Disclaimer: The tokens, exchanges, and yield instruments mentioned in this article are for informational purposes only and should not be considered an endorsement or investment advice. Readers are strongly advised to conduct their own thorough research before deciding to interact with, invest in, or participate in any transactions with the tokens or yield instruments mentioned.

As always, we continue to highlight key developments in each DeFi space, unveil new projects, and outline the trajectory of TON’s DeFi ecosystem.

TVL increased 7 times in the first quarter of 2024

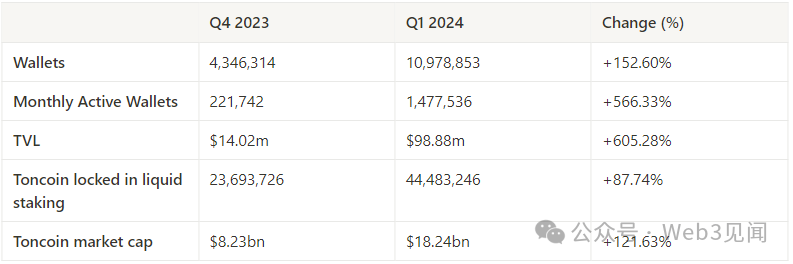

In the first quarter of 2024, memecoin hype was a central theme in the TON DeFi space and the cryptocurrency space as a whole, which at least in part led to a surge in on-chain activity and DeFi metrics:

Source: TonStat, DeFillama, CoinMarketCap

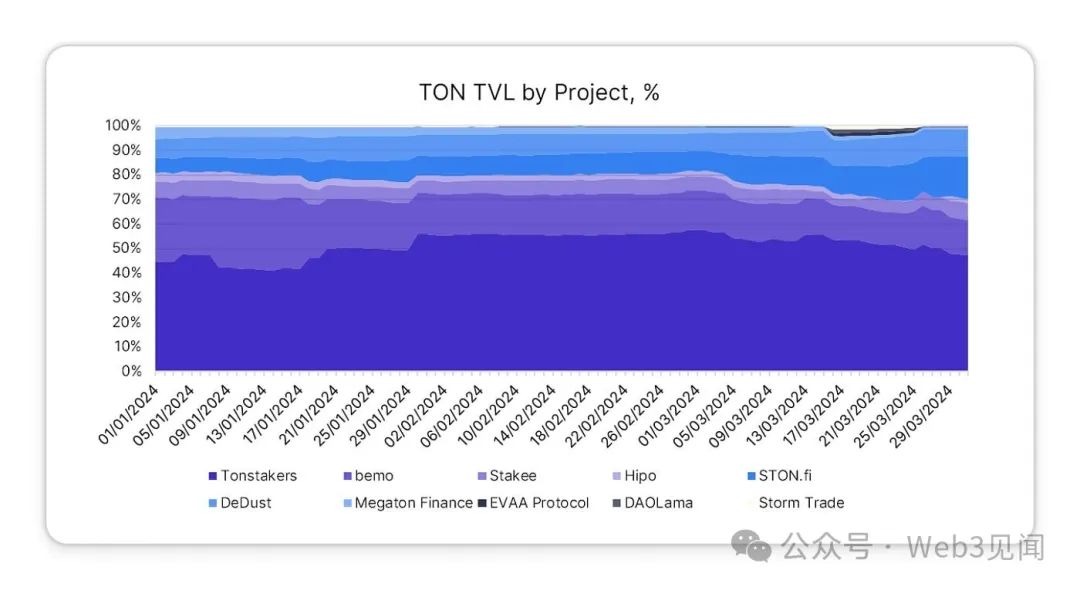

One of the main highlights of the quarter was a 7x increase in TVL, driven primarily by increased DEX activity and the market dominance of liquid staking protocol Tonstakers.

