Written by: TechFlow

There are always legends in the market about certain diamond hands getting rich returns, and it seems that achieving financial freedom only requires two simple steps: buy and wait.

But when it comes to personal practice, being a diamond hand requires a very high level of personal will. People always say "waiting pays off", but the reality is that most of the time: you wait and find that others' rewards are rich, but when you open your hands in the end, you find that there is only a handful of dust that disappears with the wind.

Compared with the less volatile BTC, more people choose to hold a variety of "value coins" for the long term, hoping that the value of the Altcoin they hold will be discovered one day, and they will obtain returns far exceeding the overall market.

But recently, the well-known Defi OG Ignas (@DefiIgnas) said in a tweet : It is not reliable to choose to hold Altcoin for a long time just because you are optimistic about the fundamentals .

The crypto does not believe in fundamental investment, just as Beijing, Shanghai and Guangzhou do not believe in tears.

Fundamental investment, basically no money

Ignas gave an example of the Brave browser and its $BAT token, which have solid fundamentals in the previous cycle:

Brave currently has about 73 million active users, and raised a large amount of financing of US$40 million as early as 2016 and 2017. Its products are reasonable and its technology is solid. From the perspective of a reliable encryption project, Brave is undoubtedly successful.

However, the price of $BAT has not increased significantly. Today, the price of $BAT is similar to when it was first issued in 2017. During the same period, $ETH has already risen from US$250 to US$3,900.

Ignas said frankly that he was very optimistic about the vision of $BAT, and said that this was once his largest position in the Altcoin. Although he sold all of it near the high point, the price trend of $BAT still brought some insights: product success does not necessarily translate into excellent price performance of tokens in the long run.

The truth that "high performance supports high stock prices" in the traditional financial market seems insignificant here; at the same time, paying for high performance and good data may result in a disastrous outcome.

Ignas also considered whether the price of the currency was suppressed due to the unlocking of tokens, but unfortunately, $BAT is now in full circulation and there is no additional issuance.

Finally, Ignas’ advice is not to easily believe any project’s commitment to long-term holding, especially for Altcoin. It is very important to adjust positions in a timely manner and carefully select investment targets.

Attention is the fundamental

After Ignas’ tweet was sent out, there were some interesting discussions in the comment section:

Some people suggested that the poor performance of $BAT may be because the team focused its funds on project development and lacked project marketing. At the same time, there are not many tweets mentioning tokens in the official tweets. Ignas also said in the comment section that attention is everything in the crypto world, and the team should perhaps invite some KOLs to promote $BAT and build a stronger community to enhance the market awareness of $BAT.

Yes, $BAT is the classic representative of "value coin": excellent project fundamentals, full circulation supply of tokens. Such an extremely undervalued golden egg seems to be just waiting to be discovered by the market value, and finally ushered in a wave of crazy buying and rising prices.

But the cold reality is: if a diamond hand holds $BAT for 7 years, his personal income will have been far behind the market.

Unlike traditional Web2 projects that focus on the project's technical composition, user data and financing background, sector effects, celebrity endorsements and even project hacks can all become the "fundamentals" for crypto projects to attract the attention of retail investors.

It is a bit conservative to blindly stick to the old-fashioned "fundamental investment" and wait for value discovery.

Retail investors like "fun", institutions want "useful"

MEMECOIN can be said to be the most direct fundamental destroyer of the crypto market. The reason why everyone loves MEMECOIN is very straightforward: you can understand it at a glance, and it can be pulled up at any time.

Due to its early fair chip distribution mechanism and various unique cultures, MEMECOIN has always had a fair and interesting image in people's minds.

However, judging from the various MEMECOIN price manipulation incidents that have been exposed, it is clear that large capitals are unwilling to let go of MEME, a new hotbed of money. Many MEMECOINs also have traces of manipulation by large institutions. For details, please see our other report: Collective evil? Insiders exposed that Polygon executives maliciously manipulated the price of Meme coins

Here is a picture that provides a simple analysis of current crypto assets:

This picture shows the different natures of the two ends of crypto assets: one end is entertainment to death and crazy speculation represented by MEMECOIN, and the other end is boring practical assets represented by RWA assets.

Interesting and useful seem to be the different choices made by retail investors and institutions.

Retail investors on the C-end prefer retail-driven markets driven by high speculation and fun, represented by the MEMECOIN craze and the artificial intelligence bubble in the fourth quarter of 2023, while the B-end represented by institutions prefers to focus on practical markets that meet regulatory requirements, such as stable narratives such as BTC/ETH ETF + RWA assets.

