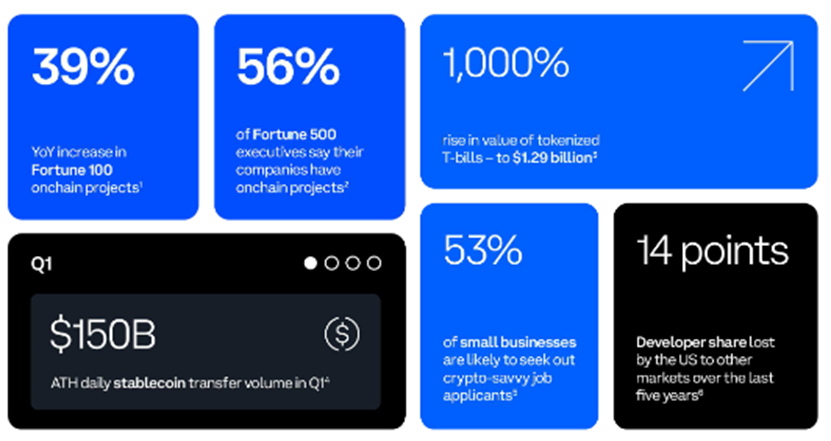

America's top public companies are busier than ever on-chain. According to research conducted by The Block for Coinbase, the number of cryptocurrency, blockchain or web3 initiatives announced by Fortune 100 companies increased 39% year-on-year and hit an all-time high in the first quarter of 2024. A survey of Fortune 500 executives found that 56% said their companies are developing on-chain projects, including consumer-facing payment applications. The increase in activity adds urgency to the development of clear crypto rules that can help keep crypto developers and other talent in the United States, fulfill its promise of better access, and keep the United States at the forefront of the global crypto space.

Many of the most trusted brands and products in finance are embracing blockchain technology and cryptocurrencies, driving innovation and providing a path for widespread adoption of a Bitcoin ETF.

• Of course, the advent of spot Bitcoin ETFs has also created a large amount of pent-up demand. Today, total spot assets under management for Bitcoin ETFs exceed $63 billion. On May 23, the U.S. Securities and Exchange Commission approved exchanges’ applications to list and trade spot Ethereum ETFs (pending S-1 approval), further expanding access to spot cryptocurrencies with familiar, trusted products and spurring adoption.

• Beyond ETFs - On-chain government securities are driving renewed interest in tokenizing real-world assets. Recent high interest rates have fueled demand for safe, high-yield U.S. Treasuries, with the value of tokenized Treasuries up over 1,000% to $1.29 billion since the start of 2023. BlackRock’s $382 million tokenized Treasury fund, BUIDL, recently surpassed Franklin Templeton’s $368 million fund as the largest tokenized Treasury fund; crypto hedge funds and market makers are using BUIDL as collateral to trade tokens and coins. By 2030, the tokenized asset market is expected to reach $16 trillion — the size of the EU’s GDP today.

• Along with Coinbase, global payment giants PayPal and Stripe are also making stablecoins more accessible. Through Circle, merchants on Stripe can now accept USDC payments through Ethereum, Solana, and Polygon, and automatically convert to fiat currency. PayPal provides cross-border transfer services for stablecoin users in approximately 160 countries, without charging any transaction fees, while the average fee in the $860 billion global remittance market is 4.45% to 6.39%. In 2023, the annual settlement volume of stablecoins will reach $10 trillion, more than 10 times the global remittance volume.

• But this progress isn’t just coming from the top down, it’s also coming from the bottom up: Small businesses — America’s most trusted institutions — are also venturing into crypto. About seven in ten (68%) believe cryptocurrency could help solve at least one of their financial pain points, the biggest of which are transaction fees and processing times.

