Table of contents

ToggleLong-term holders accumulate BTC again

According to data from Glassnode, long-term Bitcoin investors began accumulating Bitcoin again for the first time since December 2023 after months of selling. Analysts at the firm noted in a weekly note that spending pressure on long-term holders has eased significantly over the past week, with investors returning to accumulation mode - suggesting that market volatility is needed to trigger a new wave of selling.

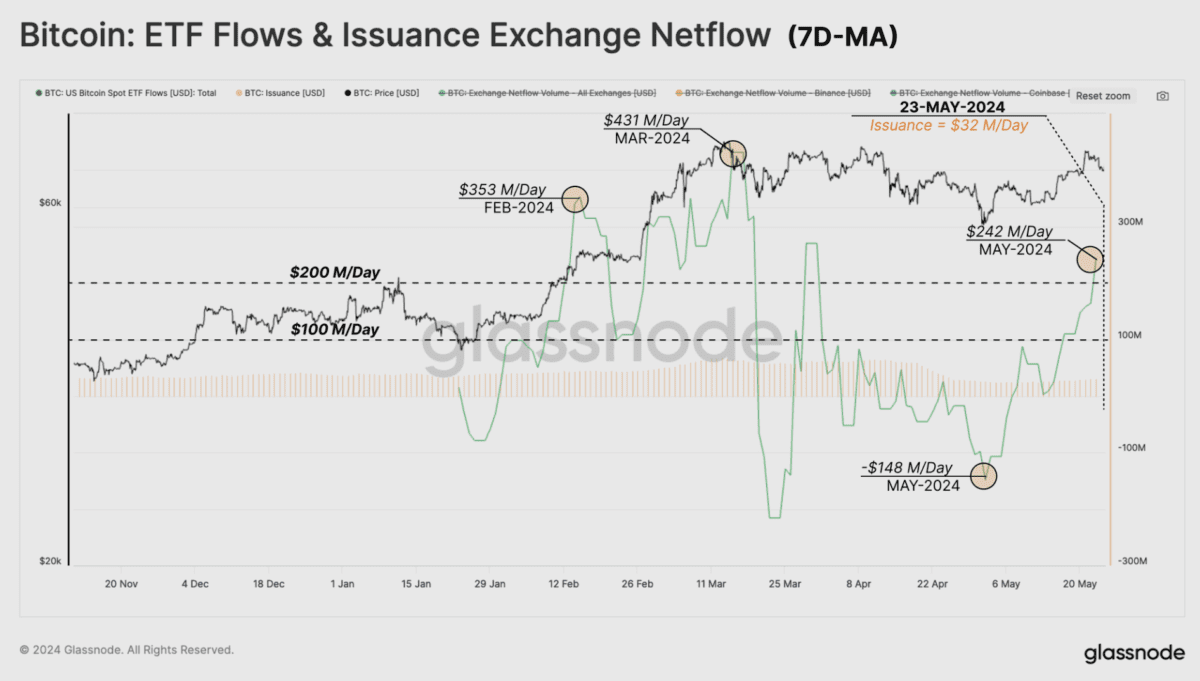

In addition, daily net inflows into U.S. spot Bitcoin ETFs reached $242 million last week, and the report cited this market indicator as indicating that buyer demand is returning. Glassnode wrote in the report:

“Considering the natural selling pressure on miners after the halving is $32 million per day, the buying pressure on the ETF is almost eight times that, which highlights the size and influence of the ETF, but also highlights the relatively small impact of the halving. "

A milder bull cycle

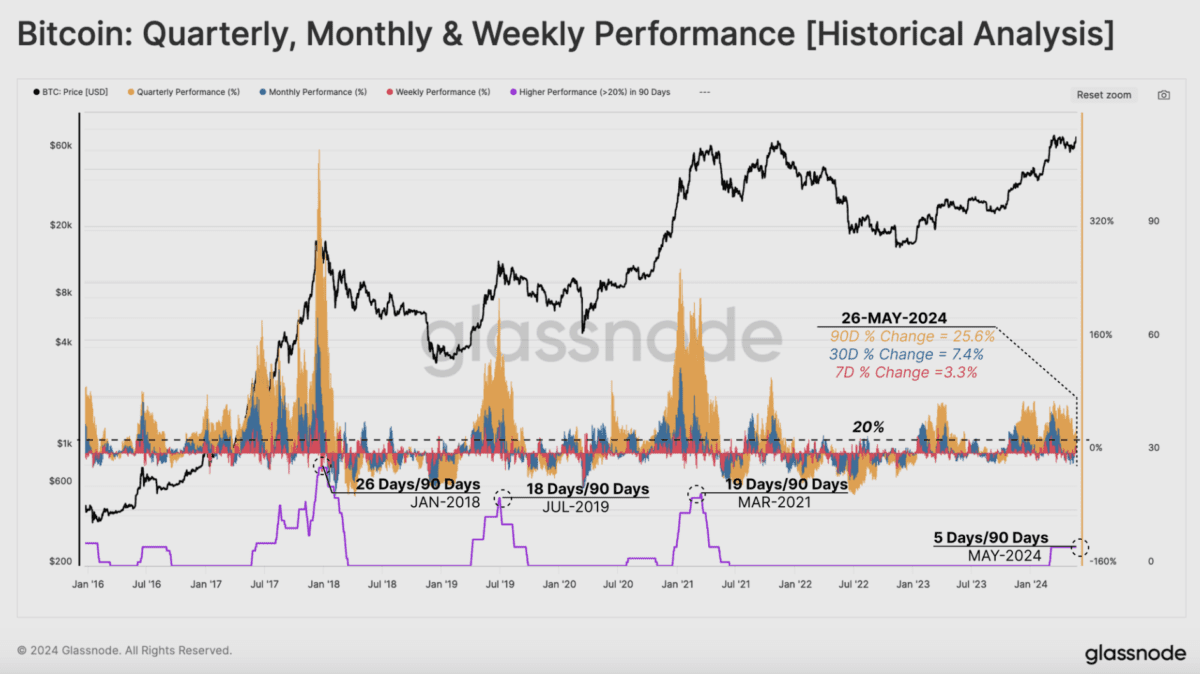

Notably, Glassnode has observed that Bitcoin’s price action over the past three months has been more modest than in previous bull cycles. According to Glassnode, in the past three months, Bitcoin has recorded weekly, monthly and quarterly gains of more than 3.3%, 7.4% and 25.6% respectively on five days out of 90.

"In previous cycles, this number reached 18 to 26 days, suggesting that the current market may be more moderate relative to past bull markets."