But although they seem to be going their separate ways, they are actually heading towards the same destination.

Phantom ranks among the top downloads in the Google Play store in many countries and regions. The MEME craze driven by retail investors has spread all over the world. The entertainment attributes of MEME culture, such as freedom, randomness, and chaos, also make retail investors willing to pay for this added value.

Even people from all walks of life want to get a piece of the pie. Political MEME, celebrity MEME, Pump.Fun live broadcast... everything can be MEME, no matter how fancy it is. Various indicators for measuring people and things are transformed into the rise and fall of MEME coin prices here. It is a paradise for the monetization of influence and traffic.

This is particularly evident from the attitudes of the old money institutions, which have gone from vilifying and questioning crypto assets to scrambling to get on the BTC/ETH ETF, and "regulation" has also transformed from a sword of Damocles hanging over the crypto market to a catalyst for the bull market. In the current US election, the crypto market has become a weight for candidates to canvass for votes.

From "considered useless" to "having to use", attention runs through the entire process of cryptocurrency's evolution from a wild path to a regular army.

In the crypto industry, the investment logic is very different from that of the traditional financial market; and the so-called fundamentals have completely different meanings when there is support from real performance and when there is no support from real performance.

Retail investors have been deceived by stories about fundamentals so often that they will naturally choose the simple and crude MEMECOIN; is the preference of institutions for utility coins really due to the fundamentals of the project? Not necessarily.

Institutions can naturally see the value of MEMECOIN, but they cannot explain their investment in MEMECOIN well to investors. They can’t just say that they invested in an emoticon package/a cat, right?

Investors may also prefer institutional investments in more "serious" assets, so fundamentals become a packaging for serious investments.

Therefore, maybe no one is really doing pure fundamental investment, it’s just that retail investors are more direct and institutions are more roundabout.

Therefore, MEME speculation and infrastructure construction are not contradictory. The smart way to play should be to accept both.

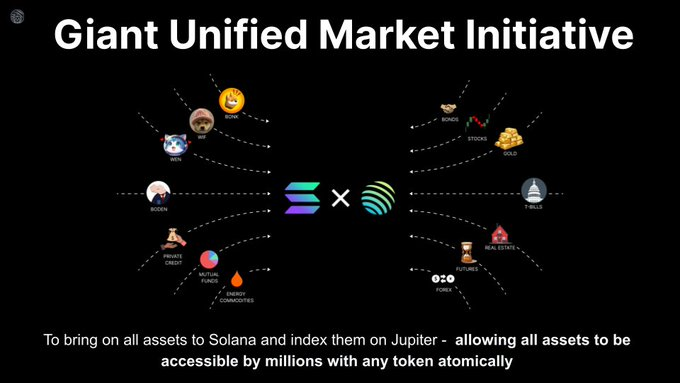

For example, Jupiter, which started out as a MEME amusement park, began to unify the market and formed the GUM Alliance with a number of projects and institutions . Whether it is MEMECOIN, RWA, stocks or foreign exchange, it covers all kinds of food and focuses on omnivorousness.

Jupiter has both MEME and "fundamental" assets. Its inclusiveness of various types of assets also reflects its business logic of not only focusing on fundamentals.

View

In this round of bull market, the market is no longer a simple model. All participants have evolved, and fundamental investments with simple structures are becoming increasingly difficult to be effective.

Judging from the lessons learned from history, the returns of some fundamental investments have not even outperformed inflation, not to mention that some strong fundamental projects are heading straight for zero. The logic of market investment is gradually changing, and fundamental investment is no longer as politically correct as before.

Of course, if the time cost is extended infinitely, the conclusion about value discovery investment may be different.

But retail investors can’t afford it.

In the crypto where information hotspots are rapidly iterating, new hotspots are the most abundant, and attention is the most valuable. Market drivers are changing, and the project's grasp of market attention can often strongly affect the price of tokens. The importance of attention economics is gradually becoming more prominent, and the market has little time left for projects to slowly discover their value.

Well-known blogger @redphonecrypto also pointed out in his latest article : The ability of a token to attract attention is more important than other indicators. The stronger its ability to attract attention, the greater its potential for growth.

"Pumpmental > Fundamental" is already a consensus among most people. For retail investors who pay real money, pumping the market is the best fundamental.