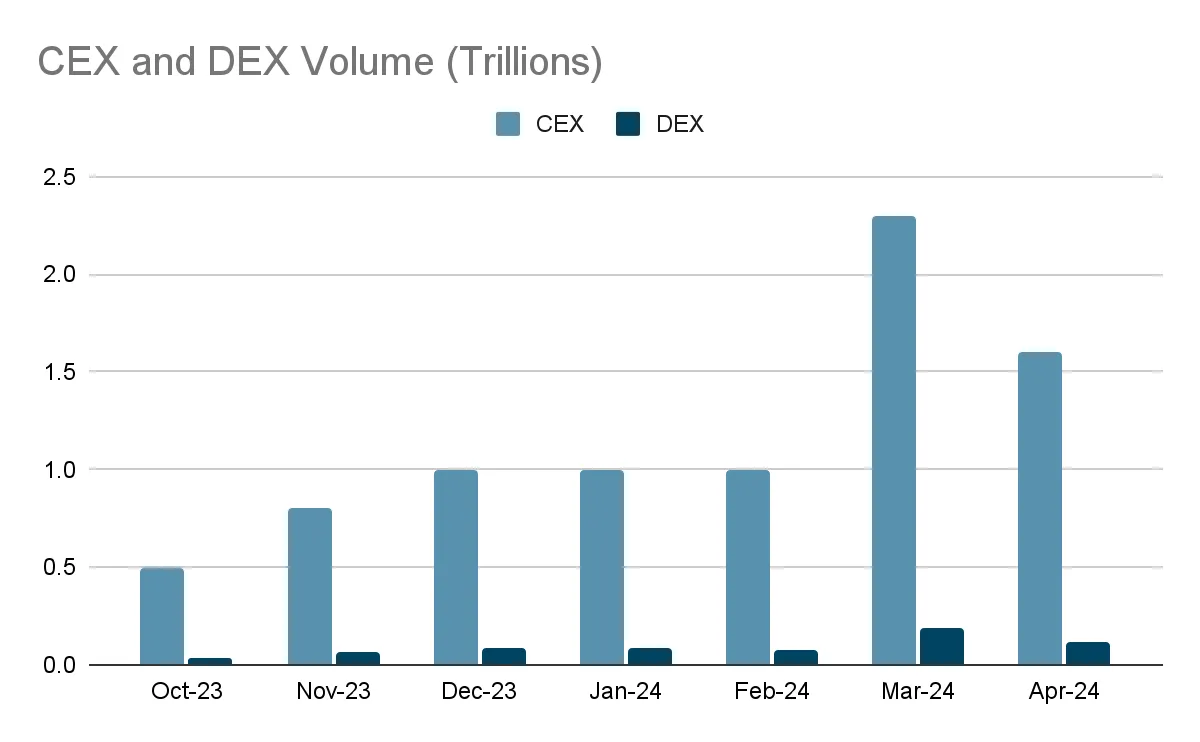

Spot Trading Volume

March 2024 was the fourth highest volume month in history with $2.48 trillion traded. High volumes indicate increased market activity, confirmation of market trends, and increased institutional interest.

On the other hand, trading volume in April dropped to an average of around 500,000 BTC per day, an annualized volume.

Centralized Exchange (CEX) and Decentralized Exchange (DEX) Trading Volume

CEX trading volume increased by 95% in the first quarter of 2024, while DEX trading volume increased by 78%. Compared with March, trading volume in April decreased by 31%, but it is still well above the average monthly trading volume in the past 6 months.