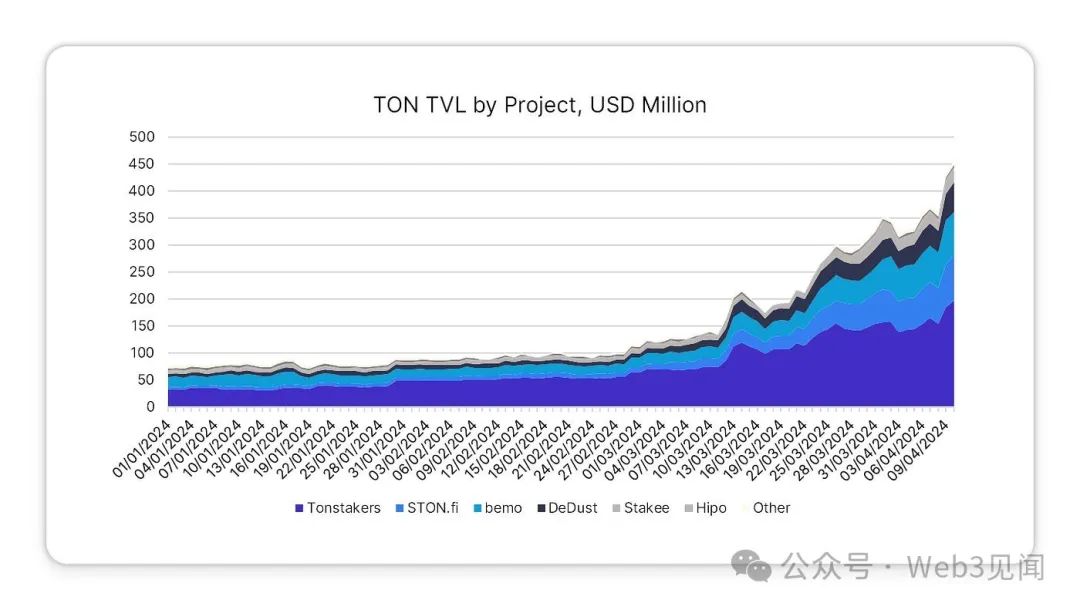

Source: DefiLlama. Note that this chart includes both “staked” and “liquid staked” values in TVL.

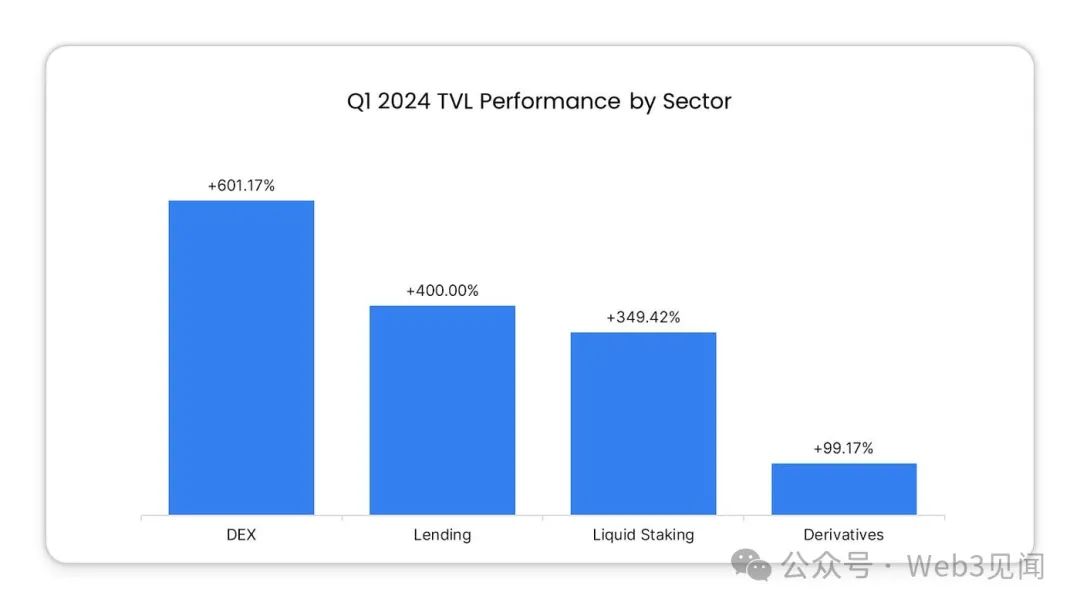

Another key theme was the launch of The Open League. The program rewards users who interact with the TON project and features a Toncoin pool competition that rewards the strongest performing TON-based projects each season. A key element of the program is a mining pool that increases APY. The introduction of mining pools, coupled with a surge in memecoin trading volume, has led to DEX becoming the best performing DeFI segment on TON based on TVL:

Source: DefiLlama. Note that “lending” includes the Evaa protocol, which was launched on DefiLlama on February 29, 2024.