At Coinbase, we applaud TradFi for their progress in updating their systems and draw some conclusions from the data:

• It’s imperative that the U.S. develops the talent it increasingly needs, rather than continuing to lose it overseas. The U.S.’s share of developers continues to decline, down 14 percentage points over the past five years; today, only 26% of cryptocurrency developers are from the U.S. Among Fortune 500 executives, concerns about available, trustworthy talent have surpassed concerns about regulation as the biggest barrier to corporate adoption. Among small businesses, half say they are likely to look for candidates familiar with cryptocurrency the next time they hire for a finance, legal, or IT/tech position. Clear crypto rules are key to keeping developers in the U.S. and for the country to continue leading the world in cutting-edge technology innovation.

• It’s also important to ensure that the technology lives up to its promise of providing better access—both for companies using cryptocurrency and, more importantly, for underserved people who need financial services. For the unbanked and underserved, about half (48%) of Fortune 500 executives say cryptocurrency has the potential to increase access to the financial system and the ability to create wealth. For companies using cryptocurrency, one Fortune 500 executive noted that banks can encourage innovation by finding more ways to work with them.

• Leadership is needed in this area. Fortune 500 executives show strong interest: 79% want to work with U.S. partners (up from 73% a year ago), and 72% believe that having a U.S. dollar-backed digital currency (versus the yen) would keep the U.S. economy globally competitive.

Cryptocurrency is the future of money. This research report, our fourth since June 2023 and a year-over-year look at enterprise adoption, is the latest from Coinbase in our comprehensive campaign to educate the public on the role that cryptocurrency, blockchain, and other web3 technologies can play in updating the global financial system for the benefit of businesses and consumers.

Top U.S. Public Companies

America’s top public companies are busier than ever on-chain.

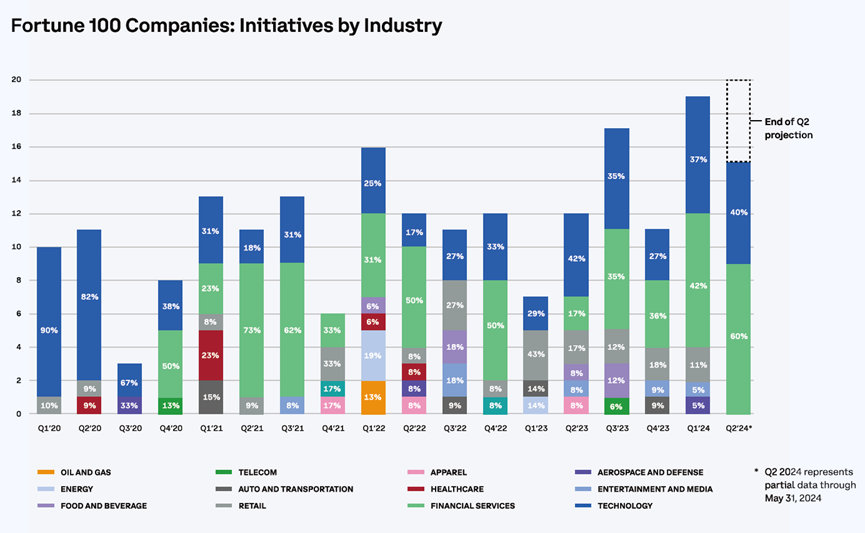

•Among the Fortune 100, a record number of on-chain projects were underway in the first quarter of 2024.

•The number of on-chain initiatives announced by the Fortune 100 grew 39% year-over-year.

•A larger proportion of programs announced in 2024 are in late stages than in any previous 12-month period: 59% year-to-date, compared to 52% in 2023 and 43% in 2022.

•Mentions of Bitcoin and stablecoins in filings with the U.S. Securities and Exchange Commission (SEC) hit a record high in the first quarter.

Cryptocurrencies are helping traditional finance update the centuries-old financial system.

• While the past three years have been years of experimentation for blockchain, tech and financial services have found their best fits. In the first quarter of this year, the two industries accounted for one in eight on-chain initiatives among the Fortune 100, a trend that has intensified since 2023, when they accounted for nearly one in six.

