Author: Tanay Ved Source: coin metrics Translation: Shan Ouba, Jinse Finance

Key Takeaways:

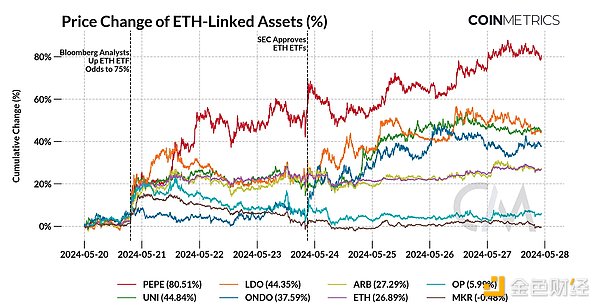

- The reversal of Ethereum ETF approval triggered a 25% surge in ETH prices, while also driving up other tokens related to the Ethereum ecosystem.

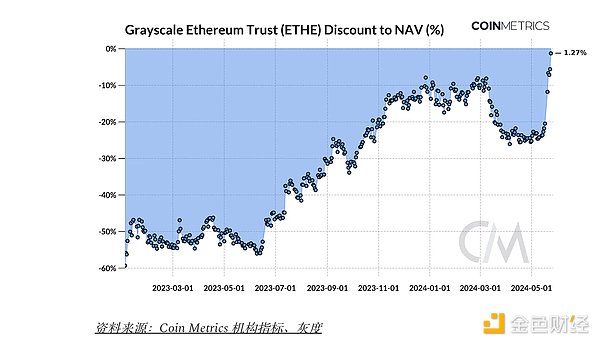

- The Grayscale Ethereum Trust’s (ETHE) net asset value (NAV) discount narrowed from 50% a year ago to 1.28% at the time of ETF approval.

- ETH ETF does not involve staking, which may have an impact on ETH's supply dynamics, staking ecosystem, and network resilience.

introduction

In a surprising move, the U.S. Securities and Exchange Commission (SEC) has approved a spot exchange-traded fund (ETF) for Ethereum (ETH), the second-largest digital asset. On May 23, the SEC approved 19b-4 proposals from eight issuers, including industry giants such as BlackRock, Fidelity, Bitwise, VanEck, and Grayscale. Just four months ago, after a decade of efforts, the race for a spot Bitcoin ETF finally came to an end, with 11 issuers participating in what was dubbed the “Cointucky Derby.” Months of anticipation triggered $1.2 billion in net inflows, making it the fastest-growing ETF launch in history.

However, for Ethereum, the situation is different. Ethereum’s security status and its Proof of Stake (PoS) consensus mechanism have been unclear, and the SEC has taken action against prominent industry players such as Coinbase and Consensys. Nevertheless, the odds of spot Ethereum ETF approval have dramatically shifted from impossible in January to reality in May, marking a major turning point in the regulatory environment of the digital asset industry.

In this edition of Coin Metrics’ State of the Network Report, we assess the market reaction and network impact following the SEC’s approval of a spot Ethereum ETF.

Market Reaction

With a short window to digest this development, the market reacted quickly. The increase in the probability of approval to 75% immediately triggered a market price reaction for ETH and other Ethereum ecosystem tokens. PEPE, the largest meme coin on Ethereum, rose 80%, LDO, the governance token of liquid staking provider Lido, rose 44%, UNI, the token behind the Uniswap decentralized exchange (DEX), rose 44%, and ETH rose 27%.

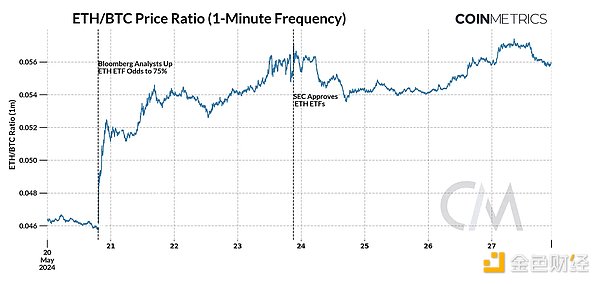

ETH's performance relative to BTC (ETH/BTC ratio) has been in a downtrend since September 2022, and this news gave it a much-needed boost. Despite rising to 0.056 before the ETF approval, it needs to break through key resistance levels to resume its uptrend and make up for the underperformance relative to other large-cap crypto assets such as BTC and SOL. Although the approval of 19b-4 has not accelerated returns, the approval of the expected S-1 registration statement and the subsequent launch of the Ethereum ETF should provide a strong impetus for the widespread acceptance of ETH as an investable "commodity" and the mainstream adoption of the Ethereum network.