In the next section, we’ll explore the patterns behind the surge in performance of TON-based DEXs in more detail.

DEX: Open Alliance meets Memecoin hype

Tokens on the TON blockchain, also known as jettons, surged in popularity in the last quarter of 2023 and have continued to grow to this day. Memecoins have largely driven the growth in trading activity.

The rally was preceded by the launch of Notcoin, a previously untradable memecoin that anyone can “mine” by clicking a button in the Notcoin applet on Telegram. In just a few months after its launch, Notcoin attracted 35 million active users. Notcoin, which is currently listed on multiple DEXs and CEXs, has inspired the creation of various meme tokens with similar mechanisms. The surge in tokens is one of the main drivers of the surge in trading volume on TON-based DEXs.

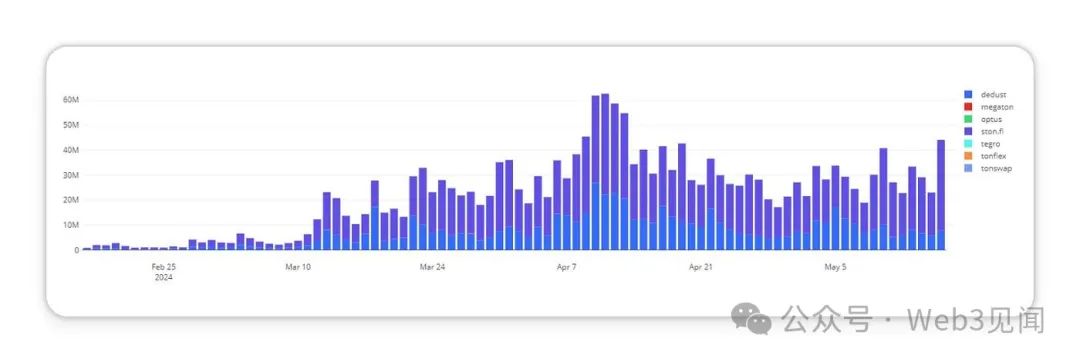

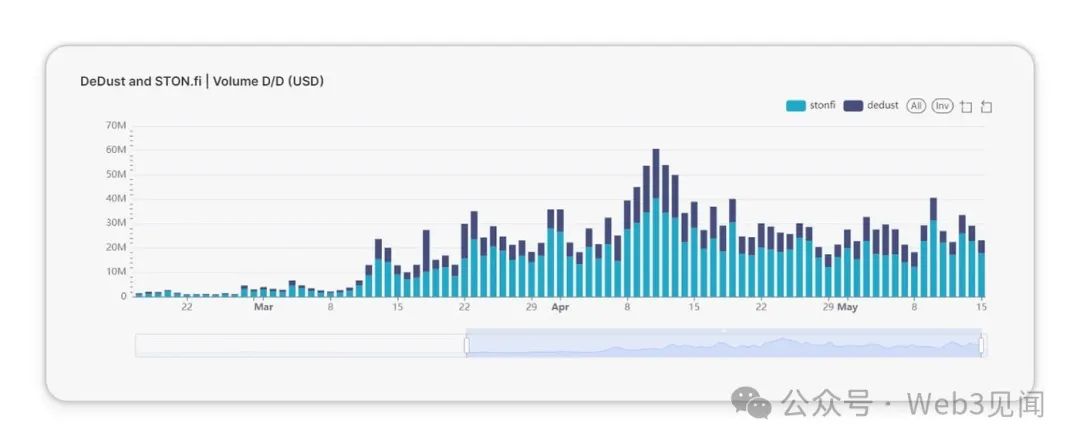

The hype of memecoin has attracted a lot of attention to DeDust and STON.fi, two DEXs that list a considerable portion of memecoin. According to Tonalytica, the total DEX trading volume on TON reached $4.2 million, a 90-day high. The second quarter set a new record high, and now exceeds $60 million:

Source: Tonalytica.redoubt.online. Accessed on 17/05/24.

Below is a screenshot from our internal analytics tool showing volume on two DEXs. The pattern is very close to the one on the Tonalytica chart:

Source: Open Platform. Access date: 17/05/24.

