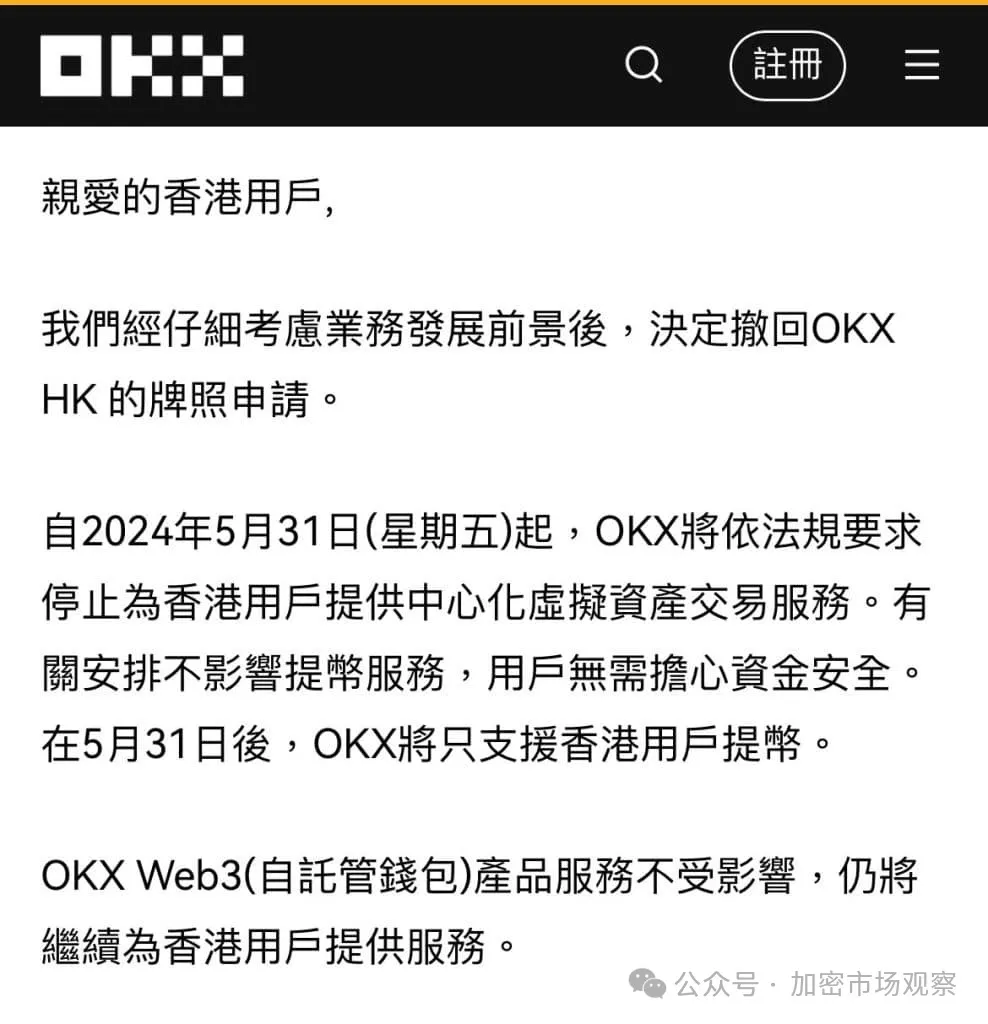

In two days, OKX will withdraw from the Hong Kong market.

I personally think it is normal for OKX to make this decision. If it does not get a Hong Kong license, at most it will clear out Hong Kong users. If it gets a Hong Kong license, I am afraid that even mainland users will have to be cleared out.

Mainstream transactions will leave Hong Kong in droves

In addition to the grand announcement by OKX a few days ago, several exchanges have withdrawn their applications:

Among them, we are familiar with OKX and Gate/Huobi.

According to the Hong Kong Securities Regulatory Commission’s regulations:

Virtual asset trading platforms operating in Hong Kong that fail to submit a license application to the SFC on or before February 29, 2024 will have to end their business in Hong Kong on or before May 31, 2024.

