01

X Viewpoint

1.Matthew Sigel (@matthew_sigel): The SEC changed its attitude overnight

$COIN COO says PANIC at the White House: "The tone from the SEC has just changed literally overnight…The administration sensing some panic"

at JPM TMT conference:

(Translation: The following is from a JP Morgan TMT industry conference call. Coinbase COO was surprised that "SEC's attitude towards ETH ETFs changed almost overnight, and some managers seemed to be beginning to panic")

2.0xTodd (@0x_Todd): Grayscale ETH ETF is also following up

Grayscale has also just updated their 19b-4 form, which is one of the many steps required before an ETF is approved.

In theory, this form is used by some "self-regulatory organizations" to report to the SEC. Of course, although these "self-regulatory organizations" are not part of the government, they are highly official in nature.

This 19b-4 form needs to be made public. After these institutions submit it to the SEC, it can theoretically be found on the SEC's official website.

This time ETH rose in response, and many people including James, Eric and others also received information that the SEC required everyone to update the 19b-4 form, so they raised the pass rate forecast to 75%.

PS: I want to complain about the number 75. It is too precise with both zeros and integers. I think it is the limit to grasp small, medium and large.

PS: Why is this a good signal? If the SEC does not want you to pass, then logically, there is no need for you to change the form.

According to the process of the last BTC ETF approval, after this form is approved, the S-1 form must be approved next, and the S-1 form is much more important.

The S-1 form is roughly equivalent to a listing application form, while 19b-4 can be understood as a preliminary action.

PS: Of course, Grayscale also has to use the S-3 form, because it is not a new asset listing, but an old financial product (that is, the current ETF trust that only allows inflows but not outflows) being converted to an ETF for listing.

02

On-chain data

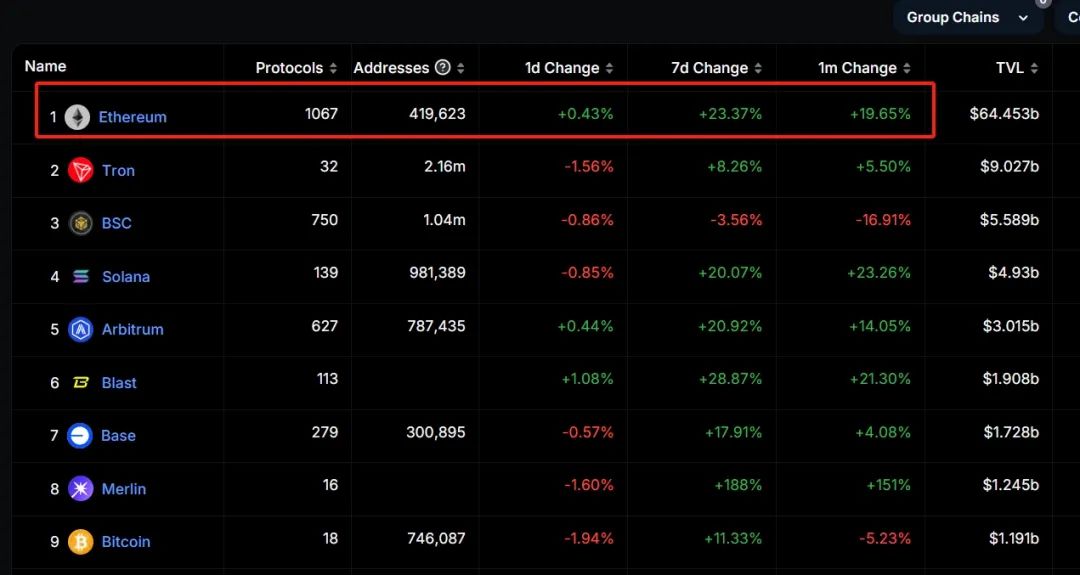

Defillama: Short-term funds have poured into Ethereum, but the inflow of funds has slowed down

DeFillama data shows that in the past month, Ethereum has a net inflow of 19.65%, and in the past 7 days, it has a net inflow of 23.37%, which indicates that the funds have mainly flowed in recently, which is mainly related to the possible approval of the Ethereum ETF. In the past 24 hours, the net inflow of funds was 0.43%, which shows that the inflow of funds has slowed down. Overall, after the news of the approval of the Ethereum ETF came out, the market saw a large influx of short-term funds, but the current inflow of funds has slowed down.