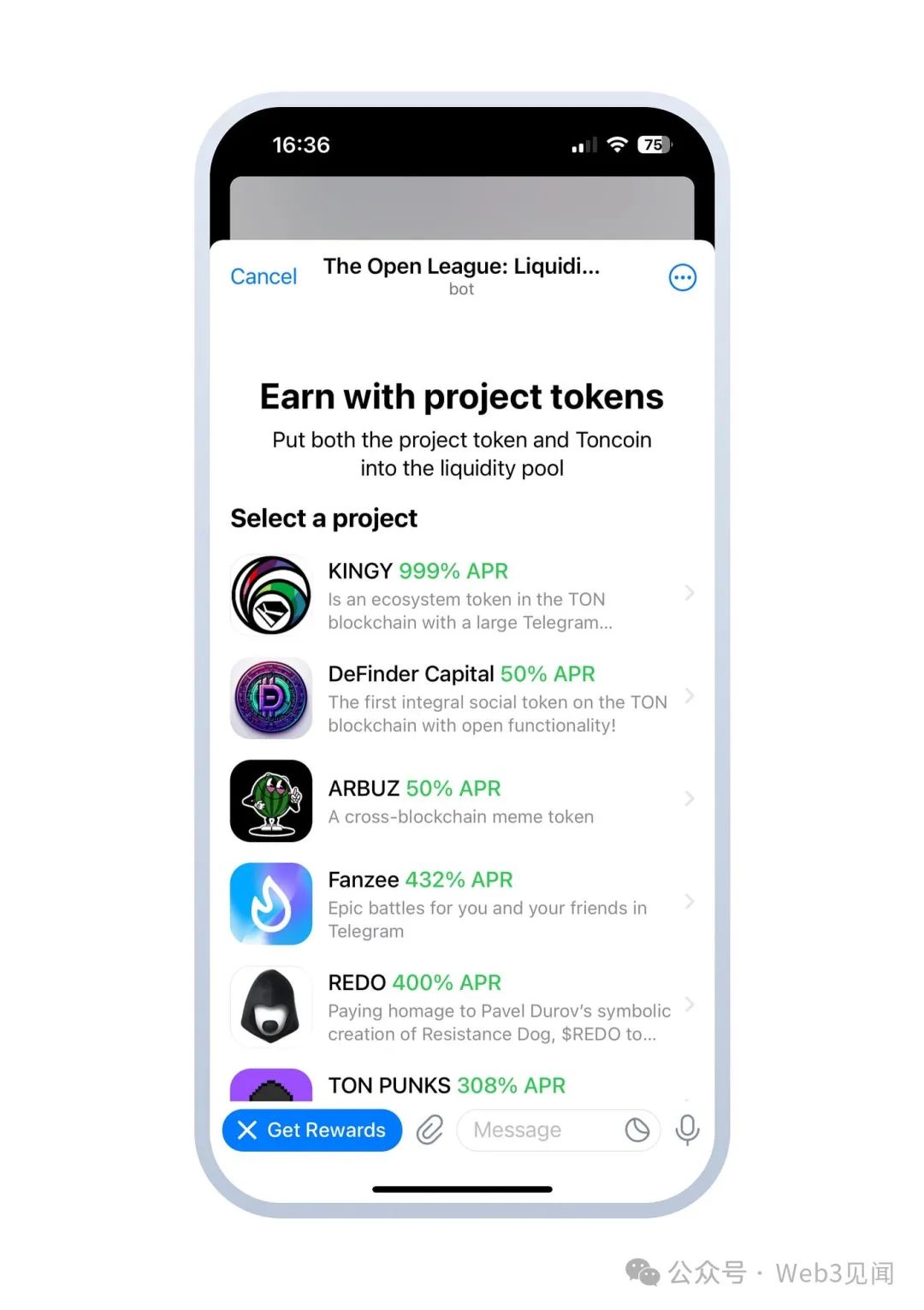

STON.fi and DeDust are the main venues for Enhanced Liquidity Pools, an incentive program of The Open League. In the first three seasons of the program, TVL on TON increased by more than 9 times, and these two DEXs made significant contributions. As the third season progresses, readers can check out the Enhanced Pools available on STON.fi and DeDust and visit The Open League Pools bot.

Public League Robots. Accessed on 17/05/24.

STON.fi ranked first in the DeFi competition of the Open League Trial Season, followed by DeDust. The ranking is based on the change in TVL and protocol fees earned during the trial season. The final ranking can be viewed here.

