Author: stella@footprint.network

Data source: GameFi research page

In May 2024, Ethereum ’s performance was significantly boosted by the SEC’s approval of the preliminary application for a spot Ethereum ETF. The total market capitalization of blockchain game tokens reached $20.1 billion, up 6.7% month-on-month. However, despite the increase in market capitalization, the industry has experienced an interesting shift in user engagement, with trading volume declining but the number of daily active users reaching a new high. In addition, the growing popularity of mini-games and game bots is gradually changing the landscape of the gaming industry.

The data for this report comes from Footprint Analytics’ blockchain gaming research page . This is an easy-to-use dashboard that contains the most important statistics and indicators for understanding the blockchain gaming industry, and is updated in real time.

Macro Market Review

In May 2024, Bitcoin rebounded strongly from its low point at the end of April, climbing from $60,653 at the beginning of the month to $67,606 at the end of the month, an increase of 11.5%. At the same time, Ethereum also showed a strong recovery trend, with its price rising from $3,011 to $3,778 during the same period, an increase of 25.5%.

Data source: Bitcoin and Ethereum prices

Data source: Bitcoin and Ethereum prices

In May 2024, market dynamics were significantly affected by a major regulatory development, with the U.S. Securities and Exchange Commission (SEC) approving a preliminary application for a spot Ethereum ETF. This milestone not only helped Ethereum stand out in the broader cryptocurrency market, but also marked a shift in regulatory support for cryptocurrencies.

In addition, the political situation also has an impact on market sentiment. The Trump campaign announced that it would accept cryptocurrency donations, a move that suggests that the upcoming US presidential election may have a profound impact on the cryptocurrency market, and its influence may be comparable to the Federal Reserve's monetary policy adjustments.

On the contrary, the ongoing settlement process of the Mt. Gox exchange bankruptcy has had a certain degree of suppression on the price of Bitcoin. The exchange, which has been in bankruptcy for a decade, announced in September last year that creditor repayments would begin in October 2024, raising concerns about the potential impact of a large-scale token sale.

Overview of the blockchain game market

The market capitalization of blockchain gaming tokens experienced fluctuations in May, but stabilized at $20.1 billion at the end of the month, up 6.7% from the previous month.

