Author: stella@footprint.network

Data source: Public chain research page

In May, the cryptocurrency market experienced important regulatory and political developments. The U.S. Securities and Exchange Commission (SEC) approved the preliminary application for a spot Ethereum ETF , a move that boosted the market performance of Ethereum and its Layer 2 solutions. The Trump campaign team announced that it would accept cryptocurrency donations, foreshadowing the potential impact that the upcoming U.S. presidential election may have on the market. Solana continued to maintain strong growth as it was adopted by more and more mainstream platforms such as PayPal.TON attracted a lot of attention due to Pantera Capital's "largest investment to date" and growing on-chain TVL and on-chain activities.

The data for this report comes from Footprint Analytics' public chain research page . This page provides an easy-to-use dashboard that contains the most critical statistics and indicators for understanding the public chain field and is updated in real time.

Crypto Market Overview

In May 2024, market dynamics were significantly affected by a major regulatory development, with the U.S. Securities and Exchange Commission (SEC) approving a preliminary application for a spot Ethereum ETF. This milestone not only helped Ethereum stand out in the broader cryptocurrency market, but also marked a shift in regulatory support for cryptocurrencies.

In addition, the political situation also has an impact on market sentiment. The Trump campaign announced that it would accept cryptocurrency donations, a move that suggests that the upcoming US presidential election may have a profound impact on the cryptocurrency market, and its influence may be comparable to the Federal Reserve's monetary policy adjustments.

On the contrary, the ongoing settlement process of the Mt. Gox exchange bankruptcy has had a certain degree of suppression on the price of Bitcoin . The exchange, which has been in bankruptcy for a decade, announced in September last year that creditor repayments would begin in October 2024, raising concerns about the potential impact of a large-scale token sale.