Futures Data

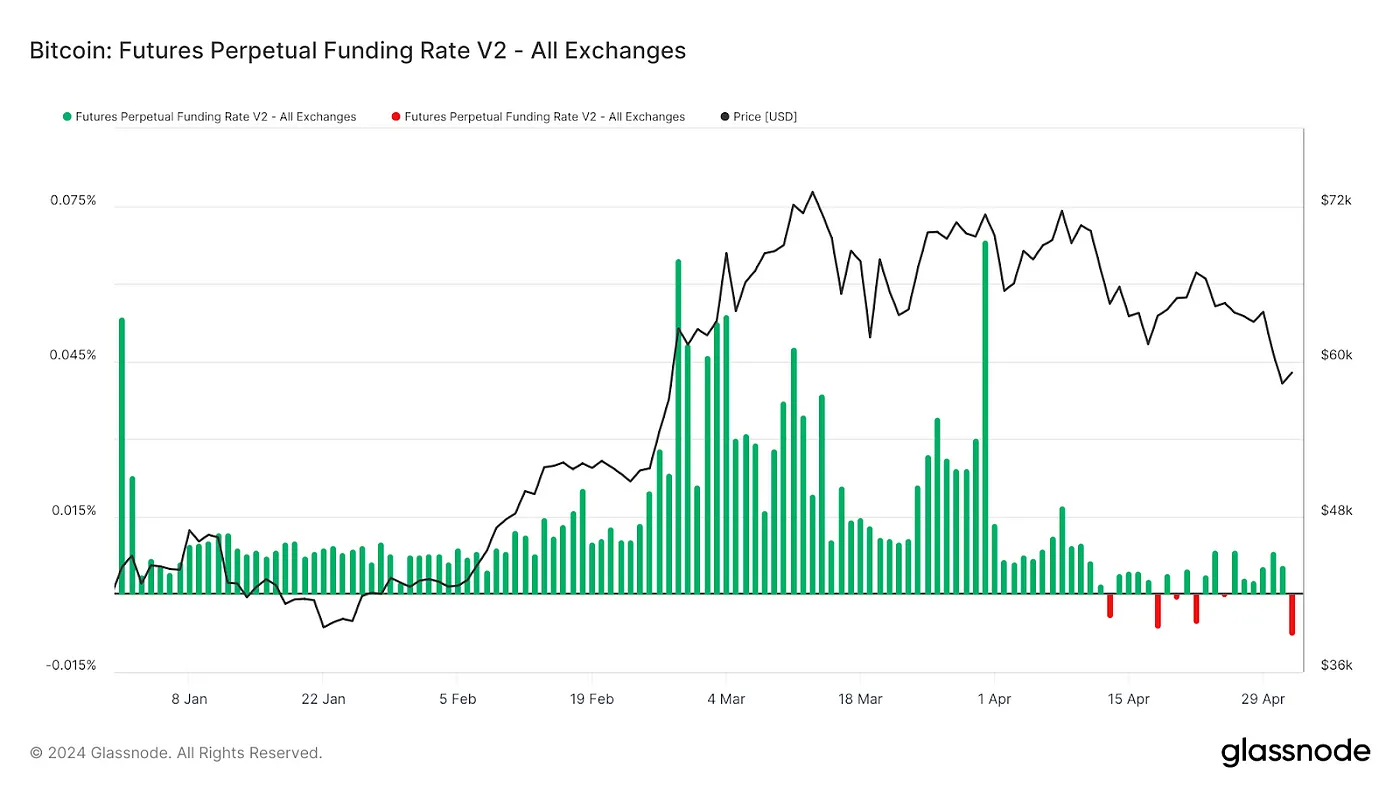

Funding rates are usually high and positive, which indicates that there are more longs than shorts. However, liquidation events push funding rates into negative territory.