Data source: Blockchain games and Bitcoin market value

Data source: Blockchain games and Bitcoin market value

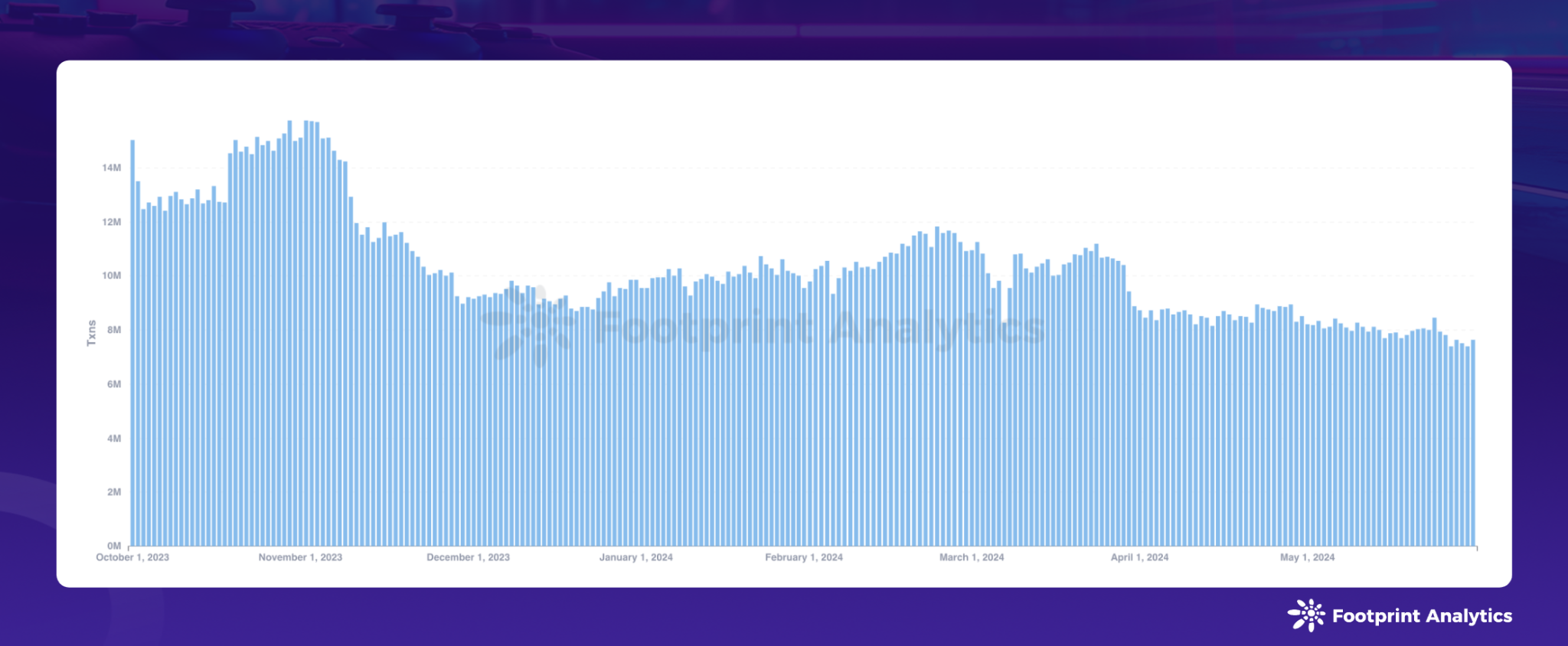

The average daily transaction volume of blockchain games was 8 million, down 7.3% from April.

