As a senior person in the crypto, I have been committed to providing useful suggestions to everyone, hoping that everyone will take fewer detours and make fewer wrong orders in this market. Although I have been earnestly advising you, you still need to explore the road of investment by yourself. Learning is endless, and the experience you have learned is the real wealth!

There is no need to over-demonstrate your strength. The key is to gain recognition from more people. On the road of investment, it is more important to do your best than to prove your strength to others. You will know whether it is a mule or a horse by taking it out for a walk.

I am an academician of the crypto and a warrior who strives to protect the leeks. I wish my fans to achieve financial freedom in 2024. Let’s cheer together!

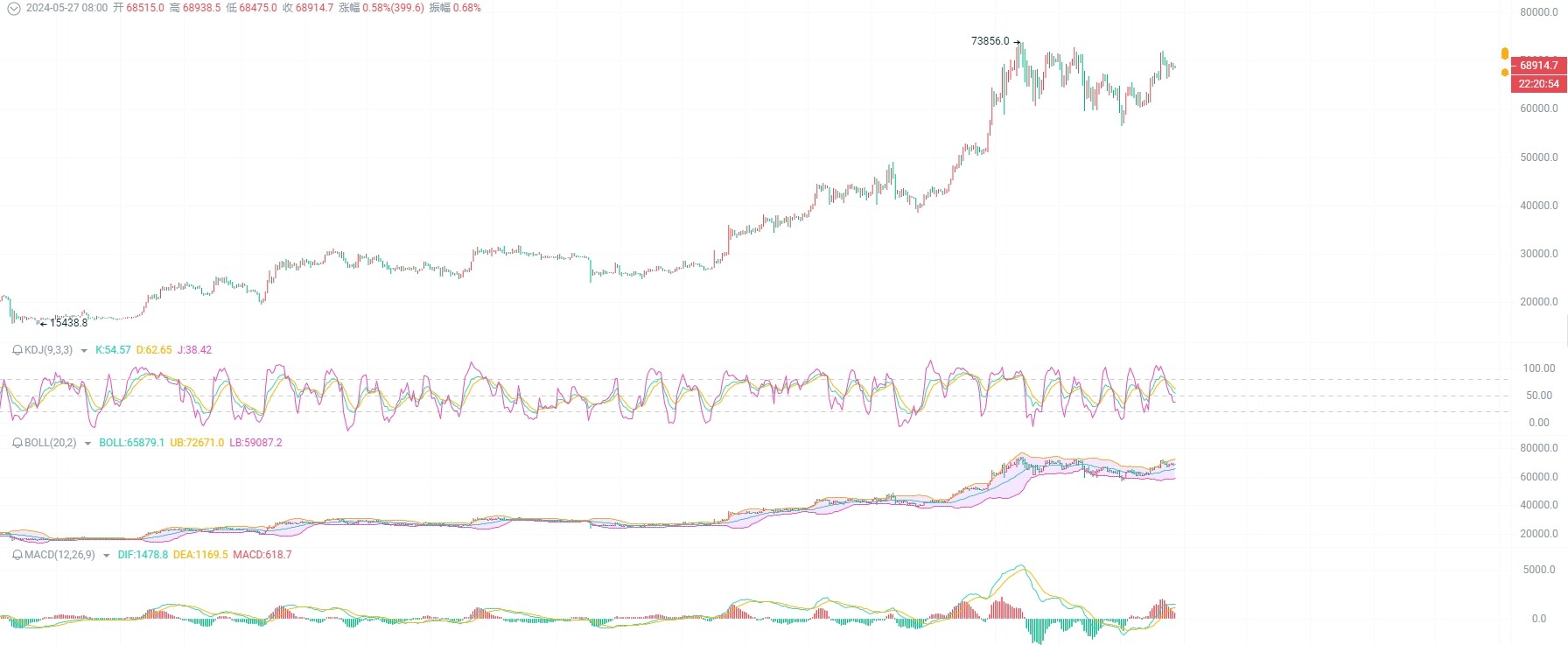

Crypto Academician: 2024.5.25 Bitcoin (BTC) latest market analysis reference:

The market continued to go sideways over the weekend to repair the shock. The market stepped back to the golden section line 0.618 support point of 68500 for three consecutive days. On Friday, the short position of 68500 was broken and the stop loss was exited. Then the long position was taken at 69000. There was no arrangement yesterday. I traded 69500 shorts by myself, and took profit at 68500 to gain 1000 points of space. As of press time, the long position of 68500 is still held. The target is to pay attention to the integer levels of 69500 and 70000. You can pay attention to it as a reference

The current price of Bitcoin is around 68,900, and the EMA trend indicator is spreading upward. EMA15 has reached 67,500. The overall trend has not ended yet and is expected to rise above 68,000 soon. At that time, the bulls will most likely take the opportunity to break through 70,000. The KDJ is blocked by the dividing line 68,500 support and begins to shrink upward. MACD is rising in volume. The high-level contraction trend of DIF and DEA is unclear. After the Bollinger Bands opened, the idle market has been trading sideways in the upward channel, but the top and bottom have changed, especially the top pressure level has broken 72,500, and the bottom support has also reached 66,000. When the top pressure level no longer moves up and a sideways trend appears, you can start to arrange longs from the bottom support.

