In this week’s newsletter, we write about the approval of an Ethereum spot ETP, the passage of the FIT21 bill in the US House of Representatives, and China’s CBDC pilot in Hong Kong.

Subscribe here and get Galaxy's weekly headlines and more delivered straight to your inbox.

One step closer to Ethereum ETP

SEC approves key regulatory filing for spot ether ETP to begin trading in the U.S. On Thursday, the SEC "accelerated" approval of 19b-4 proposals from three exchanges (namely CBOE, NYSE Arca and Nasdaq) that want to list spot ether ETPs, clearing a major hurdle for these products to begin trading. "After careful review, the Commission determined that these proposals are consistent with the Exchange Act and its rules and regulations applicable to national securities exchanges," said the notice posted on the SEC's website.

The approval follows a sudden and unexpected turnaround in the ETH ETP approval process on Monday, when the regulator sent comments to exchanges and potential ETH ETP issuers in an effort to expedite the approval process. Prior to this week, the SEC had limited engagement with potential issuers, leading many to believe the SEC was not ready to approve the ETP — Bloomberg Intelligence ETF analysts Eric Balchunas and James Seyffart had predicted a 25% chance of approval this week, but after Monday’s positive developments, the odds rose to 75%.

Before the spot ether ETF can begin trading, the SEC must still approve the issuer’s S-1 filing, and there is no clear timeline for that. Seyffart believes that S-1 approval and ETF launch will take “a few days (at least), probably at least a few weeks, if not months,” while his colleague Eric Balchunas said on Galaxy Brains that the process could be completed as early as the next two weeks.

Ethereum’s price jumped from below $3,100 to above $3,700 as prospects for ETP approval improved on Monday, and reached a high of around $3,940 on Thursday after the SEC’s approval was confirmed.

Our take:

The SEC’s approval of Rule 19b-4 marks a major milestone for the industry and a significant policy shift for the securities regulator. Many speculate that the sudden shift is the result of top-down pressure from the Biden administration, coming weeks after major Democratic parties voted in favor of pro-cryptocurrency legislation.

This development is also positive for several reasons: (i) it indicates that the SEC does not view ETH as a security, something Chairman Gary Gensler has declined to say in past interviews; (ii) the correlation analysis between ETH spot and futures prices filed in 19b-4s already passes SEC requirements; and (iii) it builds on the growing political support we have seen recently in Congress (e.g., the passage of SAB 121 and FIT21, which were overturned last week).

However, it remains uncertain whether the S-1 form submitted by the issuer will be approved, and the specific time is still unknown. The key questions going forward are:

- How long does it take for S-1 issues to be resolved? Most issuers have already removed the pledge option from their filings.

- What will the demand for an Ethereum ETF be like relative to a Bitcoin ETF? Will potential investors forgo purchasing an ETF due to productivity loss (i.e., not being able to pay gas fees to access DeFi and other applications) or due to forgoing staking returns?

- What will be the status of ETH collateralization from a regulatory perspective (the SEC has claimed in lawsuits against Coinbase , Consensys , and others that ETH collateralization products are securities)? Will these ETF issuers eventually be approved to collateralize ETH?

- Will regulators approve ETPs for other crypto assets soon?

Regardless, Thursday’s approval of the spot ether ETP is a major breakthrough with positive implications for the industry as a whole. As we’ve seen so far with the bitcoin ETP, last week’s 13F filing is very bullish for future demand for bitcoin — both inflows and the list of institutional holders are better than most expected. Well-known RIAs, hedge funds, and even pensions have already bought into the ETP, while banks and broker platforms have yet to open up access to the ETP, which could be a huge unlock for future institutional adoption of crypto. - Charles Yu

House of Representatives Passes Comprehensive Cryptocurrency Market Structure Bill

As many as 71 Democrats joined forces with House Republicans to pass the FIT21 Act. On Wednesday, the U.S. House of Representatives passed the 21st Century Financial Innovation and Technology Act ("FIT21"), a comprehensive regulatory reform that specifies when and under what conditions crypto tokens or exchanges/brokers will be regulated by the U.S. Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC). The bill clarifies the boundaries between the SEC and the CFTC, giving the CFTC more power, and is therefore a rebuke to the SEC's current position that almost all crypto assets are "crypto securities."

The vote was taken at around 6 p.m. ET on Wednesday and passed with 279 votes in favor and 136 against, with 71 Democrats voting in favor, accounting for one-third of the caucus.

The bill also requires token creators to provide "accurate and relevant disclosures, including information related to the operations, ownership, and structure of the digital asset project," and provides token issuers with a legal way to raise funds. On the business side, the bill requires companies that provide crypto services (i.e., exchanges, brokers, etc.) to separate customer funds from their own funds, provide disclosures, and submit to regulatory review.

