As the announcement of the U.S. consumer price index (CPI) for May and the U.S. base interest rate for June coincided with the announcement on the night of the 12th, market participants are paying close attention to the direction of the index.

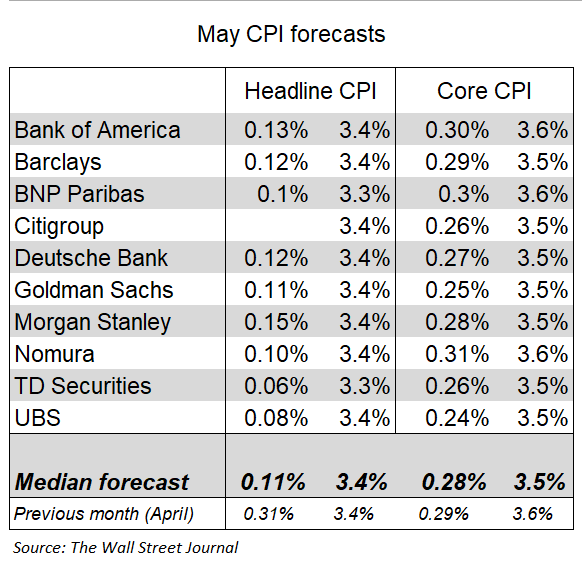

New thing I learned: The first indicator that comes out today is CPI. According to a Wall Street Journal survey, the median CPI estimate estimated by 10 Wall Street financial institutions is a 0.11% increase from the previous month and a 3.4% increase from the same month last year. In April, this value increased by 0.31% compared to the previous month and by 3.4% compared to the same month last year.

Wall Street financial institutions predict that the median expected value of Core CPI, excluding oil and agricultural products, will rise by 0.28% compared to the previous month and by 3.5% compared to the same month last year. In April, this value was 0.29% higher than the previous month and 3.6% higher than the same month last year.

The main reason why prices in the United States remain high is that prices in the service sector are robust. The fact that the core CPI forecast, which includes the services sector, is roughly the same as in April means that there is still no room for price improvement.

Background of the incident: The actual CPI is announced at 9:30 p.m. Korean time. Coincidentally, members of the Federal Reserve System (Fed) who attend the Open Market Committee (FOMC) in the United States enter the FOMC immediately after checking the CPI results and decide on interest rates.

Important point: The June interest rate decision is almost certain to be frozen. The problem is the dot plot that will be announced today. The dot plot is released every three months as each member's prediction of how the U.S. base interest rate will change in the future.

Last March, it was expected that there would be three interest rate cuts in 2024 . This time it is expected to be less than that, but it is difficult to predict whether it will happen twice, once, or not even once. This is the key point to watch for this FOMC.

What happens next: If the CPI comes out in line with Wall Street expectations, the dot plot shows that there are likely to be two interest rate cuts this year (cuts in September and December) or one cut (cuts in November). On the other hand, when the CPI is higher than Wall Street expectations, the conclusion may be that there will be one cut (in December) or no cut. Regardless of the content of the subsequent press conference by Federal Reserve Chairman Jerome Powell, this means that the content of the dot plot in which the Federal Reserve members participate may look like this.

As of 5 p.m. on the 12th, the price of Bitcoin is hovering around the $67,370 level, up 0.09% from the previous day.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.