SocialFi is an emerging trend that combines social relationships and financial tokenization. It has evolved into two unique models at the intersection of social networks and financial technology: social financialization and financial socialization. Social financialization (social finance) is based on finance, wrapping social networks in financial concepts and tokenization, relying on the Ponzi model to tokenize creators (content) and directly convert them into economic benefits. The representative is friend tech. Friend tech was born in the second half of last year, leading a round of social trends, and various friend tech-like applications emerged in large numbers; however, friend tech fell into a downturn after the first round of popularity, and various imitations basically disappeared. Recently, it has attracted attention again with the release of v2 and the release of FRIEND tokens. Financial socialization (financial socialization) is based on social platforms, building communities and social relationships through content production, and tokenization is embedded in daily social activities through airdrops, rewards and payments, creating potential economic value for every post, like or comment on the platform. The representative is Farcaster. Strictly speaking, Farcaster is a social protocol layer rather than an application layer. The "Farcaster" we usually talk about mainly refers to the Twitter-like social front-end Wrapcast built by the Farcaster team.

Applicable scene

Farcaster and friend tech both belong to the social track, but they belong to two major categories of the social track. Farcaster or Wrapcast is a public domain social similar to Twitter, while friend tech is a private domain social similar to WeChat. The difference in usage scenarios may be the basis for the evolution of two different models: financial socialization and social financialization. Public domain social emphasizes openness and visibility, user interaction based on content sharing, comments, likes and reposts, and the promotion of content discovery through trending topics and recommendation algorithms; private domain social emphasizes privacy and control, and the interaction will be more private and in-depth, usually occurring between known friends or members of private groups. This deep interaction helps maintain and strengthen existing social connections.

In accordance with their respective characteristics and user behaviors, there are different strategies for implementing tokenized incentives on public and private social platforms. On public social platforms, common incentive methods include tokenized rewards for users to create and share popular content, rewards for users to participate in forms such as likes, comments, and reposts, and distribution of tokens based on users' activities and influence on the platform. Farcaster or Wrapcast is different from some public social platforms in the past. Incentives are not carried out by the platform for potential tokenized airdrops, but by the community and third-party applications spontaneously. For example, active posting in the Degen channel and a series of active account conditions such as a certain number of fans on the account can obtain Meme coins from the Degen community and other different channel communities as rewards; Spectral airdrops to Farcaster active accounts (active is defined as more than 10 likes, 10 followers, 10 posts, and 10 to 200 contract interactions on Base). What users need to do is to participate in the interesting discussions and active atmosphere of the channel. Airdrops or incentives happen naturally, rather than being targeted at the platform for a specific period of time.

It is worth mentioning that although Farcaster is a decentralized protocol, the Warpcast front-end has an audit mechanism, which isolates almost all pornographic or vulgar content and provides a good public environment for users.

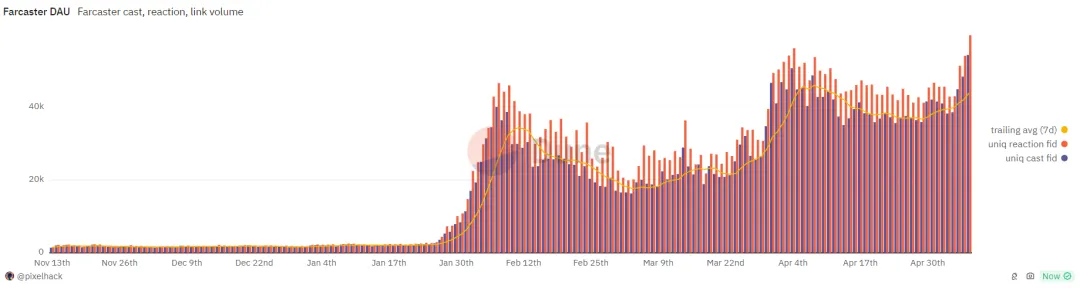

(Farcaster DAU has also hit a record high recently, data source: https://dune.com/pixelhack/farcaster)

In private social platforms, the general incentive method is chat-to-earn, which leads to various low-quality content creation. Friend tech puts the so-called Earn on where to chat, and organic entry and exit is the core of friend tech. Everyone in friend tech can be a potential chat partner for others. When other users need to chat with someone, they need to buy this person's key. The value of the key is controlled by the bonding curve. Simply put, the more people buy and the fewer people sell, the higher the value of the key. Half of the transaction tax generated in the middle flows into the protocol and half flows into the distribution to the key holder. The newly launched club in v2 is similar. The basic function is no different from the group chat of WeChat. Entering and exiting the club is the core.

What is less known is that Farcaster's FID is essentially an NFT that can be resold, and FarMarket provides this support. After the resale of the FID, all the data of the account will still be retained, including historical posts, fans, etc. The current highest-priced FID is worth 3.69 ETH, more than 10,000 US dollars; some potential high-value Farcaster accounts even ask for more than 300 ETH.