03

Sector Interpretation

According to Coinmarketcap data, the top five currencies in terms of 24-hour popularity are: BDX, PEPE, APU, DRIFT, NOT. According to Coingecko data, in the crypto market, the top five sectors with the highest growth are: Marketing, HECO ecology, Animal Racing, Hospitality, and XDC ecology.

Hot Spot Focus - In-depth Analysis: What are the key factors missing from the approval of Ethereum spot ETF?

The recent surge in Ethereum is mainly due to the fact that the US Ethereum spot ETF has gone from being unpopular to being expected to be approved. However, it is still unknown whether the US Ethereum spot ETF will be approved. The following is a summary of the conversion process of the reputation of whether the Ethereum spot ETF can be approved.

The reason is that Nate Geraci, president of ETFStore, tweeted on X, raising a potential possibility - because of the process deadline, the U.S. Securities and Exchange Commission (SEC) must decide whether to approve the spot Ethereum ETF this week. However, the complete listing process requires the submission of two forms: an exchange rule change (19b-4s) and the approval of the registration statement (S-1s), both of which are required for the launch of the ETF. Geraci pointed out that if the SEC wants to drag it out, in theory the SEC may approve 19b-4s and then slowly process S-1s, especially given that the SEC has remained silent on related matters at present, which is very different from the previous activity in Bitcoin ETFs.

Later, Bloomberg analyst Eric Balchunas reposted the post and proposed that the probability of the spot Ethereum ETF being approved has been raised from 25% to 75%. He said, "I heard some rumors this afternoon that the SEC may make a 180-degree turn on this issue (based on some political reasons), so everyone is preparing now." He also reiterated that the probability will be capped at 75% until more evidence is seen, such as application updates.

Later, his colleague James Seyffart added: “Eric Balchunas raised the odds of spot Ethereum ETF approval to 75%. But that’s for the May 23 deadline for the 19b-4 (VanEck’s deadline). We also need S-1 approval. It could be weeks to months before we see S-1 approval and an actual Ethereum ETF go live.”

Fox reporter Eleanor Terrett said that a source claimed that the current development of the spot Ethereum ETF is that things are evolving in real time. In the current context, it means that what everyone generally believed before would not be approved may change.

Judging from the previous approval nodes of Bitcoin spot ETFs, January 10 was the final approval date for BlackRock's 19B-4 document, and the SEC approved the remaining 10 Bitcoin spot ETFs on January 10. Therefore, if we take Bitcoin spot ETF as an example, May 23 is indeed the key node for the approval of Ethereum spot ETF.

When the SEC approves relevant ETFs, it will not select individual ETFs for approval, and it is likely to approve them all at the same time. This point has been introduced in the previous article about Bitcoin spot ETFs. But it is worth noting that May 23 is the final approval date for Form 19 B-4. According to the previous article, there is also an S-1 registration statement that needs to be approved. Therefore, relevant institutions in the market believe that the SEC may first approve Form 1 9B-4 and then delay the approval time in the S-1 registration statement.

The SEC may have found a way to distinguish whether Ethereum is a "security" in the key factor of whether it is a "security": if the ETH in the ETF is not pledged, then Ethereum is not a security; conversely, the Ethereum used for pledge will be defined as a "security." This is also the root cause of most issuers resubmitting S-1 documents without pledges, and it is also a necessary condition for the SEC to accept Ethereum spot ETFs.