Data source: Daily transaction count of blockchain games

Data source: Daily transaction count of blockchain games

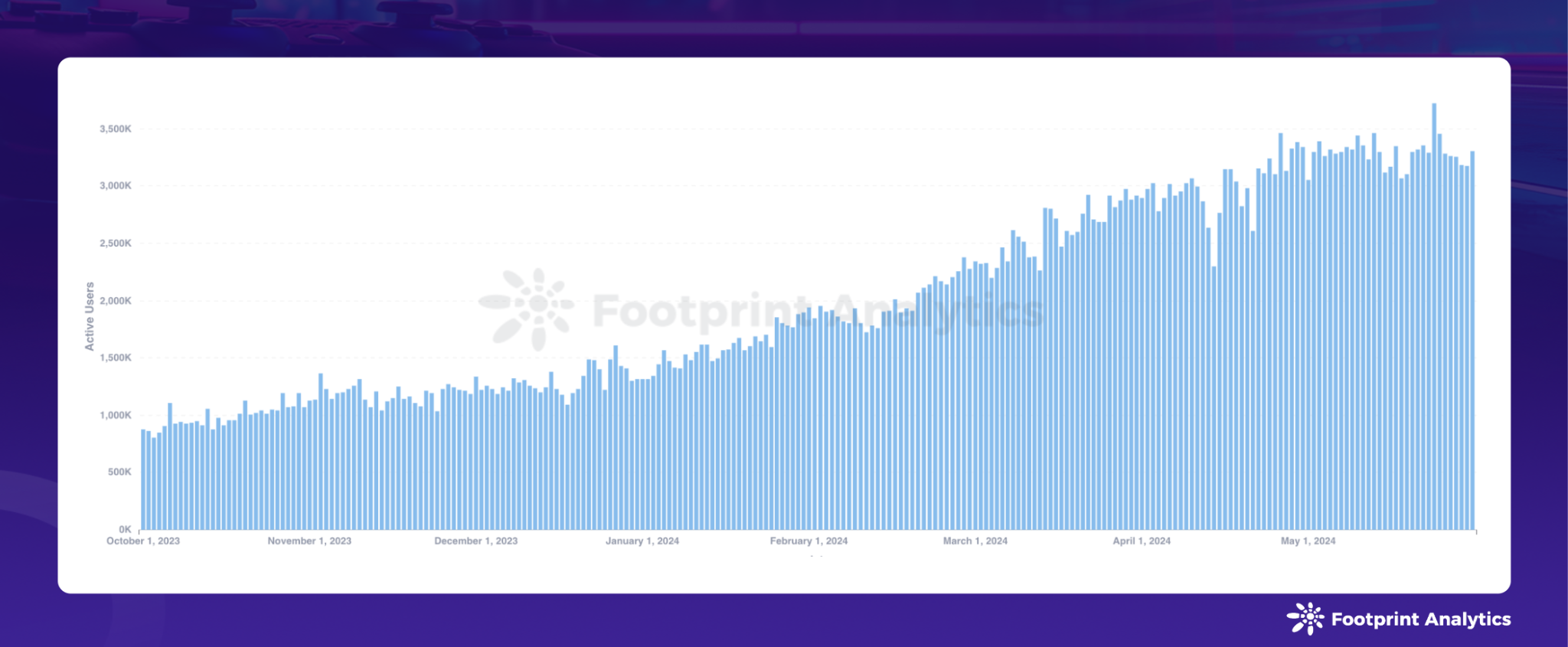

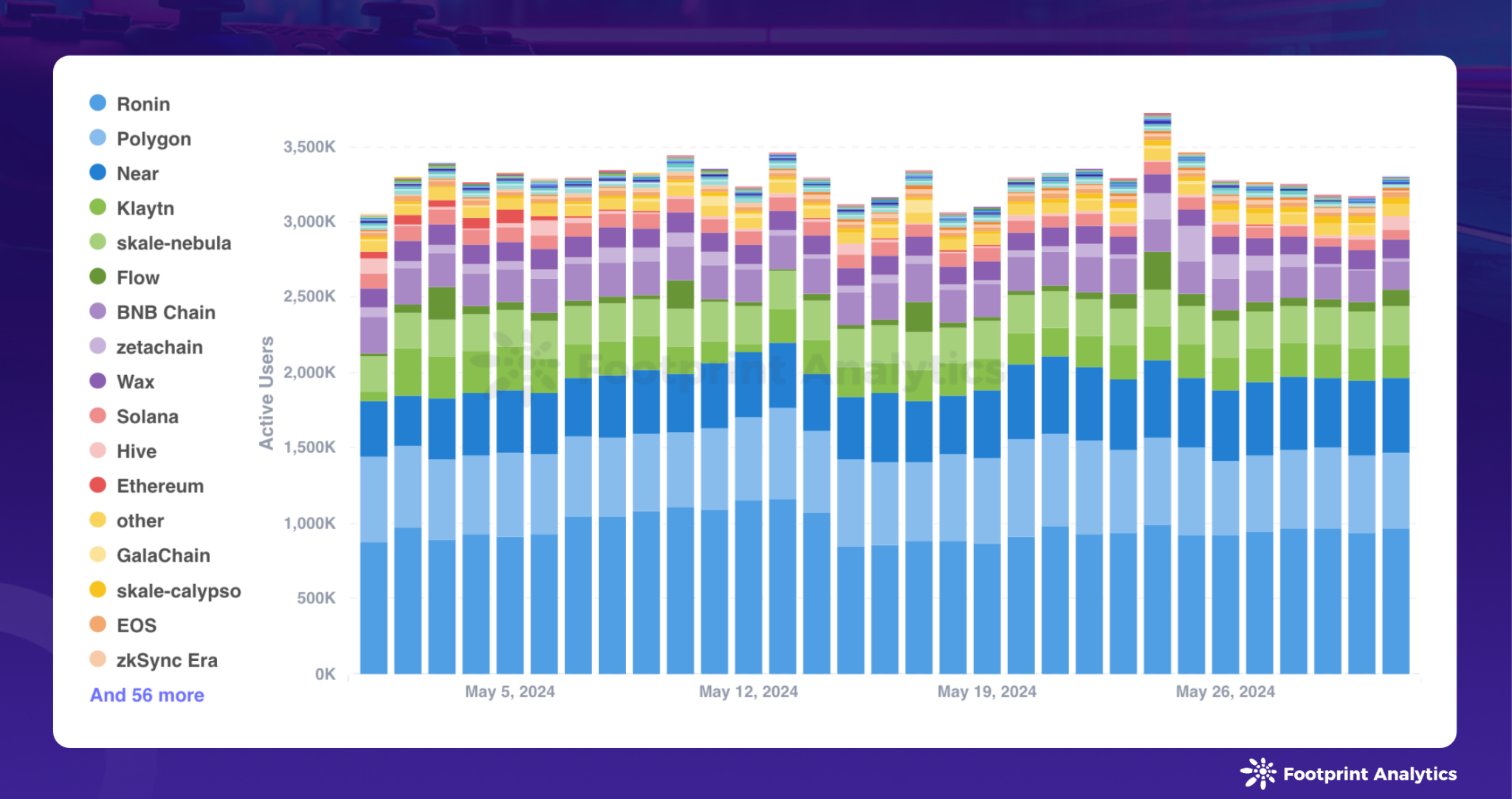

At the same time, the average daily active users (calculated by the number of wallets) increased to 3.3 million, a month-on-month increase of 9.6%, once again setting a new historical record.