Spot Bitcoin ETF

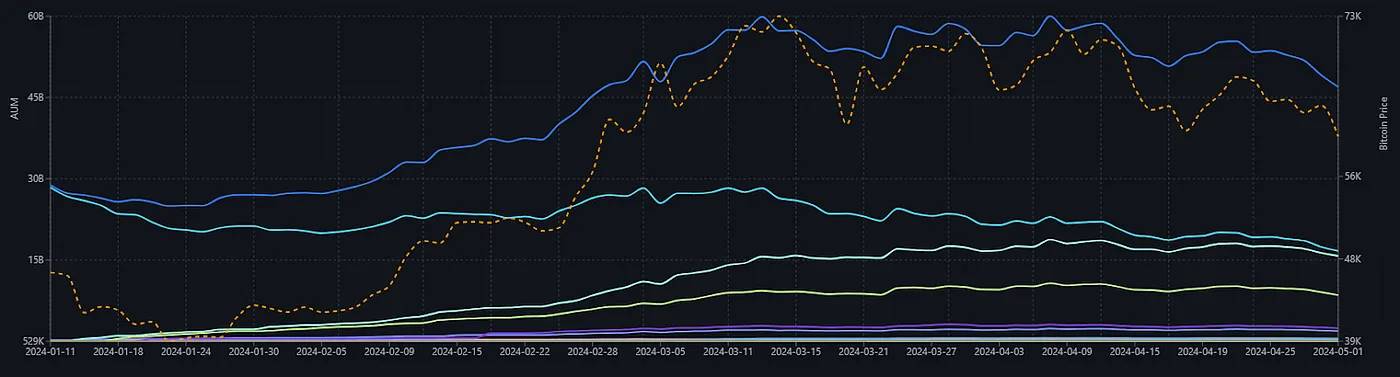

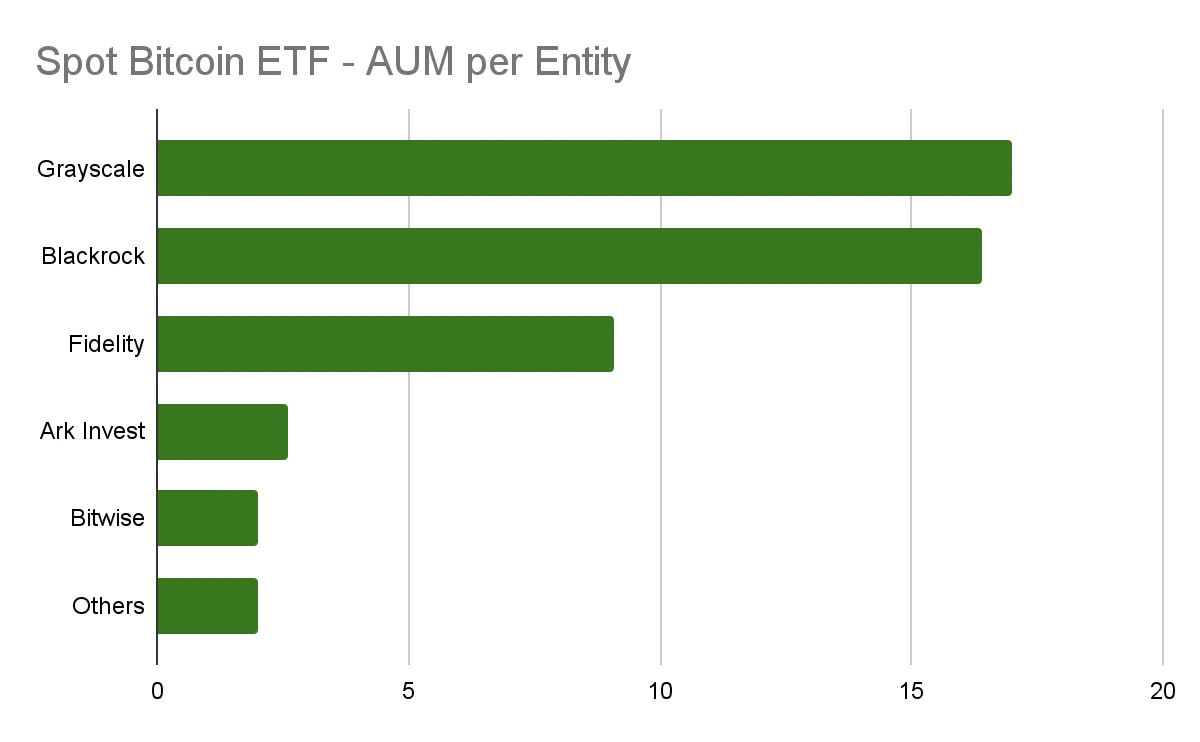

U.S. spot Bitcoin ETFs had $52 billion in assets under management at the end of April. Blackrock's ETF created a history of 72 consecutive days of positive net inflows, with assets under management reaching $16.4 billion at the end of April.

HashKey also made history on April 30, becoming part of the first batch of spot Bitcoin and Ethereum ETFs in Hong Kong together with Borsera. The trading code of the HashKey BTC ETF is 3008, and the trading code of the ETH ETF is 3009.

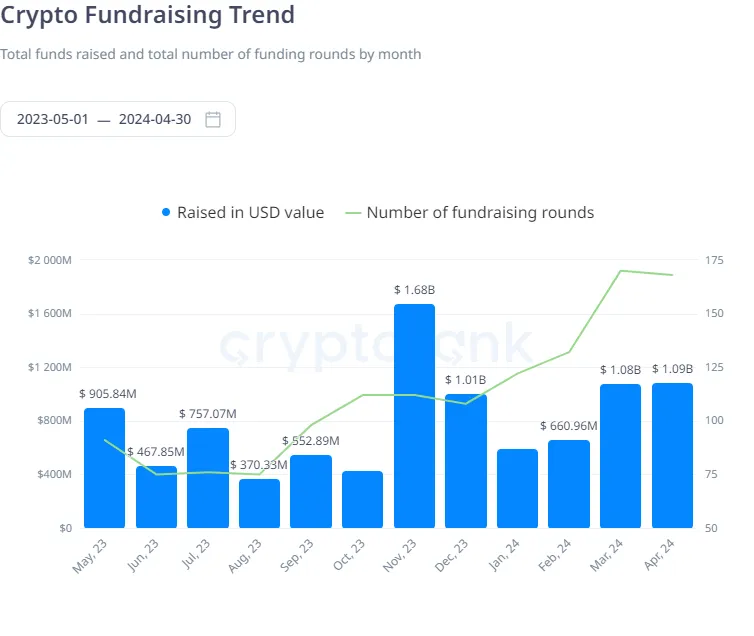

Crypto Venture Capital Activity

Venture capital activity has increased compared to much of 2023. In March and April, crypto startups attracted more than $1 billion in inflows each month.