Investor Sentiment and Market Positioning

The market sentiment for the approval of a spot Ethereum ETF is reflected in the narrowing discount of Grayscale Ethereum Trust (ETHE)’s net asset value (NAV). Only a year ago, there was a huge discount of about 50%, and now the market price of ETHE has narrowed to within 1.28% of its NAV, with a 20% reduction occurring in 5 days.

While this is reminiscent of the Grayscale Bitcoin Trust (GBTC) prior to its January ETF conversion, the faster pace of ETHE’s discount compression highlights how this development has caught market participants off guard. Nonetheless, investors are strategically positioning themselves in anticipation of ETHE’s conversion to an exchange-traded product when it becomes publicly available.

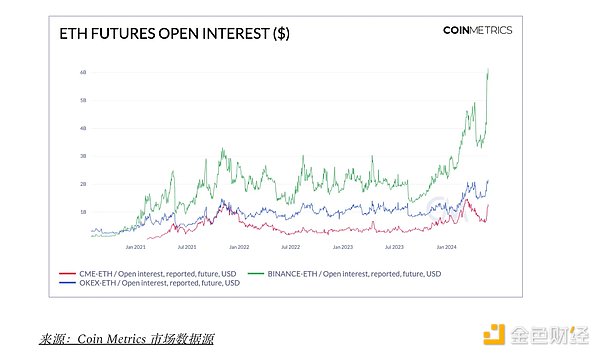

The all-time high of $1.38 billion in open interest (OI) for ETH futures contracts also indicates the high level of speculative activity around Ethereum ETFs. While still relatively lower than the levels before the launch of spot Bitcoin ETFs, the increase in the outstanding value of ETH futures contracts on Binance, OKX, and Chicago Mercantile Exchange (CME) indicates a higher level of activity from both retail and institutional participants.

The impact of ETH ETF on staking

An important development in the approval of spot Ethereum ETFs is that these products will exclude staking. The inability of issuers to stake ETH could have potential downstream effects on ETH’s supply dynamics, the health of the Ethereum consensus layer, and the entire staking ecosystem.

Impact on Ethereum supply dynamics

As the native asset of the Ethereum ecosystem, Ethereum (ETH) is fundamental to its operation and security. It can be used as a unit of account, a store of value, or collateral, and a diverse economic system has been built around it. This includes using ETH to secure the network's Proof of Stake (PoS) consensus mechanism through staking, depositing ETH into smart contracts to facilitate services such as decentralized finance (DeFi), using ETH to pay transaction fees, or simply keeping ETH in a user-owned account as an investment or store of value.

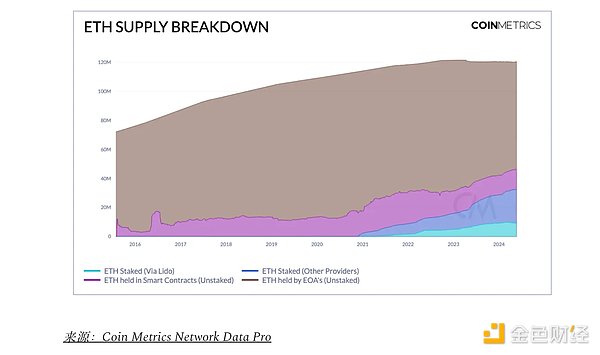

Currently, of the total 120 million ETH supply, 27% is staked in the consensus layer, 11% is unstaked in smart contracts, and 61% is held by externally owned accounts (EOAs). As ETF issuers absorb more circulating ETH, it is expected that a portion of the supply will be locked, potentially reducing the available supply on the market. This reduction in circulating supply, combined with strong demand, could increase the likelihood of ETH price increases.

Impact on Ethereum Consensus Layer

Currently, 32 million ETH, or 27% of the total supply, is staked on the Ethereum Beacon Chain through individual staking, staking pools like Lido, or custodial staking providers like Coinbase. However, if staking of ETH ETFs is excluded, the ratio of 27% staked to 73% unstaked is unlikely to change dramatically. Staking yield is a key component of the return of holding ETH. Therefore, excluding ETFs from staking may be beneficial to existing stakers because it prevents the dilution of staking returns that occurs when institutional capital enters the staking ecosystem.

