Last Friday, the price of Bitcoin fell from $72,000 to $69,000, sending many cryptocurrencies down an average of 10%.

This sharp decline has raised concerns in the market and led to questions about what is driving this change and how investors will react. To better understand what will happen next, we want to explore clearer insights through on-chain data.

Bitcoin Whale Activity: Insights into the Quiet Movement of the Market

On-chain data shows that whales, which are large holders of Bitcoin, are not only maintaining their holdings, but also increasing their supply. Strategically accumulating Bitcoin during falling prices suggests that these influential market participants view current low prices as a good buying opportunity.

Their actions can have a big impact on market sentiment and price stability, suggesting they may be anticipating a potential rebound, or at least not expecting a bigger decline in the near term.

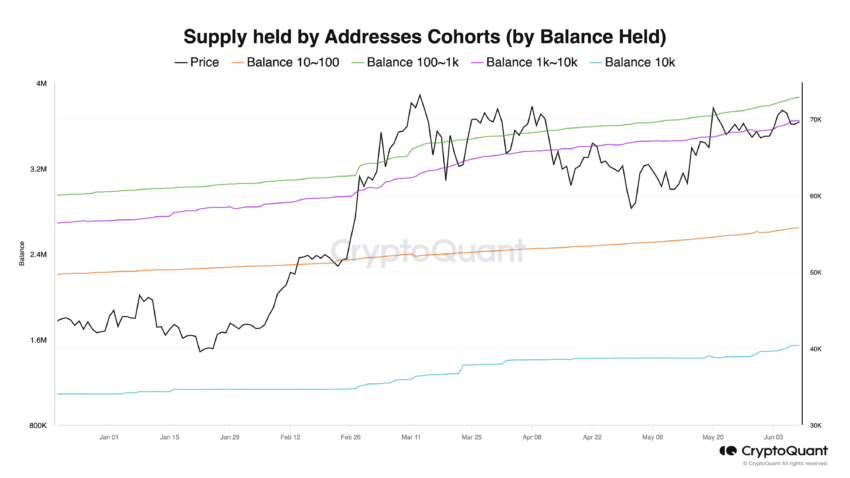

If we look at the changes in Bitcoin balances across different cohorts, we can see a noticeable increase.

Specifically, addresses holding 100 to 1,000 BTC had their balances increased by 30,601 BTC, addresses holding 1,000 to 10,000 BTC had their balances increase by 34,834 BTC, and addresses holding more than 10,000 BTC, the largest holder, had their balances increase by 24,176 BTC.

This large increase suggests that large Bitcoin holders have been accumulating more BTC during the recent market correction.

BTC Current Price: Watch Key Support Levels

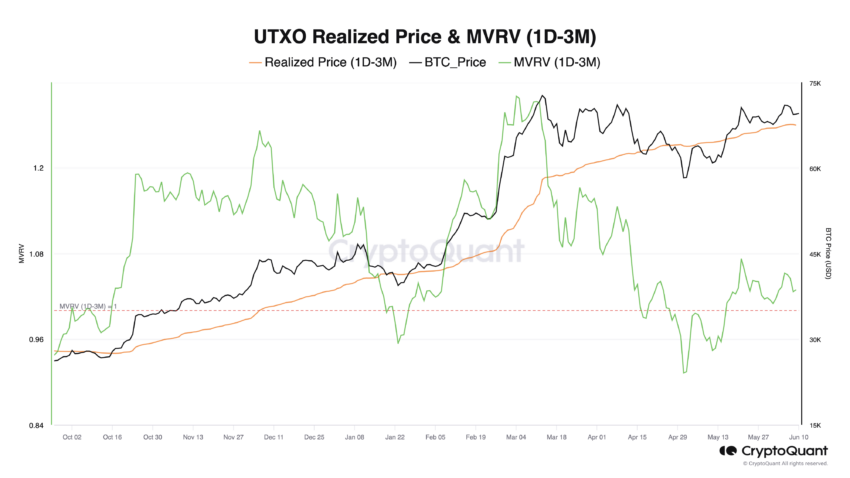

The average purchase price for Bitcoin purchased between one day and three months ago is $67,500. Bitcoin purchased within this period accounts for 17% of the total circulating supply.

If the price falls below this level, it could trigger a cascade of sell-offs as investors rush to minimize their losses.

If the price falls below $67,500 , support can be found in the $61,000-$62,000 range, which is consistent with the realized prices of the major wallet cohorts.

“Realized Price” is a financial metric that estimates the average cost at which all Bitcoins in circulation were last moved or traded. Unlike the ‘market price’, which fluctuates based on trading activity, realized price aggregates this data across all Bitcoins, giving investors insight into what they paid for the Bitcoin they hold.

If the market price falls below the realized price, this could mean that, on average, 17% of the circulating Bitcoin supply is losing money. In these situations, investors may be pressured to sell to minimize losses.

On the other hand, if the market price remains above this realized price, 17% of the Bitcoin supply would benefit. This could potentially be a positive signal for the market as it incentivizes holders to hold their positions for the long term.

If the price surges to the $72,000 level, it could be a decisive opportunity to break the all-time high in the medium term.

As detailed in the analysis, this scenario is plausible if Bitcoin can maintain its position above the $67,500 support level.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.