Author: 0xkyle, on-chain analyst Source: substack, @Oxkyle Translation: Shan Ouba, Jinse Finance

Congratulations, fellow crypto enthusiasts! In a move that no one expected, the U.S. Securities and Exchange Commission (SEC) has approved a rule change to create an Ethereum ETF — despite Gary Gensler’s public hawkish stance on Ethereum.

I won’t go into the reasons behind this, that’s for the political commentators on Twitter to debate. Our main focus is that the fact that this has happened indicates a significant shift in the US government’s attitude towards cryptocurrencies.

In addition, the passage of the FIT21 Act (“FIT21 provides the necessary regulatory clarity and strong consumer protections for the digital asset ecosystem to thrive in the United States”) has furthered this progress. A new era of regulatory compliance is approaching for businesses.

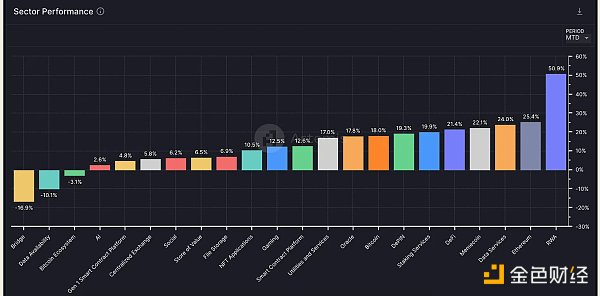

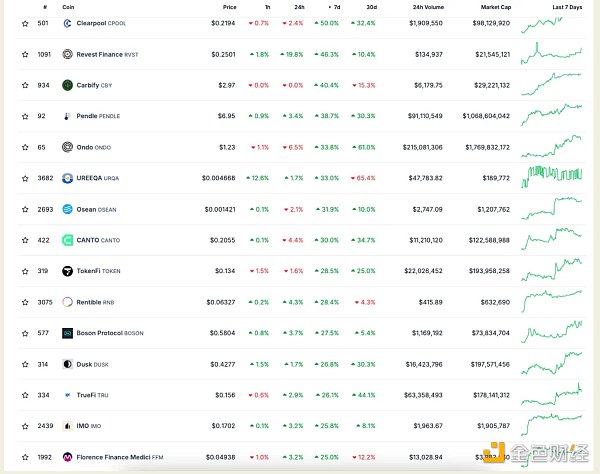

The U.S. government’s new dovish stance on cryptocurrencies is very bullish, and you can see how the market is digesting this information — the Real World Assets (RWA) and Ethereum sectors have been the standout performers so far this month.

I believe that with the launch of the Ethereum ETF and the recent mild sentiment towards cryptocurrencies, both sectors will continue to outperform in the coming weeks and months.

introduce

Overview

The argument for this article can be divided into two parts: first, the outperformance of Ethereum as an asset class and its related alternatives, and second, the RWA sector as a manifestation of the overall “bullish crypto government stance”.

These two sectors are closely linked because:

With the SEC approving an Ethereum ETF, signaling a more benign attitude toward cryptocurrencies, this means that institutionally driven RWA assets will also see more inflows (as we’ve already seen with ONDO’s relationship with Blackrock).

The institutional “investment thesis” for Ethereum has been tokenization, stablecoins, and real-world settlement - major institutions will discuss RWA assets on Ethereum, which has always been the main narrative for Ethereum.

So, to sum up:

Long Ethereum and its best alternatives

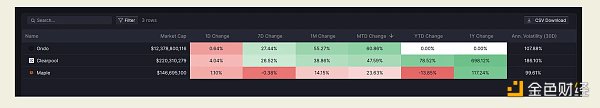

long- ONDO is my favorite

You can also consider other RWAs, but I don't do that because ONDO itself is an Altcoin of Ethereum, and going down the risk curve means you are more exposed to market risks in the event of a downtrend. I prefer to keep things simple.