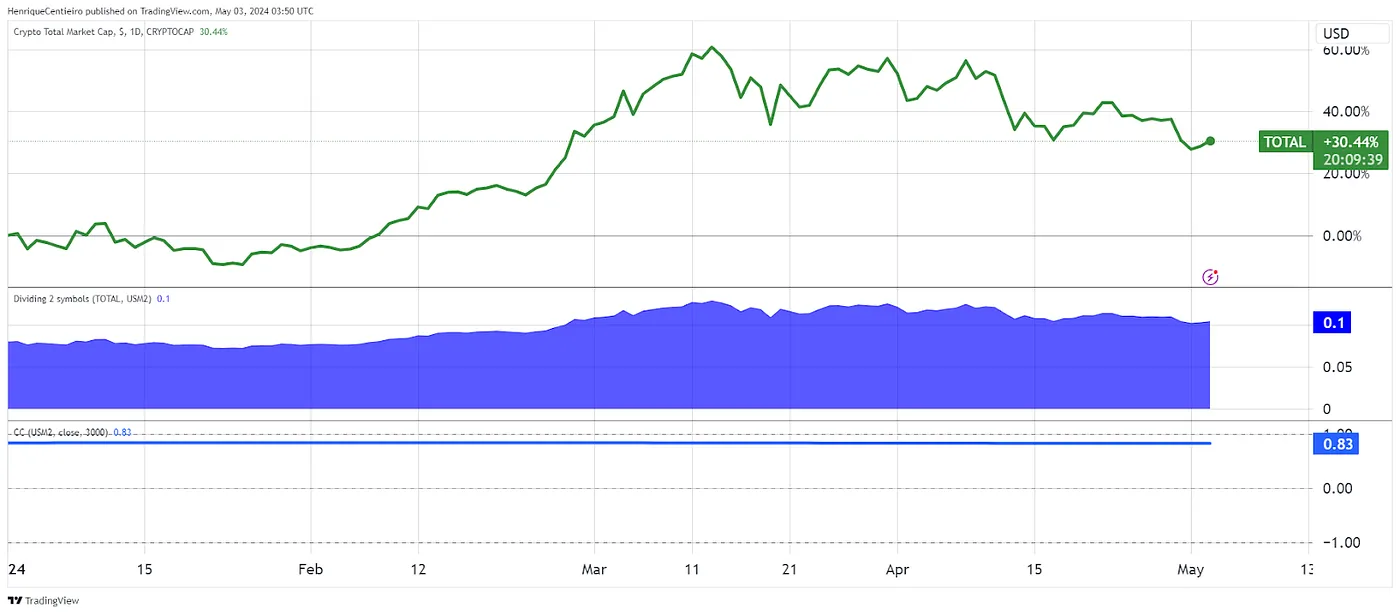

Market share and dominance and M2 correlation

The 10-year correlation between crypto market capitalization and US M2 is 0.83. We can also observe that although M2 has not increased significantly over the past two years, crypto market capitalization has increased significantly.

The middle line shows the ratio of crypto_market_cap/US M2, which is currently 0.10. This basically means that if we compare the crypto market size to US M2, the crypto market accounts for 10% of it.

Explanation: Crypto assets are gaining more and more market capitalization. This ratio is close to the previous all-time high of 0.14. However, there is one major difference: the previous all-time high of 0.14 was in November 2021, when the market was driven by very loose monetary policy. This means that the current market surge is more based on fundamentals than simple money printing momentum.