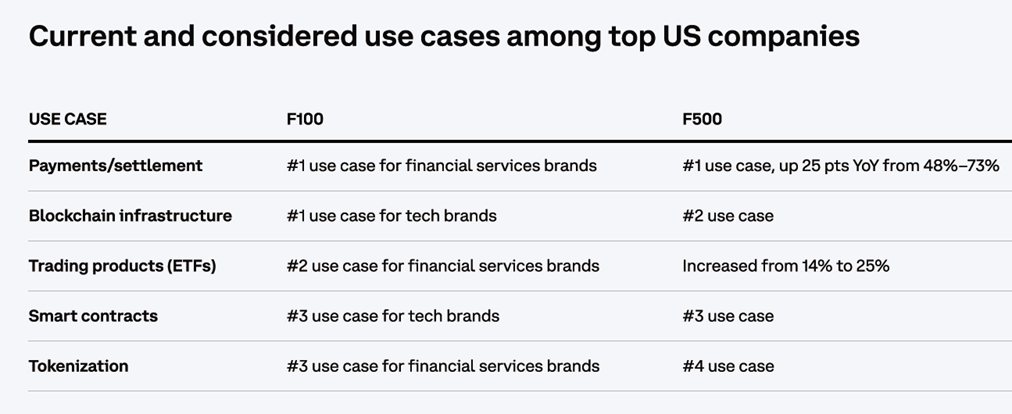

•In the financial sector: Bitcoin ETFs have driven most of the initiatives, with Bank of America, Wells Fargo and Morgan Stanley beginning to roll out these products to their brokerage and wealth management clients. Goldman Sachs, JPMorgan and Citi have become authorized participants in Bitcoin ETFs. Both Citi and Goldman have conducted tokenization tests.

• In technology: Google announced and launched the ability to search for blockchain information directly on its search engine. Google also announced infrastructure support by acting as a validator for several new blockchains. Microsoft participated in testing a new blockchain network (Canton network) for asset tokenization. IBM partnered with Casper Labs to help companies audit data used to train artificial intelligence models in a blockchain-based way.

Interest in using on-chain technology for consumer-facing transactions (not just back-end systems) extends beyond Fortune 500 corporate financial services brands to retail, healthcare, and consumer packaged goods, including:

• Explore cryptocurrency as a payment method in remote or global areas

• Implementing game-to-earn mechanics to enhance the video game experience

• Enable healthcare patients and customers to pay for products and services using digital wallets

• Accept crypto medical donations

• Restaurant loyalty program based on blockchain and NFT

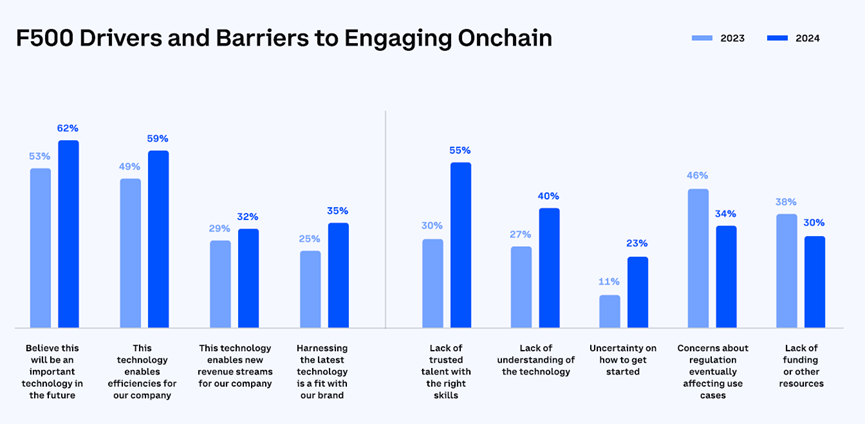

Attitudes toward Fortune 500 companies change year over year, indicating a growing awareness of the importance of this technology

•Fortune 500 executives say the average budget for on-chain projects will be $9.5 million in 2024. Most Fortune 500 executives say their companies will maintain or increase their budgets for crypto and on-chain projects over the next two years.