Public Chain Overview

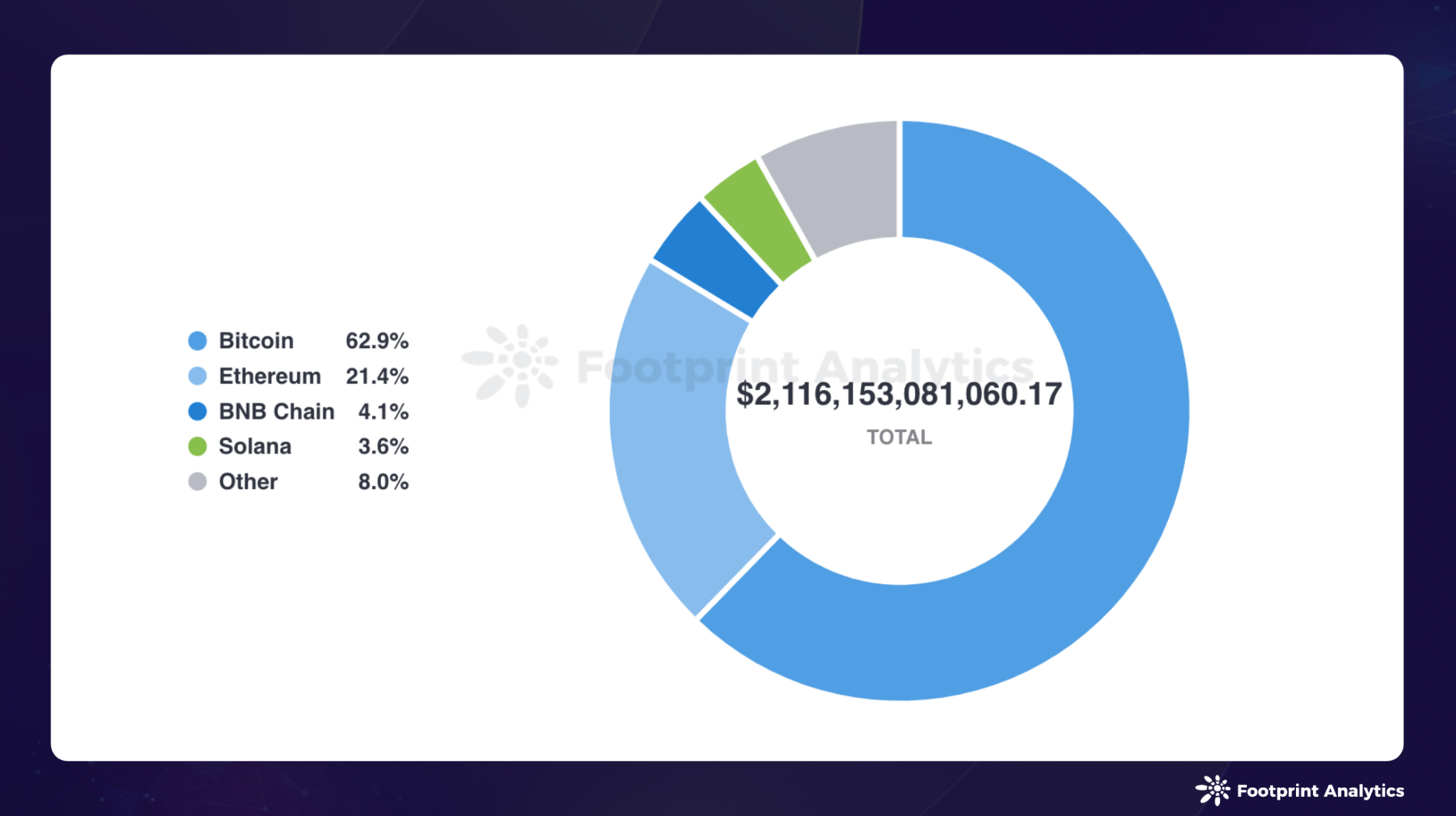

As of the end of May, the total market value of public chain cryptocurrencies increased by 10.5% from April to $1.9 trillion. Among them, Bitcoin, Ethereum , BNB Chain and Solana led the market share, with 62.9%, 21.4%, 4.1% and 3.6% respectively. It is worth noting that Ethereum's market share increased from 19.7% to 21.4%, while Solana increased from 3.1% to 3.6%.

Data source: Market value of public chain tokens

Data source: Market value of public chain tokens

In May 2024, Bitcoin rebounded strongly from its low point at the end of April, climbing from $60,653 at the beginning of the month to $67,606 at the end of the month, an increase of 11.5%. At the same time, Ethereum also showed a strong recovery trend, with its price rising from $3,011 to $3,778 during the same period, an increase of 25.5%.

Data source: Bitcoin and Ethereum price trends

Data source: Bitcoin and Ethereum price trends

Driven by the broader cryptocurrency market trend, public chain cryptocurrencies recovered from April's sluggish performance. In addition to Bitcoin and Ethereum, Solana's market capitalization increased by 34.5%, NEAR increased by 19.0%, and Avalanche increased by 14.8%.

Data source: Public chain token price and market value

Data source: Public chain token price and market value

Toncoin's price rose by 23.0%, but its market cap fell by 14.6%. The reason for this is that on May 30, The Open Network (TON) announced an update to the Toncoin circulating supply on data aggregators, excluding the portion held by Telegram, TON Foundation, and TON Believers Fund. This update caused Toncoin's market cap to drop immediately.

As of the end of May, the overall TVL of the public chain reached 87.2 billion US dollars, an increase of 14.7% from April. Among them, Ethereum, Tron and BNB Chain are in the leading position. It is particularly noteworthy that TON’s TVL surged by 106.4% in one month.