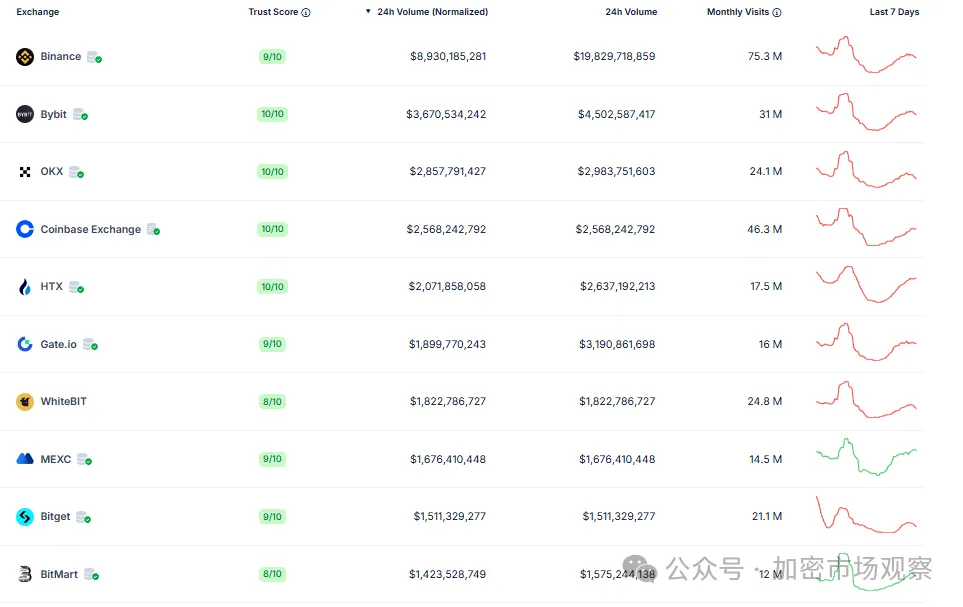

This means that among the top ten exchanges in terms of global trading volume, except Bybit, all will have to say goodbye to Hong Kong:

You should know that all emerging projects in the crypto industry, especially project tokens screened by professional institutions, are issued on these exchanges.

We can’t expect the entire crypto industry to be built on the twenty or so old coins approved by the China Securities Regulatory Commission, right?

If Hong Kong's current encryption policy is strictly enforced, Hong Kong may be the most encryption-resistant place in the world besides mainland China.

Licensed exchanges are not successful

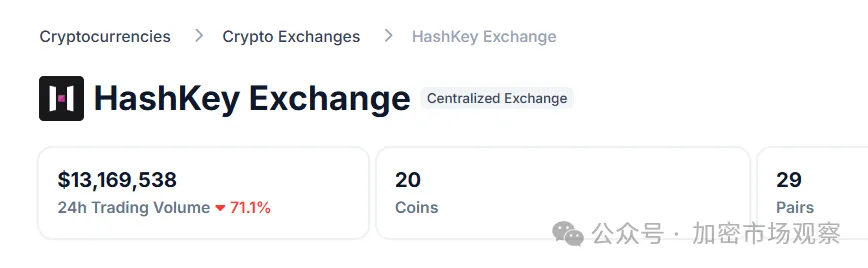

According to the Hong Kong Securities and Futures Commission, there are only two companies that have obtained VASP licenses: Hashkey and OSL.

Hashkey can be considered as the leader among this group of Hong Kong compliance institutions. Its exchange business now adopts a dual flagship model, with Haskey Exchange responsible for local Hong Kong business and Hashkey Global responsible for global business.

Let's look at Hashkey Exchange first:

Yesterday's trading volume was only over 13 million US dollars, and there were only 20 currencies listed.

I feel sorry for Hashkey. They have to work so hard to do so many things and comply with the regulations. Many people are not qualified. Even in this situation, there are only 20 coins available for trading.

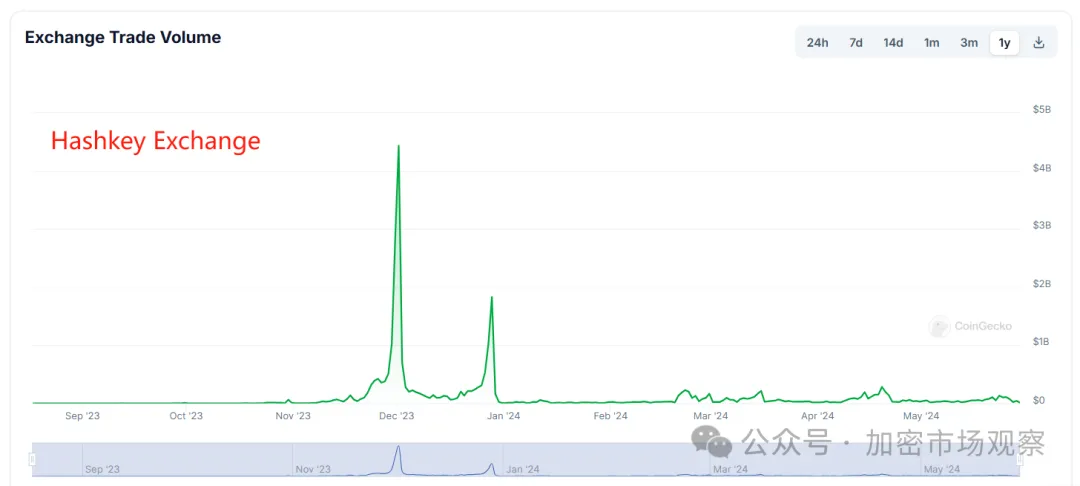

Historical transactions have always been so bleak, and can only be strong when there is a lot of volume:

Many people may have no idea about the transaction volume of 13 million US dollars. The transaction volume of Cobase, a compliant exchange in the United States, was 2.6 billion US dollars yesterday, which is 200 times that of Hashkey Exchanged.