The bill has the broadest bipartisan support for encryption legislation in history, thanks to high-profile support from Democratic leaders such as Rep. Nancy Pelosi (D-CA) and a changing political climate in which encryption has become a major political issue.

Our take:

This vote has important implications on both policy and politics. On the policy side, the bill is extensive in scope and size, and is the most significant package of crypto legislation ever passed by Congress. The bill is complex, and many parts could have a negative impact on the industry, including creating a strange forked market that could harm liquidity or the market as a whole. But overall, FIT21 is the direction the United States needs to protect consumers, support innovation, maintain and enhance U.S. competitiveness, and regulate crypto market regulation.

Politics may be the bigger issue, though. Democratic support for FIT21 is more than three times stronger than House Democratic support for SAB 121 two weeks ago. With the overturn of SAB 121 passing both the House and Senate despite explicit White House threats of a veto, and the Trump campaign now explicitly building a “crypto army,” the crypto policy issue has risen to the national stage, and Democrats no longer seem to want to cede the issue to Republicans. While the White House’s veto threat on SAB 121 two weeks ago included hyperbolic language suggesting that overturning the rule would create “financial instability,” the White House’s government policy statement on FIT21 two weeks later was full of conciliatory language and notably absent a veto threat. The difference between these two government policy statements, released just two weeks apart, is the clearest indication of the apparent shift in the White House’s political strategy on this issue.

Senate Majority Leader Chuck Schumer (D-NY) voted to overturn SAB 121. Former House Speaker Nancy Pelosi (D-CA) voted for FIT21. House Financial Services Committee Ranking Member Maxine Waters (D-CA) and House Agriculture Committee Ranking Member David Scott (D-GA) both opposed FIT21 but made clear they would not vote against it. But in just the past two weeks, the small rift between the Elizabeth Warren wing of the Democratic Party and the White House, Senate leadership, and one-third of the House Democratic caucus has widened into a larger and larger wedge. This is a major political shift. Whether it will lead to a real policy shift under the current Democratic administration or any future one-party administration obviously remains to be seen. —Alex Thorne

China expands digital yuan payment system to Hong Kong

On Friday, May 17, the Hong Kong Monetary Authority (HKMA) and the People's Bank of China (PBoC) announced that they would expand the e-RMB pilot to Hong Kong and facilitate Hong Kong residents to set up and use e-RMB wallets. The e-RMB, also known as the digital RMB, is a central bank digital currency (CBDC) issued by the Chinese government, which was piloted in mainland China as early as 2019. It is the largest and most advanced CBDC pilot in the world. According to an article in the Atlantic Council in 2023, there are 13.61 billion RMB in circulation and 260 million wallets on the e-RMB network.

Electronic RMB is being piloted outside the Mainland for the first time. HKMA Chief Executive Eddie Yue said : "We are very pleased that Hong Kong is the first place to carry out a cross-border electronic RMB pilot and the first place outside the Mainland to allow residents to set up electronic RMB wallets locally. By expanding the electronic RMB pilot in Hong Kong and taking advantage of the 24x7 service and real-time transfer of FPS, users can top up their electronic RMB wallets anytime and anywhere without opening a Mainland bank account, making it convenient for Hong Kong residents to pay at Mainland merchants. We will continue to work closely with the People's Bank of China to gradually expand the application areas of electronic RMB, enrich the functions of electronic RMB wallets available to Hong Kong residents, and step up efforts to promote more retail merchants in both places to accept electronic RMB."

The Hong Kong Monetary Authority announced earlier this year that they are moving forward with testing of their national currency CBDC, or e-HKD. Notably, unlike other CBDCs being trialed by governments around the world, the e-RMB does not use blockchain or distributed ledger technology. However, as the Chinese government moves forward with the e-RMB, it is also working on the Blockchain Services Network (BSN). The BSN is a general-purpose blockchain similar to Ethereum where companies and software developers can build blockchain-based applications. In December 2023, China’s Ministry of Public Security announced that they would launch a decentralized identity service called RealDID on the BSN.

On Thursday, May 23, 2024, the U.S. House of Representatives passed a Republican-led bill that would prevent the Federal Reserve from issuing CBDCs to individuals. House Majority Whip Tom Emmer, a Republican from Minnesota, introduced the bill in September 2023, saying at the time: “If not designed to be open, permissionless, and private — mimicking cash — then a government-issued CBDC is nothing more than a Chinese-style surveillance tool that will be used to undermine the American way of life.”