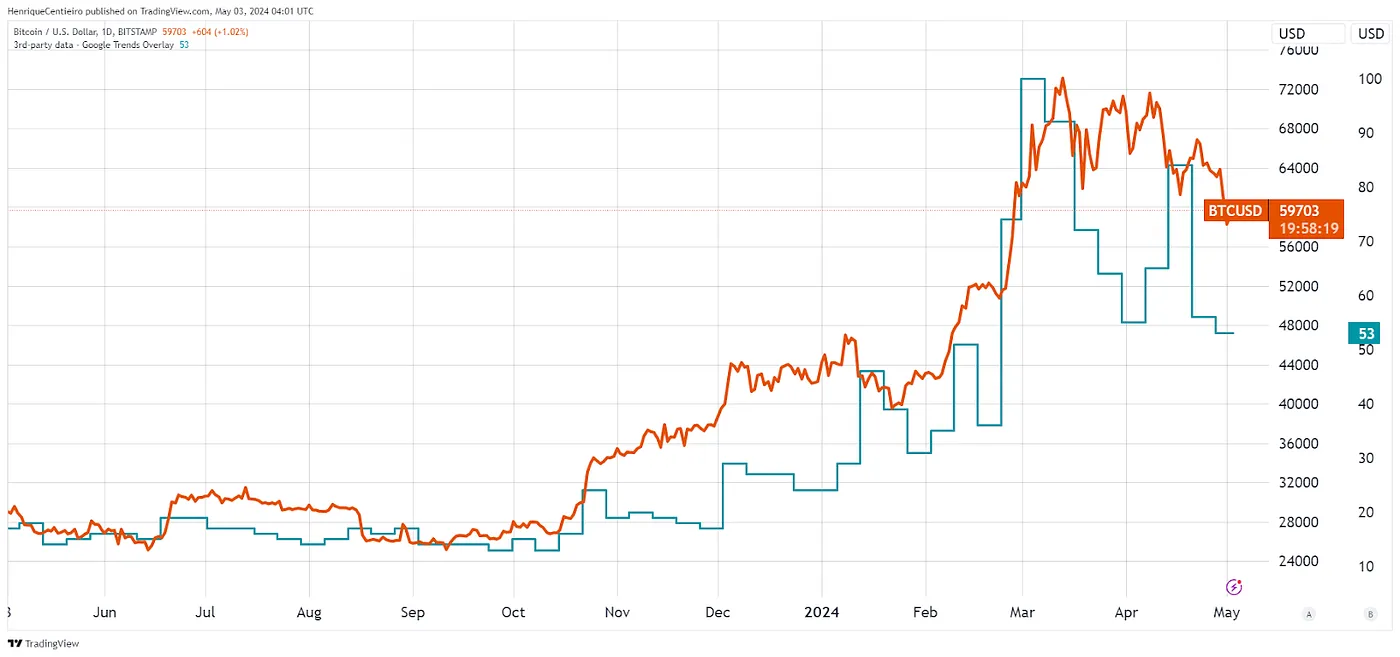

Bitcoin and Google Trends

According to our analysis, there is a significant correlation between Google Trends (Google search frequency) and Bitcoin price.

Coincidentally, low Google search volume indicates that the market is quieter from a retail perspective, thus continuously forming a good buying opportunity.

Compared to last year, Bitcoin Google Trends data shows that Google searches for Bitcoin have increased significantly. However, it is important to note that as time goes on, fewer people may be searching for Bitcoin because more people already know what Bitcoin is. Although Google searches fell in April, the search volume is still over 90% of all historical months.