• The main drivers for these projects include: the technology is important for the future, it fits with their brand, it improves company efficiency, and it creates new revenue streams

• Among Fortune 500 enterprise companies that are not currently planning any initiatives, some of the biggest barriers include a lack of trusted, skilled talent – notably, this share nearly doubled year-over-year – and a lack of understanding and uncertainty about how to get started using the technology. Concerns about regulation that will ultimately impact use cases have significantly diminished.

Drivers and barriers to Fortune 500 companies’ participation in the chain

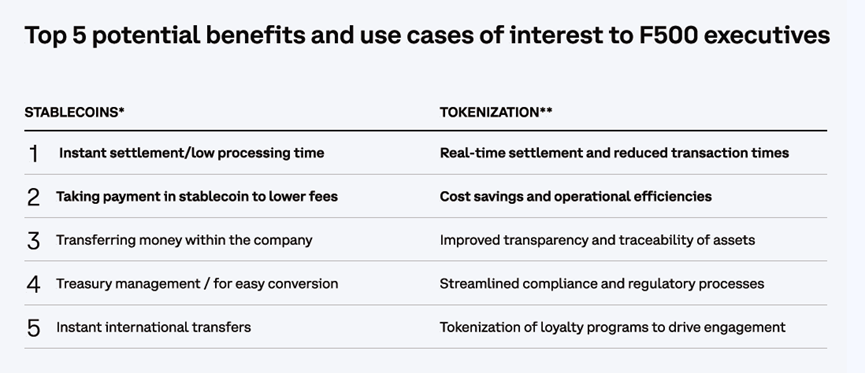

Most of the top companies are interested in the potential benefits of stablecoins and other types of tokens, especially for faster and cheaper transactions.

• Seven in ten Fortune 500 executives are interested in learning more about stablecoin use cases, primarily instant processing times and lower fees

•86% recognize the potential benefits of asset tokenization for their company.

35% said their companies are currently planning tokenization projects (including stablecoins).

Stablecoins

•Daily stablecoin trading volumes have been rising since Q3 2023, reaching an all-time high of $150 billion in Q1 2024.

•Annual settlement volume of stablecoins reaches $10 trillion in 2023, more than 10 times the global remittance volume.

•Since the beginning of 2024, stablecoins mentioned in U.S. Securities and Exchange Commission (SEC) documents have been on an upward trend, with a significant increase.

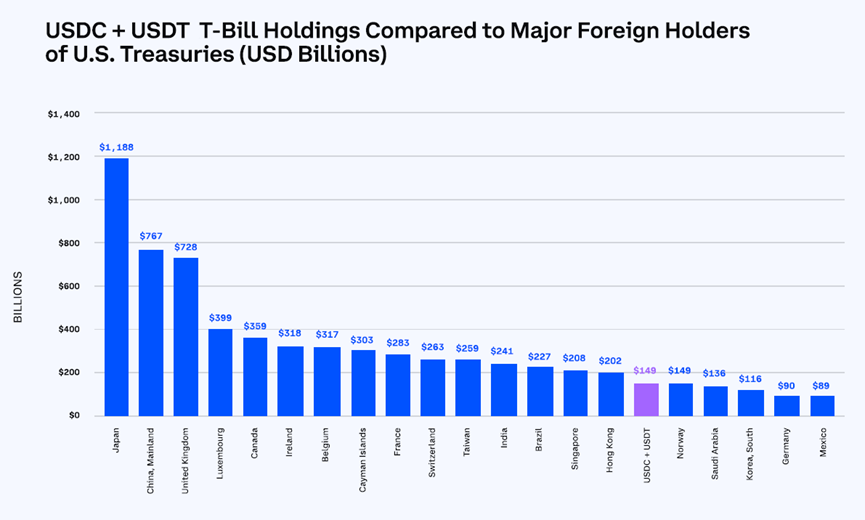

• By Q2 2024, issuers of USDC and USDT will hold as much US Treasuries (as reserves for the stablecoins they issue) as Norway, Saudi Arabia, and South Korea