One of the themes of the first quarter of 2024 is that both major DEXs have launched Telegram Mini Apps. DeDust and STON.fi now have their own Mini Apps, which will make the trading experience more diverse and allow users to execute trades directly in Telegram. This may be particularly convenient for traders who use Telegram-based token research tools and news channels.

Additionally, Storm Trade, currently the leading derivatives exchange on TON, now allows traders to use Toncoin as collateral for trading futures. This update eliminates the need to convert TON to jUSDT to place collateral, simplifies the user onboarding process, and assigns additional utility to Toncoin in the ecosystem. Additionally, Storm Trade completed its largest ever bounty program as part of the Open League with a prize pool of approximately $130,000. The bounties will be distributed to the top performers in terms of trading volume, PnL ranking, and liquidity provided in designated pairs.

Liquid Staking Helps TON Enter the Top 20 TVL Blockchains

Liquidity staking remains the dominant sector in TON by TVL. According to DefiLlama, as of this report, TON ranks 17th by TVL, based on both staking and liquidity staking value.

Source: DefiLlama

Tonstakers won the liquidity staking competition in The Open League pilot season, followed by bemo and the new liquid staking protocol Stakee, and continued to dominate the TVL market. Similar to the DeFi competition, the ranking is based on the change in TVL; another metric used is the number of new users joining the protocol during the corresponding period.

Stakee ( Stakee Bot ) is a new liquid staking protocol on TON. Stakee combines simplicity, reliability, and high APY to attract Toncoin holders who seek higher returns with minimal fees. The platform ensures the security and transparency of transactions through official smart contracts developed by the TON Foundation.

In addition, TON Whales launched a new liquidity staking pool, Whale Liquid. The protocol allows Toncoin holders to earn wsTON, redeemable on DeDust, and lend on the TON protocol. The project is currently in the testing phase with a total stake of 848K Toncoin (over $5 million).

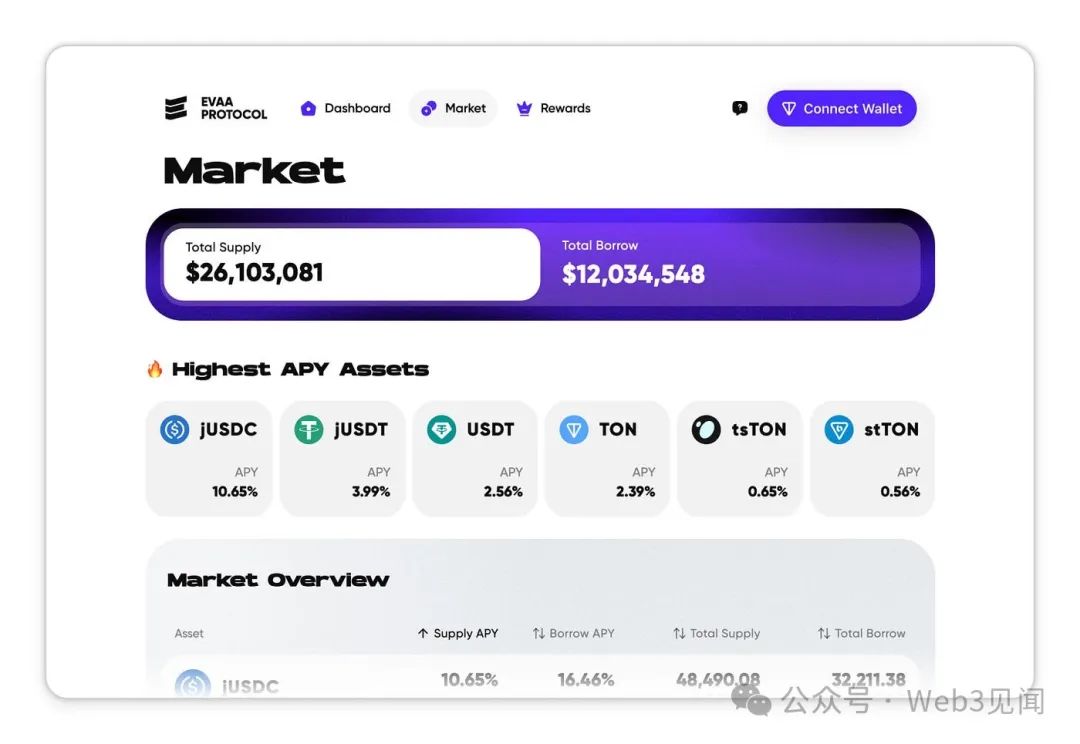

Lending: EVAA protocol launched on TON

The Evaa protocol is live on the TON mainnet. As of this report, the total supply of Evaa is $26.1 million and the total borrowing is $12.03 million.