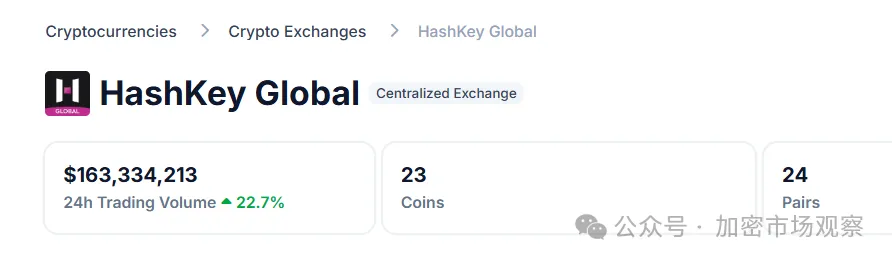

The data of Hash Global, which is promoted globally, is slightly better:

Although there are only three more currencies, the transaction volume has reached 160 million US dollars, which is more than ten times the scale of Hashkey Exchange.

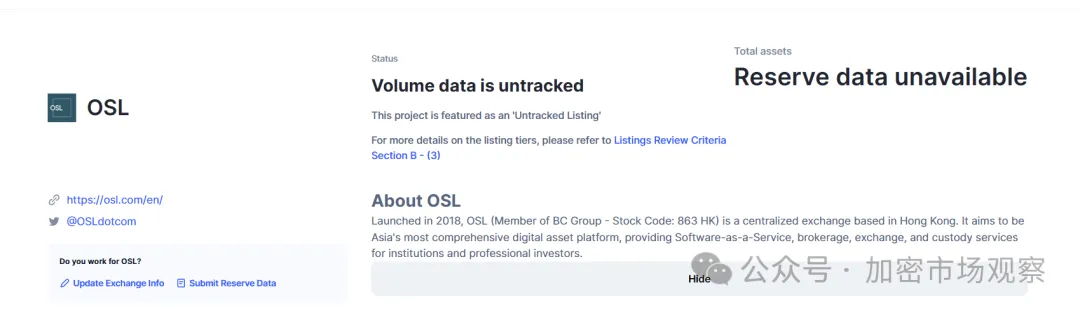

Another licensed institution, OSL, actually obtained a virtual asset trading license a long time ago:

OSL then consciously attached itself to Bitget, a traditional leading exchange. On November 14, 2023, OSL announced on its official website that it had received a strategic investment of approximately HK$710 million from BGX Group. BGX held 29.97% of the shares, becoming OSL's largest shareholder (the original BC Technology Group has been renamed). Bitget finally entered the Hong Kong virtual asset market in compliance with regulations in its own way.

So far, OSL’s transaction data is still unavailable. It is a Hong Kong feature that an exchange without any transaction data has obtained a VASP license in Hong Kong.

Many traditional institutions in the queue

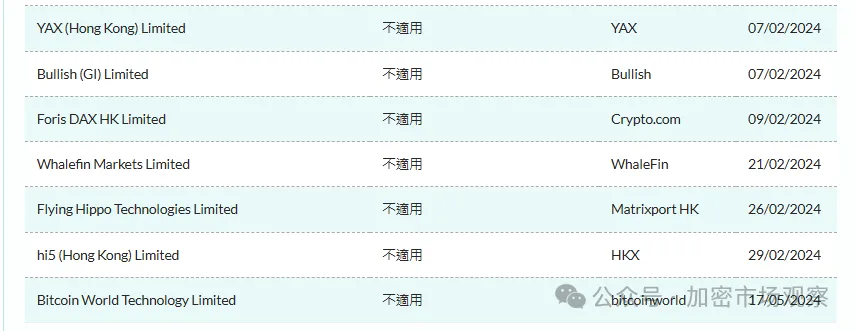

There are still 18 institutions waiting in line for application:

It may be that the business of the first two licensed institutions was not very good, and these dozen or so institutions have yet to obtain licenses.

However, it is probably difficult to obtain a license. Among the applicants, only Bybit has some trading volume, and the others are far away from the center of the crypto industry.

Without long-arm jurisdiction, Hong Kong will be embarrassed

In today's world, apart from the United States, there is no other country that has the ability of long-arm jurisdiction.

As powerful as mainland China is, even with such a strict ban on encryption today, it is still very easy for Chinese people to download an exchange overseas to register for trading.

On the one hand, as a more international place, it is easier for Hong Kong people to go overseas, and it is difficult to require all exchanges to pay attention to the needs of the Hong Kong government. Even if you are an offshore (former financial) center, you will have no jurisdiction outside Hong Kong.

On the other hand, for projects representing the forefront of cryptocurrencies, the first choice for token issuance is still the large exchanges we are familiar with, such as Binance/OKX.

What should crypto investors and project owners do if they stay in Hong Kong? Can they only list on compliant exchanges? Can they only trade on compliant exchanges?

All of these will only push the crypto industry further away from Hong Kong.