•Notably, this momentum is building despite a lack of clear rules for stablecoins — though many industry analysts speculate that the dominance of offshore Tether’s USDT is at least in part due to this regulatory vacuum and recent events affecting USDC. While concerns about regulation have receded as an overall barrier to cryptocurrency/on-chain adoption, more than half of Fortune 500 executives see it as a barrier to their adoption of stablecoins.

Case Study 1: PayPal’s PYUSD

In August 2023, payment giant PayPal launched the PayPal USD stablecoin (PYUSD) on the Ethereum network, and then opened it to its 60 million users on Venmo. Developed in partnership with Paxos and backed by USD deposits and short-term US Treasuries, PYUSD has a 10-month circulation of $400 million and a record daily trading volume of $60 million in April. The supply of PYUSD in circulation has increased by more than 600% since August. The recent subpoena issued by the SEC related to PYUSD has been complied with, and the stablecoin continues to operate normally.

“Stablecoins are currently the killer app for blockchain, and they are essential to the dollar’s status as the global reserve currency.”

—Jose Fernandez da Ponte, Senior Vice President and General Manager of Blockchain, Cryptocurrency and Digital Currency at Paypal

Case Study 2: JPMorgan Chase’s JPMCoin

JPMorgan Chase, a leading global financial institution, has been investing in the digital asset sector since 2015 and developed the Quorum blockchain in 2016. It established Onyx's official digital asset business unit in 2020. Onyx's core product is JPMCoin, a distributed ledger-based payment system for use within the bank.

Although Onyx operates on a private ledger, making data difficult to verify, JPMorgan executives shared impressive statistics highlighting the growth and adoption of JPMorgan Coin — including that it now processes $1 billion worth of transactions per day, a figure that is expected to rise to $10 billion in the next year or two.

Other moves to provide programmable payments capabilities and expand JPMCoin settlement capabilities to third-party platforms, as well as public comments from Onyx executives, indicate that JPMorgan is seeking to create a network effect through JPMCoin that will position Onyx as a top tokenization platform.

Tokenization of non-stablecoins

•By 2030, the market for tokenized assets is expected to reach $16 trillion — equivalent to the current size of the EU’s GDP.