Data source: Public chain TVL comparison

Data source: Public chain TVL comparison

In May, Solana continued to rise, mainly due to the continued popularity of the meme coin and a series of major developments. Among them, LayerZero included Solana in its cross-chain network, connecting with seven chains: Ethereum, Avalanche, Polygon, Arbitrum, BNB Chain, Optimism and Base, and plans to expand this network to more than 70 blockchains. In addition, PayPal chose Solana to expand its stablecoin PayPal USD (PYUSD), marking the company's first foray into a public chain outside the Ethereum ecosystem.

TON has also attracted a lot of attention. In early May, Pantera Capital, which manages more than $5 billion in assets, announced its " largest investment to date " in TON. In addition, Telegram's gaming robot projects such as Tapswap and Hamster Kombat have been sought after in the Notcoin craze, attracting more users to join TON and driving an increase in on-chain activity.

Development of major Layer 1 public chains in May 2024

Bitcoin

BlackRock's IBIT breaks the record, becoming the fastest ETF to reach $20 billion in assets.

Animoca Brands has announced that it will enter the Bitcoin space through OPAL Protocol.

Ethereum

Bloomberg analysts predict that demand for spot Ethereum ETFs may reach 20% to 25% of spot Bitcoin ETFs.

Vitalik Buterin and other core Ethereum developers proposed EIP-7702.

BNB Chain

BNB Chain announced that it had conducted four hard forks on the opBNB testnet, and the gas cost on opBNB will be reduced by 10 times in the future.

BNB Chain has launched its latest trading volume incentive program.

NEAR

NEAR: The number of mainnet shards has increased from 4 to 6, further improving network performance.

NEAR announced the launch of NEAR AI, its new R&D lab.

Sui

Sui has denied allegations of manipulating the token supply.

Sui's social login infrastructure tool zkLogin adds multi-signature recovery functionality and supports logging in with an Apple account.

Polygon

Polygon Labs announced that it will use SP1 to create pessimistic proofs for AggLayer.

Core Chain

Core DAO’s “Summer Gaming Contest — Summer 2024” kicks off on May 20th.

GalaChain

An unknown hacker compromised Gala Games' internal control account and minted 5 billion new GALA tokens on May 20. The Gala Games team quickly discovered the attack and used their blacklist feature to isolate the attacker's address.

Layer 2

In May, the SEC approved the preliminary application for a spot Ethereum ETF, boosting the performance of Ethereum Layer 2. Arbitrum leads the market with a 44.8% market share and a 19.6% TVL growth. Optimism follows closely behind with a 22.2% market share and a 13.1% TVL growth. Blast's TVL grew by 22.3%, while Base grew by 27.2%.

Linea’s TVL surged 82.9% due to its DeFi campaign Linea Surge, which attracted more DeFi enthusiasts and significantly increased TVL on the network. Manta Pacific’s TVL increased 17.4% due to the successful launch of its new product Manta CeDeFi, which provides rewards from CeFi and DeFi earnings.

Data source: Ethereum Layer 2 Overview

Data source: Ethereum Layer 2 Overview

Development of major Layer 2 public chains in May 2024

Arbitrum

Uniswap: Arbitrum is the first Layer 2 to exceed $150 billion in total trading volume on DEX.

Injective plans to launch its own Layer 3 network inEVM based on Arbitrum Orbit.

Optimism

The Optimism team welcomes Layer 3 to join Superchain, build on the OP Stack and share revenue with the Optimism Collective.

Starknet

StarkWare announced the launch of ZKThreads, a scaling framework based on ZK execution sharding.

Blast

Blur launches Blast, offering Blast Points and 2 million GOLD rewards.

Taiko

Taiko was launched on the mainnet on May 27.

Rootstock

Rootstock founder: Bitcoin programmability could come within 12 months

Merlin Chain

Merlin Chain announced that all assets of Merlin's Seal can be unpledged.