Data source: Number of daily active users of blockchain games

Data source: Number of daily active users of blockchain games

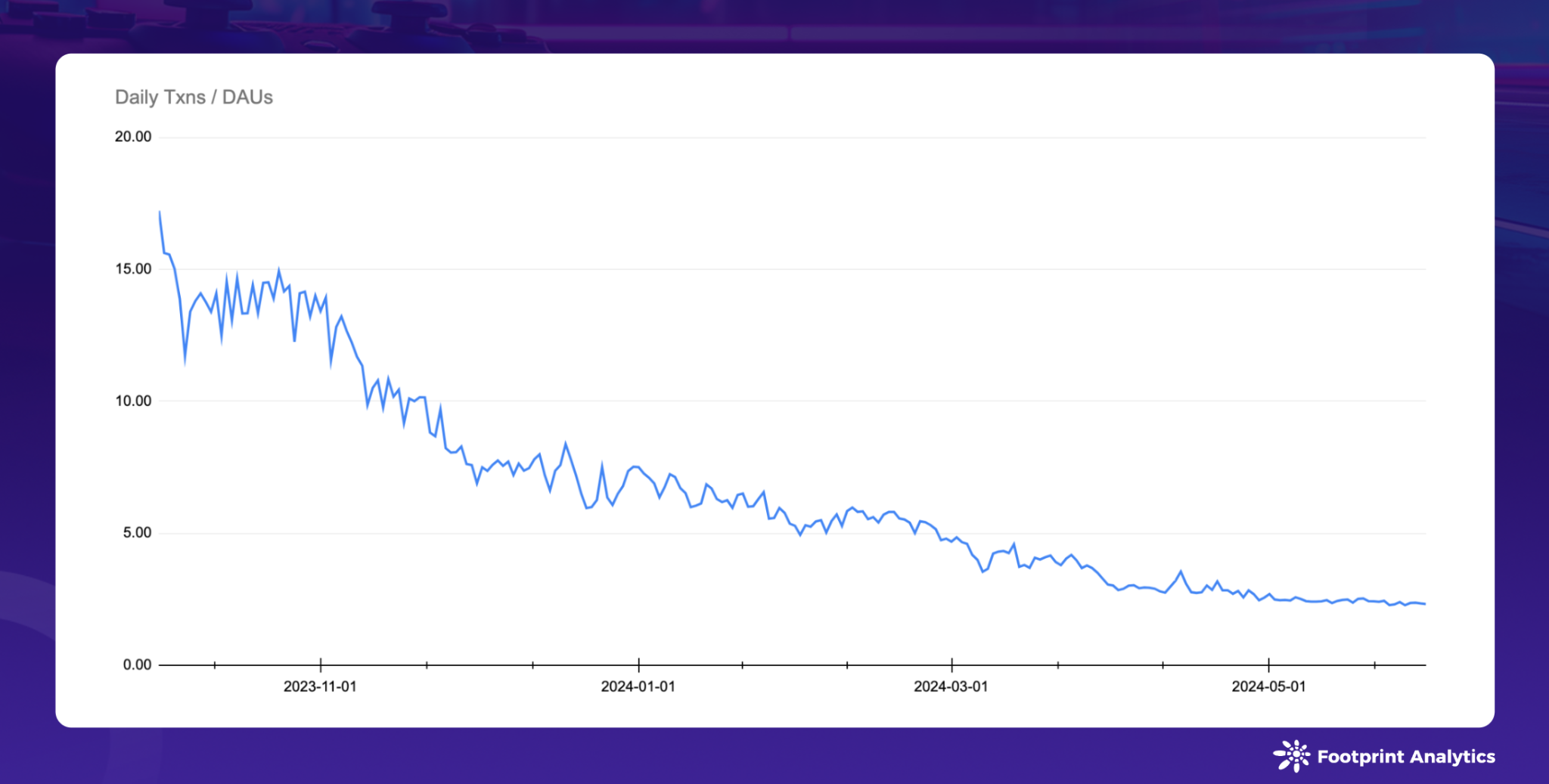

After observing the market dynamics in May, we noticed an interesting phenomenon: the downward trend in daily transaction volume in blockchain games coexists with the upward trend in daily active users. Since October 2023, the ratio of daily transaction volume to daily active users has gradually decreased from 17.2 to 2.3.