EVAA Protocol hosted a Supply and Lending event in The Open League. The event provided users with a unique opportunity to lend or borrow TON, stTON, tsTON, jUSDC and jUSDT tokens through EvaaAppBot or app.evaa.finance. Participants received weekly airdrops, interest rewards from supply and lending events, and EVAA XP points, which can be redeemed for EVAA DAO tokens in the future.

While the campaign has officially ended, the bonus pool with an attractive APY is still available in the app:

Source: https://app.evaa.finance/market. Accessed on 17/05/24.

Similarly, DAOLama held a farming season and launched Reward Points (RP), an internal token designed to incentivize users through in-app activity. Each loan earns RP, which can be redeemed for $LLAMA. The promotion period ended on March 30, and users can now trade tokens on STON.fi and DeDust.

RedStone is the first oracle solution on TON

Oracles are a critical component in blockchain technology because they act as a bridge between the blockchain and the outside world. They provide a reliable way to input external data, such as token or stock prices, into the blockchain. This functionality is essential to enabling smart contracts (self-executing contracts that have terms written directly into the code) to interact and respond to external events.

RedStone becomes the first available oracle on TON, marking an important milestone in the data integrity of TON-based DeFi.

Toncoin price information from RedsStone, combining data from 11 external sources

RedStone emphasizes that TON's asynchronous and fully decentralized nature requires a significant shift from the usual integration approach, involving more complex inter-contract messaging rather than direct contract interactions common in other blockchains. Looking ahead, RedStone aims to enhance TON's DeFi ecosystem with a new relay system for continuous price updates, smart contract templates for easier integration, and advanced data feeds to meet the growing needs of TON-based DeFi. Learn more about the integration here.

Future Outlook

Jettons on the TON blockchain are carving out a unique space, representing a diverse range of digital assets that go beyond traditional utility. While some of these Jettons may not yet have clearly defined real-world applications, they still have an important place in the broader ecosystem.

The surge in interest in these diverse assets could be the starting point of a larger process: growing demand for DeFi infrastructure to meet the capital efficiency requirements of token holders. We can already see evidence of this from the success of the Open Alliance incentive campaign.

To be honest, ever since I discovered TON in 2022, I never believed in it. Never. I thought, “It’s just another ghost chain.” But as you can see, it is not. My first interaction with TON was at the end of 2022, when I owned 2 mid-digit cryptocurrencies (yes, 2 digits) and won a giveaway.

The admin of this Telegram channel DMed me and said, "Yo, can I send my prize to a Telegram wallet with TON?" I was like, "What? Telegram wallet?" He kindly explained everything and sent me a prize. The prize was $10, by the way. Thankfully, TON fees are low, so I sent it to CEX.

I got deeply involved in the marketing strategy when I started writing posts and leveraging content creation by studying 24/7. For some reason, I didn’t like TON’s marketing strategy at the time. 6 months later, I still don’t completely like their marketing strategy. But as we can see from the numbers of TVL and TON price, it works despite my different opinion.

I started hearing about TON from regular people who weren’t involved in crypto at all. TON is cheap, accessible, and easy to understand. That’s why regular people are farming Notcoin in large quantities. According to CoinMarketCap, at the time of writing this article, TON is ranked #9 in “Today’s Cryptocurrency Price by Market Cap.”

Although there are still many things to improve, such as marketing (hello Const), TON will get more and more attention in the future. The number of active users, TVL and TON market cap are all crazy, I really didn't expect such a flywheel.

Defizard, ZKasino Survivor and Derivatives Monke Slayer

As the DeFi landscape on TON becomes more complex, the demand for reliable and secure oracle services will continue to grow. RedStone’s efforts in this regard show that data integrity on TON is trending towards a higher level. We can expect oracle solutions to further penetrate the ecosystem in the near future.

What to build on TON now?

We expect to see:

Solutions that bring EVM functionality to TON

DEXs with non-standard order execution models, including limit order book-based exchanges

Automatic Compounder/Yield Optimizer