2024.06.12 - 1 hour ago Share to The most likely scenario is that Chairman Powell provides a similar tone to recent Fed speeches at the press conference: that is, the next move may be a rate cut, but given the stickiness of inflation data, emphasize patience.

Written by: Chen Min, Good Morning Currency Market

Tonight, the US CPI and FOMC interest rate meeting will be held one after another, with a gap of no more than 6 hours. After the non-agricultural data, it may be another night of terror.

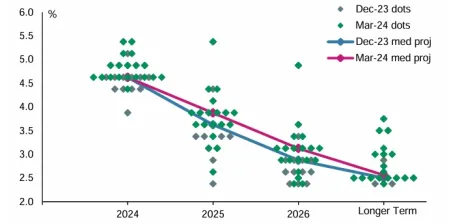

01 Dot Matrix

With little suspense about the rate decision itself (rates will remain unchanged at the June policy meeting), almost all eyes will now be on the dot plot guidance from the meeting.

The results can be roughly divided into the following three situations:

- Base case: In the updated dot plot, the median is two rate cuts by the end of 2024

- Dovish scenario: In the updated dot plot, the median is three rate cuts by the end of 2024

- Hawkish scenario: In the updated dot plot, the median is one rate cut by the end of 2024

The baseline scenario has the highest probability among the three scenarios. According to the voting results of the last FOMC meeting in March, the vote ratio for more than three rate cuts and less than two rate cuts this year is 10:9. Considering the recent hawkish statements of Fed officials, the baseline scenario is that the dot plot is reduced once this year.

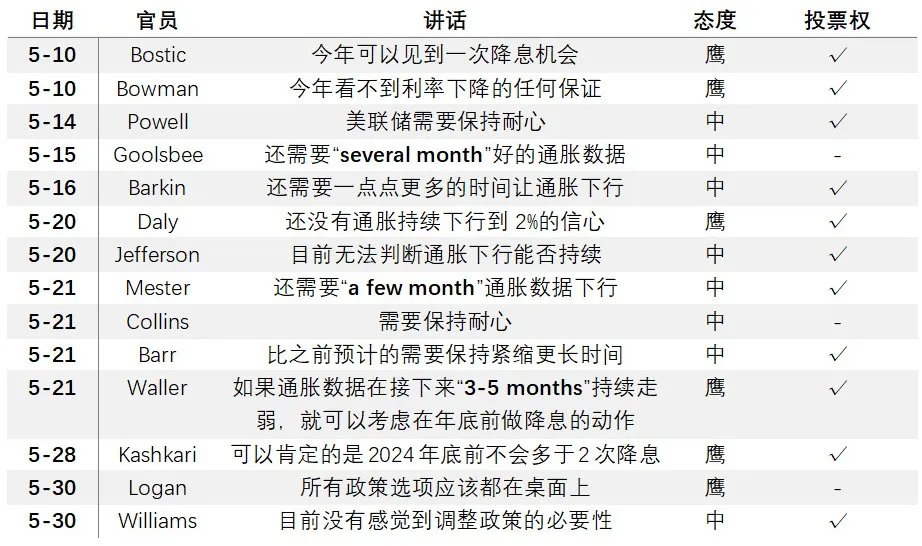

Recent speeches by Federal Reserve officials include:

At present, the forecast results of major foreign financial institutions are: the dot plot will be increased by 25bp in 2024 (two interest rate cuts within the year). There are large differences in the number of interest rate cuts within the year and the time of the first interest rate cut.

Regarding the medium- and long-term dot plot, if the dot plot moves up in 2024, the median of the long-term or neutral interest rate dot plot may rise further; according to the baseline scenario, the median dot plots in 2025 and 2026 may also move up slightly by about 25 basis points simultaneously.

02 Conference Statement and Press Conference

The statement is likely to be little changed from May, and the post-meeting press conference is likely to be the focus. The news media may ask Powell questions directly, and more information can be obtained from Powell's answers and wording. At the May FOMC meeting, Powell dismissed the possibility of "another rate hike", which became the focus of the meeting. At the press conference after the May meeting, Chairman Powell must be considered dovish.

But the most likely scenario is that Chairman Powell strikes a similar tone at his press conference as in recent Fed speeches: that is, the next move may be a rate cut, but given the stickiness of inflation data, he emphasizes the need to remain patient.

03 Economic Forecast

Economic forecasts are more likely to be downward: Since May, US economic data have generally been weaker than expected. The US GDP in the first quarter has been adjusted downward, and recent retail, industrial output, PMI, JOLTS job vacancies, ADP employment data have generally been adjusted. Although non-agricultural employment exceeded expectations, the downward revision of the previous month's data and the continuous increase in the household survey unemployment rate still make this year's growth forecast likely to be slightly adjusted downward.

Information on inflation may be closely related to the CPI released a few hours earlier. Although the CPI is released only a few hours earlier than the FOMC meeting, policymakers are likely to have a good idea of inflation. Judging from the recent inflation sub-items, the stickiness of core services and housing sub-items is still the key to affecting inflation.

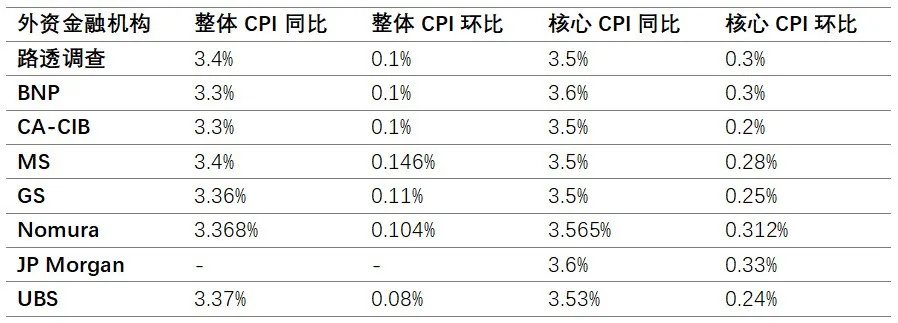

The following CPI forecasts of foreign banks are for reference:

04 Market reaction

If things go in the direction of the benchmark, the foreign exchange market will probably not get much information from the Federal Reserve's interest rate meeting this week.

However, if tonight's CPI data exceeds expectations, which in turn leads to a "hawkish" FOMC result, the market may panic and start trading on "no interest rate cuts this year". The current market's implied expectation of 1-2 interest rate cuts may quickly drop to less than 1; judging from the market reaction, the US dollar index and US Treasury yields will rise rapidly, and the US dollar index may challenge the previous high of 106.

If the CPI data is weak, we expect that the information given by the FOMC meeting is more likely to be neutral, at least affecting Powell's attitude at the press conference after the meeting. At that time, the market is more likely to continue to trade in a range and fluctuate.