In-depth analysis of Ethereum ETF

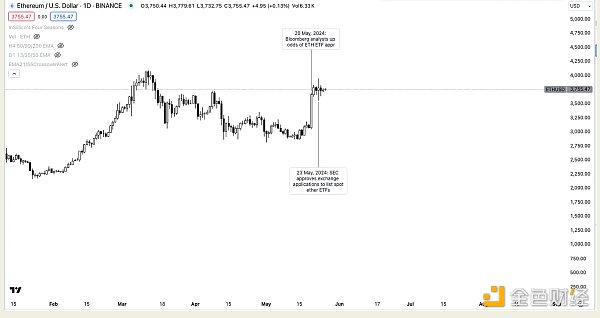

Now onto the Ethereum ETF trade. I think this is very interesting because unlike the Bitcoin ETF, for which we had a lot of time to “prepare” – the Ethereum ETF caught many market participants off guard. This is why when the probability of approval of the Ethereum ETF changed dramatically overnight, we saw a massive 25% rally in a single day.

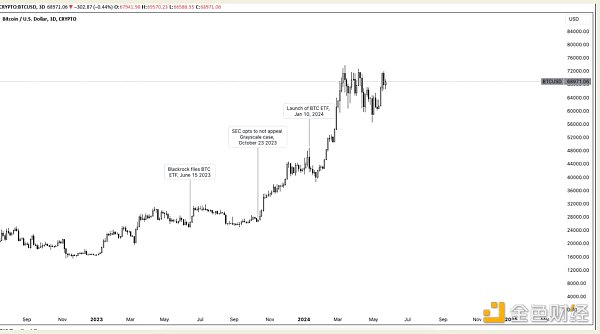

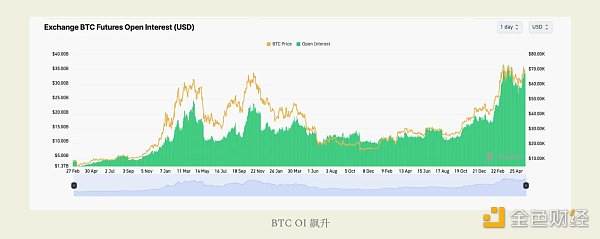

The problem is that the market rarely lets you repeat the same trade - and this trade's thesis is based on the idea that an Ethereum ETF has not yet been priced in by the market. To gauge this, we first look at the performance of the Bitcoin ETF:

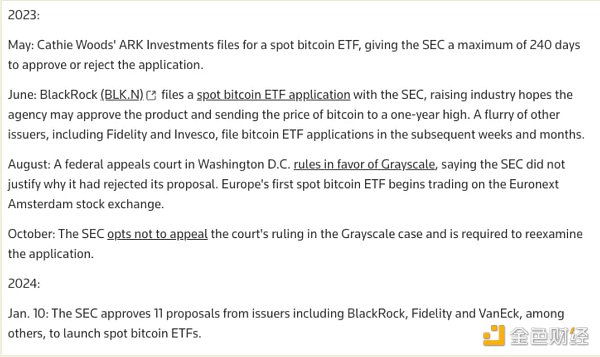

Key Dates for Bitcoin ETFs

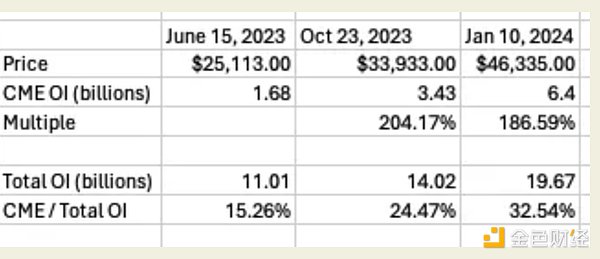

June 15, 2023: A critical week for Bitcoin, Blackrock shows their intent and submits spot Bitcoin ETF application

October 23, 2023: Perhaps the moment that really solidified the possibility of a Bitcoin ETF was when the SEC did not appeal Grayscale’s court ruling, which meant they were seriously considering it → the market got validation

January 10, 2023: Bitcoin ETF officially launched

Some things to note:

