The market was volatile this week, with the latest US personal consumption expenditures (PCE) index (the Fed's preferred inflation indicator) meeting expectations, remaining flat at 2.7% year-on-year in April, leading investors to speculate on the next interest rate trend. In traditional markets, as of the close, the S&P and Dow Jones indexes rose 0.80% and 1.51% respectively, while the Nasdaq index was flat.

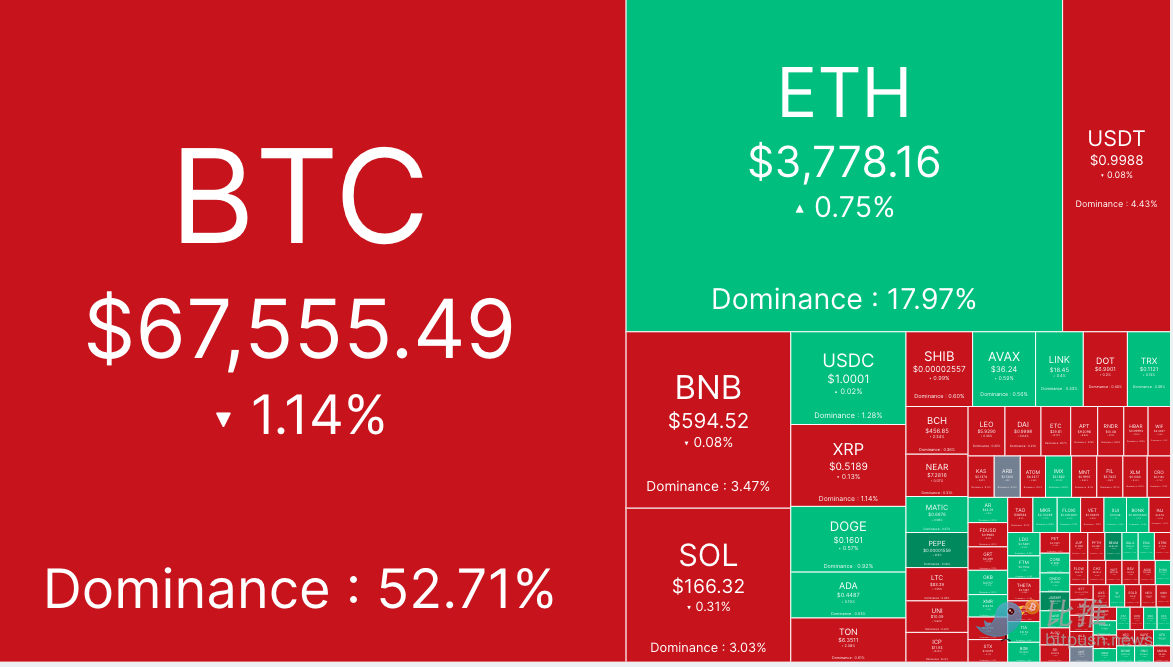

According to Bitpush data, Bitcoin (BTC) rebounded to a high of just over $69,000 in the morning, then fell to a low of $66,595 before recovering to the $67,600 support level. As of press time, BTC is trading at $67,559, down 1.16% in 24 hours.

Altcoin were mixed, with about a third of the top 200 tokens by market cap rising and the rest trending lower.

ConstitutionDAO (PEOPLE) closed the week strongly, up 12.5%, followed by Highstreet (HIGH) at 10.1%, and Beam (BEAM) at 8.35%. Enjin Coin (ENJ) was the biggest loser, down 10.3%, Notcoin (NOT) down 7.3%, and Akash Network (AKT) down 6.8%.

The current overall market value of cryptocurrencies is $2.53 trillion, and Bitcoin’s market share is 52.8%.

June U.S. economic data may provide the next catalyst

Investors are watching the national PMI report and employment report to be released next week, with U.S. economic data for June likely to provide the next catalyst for BTC.

Analyst Stephen Alpher said that confirmation of weak economic conditions, along with improved prospects for lower interest rates, could be a catalyst for Bitcoin to attempt to break through its all-time high above $73,000 set in March. However, strong economic data could mean a retest of the May lows.