Our take:

The United States and China continue to take very different approaches to digitizing their currencies. Recognizing the clear advantages of the digital RMB (simplified cross-border payments, wider public use of the RMB, 24/7 operation, and real-time transfer advantages), China is doubling down on the e-RMB system, expanding it to its first region outside of mainland China. As an international gateway to mainland China, Hong Kong is an important global financial center, and the e-RMB system will be launched here for the first time to a global audience.

Meanwhile, the Fed’s ambivalent stance on CBDCs doesn’t appear to have changed significantly since it began researching them in 2022, which you can read more about in a previous Galaxy Research newsletter . Meanwhile, U.S. lawmakers, mostly Republicans, are doubling down on their opposition to CBDCs, recently passing legislation in the CBDC Anti-Surveillance State Act, which would restrict the Fed from even attempting to develop anything close to the Chinese e-yuan in order to protect civil liberties and freedoms. Instead, U.S. lawmakers are likely to move forward with legislation to establish a comprehensive regulatory framework for stablecoins issued by private companies. Last month, U.S. Senators Cynthia Lummis of the Senate Banking Committee and Kirsten Gillibrand of the Senate Agriculture Committee introduced the Lummis-Gillibrand Payments Stablecoin Act, which you can read more about in a previous Galaxy Research newsletter .

Assuming the U.S. and China continue to pursue divergent policies regarding the use of CBDCs and other digital currencies, China is likely to lead innovation in CBDC infrastructure while the U.S. leads adoption of privately issued dollar-denominated stablecoins. As former CFTC Chairman J. Christopher Giancarlo said in an interview with CoinDesk , CBDCs may increasingly be used as a form of statecraft by countries that have been subject to U.S. sanctions and seek to avoid them in the future. Without exporting its own CBDC network, the U.S. may have to maintain the dollar’s centrality in global finance and compete in the new digital age through private, U.S.-based stablecoin issuers, which do have the advantage of protecting Americans’ financial privacy rights but also the disadvantage of capital inefficiency. To learn more about the pros and cons of stablecoins, read the Galaxy Research Digital Dollar Report . - Christine Kim

Chart of the Week

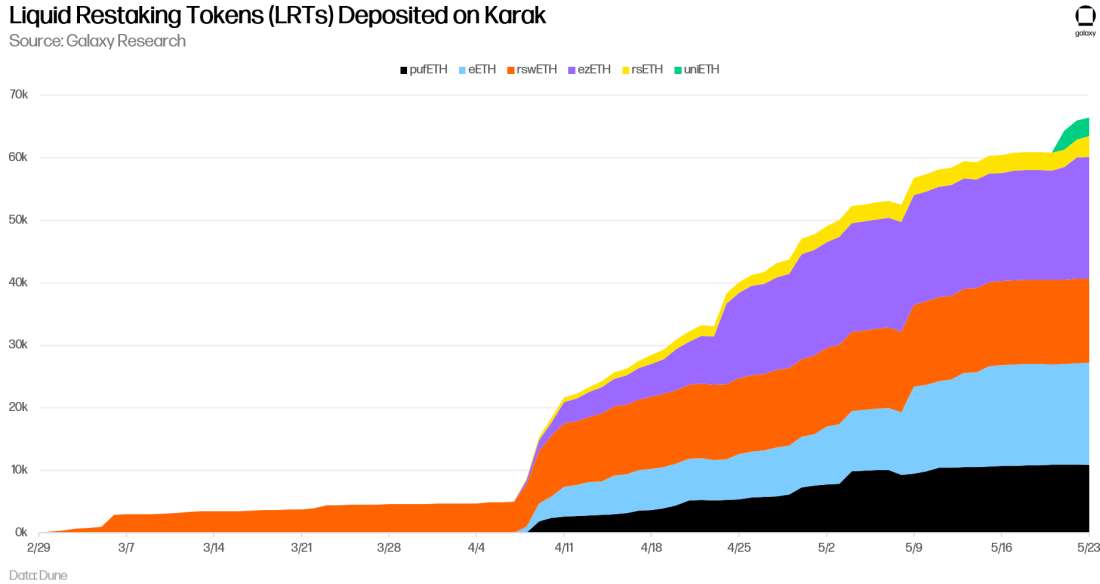

Last week, we highlighted the total value of all assets deposited in re-staking platforms EigenLayer and Karak. This week, we narrowed it down to a subset of assets deposited in Karak, namely Liquid Re-staking Tokens (LRT).