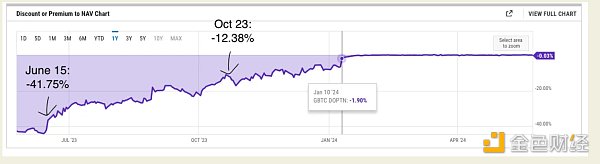

The Blackrock ETF announcement essentially kicks off the narrowing of the discount

Only when the ETF is launched does the discount completely disappear (obvious statement, but think about it, it’s like “free money”, now that we have “evidence” that an ETF can/will be launched, the discount may disappear before the ETF is launched)

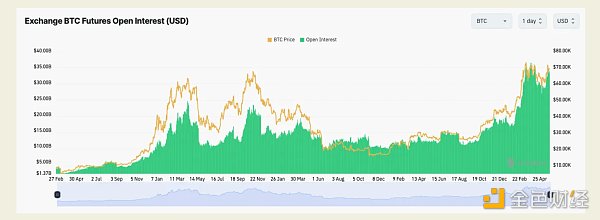

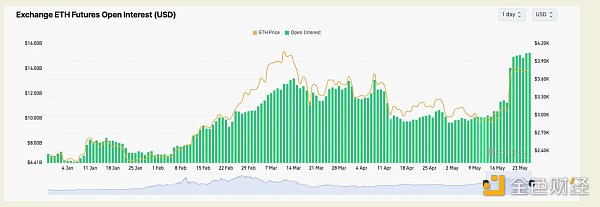

After June 15, the open interest (OI) surged, fell sometime in August, but began an upward trend in October, peaking in February.

I look at CME open interest because it is the best tool to see institutional positioning.

Now, let’s look at the situation with Ethereum.

Key Dates for Ethereum ETFs

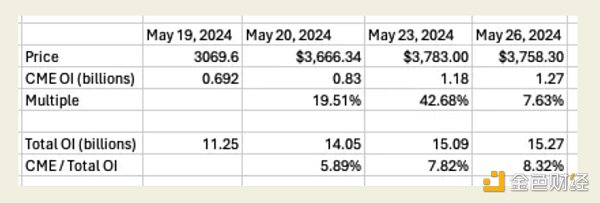

May 20, 2024: Bloomberg analysts raise the probability of Ethereum ETF approval from 25% to 75%

May 23, 2024: SEC approves exchange application to allow listing of spot Ethereum ETF

Interestingly:

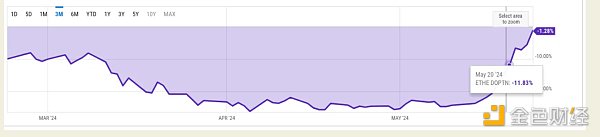

- ETHE’s discount narrowed from -24% to -1.28% in 2 days, compared to GBTC which took months to narrow its discount.

- CME open interest growth is not as strong as Bitcoin ETF.

- Ethereum’s major gains were already reflected in the probability adjustment, not in the event itself — that is, the market priced in the ETF announcement in advance, which is the opposite of the case for Bitcoin, where every announcement led to a significant price increase; as I said, the same trade doesn’t work twice.

With that background, let’s break it down:

Arguments and risks

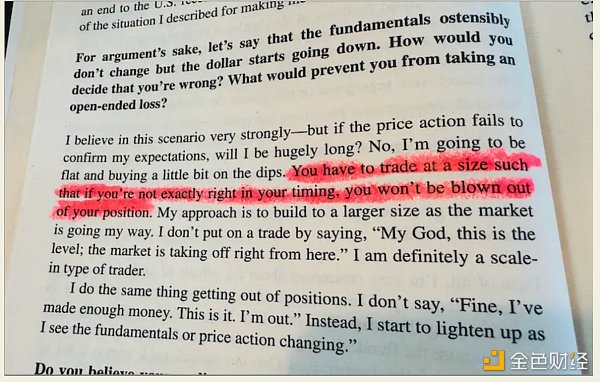

I’ll start with the risk of the trade because I believe it’s more important to weigh the downside of a trade against its upside potential – manage the downside and let the upside manifest itself.

risk:

1. Main risks : the market has peaked or is close to peaking/time stop loss.

The argument in favor of this view is the rapidly narrowing discount and Ethereum’s price performance prior to the announcement. It can be argued that these guys know how to trade — it’s basically an upside-only trade, but CME and total open interest have been largely stagnant.