The ratio of daily transactions of blockchain games to daily active users

The ratio of daily transactions of blockchain games to daily active users

We believe several factors may have contributed to this trend. First, the rise of the “play-to-airdrop” strategy has led to more users participating in games mainly to complete tasks rather than seeking entertainment, so the frequency of interaction is reduced. Second, many developers choose to partially on-chain games or mini-games to balance seamless Web3 integration with engaging gameplay. These games usually create user wallets or issue tokens on the chain, or even only the tokens are on the chain, but most of the activities are carried out off-chain.

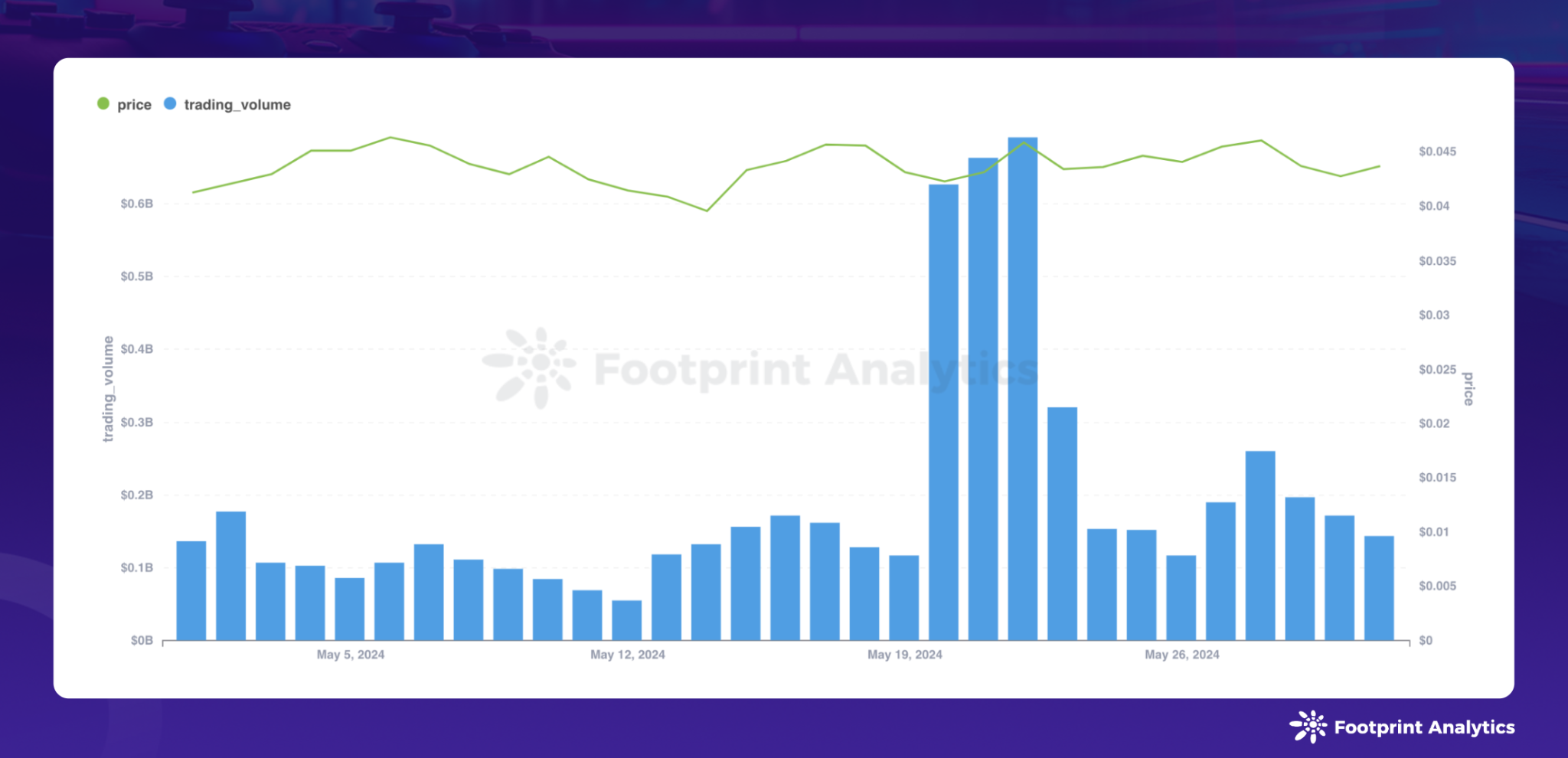

Additionally, there was a security incident in May. An unidentified hacker broke through Gala Games’ internal controls and minted 5 billion new GALA tokens on May 20. The hacker then sold 600 million tokens on a decentralized exchange for nearly 6,000 ETH. Within hours of the attack, the Gala Games team detected the attack and took action, activating their blacklist function to isolate the attacker’s address. The stolen funds were then quickly transferred from the hacker’s wallet to a wallet controlled by Gala Games. Although the GALA token fell by more than 15% immediately after the incident, it quickly recovered due to the team’s quick response. This is a lesson worth learning.

Data source: GALA price and transaction volume in May 2024

Data source: GALA price and transaction volume in May 2024

Blockchain Game Public Chain

In May, a total of 1,525 games remained active across multiple blockchain platforms, with BNB Chain , Polygon , and Ethereum leading the way with 23.3%, 19.7%, and 15.7% of the market share, respectively.

Among the 3.3 million daily active users in May, Ronin , Polygon, and NEAR still ranked at the top, similar to the previous month. Ronin continued to dominate, with about 29.0% of the market share. NEAR's share increased from 12.1% at the beginning of May to 14.8% at the end of the month. Flow also showed an upward trend, with its share rising from 0.7% to 3.3%. BNB Chain's share declined from 8.0% to 5.9%.

Data source: Daily number of active blockchain game users on each public chain

Data source: Daily number of active blockchain game users on each public chain

In May, various public chains implemented a number of strategic initiatives aimed at enhancing the gaming ecosystem.

On May 24, the Arbitrum community launched a vote for the 200 million ARB game catalyst plan, which will end on June 8, with the goal of strengthening the gaming ecosystem on the network. As of the time of writing this report, the proposal has received majority support , with a support rate of 80.6%. At the same time, Arbitrum is developing a Layer 3 game-specific chain ecosystem, and the multi-chain NFT game ecosystem Polychain Monsters announced the launch of a Layer 3 game-specific chain based on Arbitrum Orbit through Altlayer.

The Starknet Foundation has awarded a 2 million STRK grant to on-chain metaverse game Realms.World as part of its strategy announced in March to strengthen the Starknet gaming ecosystem through the distribution of 50 million STRK tokens.

The classic soccer game Captain Tsubasa, developed by Mint Town Co., Ltd. and BLOCKSMITH&Co., subsidiaries of mobile gaming giant KLab Inc., officially landed on Oasys in May. Oasys is actively seeking further cooperation with Mint Town and other developers to integrate high-quality intellectual property (IP) into blockchain games.

TON continues to receive widespread attention. In early May, Pantera Capital, which manages more than $5 billion in assets, announced its “largest investment ever” in TON. In addition, with the rise of the Notcoin craze, game bots projects such as Tapswap and Hamster Kombat have also gained more and more attention.