The SEC's change of attitude is based on some political factors. This statement is not groundless. According to relevant news reports, one of the points is that the SAB 121 rule that has plagued the encryption industry may be overturned.

The core content of SAB 121 is that companies that hold cryptocurrencies are required to record the cryptocurrencies held by customers as liabilities on their balance sheets. However, the cryptocurrency industry generally believes that this regulation is too strict, which actually hinders custodians or companies from holding crypto assets on behalf of their customers, which is not conducive to the further development of the industry. Therefore, it has long been trying to overturn SAB 121 through lobbying and other means. In other words, assuming that the SAB 121 clause is overturned, the shackles restricting the development of the crypto industry in the United States will be broken. The key node at present is the final resolution of US President Biden on this clause on May 28. Another political factor is whether the FIT 21 (also known as HR 4763) bill can be approved, which is a new bill aimed at clarifying the regulatory framework for cryptocurrencies. The current progress is that all members of the House of Representatives plan to vote on FIT 21 this week (it is expected to start voting late Wednesday or early Thursday local time, and it may be landed at the same time as the ETH ETF). The two clauses of the bill will change the overall development of cryptocurrencies in the United States, which may determine the progress of the SEC's approval of the Ethereum spot ETF.

If the SEC follows the previous approval process for the Bitcoin spot ETF, May 23 will be the fastest time point for approving the Ethereum spot ETF. At the same time, judging from the fact that issuers are continuously submitting revised 19B-4 and S-1A documents, the possibility of approval on May 23 is relatively high.

However, the author believes that starting from the Ethereum spot ETF itself, the core issue of whether Ethereum is a "security", the SEC and the issuer have found a balance point, so it is likely to be approved on May 23.

04

Research Reports

HashKey Group: Three arrows from the United States that are good for cryptocurrencies in the second half of the year

After four weeks of sideways decline, the prices of Bitcoin and Ethereum have finally seen a wave of increases recently. Has the bull market recovered? What important opportunities will trigger a bull market surge this year? This article will analyze the three major macroeconomic factors that the market is most concerned about: Ethereum spot ETF, Fed rate cuts, and the US election.

1. Is Ethereum ETF about to be approved?

The influence of Bitcoin ETF is unquestionable. The SEC and the Bitcoin spot ETF application had been "struggling" for 10 years, and it was finally approved last year. It brought in $8.6 billion in funds in just 40 days. The price of Bitcoin has since risen from the $40,000 mark at the beginning of 24 years to $70,000.

As for the Ethereum spot ETF, the impact of its approval expectations was reflected this week. With news that the SEC is urging the approval progress of the 19b-4 document of the Ethereum ETF and may make a 180-degree turn in its approval stance on the Ethereum spot ETF, with approval as early as Wednesday this week, the price of Ethereum rose by more than 20% in 8 hours, and the price once exceeded $3,700. Bloomberg senior analyst Eric Balchunas also raised the probability of approval of the Ethereum spot ETF from 25% to 75%.

However, one of the important reasons why the Ethereum ETF has not been passed is that in specific jurisdictions, it has not yet been determined whether it is a commodity or a security. At present, the attention and market investment demand for Ethereum spot ETFs have not reached the same scale as Bitcoin spot ETFs. At the same time, the Ethereum consensus mechanism has shifted from proof of work (PoW) to proof of stake (PoS), the same as Bitcoin, which greatly increases the possibility that US regulators will classify Ethereum as a security rather than a commodity.

In addition, the Ethereum network upgrade will also bring about the "Ship of Theseus" effect - Ethereum after multiple upgrades and the previous Ethereum can hardly be called the same blockchain network, and SEC Chairman Geisler has never had a good impression of this type of "fickle" cryptocurrency.

But the market is very optimistic about its prospects, most importantly its attractiveness as an "interest-earning asset".