Aurelie Barthere, chief research analyst at Nansen.ai, stressed that inflation remains firm.

Barthere said in its latest report that the market has already priced in two rate cuts from the Federal Reserve in 2024: "The longer we stay in this high-rate regime, the greater the downside risks."

He added: "Slower growth is not good for cryptocurrencies. At the same time, we are strategically constructive on cryptocurrencies but remain alert to signs of weaker growth."

Adjustments will continue

While many new investors are somewhat impatient with Bitcoin’s sideways movement over the past few months, some veteran investors believe that this is a normal part of the bull market cycle and that what traders really need is patience.

Market analyst ShardiB2 said on the X platform: "It is clear that the Bitcoin adjustment season is coming. I think we are all tired of trying to catch these breakout opportunities and then watching them fall back again. This situation may continue for a few more months... Maybe the best way is to buy and hold and enjoy life for a few months without being plunged."

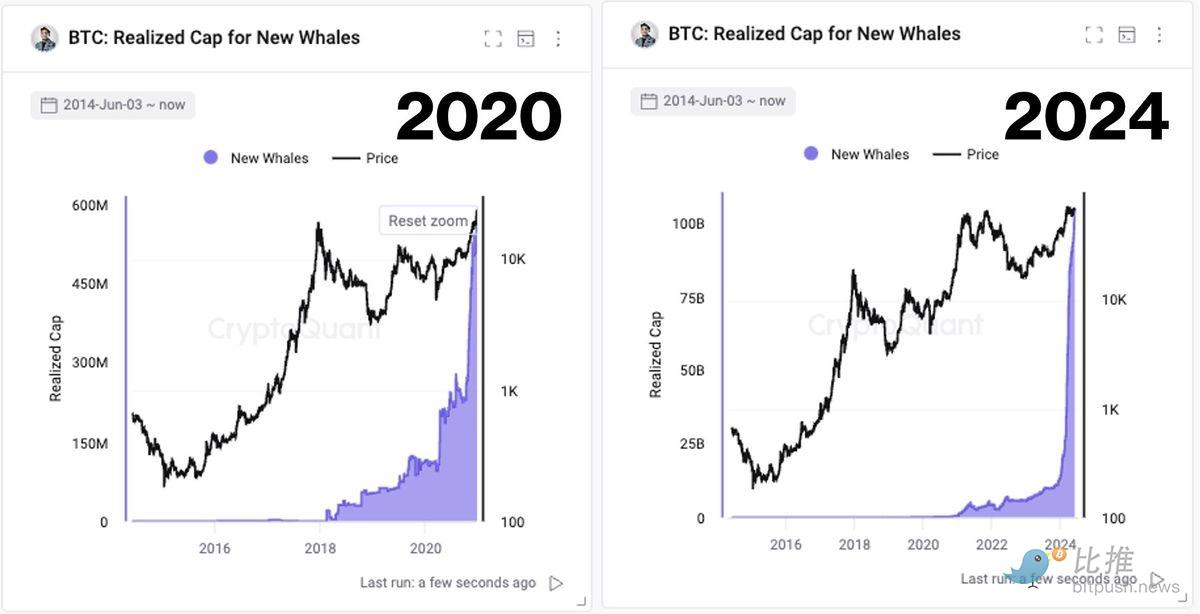

CryptoQuant founder Ki Young Ju noted that the recent price action is “the same vibe as Bitcoin was in mid-2020.”

Ki Young Ju analyzed: "At that time, the BTC price hovered around $10,000 for 6 months, and on-chain transactions were active, which were later confirmed to be over-the-counter transactions. Now, despite the low price volatility, on-chain transactions are still active, and $1 billion in funds enter new whale wallets every day, which may belong to custodians."

Michaël van de Poppe, founder of MN Trading, warned that if Bitcoin fails to break through $70,000, it could fall back to $60,000 in the coming months.

But Captain Faibik believes that the "upward breakout of the ascending triangle has been confirmed" and a successful retest of support could kick off a bull run in 2024-2025.