It is not difficult to see that the Farcaster protocol or Wrapcast front-end application itself does not provide direct incentives. Whether the user is motivated or not has nothing to do with the platform. It comes from the spontaneity of the community and third-party applications. It is a light incentive. Friend tech is a strong incentive built into the bottom layer of the application. The higher the key base price and the more transactions, the higher the incentive for the creator, and the higher the platform's income.

Entry threshold

Friend Tech relied on the invitation code model to become popular in CT. In the early days, tens of thousands of users were struggling to get a code to enter the platform. Using the invitation code access model is a very effective strategy in the early stages of new social networks or services, especially to expand the user base through seed users and KOLs. In the early days, the official issued a certain number of invitation codes to seed users and KOLs. After the seed users and KOLs entered, they generated invitation codes to invite other friends, relatives or fans, thus forming a chain reaction and gradually expanding the user base. Each new user usually also receives a limited number of invitation codes to continue to promote the expansion of the network. Although the invitation code is free, it is easy to create heat and topics in existing social platforms and communities by using hunger marketing and users' FOMO psychology. However, as the number of users gradually increases, the congestion of entering the platform will also ease.

Farcaster adopts a login payment system. The basic fee for registering FID is $5 per year ($3 via an invitation link), which is relatively rare for a social platform. This has led to a barrier to entry for users after the enthusiasm of early users has faded. So this is why even though Farcaster was born last year, it has been tepid before this year. It is more of a communication place for niche technology enthusiasts. However, strictly speaking, $5 is not paid for entering the social network, but for renting the data storage space of the social network, which is also the core income of Farcaster. If the storage fee is not paid after the expiration, the user's social data will be cleared.

In general, the invitation code mechanism can attract users' FOMO in the early days of social platforms and stir up discussions on existing social platforms, further enhancing the FOMO atmosphere; the mechanism of requiring payment for login will become a barrier to entry for users without their knowledge, and the additional education and opportunity costs need to be compensated by other means. Of course, appropriate thresholds can exclude some studios and brush users.

Agreement/application revenue

Farcaster's revenue mainly comes from new user registrations, renewals of old users, and payment requirements for more storage space, so the growth of new users at this stage is directly linked to Farcaster's revenue. Currently, the Farcaster protocol has accumulated revenue of more than 1.3 million US dollars, with an average daily fluctuation of 10,000 US dollars; it has about 362,000 users.

Friend Tech's revenue mainly comes from user key fees (10% fee for each transaction). In v2, club, built-in swap and FRIEND LP fees were added, so the revenue is mainly related to TVL and transaction activity.

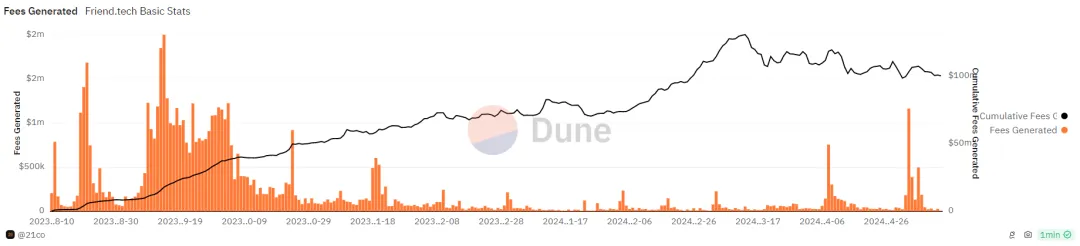

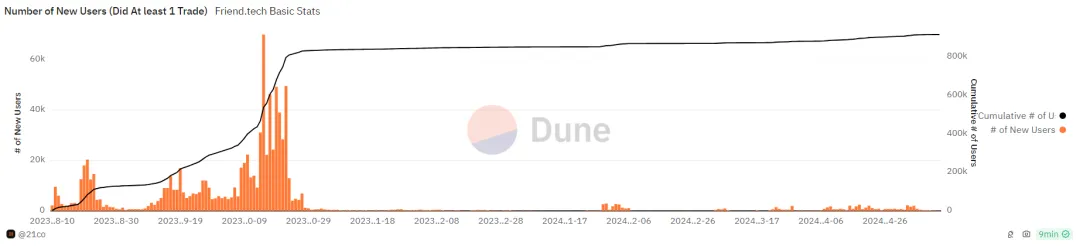

(Data source: https://dune.com/21co/friendtech-analysis)

Friend Tech has a total of about 915,000 users, three times more than Farcaster, but the revenue captured from transaction fees is obviously more explosive than the registration fee revenue. Friend Tech has captured more than $100 million in historical cumulative fees, half of which has flowed into protocol revenue, which also means that the development team has earned more than $50 million from the protocol. On September 14 last year, the fees captured by Friend Tech in a single day reached $2 million, which means that the revenue in just one day exceeded the cumulative revenue of Farcaster. The high fee tax allowed Friend Tech to capture tens of millions of dollars in revenue in more than a month, and the team became rich. The subsequent development and maintenance gradually stagnated and fell into a long period of depression. It was not until the launch of v2 and the release of FRIEND that some return attention was re-attracted, but overall it was still a long way from the peak, and the growth of new users remained stagnant.