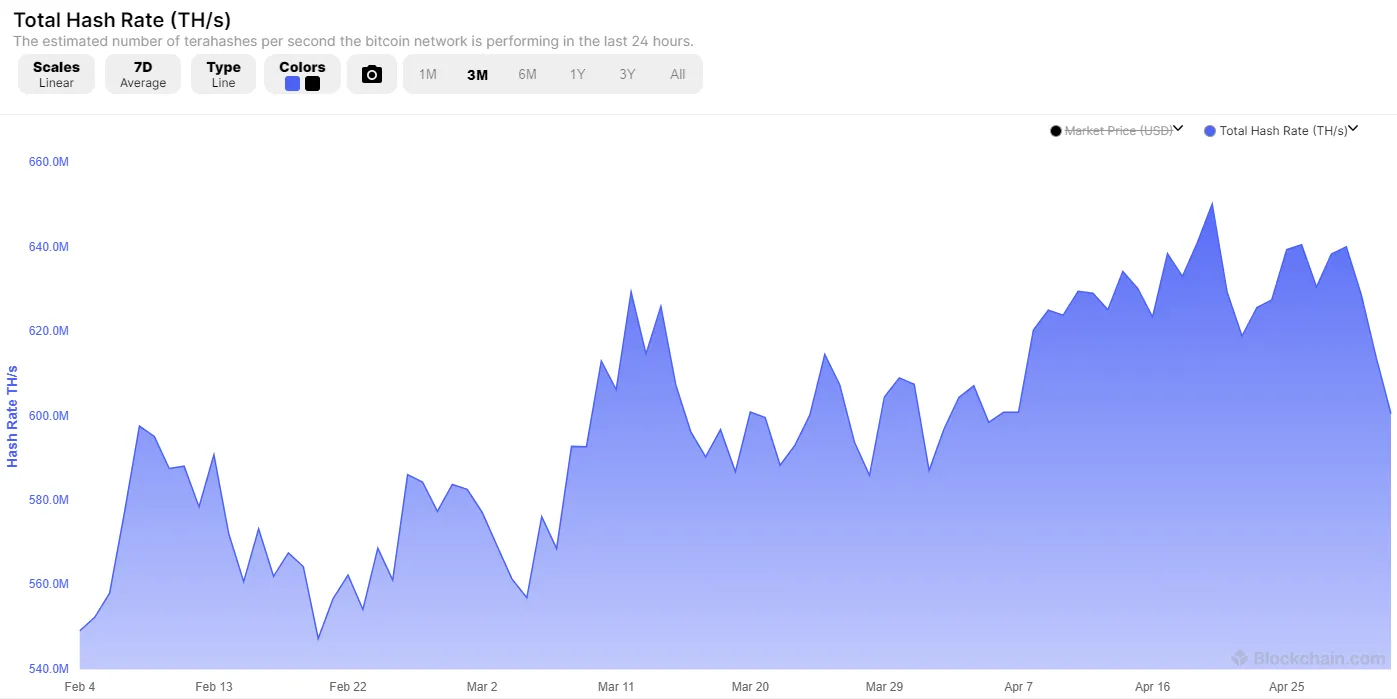

Bitcoin computing power and hashing metrics and mining revenue per terahertz

Bitcoin computing power measures the computing power on the network and also reflects the security of the network.

Despite the upcoming Bitcoin halving, we continue to see hashrate reach new all-time highs, with a 2% increase in Q1 2024.

However, after the Bitcoin halving on April 19, the mining reward was reduced from 6.25 to 3.125, and the Bitcoin hashrate dropped by 7.5%. With the reduction in miner rewards, higher-cost miners will no longer be viable.

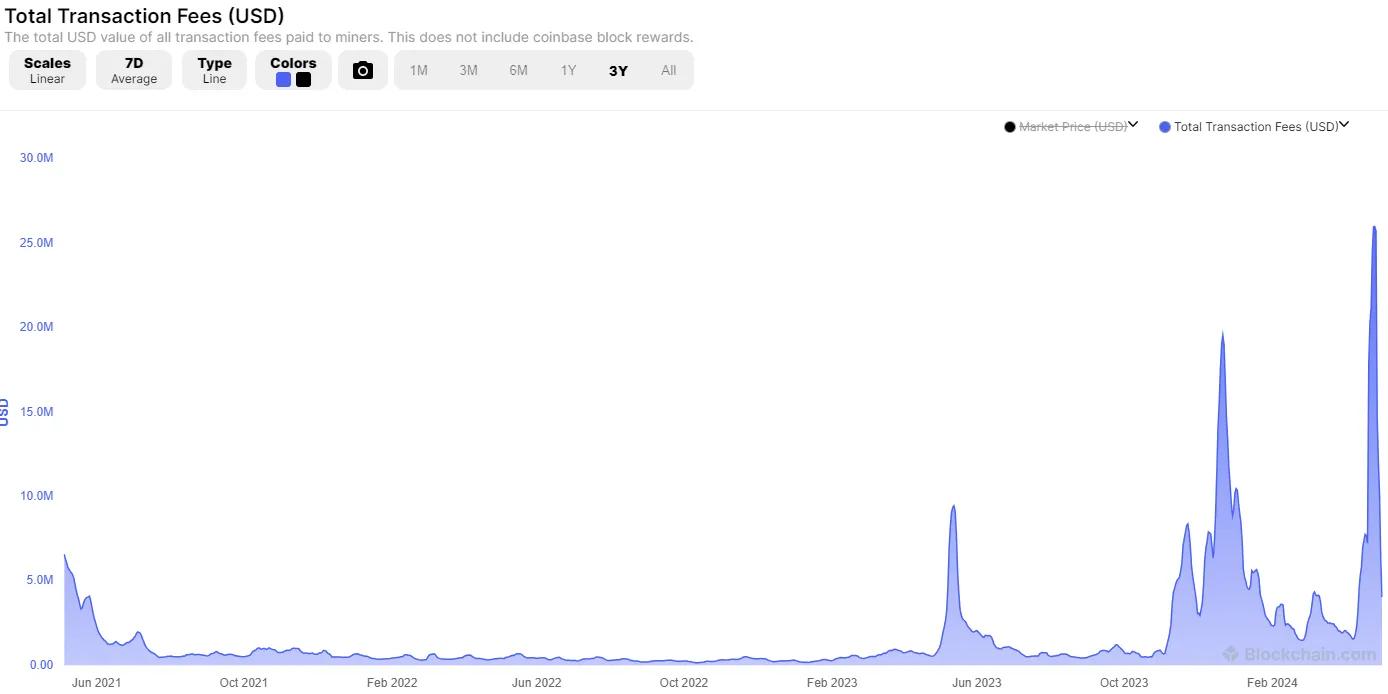

However, April 2024 is the month with the highest transaction fees paid by users. This is also an important source of income for miners.