The performance of the four-hour K-line is more obvious. It directly stepped back to the standing golden section line of 0.618 and then stretched in the opposite direction to impact the EMA15 trend pressure level of 68,900. The bullish performance is relatively obvious, and you can hold and continue to look up. KDJ closed upward, MACD shrunk and increased its trend. The original short position of DIF and DEA turned back to the upward closing. It can be seen that the bottom absorption is sufficient and the main force's momentum in the market has been significantly enhanced. Pay attention to prevention. The Bollinger Bands closed, and the K-line broke the Bollinger Bands' middle rule of 68,600. It is expected to impact the upper rail pressure level of 69,900. In terms of thinking, short-term long layout, temporarily not short, those who have not boarded the train can wait for the opportunity to pull back and continue to long

The specific reference ideas are as follows: Long orders are currently held

For long positions, pay attention to the range of 68500 to 68000. If it does not break, place more orders. The first exit target is 69200 to 69500, and the second exit target is 69900 to 70500. Stop loss is 500 points.

For short attention to the range of 70900 to 71200. If it does not break, arrange short selling. The first exit target is the range of 70000 to 70300, and the second exit target is the range of 69100 to 69400. Stop loss is 400 points.

The specific operation ideas are mainly based on the market data. For more information details, please contact the author. There is a delay in the release of the article. The suggestions are for reference only and the risks are borne by the user.

Crypto Academician: 2024.5.27 Ethereum (ETH) latest market analysis reference

Ethereum has broken away from BTC and walked its own path. It will have its own path for at least the next three months. Since the market has deviated from BTC, I have not given you any advice in the past few days. I have been trading privately, just to get rid of the influence of following BTC thinking as soon as possible. Yesterday, I arranged a short position at the pressure level of 3810, 3% position, stop loss at 3850, and placed a long order at the golden section line of 0.786, 3824. I entered the market at around 7 o'clock in the morning and am holding it. You can pay attention to the upper target near the 4000 mark. You can pay attention to it.

As of press time, Ethereum is currently priced at around 3870. The daily K-line bulls are trying to hit the previous high of 3950, which is very strong. The EMA15 fast line has reached 3530 and is still stretching rapidly. MACD is increasing in volume and moving upward. DFI and DEA are beginning to impact the energy index. There will be a wave of stretching after the break. The upper rail pressure level of the Bollinger Band has reached 4080, and the middle rail is also moving upward. The short position of KDJ has been pulled back to spread upward. The idea is to buy more and sell more.

The four-hour K-line shows a bullish energy indicator, and the energy on the trend line is enhanced. The EMA15 fast line has reached 3800, and the MACD has ended its shrinking and increasing volume and started to increase upward. The golden golden cross of DIF and DEA has initially formed, breaking the first barrier at 3907. At the golden section line 1, you can take half of the profit and continue to hold the rest. The KDJ short position has reversed, indicating that the golden section line 0.786 support is effective. Four consecutive K-lines in four hours are densely packed at this position. The Bollinger Bands have been sideways for a while and are now impacting the upper Bollinger Bands at 3890. Those who have not gotten on the train can wait for the callback to continue to arrange more and defend the support of the 3830 to 3810 range.

Short-term thinking reference: long positions are being held

The entry point for long positions is 3640 to 3660. The first exit point refers to the pressure level of 3750 to 3770. If it breaks, the second exit point is 3830 to 3850. The stop loss is 3600.

The entry point for short is 3810 to 3830. The first exit point is 3750 to 3730. If it breaks, the second exit point is 3670 to 3640. The stop loss is 3860.

The specific operation is based on the real-time data of the market. For more information and details, please contact the author. There is a delay in the release of the article. The suggestions are for reference only and the risks are borne by the user.

This article is exclusively contributed by the academician of the crypto, and only represents the exclusive views of the academician. There are in-depth studies on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the time of article push, the above views and suggestions are not real-time, for reference only, at your own risk, please indicate the source for reprinting, and reasonably control the position when making orders, and do not operate with heavy or full positions. The academician also hopes that all investors understand that the market is always right. If you are wrong, you should summarize your own problems and don't let the profits that should have been obtained fly away. There is no need to be smarter than the market in investment. When the trend comes, respond to it and follow it; when there is no trend, observe it and be quiet. It is not too late to wait for the trend to finally become clear before taking action. Tomorrow's success comes from today's choice. God rewards diligence, earth rewards kindness, humanity rewards sincerity, business rewards trust, industry rewards excellence, and art rewards heart. Gains and losses are inadvertent. Develop the habit of strictly taking stop loss and stop profit for each order. The academician of the crypto wishes you a happy investment!