The essence of friend tech lies in the bonding curve rather than social networking itself, and its development is subject to the Ponzi law of the Ponzi model; Farcaster is relatively more dependent on capital supplements from external VCs.

Asset issuance and application construction

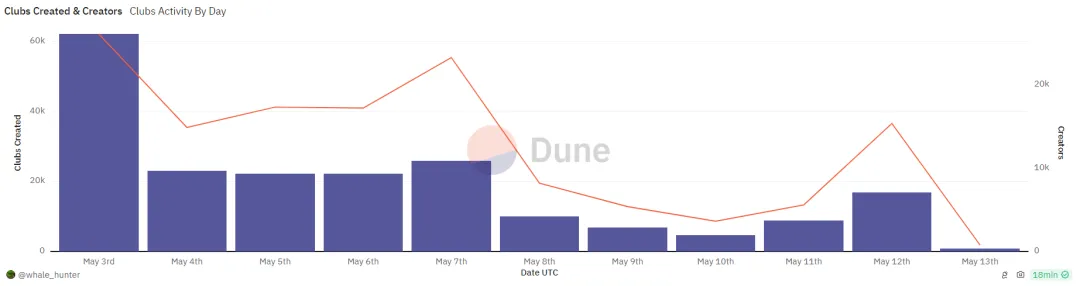

(Data source: https://dune.com/whale_hunter/friend-tech-ultimate-analytics)

For friend tech, each user is a FT asset called key. There are 915,000 users, which means there are 915,000 key assets. Since the launch of v2 on May 3, more than 200,000 clubs have been created (one user can create multiple clubs), which also corresponds to more than 200,000 club key assets. In friend tech, all user profiles and group chat clubs are assets, while user keys are mainly traded using ETH, and club keys are mainly traded using FRIEND. At present, the overall market value of 915,000 user keys is about 150,000 to 200,000 US dollars; the overall market value of 200,000 club keys is about 10-11 million US dollars, of which there are two clubs worth more than 1 million US dollars. Friend tech's native token FRIEND is fully circulated as soon as it goes online, with a market value of approximately 210 million US dollars.

Farcaster's asset issuance methods are more diverse and can be mainly divided into three types. First, the FID registered by the user is essentially an NFT, an asset with user social data, which can be traded on secondary markets such as FarMarket. Second, social relationships generate social assets, which mainly rely on channels. Meme coins are a product of financial socialization and are issued by channel communities. According to Farcaster Index data, there are 28 types of Farcaster community Meme assets that have been counted, covering Base and Zora chains, with a market value of approximately US$880 million, of which DEGEN has a market value of US$703 million. Third, Frame issues assets or builds applications. Frame is simply an embedded application that can directly implement third-party interaction on Wrapcast without jumping to a third-party web page or signing to jump, which is simple and convenient to operate while transferring the user's operational risks. Project parties can build directly on Frame, and users can directly use Frame to mint NFTs, play games, do interactive tasks, and receive Meme coins. After Frame was launched in late January and early February this year, Farcaster's DAU and new users have increased more than tenfold. In addition, Farcaster also has Wraps rewards and payments (5u=500 Wraps), but they cannot be exchanged in both directions; Syndicate, which was once invested by a16z , used Arbitrum Orbit to build the L3 Degen Chain using DEGEN as the native Gas token.

Farcaster is essentially a social layer . FID is a universal identity. Any developer can use the Farcaster protocol to build a front-end similar to Twitter or Reddit. In addition, social aggregators like Firefly under Mask have also aggregated posts from Farcaster and Lens. Currently, dozens of applications are building social ecosystems around Farcaster. For example, Launcher and Neynar are building Farcaster ecosystem components and have been shortlisted for the a16z 2024 accelerator program.

Social financialization and financial socialization each have their own advantages and disadvantages. Social financialization applications represented by friend tech can attract a large number of participants through a mechanism similar to the Ponzi model because it provides rapidly increasing profit potential, but excessive financial activities may lead to investment bubbles and unsustainability after the user growth slows down, which is limited by the Ponzi model itself; financialized social networking represented by Farcaster is all about making social networking more interesting. Information flows with value, and the Meme community network is built accordingly. Frame has also created a new seamless interactive experience, but the paid entry threshold also brings challenges in terms of user education and acceptance.