Overview of blockchain game projects

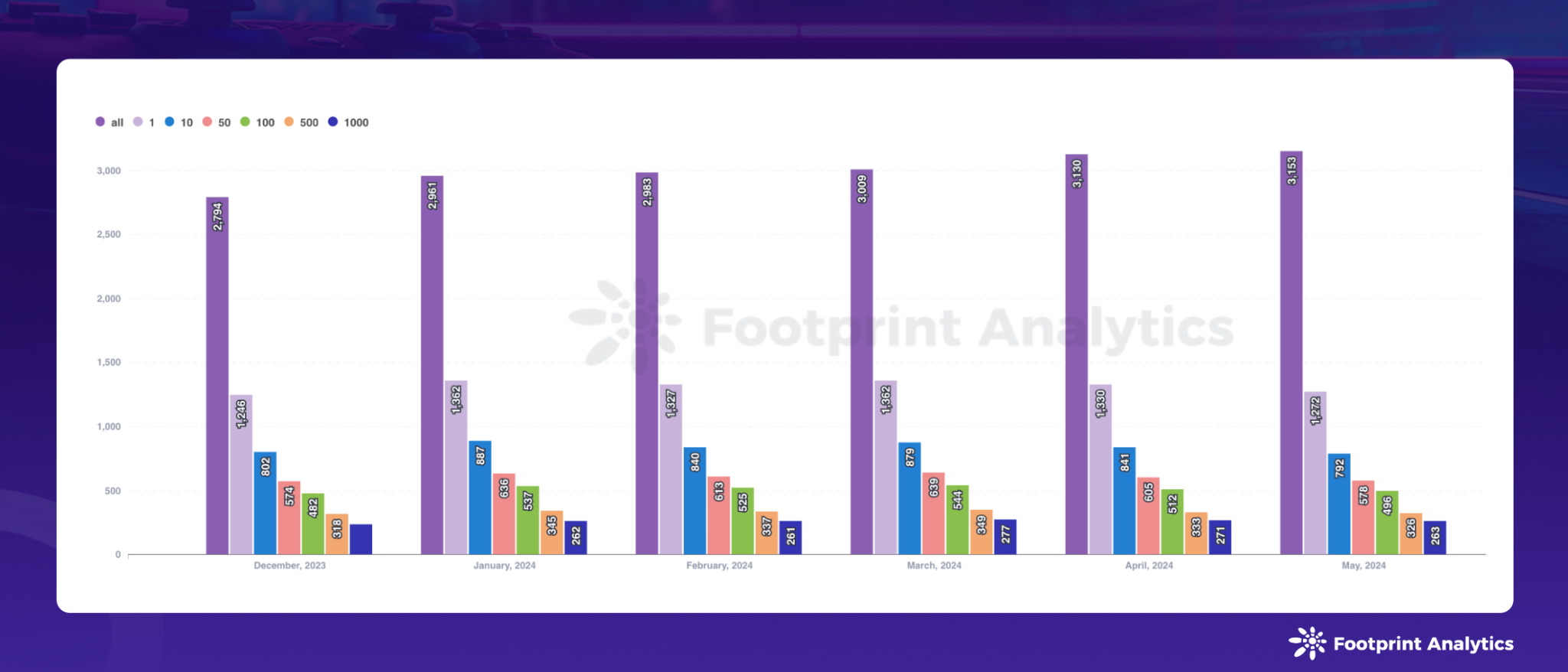

In May, the total number of blockchain games climbed to 3,153, of which 1,272 were active. Among these active games, 263 games successfully attracted more than 1,000 monthly users, accounting for 8.3% of the total number of games and 20.7% of the number of active games.

Data source: Monthly number of active blockchain games

Data source: Monthly number of active blockchain games

Although the blockchain gaming industry has been very active in recent years, there has been a lack of enough flagship games to truly highlight its potential. Popular games like Pixels , Matr1x FIRE , Sweat Economy , and Another World have attracted attention, but many games still struggle to exceed 1,000 monthly active on-chain users. This stagnation is partly due to the popularity of non-full-chain games, most of which are still off-chain, even though full-chain games and AAA games have been the main narrative for a long time.

In the face of these challenges, the rise of Telegram game bots and mobile mini-games, with Notcoin as an example, shows that changes are brewing in the industry. Binance launched the NOT token through its Launchpool on May 9 and began trading on May 16, further fueling this trend. Today, Notcoin has a strong community of over 7.7 million subscribers on Telegram, and similar projects such as Hamster Kombat and Tapswap have also gained significant attention, with 25.3 million and 18 million subscribers respectively.

These developments suggest that mini-games and game bots may pave the way for broader Web3 adoption. Unlike the long development cycles required for full-chain games or AAA titles, these platforms focus on flexibility and rapid deployment. They are able to move quickly and fail quickly. This approach may be more effective in attracting and retaining a large number of users than pursuing complex but inaccessible gaming experiences.