Blockchain Games

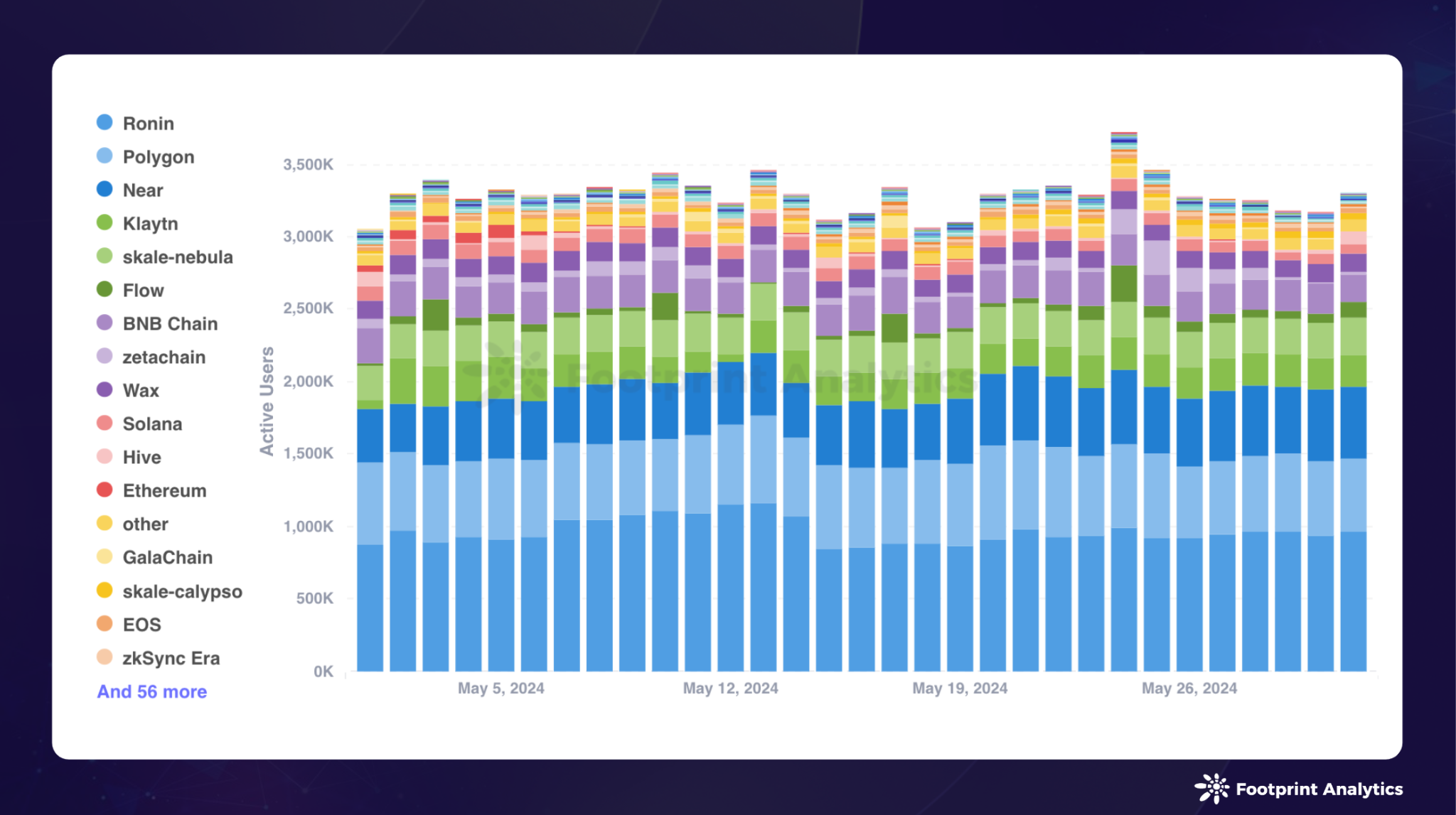

In May, a total of 1,525 games remained active across multiple blockchain platforms, with BNB Chain , Polygon , and Ethereum leading the way with 23.3%, 19.7%, and 15.7% of the market share, respectively.