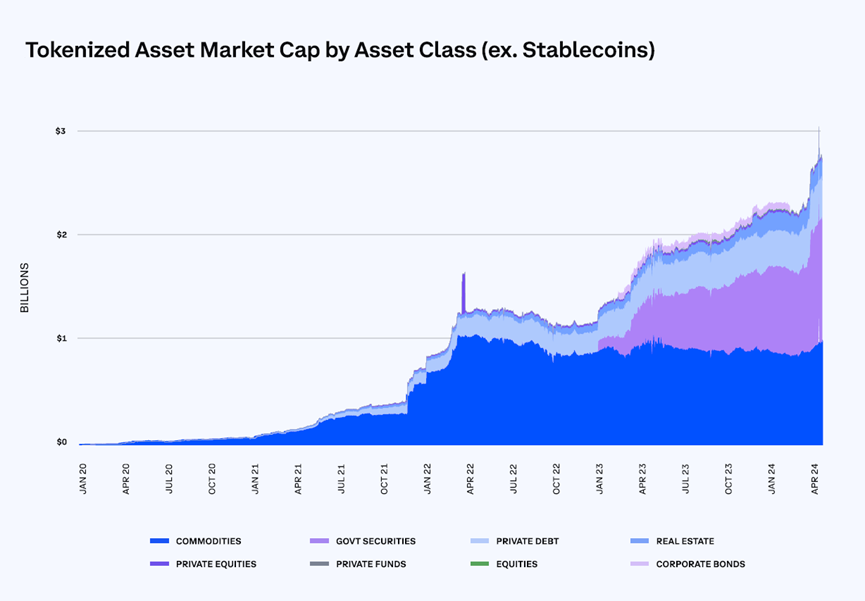

•While stablecoins are the primary driver of tokenization growth, tokenization of real-world assets (whose value exists outside of blockchains) is also on the rise. The total value of tokenized non-stablecoin assets has reached approximately $3 billion, more than doubling since the beginning of 2023. And that figure only includes publicly trackable assets — the Hong Kong Monetary Authority estimates that another $3.9 billion in bonds have been tokenized.

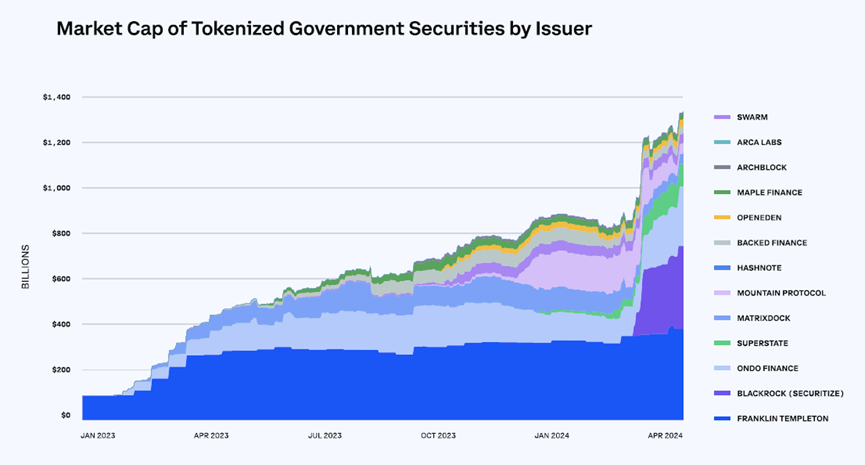

•Government securities are driving the tokenization of real-world assets and are the only asset class being tokenized by established US brands, led by BlackRock and Franklin Templeton. Recent high interest rates have fueled demand for safe, high-yield Treasury bonds, driving the value of tokenized US Treasury products from over 1,000% in January 2023 to $1.29 billion by May 31, 2024. The yields on these securities are at a 30-year high.

• Prior to tokenized Treasuries, interest was focused on commodities, and while their tokenized value was overshadowed by soaring government securities, more on-chain users hold commodity-based tokenized assets than any other tokenized asset type (except stablecoins)

• Gold is by far the top commodity, accounting for almost all of the $1 billion in tokenized commodities

•The total value of tokenized loans on public chains has grown from near zero in October 2020 to over $400 million in April 2024. Loan types have diversified to include categories such as trade finance, income-based financing, and real estate financing, indicating that the tokenized lending space has expanded in recent years to provide financing for more types of borrowers and use cases.

Case Study 3: FOBXX by Franklin Templeton

In 2019, Franklin Templeton, one of the world's largest asset management companies, launched FOBXX, a U.S. Treasury money market fund, giving investors access to government money markets through a trusted channel. By tokenizing the fund, Franklin expanded investors' access to on-chain products and issued and traded ownership on public chains. The fund's BENJI token was first deployed on the Stellar blockchain and then expanded to the Polygon network. As of mid-May, FOBXX had $360 million in assets under management.

The company also began operating as a node validator on the Provenance and Stellar blockchain networks in 2019, and has since expanded these operations to support major blockchain networks such as Ethereum, Polkadot, Cardano, and Solana, playing a key role in building the broader blockchain ecosystem.