The successful listing of Ethereum ETF may place it in a position similar to the "eighth largest technology stock" in the United States. In particular, if the on-chain staking problem of custodial ETH tokens is solved, it will attract more large institutional investors to choose this "interest-bearing asset", which may be more attractive than Bitcoin spot ETF. Therefore, the impact of the listing of Ethereum ETF is by no means limited to Crypto itself, but will also directly have a huge driving effect on the Ethereum ecosystem and projects within the ecosystem.

Based on previous historical experience, the final fate of the Ethereum ETF may be determined by a vote by SEC Chairman Gessler this week. In January of this year, the approval of the Bitcoin spot ETF was handled by a group of five commissioners. Gensler ultimately voted in favor, and many industry insiders believe that his vote ultimately ensured the approval of the spot Bitcoin ETF. The same five SEC commissioners will vote to approve or reject VanEck's Ethereum spot ETF on May 23.

Considering the silence of the SEC chairman when asked whether Ethereum is a security, and his subsequent assertion that many tokens are actually securities, the prospects of Ethereum ETFs remain to be seen. His attitude has also caused a lot of dissatisfaction. Ripple CEO once commented that the SEC's evasion of the main issue will confuse regulatory transparency, and Patrick McHenry, chairman of the U.S. House Financial Services Committee, directly stated that Gensler misled Congress on the characterization of Ethereum in a previous hearing.

In addition to the approval of VanEck on May 23 and 21Shares&ARK Ethereum spot ETF on May 24, which are worthy of attention, BlackRock's application for spot Ethereum ETF has a higher chance of approval and will also reach the deadline on August 17. It is worth looking forward to how it will affect the market.

In contrast, Hong Kong may be ahead of the curve. On April 29, six digital currency spot ETFs approved by the Hong Kong Securities and Futures Commission from China Asset Management (Hong Kong), Harvest Global, Bosera (International) and HashKey Capital Limited were issued for the first time and officially listed on the Hong Kong Stock Exchange on April 30. Three of them are Bitcoin spot ETFs, and the other three are Ethereum ETFs. HashKey Group COO Livio predicts that the medium-term capacity of the Hong Kong ETF market is expected to reach 20% of the US ETF market, with an estimated size of around US$10 billion. As a new channel for "old money" to enter the virtual asset industry, ETFs will attract more traditional investors to enter the virtual asset market and drive the growth of the market size.

2. Pension funds may enter the market in large numbers

Compared with the many uncertainties of Ethereum ETF, industry insiders believe that the Federal Reserve interest rate has become one of the certain factors for starting a crypto bull market.

Recently, the Bureau of Labor Statistics of the U.S. Department of Labor reported that the Consumer Price Index (CPI) rose by 0.3% from March. The decline in the CPI index means that the U.S. economy has stabilized significantly and inflation is under good control. As inflation is brought under control, the Federal Reserve's tendency to cut interest rates will gradually become apparent.

Judging from historical data, interest rate hike cycles often put pressure on the crypto market, while interest rate cut cycles represent increased liquidity. Investors tend to transfer funds deposited in traditional banks to riskier and more volatile assets, which also includes increasing investment in the crypto market. Looking back at the last bull market, in 2020, the Federal Reserve printed trillions of dollars to cope with the impact of the new crown. In March, the Federal Reserve launched the fifth round of quantitative easing, and two months later, the Federal Reserve interest rate fell to a nearly ten-year low. Bitcoin reached a price high of $69,000 in November of that year, an increase of nearly 18 times from the bottom of the previous bear market.

As a result, we may see a recovery in investor interest in risky assets such as cryptocurrencies. Pension funds that are currently on the sidelines may enter the market in the second half of 24, bringing in hundreds of billions of dollars in funds once favorable factors emerge. A bullish Bitcoin investor predicts that "$6 trillion in cash on the sidelines" could push Bitcoin prices to $150,000 this year, saying the current bull run is "still too early."

