Author: Nancy Lubale, CoinTelegraph; Translated by: Tao Zhu, Jinse Finance

Growing expectations for the approval of a spot Ethereum ETF in the United States have caused Ethereum (ETH) prices to rise by more than 26% in the past two days to their highest level since March 15.

ETH/USD daily chart. Source: TradingView

ETH prices have retreated slightly since hitting $3,800, but the likelihood of a spot Ethereum ETF being approved, as well as fundamental factors and on-chain indicators, suggest that ETH’s uptrend remains strong.

Rising open interest supports Ethereum’s uptrend

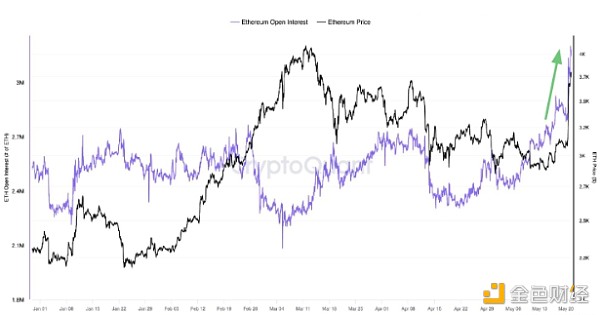

One of the factors supporting Ethereum's rise is the increase in open Ethereum long positions in the futures market. According to data from on-chain market intelligence firm CryptoQuant, the total open interest of Ethereum in the derivatives market increased from 2.8 million ETH to 3.2 million ETH on May 20, following rumors that the U.S. Securities and Exchange Commission (SEC) had made a 180-degree turn on approving a spot Ethereum ETF. This is the highest open interest since January 2023.

CryptoQuant analysts pointed out that

“Traders in the perpetual futures market actively opened long Ethereum positions in anticipation of higher prices following rumors that a U.S. spot Ethereum ETF could be approved in May.”

ETH open interest across all exchanges. Source: CryptoQuant

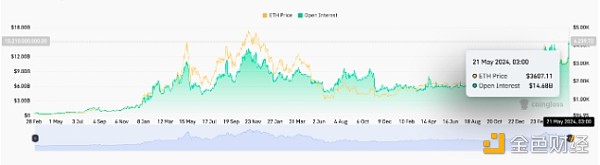

In U.S. dollar terms, ETH open interest has now risen to a record high of $14.68 billion. High open interest simply indicates that the underlying trend is strong and investor confidence in Ethereum is likely to continue.

Ethereum futures open interest. Source: Coinglass

Traders now prefer Ethereum over Bitcoin

The potential approval of an Ethereum spot ETF this week has sparked discussion among analysts about the possible impact on Ethereum prices.

According to CryptoQuant analysts, there are currently more orders to buy ETH in the perpetual futures market than other types of orders. The chart below shows that the buy-to-sell ratio is above 1, indicating that the buy orders in the perpetual contract market are currently greater than the sell orders.

“That puts upward pressure on prices.”

Ethereum buy/sell ratio across all exchanges. Source: CryptoQuant

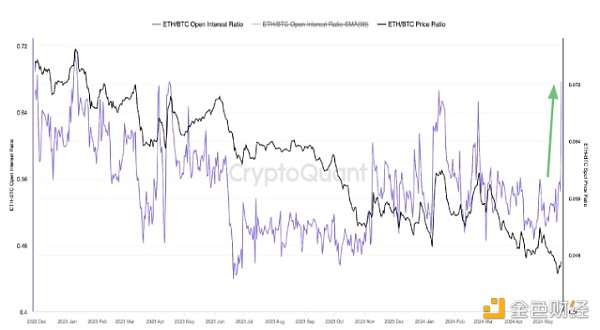

Other data from CryptoQuant also shows that traders are now willing to have more exposure to Ethereum relative to Bitcoin:

“A higher ratio means that traders are more willing to hold more ETH than Bitcoin on margin and vice versa.”

ETH/BTC OI ratio. Source: CryptoQuant

Likewise, data from TradingView shows that the ETH/BTC trading pair has risen 19.6% from a low of $0.04572 on May 20 and reached a two-month high of $0.06471 on May 21. This indicates that Ethereum’s price has strengthened relative to BTC.

ETH/BTC daily chart. Source: TradingView

The relative strength index at 68 strengthens the strength of the ETH/BTC uptrend, indicating that Ethereum’s uptrend remains strong.

Increased demand for ETH

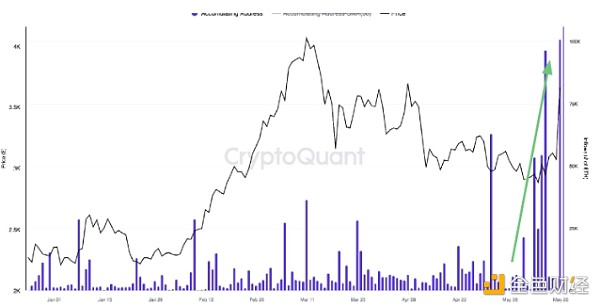

CryptoQuant data shows that demand for ETH appears to be gaining attention again as permanent holders increase purchases amid rumors of ETF approval. The chart below shows the increase in ETH purchases by permanent holders on May 20 in anticipation of spot ETF approval.

CryptoQuant defines permanent holders as “addresses that accumulate ETH and never sell.”

“Such holders purchased 100k+ ETH, the highest daily level since September 2023.”

ETH permanent holder inflow. Source: CryptoQuant

A similar observation was made by popular analyst Ali Martinez, who shared the following chart from Santiment showing an increase in ETH whale accumulation on May 20.

Source: Ali

Market intelligence firm Santiment noted that while sentiment towards Bitcoin and Solana remains bearish, hype around Ethereum has reached its highest level since September 2023.

“#Ethereum sees most #bullish crowd sentiment since September, #SEC likely approves first #ETF, and price surges in $ETH.”

BTC, ETH and SOL weighted sentiment. Source: Santiment

According to Alternative.me, the Crypto Fear and Greed Index has risen from last week’s “greed” index of 64 to the “extreme greed” range of 76. This means that retail investors are becoming more positive about cryptocurrencies, and if the SEC approves spot Ethereum EFTs this month, then the price of ETH is expected to continue its upward trend.