As network activity grows and BRC-20, Runes, and Bitcoin L2 chains are revived, transaction fees will likely continue to grow and eventually replace block rewards as the primary source of income for miners.

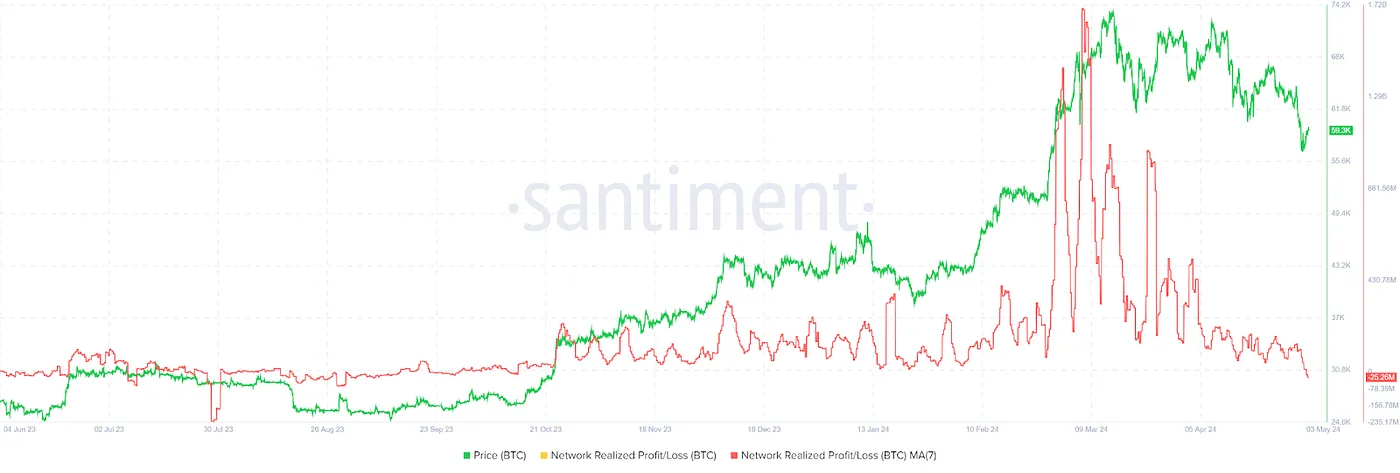

Bitcoin has realized profit and loss

In March 2024, Bitcoin realized profit and loss reached a new high. However, realized profit and loss turned negative in late April. This important indicator uses the concept of price marking, where each UTXO is assigned a price.

When the value is negative, it means that investors may sell Bitcoin at a loss. This is a capitulation signal (usually a relatively good time to buy). This can be interpreted as more room for growth after the market correction.

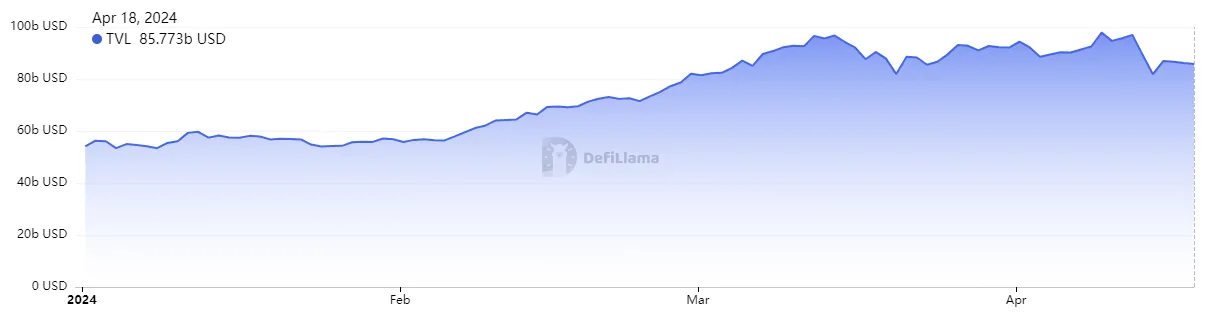

DeFi Activities

Over the past 6 months, we have seen a significant increase in DeFi activity. DeFi market cap has risen from 17% to 25% of Ethereum’s market cap, indicating an acceleration in DeFi activity relative to ETH price dynamics.