Last week, Fed Chairman Powell also gave a speech on the current inflation situation, saying that the US economy is performing very well. The inflation rate is expected to fall month-on-month. But Powell also said that restrictive policies may take longer than expected to work to reduce the inflation rate to the target of 2%. "In many ways, the policy interest rate is restrictive. I don't think the next move may be a rate hike, and it is more likely to maintain the policy interest rate at its current level." Powell said.

Combined with Powell’s remarks and data showing that the year-on-year increase in core CPI was the smallest in three years since the beginning of 21, expectations for rate cuts have been rekindled.

The overall market sentiment is optimistic, and some analysts predict that by the time of the Federal Reserve meeting in September, the probability of a 25 basis point rate cut will exceed 80%. By then, the US stock market may surge to a record high, the US dollar index will plummet, and the crypto market will rebound strongly following the US stock market.

3. US election and the new “crypto supporter” Trump

Another important factor is the US election to be held in November this year. The two candidates with the highest support, Biden and Trump, have shown completely different attitudes towards cryptocurrencies. In this election, cryptocurrencies have stood at the center of the US political stage for the first time.

A poll shows that cryptocurrency has become a major issue for voters in the 2024 US election. The crypto industry has also stepped up its lobbying efforts, with cryptocurrency political action committees and industry donors injecting $94 million into federal political committees since 2023. Coinbase and Ripple Labs have donated more than $40 million to political campaigns to support active cryptocurrency regulation causes.

The most significant change is Trump's attitude towards cryptocurrency. The former US president, who in the past few years had said on social media that cryptocurrency was "air", has now positioned himself as the first major party nominee to actively embrace Bitcoin and cryptocurrency holders.

Trump's message is clear: support him, or face strict regulatory measures against the industry from the Biden administration. Republicans are increasingly accepting of digital assets, while Democrats remain divided over giving legitimacy to the industry. Not only that, the value of Trump's crypto assets has also increased significantly, currently at $8,903,246.13, including 579,290 TRUMPs (worth $5.72 million), 431,018 ETH (worth $1.29 million), and 374,724 WETH (worth $1.13 million). This "straightforward" support may mark a critical moment for the U.S. cryptocurrency industry.

But it is still uncertain whether Trump's presidency will really be friendly to cryptocurrencies. He has not promised any development related to cryptocurrencies after taking office. Some people believe that his affinity for cryptocurrencies is just a means to attack Biden. Although the Biden administration has been "hitting hard" on the crypto industry, under its leadership, the crypto industry has basically gotten rid of the impact of the 2022 cryptocurrency crash, and the Bitcoin spot ETF was finally approved, so Biden may not be "as bad as imagined."

Moreover, in terms of the US political system, the president's influence may not be as great as imagined. The SEC has the independent characteristics of a general independent regulatory agency: the appointment of its members is not affected by the change of the ruling party, and the new president cannot replace its members like the previous cabinet members unless the term expires. Moreover, some crypto entrepreneurs believe that even if the current SEC Chairman Gary Geisler, appointed by Biden, steps down, regulatory uncertainty and enforcement actions against cryptocurrencies will not decrease.

The market speculates that the US election may only affect the crypto market in the short term. In the long run, the trend of the crypto market is subject to checks and balances from many factors.

If the next president is not enough to change the overall crypto narrative, then US regulation will still be the biggest catalyst for the crypto market, including the US Securities and Exchange Commission (SEC) decision on spot Ethereum exchange-traded funds (ETFs), the White House's possible action on the SEC's SAB 121 repeal bill, and the US House of Representatives' vote on the 21st Century Financial Innovation and Technology Act (FIT). Potential stablecoin legislation, such as the Lummis-Gillibrand Payment Stablecoin Act, is likely to affect the overall situation of the crypto market. At the same time, given the possibility of a rate cut by the Federal Reserve, capital on the sidelines will eventually need to "have somewhere to go", and considering the current good performance of the US Bitcoin ETF, the crypto market is still one of their best options.