Among the 3.3 million daily active users in May, Ronin , Polygon, and NEAR still ranked at the top, similar to the previous month. Ronin continued to dominate, with about 29.0% of the market share. NEAR's share increased from 12.1% at the beginning of May to 14.8% at the end of the month. Flow also showed an upward trend, with its share rising from 0.7% to 3.3%. BNB Chain's share declined from 8.0% to 5.9%.

Data source: Daily active users of public chain blockchain games

Data source: Daily active users of public chain blockchain games

On May 24, the Arbitrum community launched a vote for the 200 million ARB game catalyst plan, which will end on June 8, with the goal of strengthening the gaming ecosystem on the network. As of the time of writing this report, the proposal has received majority support , with a support rate of 80.6%. At the same time, Arbitrum is developing a Layer 3 game-specific chain ecosystem, and the multi-chain NFT game ecosystem Polychain Monsters announced the launch of a Layer 3 game-specific chain based on Arbitrum Orbit through Altlayer.

The Starknet Foundation has awarded a 2 million STRK grant to on-chain metaverse game Realms.World as part of its strategy announced in March to strengthen the Starknet gaming ecosystem through the distribution of 50 million STRK tokens.

The classic soccer game Captain Tsubasa, developed by Mint Town Co., Ltd. and BLOCKSMITH&Co., subsidiaries of mobile gaming giant KLab Inc., officially landed on Oasys in May. Oasys is actively seeking further cooperation with Mint Town and other developers to integrate high-quality intellectual property (IP) into blockchain games.

For more data, see the May blockchain game report: " Blockchain Game Research Report in May 2024: Market Cap Growth, Changes in Player Participation, and the Rise of Mini Games ."

