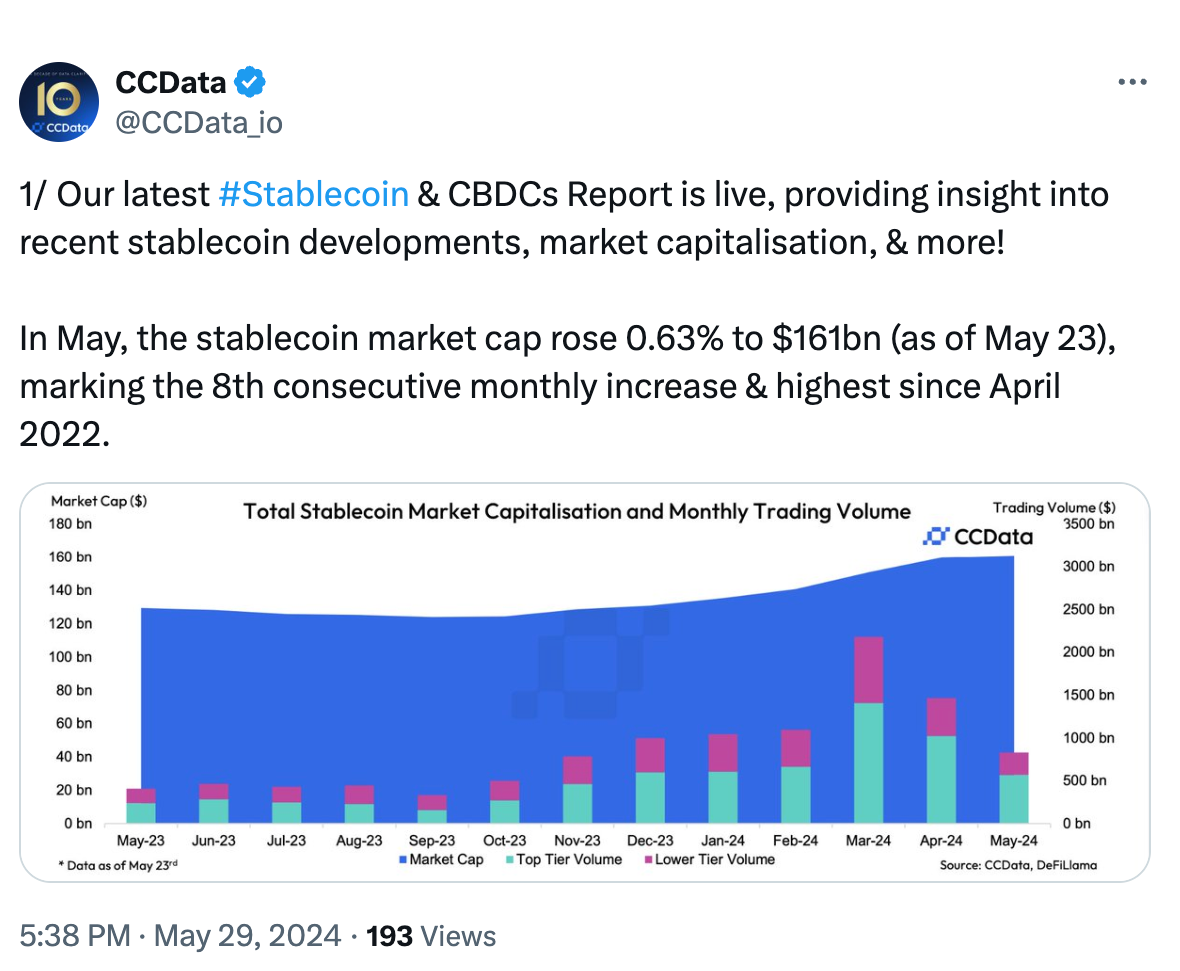

According to a new report by CCData , stablecoin market Capital reached its highest level since April 2022, after eight consecutive months of growth.

The crypto analytics platform reported on May 29 that the market Capital of stablecoins increased 0.63% from the beginning of the month, reaching $161 billion. However, stablecoin market dominance decreased slightly to 6.07%, down from 7% in March.

The decline underscores the recovery in prices of major Cryptoasset , reflecting improved market sentiment following the surprise approval of a spot Ether ETF in the US.

Among the top 10 stablecoins, USDe's market Capital increased for the fifth consecutive month, increasing 11.6% to $2.61 billion. CCData attributes this increase to its expanded use as collateral for perpetual trading on Bybit.

Tether (USDT), the largest stablecoin by market Capital , recorded an All-Time-High market Capital of $111 billion as of May 29, increasing its stablecoin market Capital dominance. it increased to 69.3%.

BlackRock's tokenized fund Token BUIDL, rose 19.6% to $448 million, becoming the largest tokenized treasury fund, surpassing Franklin Templeton's BENJI. BUIDL represents a portion of BlackRock's USD Institutional Digital Liquidity Fund and can be swapped for USDC on a 1:1 basis.

The report also revealed Circle 's USDC market Capital increased for the sixth consecutive month to $32.6 billion in May.

This increase is in line with the increase in demand, with USDC pairs recording an All-Time-High monthly volume in March. USDC 's market share by volume increased for a second month to 8.27%.

The report notes that USDC has benefited from increased on-chain trading activity on networks such as Base and Solana, with the USDC supply ratio on these chain increasing to 9.29% and 7.78% respectively. %.

Despite the increased market Capital , stablecoin volume on centralized exchanges fell to a monthly low of $829 billion on May 23.

Overall, the CCData report concludes that the total market Capital of stablecoins has now recovered from the losses incurred since the collapse of the Luna ecosystem and Algorithmic Stablecoin TerraClassicUSD (USTC), which initiated a downtrend. Price lasts 17 months.