In fact, Ethereum open interest is only 4 billion less than Bitcoin open interest on January 10, which may indicate that “all the long are already long, who’s going to buy?”

Honestly, I think this argument is pretty strong. I think the market is way ahead of itself on this trade - even though the ETF has just launched, open interest is already exceeding all-time highs, unlike Bitcoin, where the market only saw such high open interest when the ETF was launched.

The market is equating “ETF approval” with “Ethereum ETF launch”, which are two completely different things. Looking at how the price reacted to the approval announcement, and how quickly the discount narrowed, this view makes sense.

I actually agree with this view, which is why I said at the beginning of the article: "Both sectors will continue to outperform in the weeks and months ahead."

I believe that when people realize that these effects are not instant, we will see some time stops, and that is when you can start buying. I myself have placed buy orders at certain price levels - doing it slowly and steadily. Here is an example of how I would trade:

2. Unique regulatory risks

I can't comment much on this because I don't understand how regulatory risk works, but from what I read on Twitter, people are saying that only the 19b-4 was approved, not the S-1.

This basically means that it “can be challenged within the next 10 days” (?) ← I have no idea if this is true! But if it is true, it certainly poses a huge risk to trading if the whole thing is a scam.

Or, there may be some other "hidden between the lines" risk associated with this approval - don't know. But it's definitely something to keep in mind.

I like this trade, what to long on?

I know this post is already long, but we’re getting to the good stuff. The story so far is: Ethereum is good, but the market may have gotten ahead of itself. Still, there are bullish catalysts in the long term. So, what to buy?

When choosing Ethereum-related bets, many participants will be caught in a dilemma - after all, you can choose liquid staking derivatives (LSDs), Layer 2, ZK-Rollups, decentralized financial protocols (DeFi), meme coins, etc.

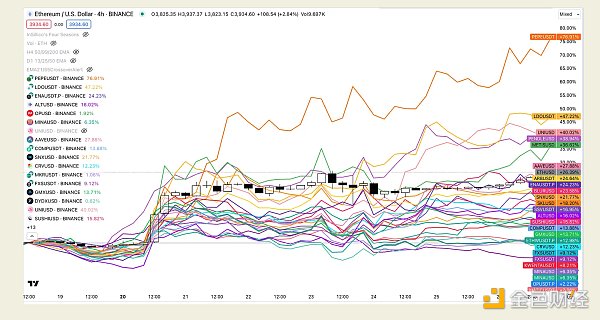

So when we plot the performance of all of these coins, we can see that the best performers are (sorted by performance from highest to lowest):

PEPE, LDO, UNI, PENDLE, METIS, AAVE

This is based on a 1-week lookback period (i.e. May 18th to May 26th). This is a crude measure - a more scientific approach would be to calculate the beta of these coins over a more "correct" lookback period - but for me, this works.

I personally choose to long on PEPE and PENDLE because they have been popular in the market all year. Not only have they performed well, but they are also one of the best performing currencies so far this year.

Therefore, I believe PEPE and PENDLE offer the most upside. They have the added advantage that the market loves high-profile coins; I would not discount the strength of the PEPENDLE combination.

It’s time to trade RWA

I’ve spent so long talking about the ETH ETF deal that I’m running out of energy to write about the RWA side of the deal. The argument is simple: RWA has been something institutions have been pushing for since the beginning of crypto, and ETH has been the main chain for this — ONDO’s partnership with Blackrock was built on ETH.

Therefore, it is equivalent to betting on the overall narrative development of Ethereum. For asset selection, I mainly choose ONDO, and some people I know also shill CANTO/DUSK. Personally, my approach is simple - 1 ONDO = 1 CONDO.

By the way, I think the ETH/SOL pair is a good pair to trade. Overall, my feeling is that SOL has peaked for now and long ETH/ short SOL beta will be very attractive.