Blockchain game investment and financing

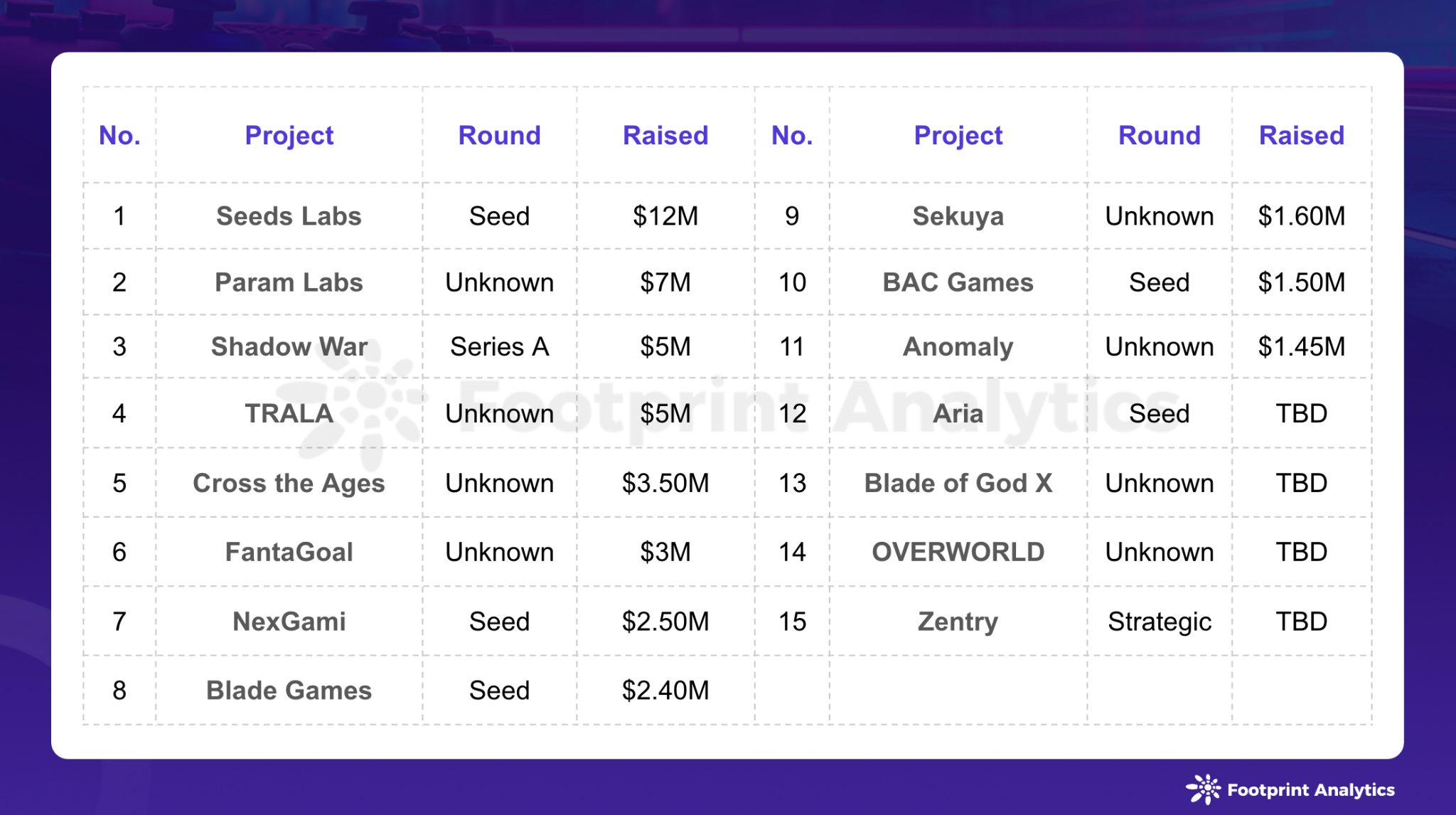

In May, the blockchain gaming industry successfully raised $44.95 million in 15 financing activities, a decrease of 42.9% compared to April.

Investment and financing events in the blockchain gaming sector in May 2024 (Source: crypto-fundraising.info )

Investment and financing events in the blockchain gaming sector in May 2024 (Source: crypto-fundraising.info )

Seeds Labs successfully raised $12 million in a seed round, with support from Avalanche’s Blizzard Fund, Solana Foundation, and Hashkey Capital. Their flagship product, the Web3 game Bladerite, was officially released in May. The game is built on Solana.

——————————————

The content of this article is only for industry research and communication purposes and does not constitute any investment advice. The market is risky and investment should be cautious.

About Footprint Analytics

Footprint Analytics is a blockchain data solution provider. With cutting-edge artificial intelligence technology, it provides the first code-free data analysis platform and unified data API in the Crypto field, allowing users to quickly retrieve NFT, Game and wallet address fund flow tracking data from more than 30 public chain ecosystems.