Cryptocurrency markets are bracing for volatility as approximately $2.06 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today.

How will expiring options affect market dynamics, and what are the notable data points that reveal the important stakes involved?

Key Insights on Bitcoin and Ethereum Options Expiration Today

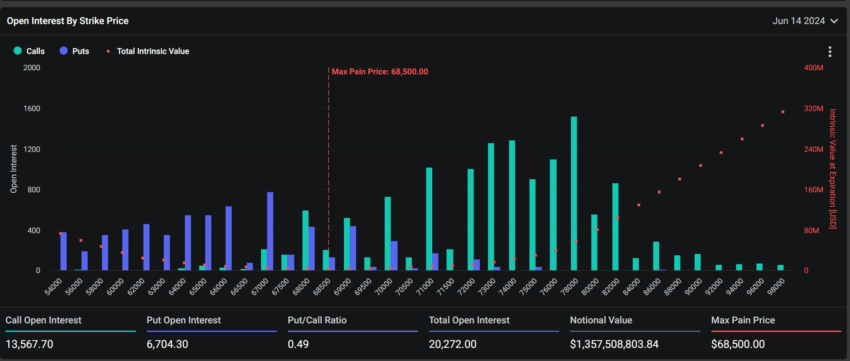

Approximately 20,276 Bitcoin options contracts are scheduled to expire today. The notional value of these contracts is $1.35 billion and the put-call ratio is 0.49. In cryptocurrency options trading, this ratio means that buy options (calls) are more dominant than sell options (puts).

Read more: Introduction to Cryptocurrency Options Trading

The maximum stop loss for expiring Bitcoin options is $68,500. This is the price level at which an option holder can incur the greatest financial loss and represents an important threshold for market participants.

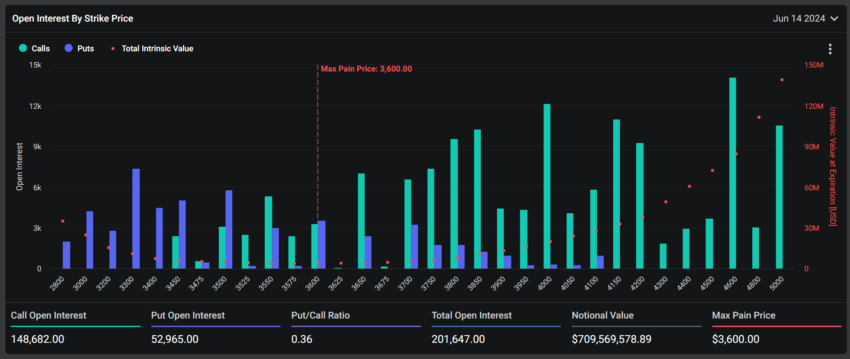

Additionally, 201,647 Ethereum contracts will expire simultaneously. According to data from Deribit, the notional value of these contracts is $799.76 million, with a maximum pain point of $3,600. Additionally, the data shows that the put-call ratio for this option is 0.36.

Adam, a macro researcher at options trading tool Greeks.Live, shared insights on Bitcoin and Ethereum contracts expiring today. He emphasized the importance of macroeconomics this week.

“This is an important week for the macroeconomy . Economic indicators are relatively favorable for the venture capital market. The US stock marketrose significantly, but the cryptocurrency market was sluggish . Mainstream coins fell overall, and altcoins fell even more. “There are few hotspots in the market these days and the market is relatively quiet,” he noted.

He then explained volatility and potential strategic moves by traders.

“Currently, BTC’s major short-term and medium-term implied volatilities are all below 50%, and Ethereum’s major short-term and medium-term [implied volatility] IVs are all below 60%. Both are priced at relatively low levels, offering buyers great value for money. “At the end of this month, there will be news on the approval of the [spot] Ethereum [exchange-traded fund] ETF, so we can prepare in advance for next month’s call options,” Adam suggested.

Bitcoin and Ethereum are facing price declines ahead of this expiration. Bitcoin, which was trading at $71,643 on June 7, briefly fell to $66,254 on June 11, then recovered to $69,945 on June 12 .

Bitcoin is currently trading at $67,064, down 6% over the past week. Meanwhile, Ethereum is trading at $3,519, down 7.8%.

Read more: 9 Best Cryptocurrency Options Trading Platforms

Option expirations can cause temporary market turmoil, but often stabilize soon after. Traders must remain vigilant by analyzing technical indicators and market sentiment to effectively navigate expected volatility.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.