At the same time, DeFi is one of the biggest winners in the field. As shown in the figure below, the DeFi market value rose from $35 billion to $120 billion in 6 months.

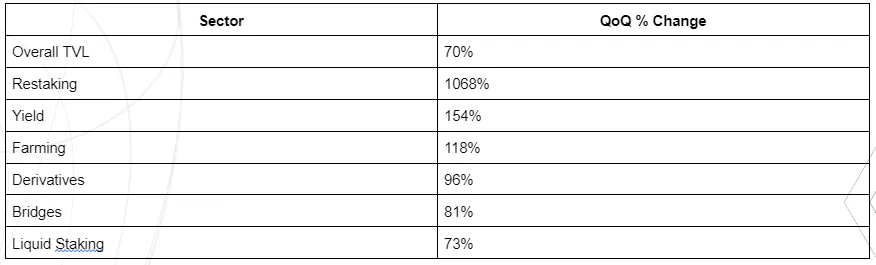

Additionally, DeFi’s total locked value (TVL) has grown 60% year-to-date, but contracted by about 10% in April.

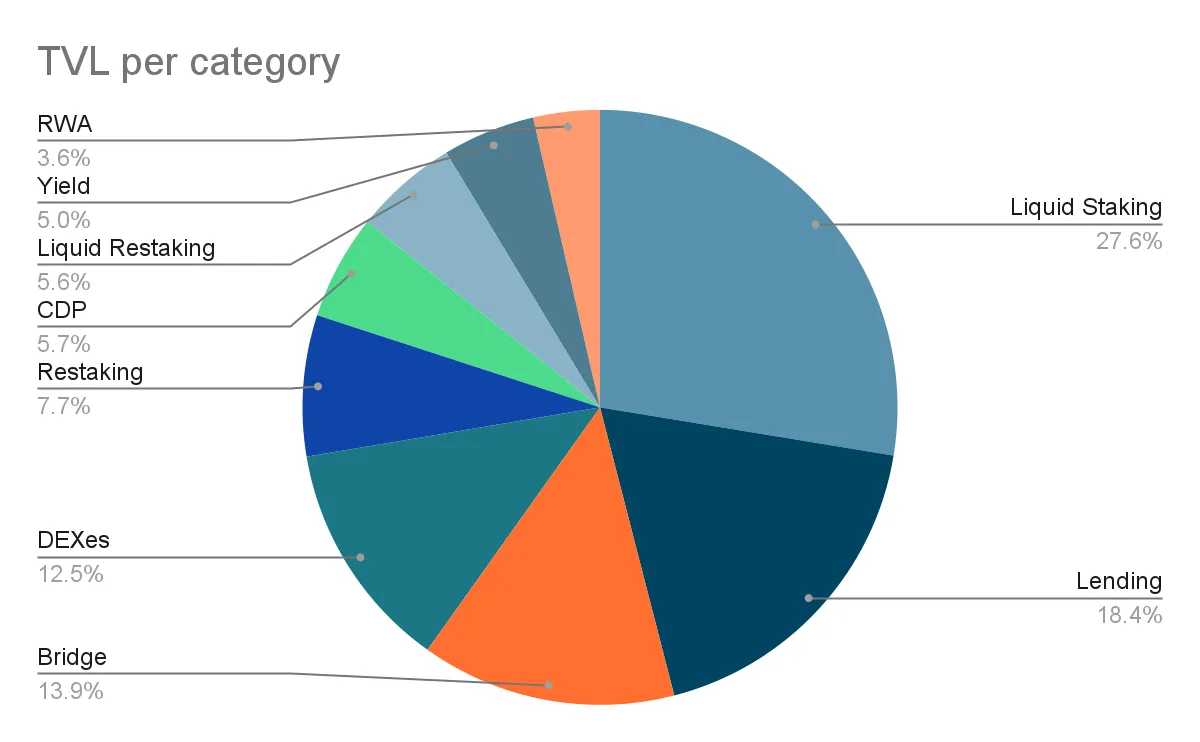

Overview of the DeFi Ecosystem

Liquidity staking has been the dominant DeFi space in terms of TVL since early 2024. However, other use cases, such as staking and yield, have also seen significant inflows. This is thanks to protocols such as EigenLayer, EtherFi, Zircuit, Swell, Puffer, and Pendle.