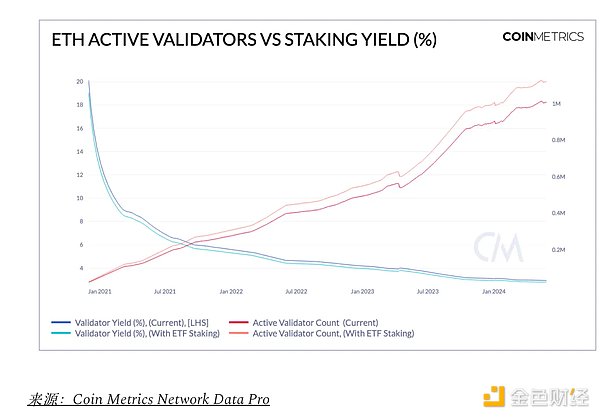

The potential impact of consensus rewards (excluding tips and MEV) on validator returns can be visually seen in the figure above. Assuming an Ethereum ETF issuer obtains 10% of the ETH supply (12 million ETH) and holds 30% of it, the number of active validators on the consensus layer will increase by 11.25%, from the current 1 million to 1.12 million. Following an inverse relationship, the influx of validators and staked ETH will result in a decrease in the annual percentage yield (APY) for stakers, from about 2.9% to 2.7%. While this does not provide an exact measure, it illustrates the potential impact on the staking yield if the ETF issuer stakes additional ETH.

It’s also important to consider that changes to Ethereum’s maximum effective balance per validator (currently set to 32 ETH) will increase to 2048 ETH in the upcoming Electra upgrade, which could change validator and network security dynamics.

In addition, the lack of ETH ETF pledge may have a positive impact on Ethereum's pledge rate and decentralization. Currently, with the rapid growth of the pledge ratio, providers such as Lido and Coinbase account for 28% and 13% of the market share of pledged ETH respectively. If institutional capital participates in staking, Coinbase, as the main ETF custodian, is likely to become the main beneficiary of staking ETH, thereby exacerbating these centralization risks.

These concerns have sparked discussions in the Ethereum community about adjusting the ETH issuance rate to mitigate negative externalities such as equity concentration, reduced competitiveness of independent stakers, and inflationary pressures faced by non-stakers. In the long run, it remains to be seen whether the SEC will allow staking of ETH ETFs. However, by not staking ETH, ETFs can indirectly help maintain a balanced staking ratio and temporarily promote a healthier staking distribution.

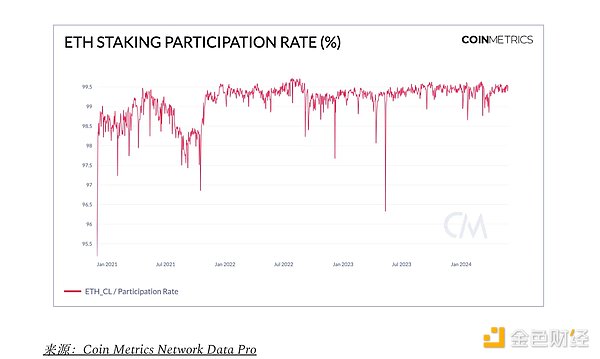

The 99.5% participation rate of the Ethereum consensus layer indicates that a large portion of validators are proving (voting) and proposing blocks to maintain the security of the network. This also means that staking rewards will be distributed to more validators, thereby ensuring decentralization. Looking ahead, the proposed changes to issuance and effective balances, as well as the SEC's stance on staking ETFs, will affect the future of the Ethereum staking ecosystem.

in conclusion

This past week marked a key shift in the U.S. digital asset regulatory landscape, with the approval of the FIT21 cryptocurrency market structure bill and the approval of an Ethereum ETF. Despite this, several questions remain unanswered: Can an Ethereum ETF garner comparable investment flows to a Bitcoin ETF? How will staking dynamics evolve in light of these developments? What broader implications will there be for the rest of the cryptocurrency market? While this remains to be seen, increased regulatory clarity and accessibility will hopefully attract broader demand for ETH and its ecosystem.