“We’ve been issuing, trading and bringing assets into portfolios with market infrastructure for 50 years… We’re starting to see that there are a lot of ways that blockchain technology can dramatically improve that. There are a lot of ways to reduce processing time, get more real-time information, and enable 24/7/365 trading because we live in a global world and our business runs 24/7.”

— Sandy Kaull, head of digital assets at Franklin Templeton

Case Study 4: BlackRock’s BUIDL Fund

BlackRock, a global asset management leader, launched the first tokenized fund on the Ethereum network on March 20, 2024, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), which caused a sensation.

In partnership with Securitize, a well-known digital asset securities company, BlackRock's BUIDL fund provides qualified investors with the opportunity to earn the yield of U.S. Treasury bonds. The fund aims to maintain a stable value of $1 per token and deposits daily accrued dividends directly into investors' wallets as new tokens.

Early participants in the BUIDL ecosystem include well-known companies in the crypto space, such as Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks. BlackRock is the fund's investment manager, and Bank of New York Mellon is the asset manager and custodian. PricewaterhouseCoopers will serve as the 2024 year-end audit.

BUIDL has seen massive growth since March, surpassing Franklin Templeton’s FOBXX in assets under management and capturing nearly 30% of the $1.3 billion tokenized U.S. Treasury market.

“I believe this technology is going to be very important. I believe the next generation of markets, the next generation of securities, will be the tokenization of securities. If we can have a distributed ledger where we know every beneficial owner, every beneficial seller, and we have the code for who’s buying and who’s selling, with instant settlement, it will change the entire ecosystem.”

-- Larry Fink, Chairman and CEO of BlackRock

As the most trusted institutions in the U.S., small businesses are also venturing into cryptocurrency and blockchain technology

• Among small businesses that are crypto-savvy, 53% are likely to seek crypto-savvy candidates the next time they hire for a finance, legal or IT/tech role—a percentage that suggests a shortage of skilled talent could be holding small businesses back

• More than half believe that the adoption of stablecoins will help open up new business opportunities.

They are attracted to cryptocurrency because it is cheaper and faster

• Transaction fees and processing time are the biggest financial pain points for small businesses

• About seven in ten (68%) believe cryptocurrency could help solve at least one of their financial pain points

• Three quarters (76%) are interested in any benefit of cryptocurrencies.

Blockchain Use Cases

People's medical records exist in many forms—think of those handwritten or typed documents sitting on a shelf in your doctor's office.

Acoer uses blockchain technology to help public health organizations collect, organize and analyze large amounts of healthcare data to gain a more comprehensive understanding of the public health situation and achieve better public health outcomes.

Smallholder farmers around the world are often unbanked or underbanked and excluded from global supply chains. BanQu uses blockchain technology to give smallholder farmers access to the financial system for accounting and payments, allowing them to expand their influence and participate in the global economy.

Every year, more than $1 trillion in unused inventory, including raw materials and finished goods, sits in warehouses. Inventory tracking company Queen of Raw is using blockchain technology to help companies better track and make the most of their inventory.

Stablecoin Example: Compass Coffee

Compass Coffee, a long-standing coffee brand with 18 stores in the Washington, D.C. area, currently loses revenue each year to credit card fees, money that could be invested in the business, its employees, and its customers.

Compass, in partnership with Coinbase, now offers customers the option to pay for their morning coffee with USDC, making credit card transaction fees a contentious issue. The initiative highlights that credit card transaction fees paid by U.S. merchants are estimated to be $126 billion in 2022, 2.5 times the size of the entire U.S. coffee shop market.

It stressed that by using blockchain technology instead of credit cards, these fees could be significantly reduced, and it was also a recent example of how cryptocurrencies are gradually moving towards the mainstream.

“Accepting crypto payments could be a game changer for our business. We hope to help transform the retail experience by accepting USDC.”

— Michael Haft, Founder and CEO of Compass Coffee