Public chain investment and financing situation

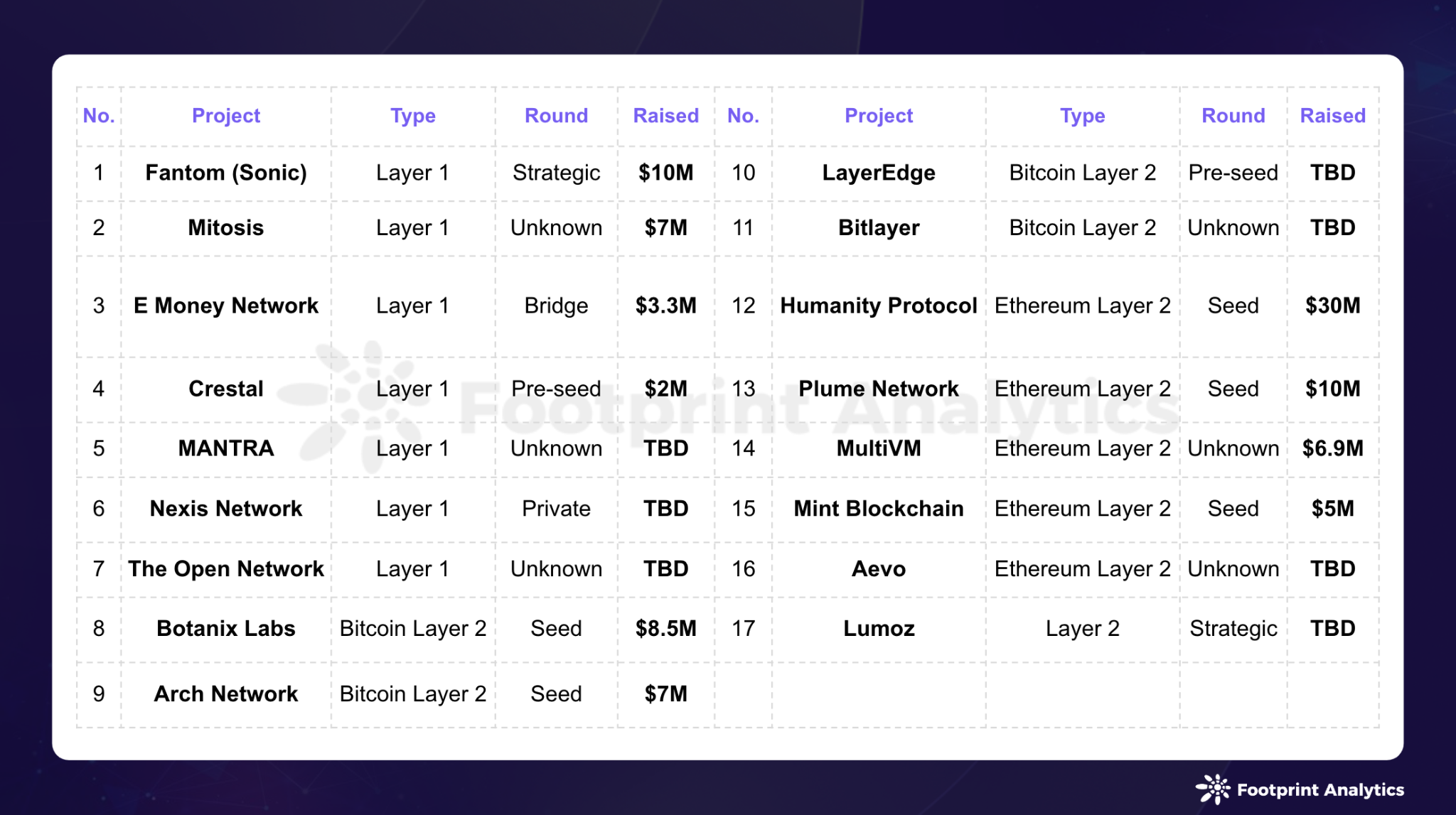

In May, there were 17 financing events in the public chain field, with a total financing amount of US$89.7 million, a decrease of 14.3% from the previous month. However, 7 of the financing events did not disclose the specific financing amount. It is worth mentioning that Pantera Capital announced its investment in TON and called it "the largest investment in history." Previously, Pantera's largest investment was US$250 million, which was used to purchase Solana at a discount from the bankrupt FTX exchange.

Public chain financing events in May 2024 (data source: crypto-fundraising.info )

Public chain financing events in May 2024 (data source: crypto-fundraising.info )

In the field of blockchain infrastructure , technological progress continues to be the focus, attracting the attention of a large number of investors. Among them, a significant technological advancement is the integration of real-world assets (RWA) in crypto applications. In May, Layer 1 blockchain E Money Network and Ethereum Layer 2 Plume Network both successfully obtained a new round of financing, aiming to integrate their networks with RWA.

Humanity Protocol is another notable example, having successfully raised $30 million at a $1 billion valuation. The company is focused on developing a blockchain-based identity system that uses palm scanning technology to identify individuals, with the goal of providing online identity verification services in an era of AI-powered deepfakes. This funding event quickly propelled Humanity Protocol into the ranks of unicorn companies, a feat that took less than a year to achieve.

Interestingly, it is becoming increasingly difficult to clearly define Layer 2 as Bitcoin or Ethereum's Layer 2, as many Layer 2 solutions support the expansion of multiple chains. For example, Lumoz, as a modular computing layer and ZK-RaaS platform, simplifies the use of ZK-Rollup and promotes its wider adoption. The platform supports multiple networks, including Ethereum, Bitcoin, and BNB Chain.

——————————————

The content of this article is for industry research and communication purposes only and does not constitute any investment advice. The market is risky and investment should be cautious.

About Footprint Analytics

Footprint Analytics is a blockchain data solution provider. With cutting-edge artificial intelligence technology, it provides the first code-free data analysis platform and unified data API in the Crypto field, allowing users to quickly retrieve NFT, Game and wallet address fund flow tracking data from more than 30 public chain ecosystems.