LRT is a tokenized claim on re-collateralized assets deposited to EigenLayer. In effect, re-collateralizing these LRT on Karak is equivalent to using EigenLayer deposits to secure the Karak Active Validation Service (AVS). The idea is similar to the dynamics of Beacon Chain deposits, where AVS is secured by re-collateralizing Liquid Staked Token (LST) deposits on the application. This could lead to a situation where EigenLayer delegation and AVS are impacted by Karak node operator failures, which is not a desirable outcome. However, this trend is incentivized by points programs that allow users to accumulate and increase points from many sources.

The chart below shows the trend of the top LRTs deposited in Karakoram. As of May 23, 2024, there are 66,500 of these LRTs on the re-pledge application. The Magpie LRT is not included in the chart.

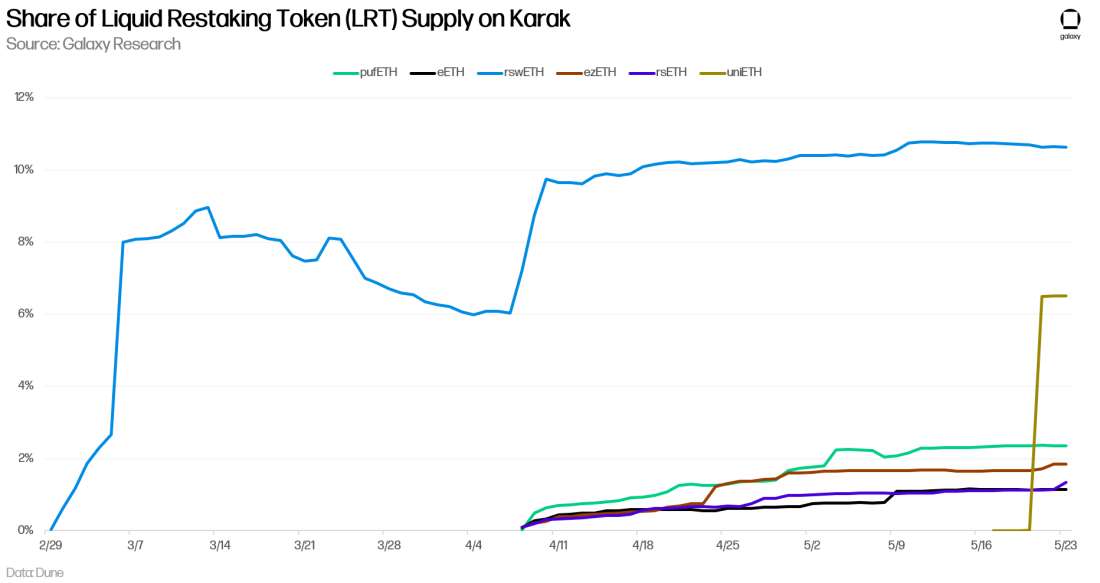

To frame these deposits, we can compare them to the total supply of the corresponding LRT. The chart below tracks the share of each LRT supply that has been deposited on Karak. Of the observed LRTs, Swell’s re-collateralized ETH, rswETH, has the largest share of deposits on Karak, at 10.63%. Users who deposit rswETH on Karak can earn points from the re-collateralization application itself, in addition to a triple multiplier on Swell points. Bedrock has the second-highest share of uniETH at 6.5%, with depositors receiving a 1.5x multiplier on Karak points and a 5x multiplier on Bedrock points. Each of the remaining LRTs has a smaller share of supply on the re-collateralization application, at 2% or less, but still enjoys a double point multiplier.

To frame these deposits, we can compare them to the total supply of the corresponding LRT. The chart below tracks the share of each LRT supply that has been deposited on Karak. Of the observed LRTs, Swell’s re-collateralized ETH, rswETH, has the largest share of deposits on Karak, at 10.63%. Users who deposit rswETH on Karak can earn points from the re-collateralization application itself, in addition to a triple multiplier on Swell points. Bedrock has the second-highest share of uniETH at 6.5%, with depositors receiving a 1.5x multiplier on Karak points and a 5x multiplier on Bedrock points. Each of the remaining LRTs has a smaller share of supply on the re-collateralization application, at 2% or less, but still enjoys a double point multiplier.

Other News

Other News

- MetaMask plans to add Bitcoin support

- Phantom Wallet beats PayPal to become the second most popular app on Google Play Store

- Trump campaign accepts cryptocurrency donations, including Dogecoin and Shiba Inus

- Hong Kong may allow staking of Ethereum spot ETFs

- ZkSync plans to generate tokens this week and airdrop in mid-June

- Uniswap Labs Responds to Wells Notice, Calls SEC Legal Action “Weak and Wrong”

- Yuga Labs to ‘no longer engage’ with CryptoPunks following backlash to new series

- US House of Representatives passes Republican-led anti-CBDC bill

- London Stock Exchange to List Crypto ETP for the First Time