Author: Sunil Jagtiani, Bloomberg; Translated by: Wuzhu, Jinse Finance

Stocks and bonds have delivered higher returns than bitcoin this quarter, raising the possibility that the cryptocurrency boom is losing steam.

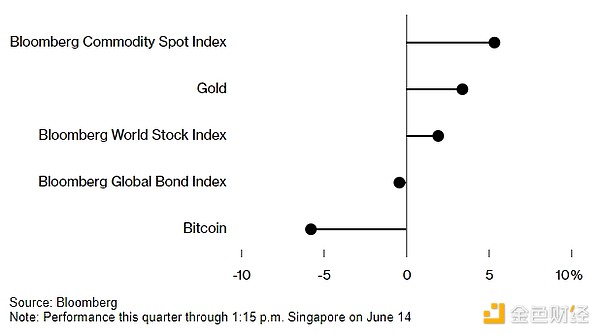

Gauges of global equities, fixed income and commodities are all ahead of the largest digital asset , with bitcoin down about 5% from the beginning of April as of 1:15 p.m. Singapore time on Friday.

Bitcoin has retreated since hitting a record of $73,798 in March, and attempts to rally back to that peak have repeatedly failed. Inflows into U.S. bitcoin exchange-traded funds or optimism about an eventual rate cut by the Federal Reserve haven’t done much to change the market.

Bitcoin has underperformed traditional assets so far this quarter

For Noelle Acheson, author of the Crypto Is Macro Now newsletter, most of the subscribers to the U.S. ETF, which was established five months ago, are likely to come from existing bitcoin holders. “In other words, not all ETF inflows represent new money entering the market, and only new money can drive prices,” she wrote.

The team, led by JPMorgan strategist Nikolaos Panigirtzoglou, also explored the nature of demand for the products, which have attracted about $15 billion in net inflows so far, according to data compiled by Bloomberg.

They said that “digital wallets on exchanges may have shifted en masse to the new spot bitcoin ETF.” Excluding these factors, they estimate net inflows into cryptocurrencies this year (including ETFs, venture portfolio financings and the “impulse” implied by CME Group futures) to be $12 billion.

The 'skeptical' strategist

That’s down from about $45 billion in 2021 and about $40 billion in 2022, the strategists wrote in a note, adding that they are “skeptical” whether the current pace of inflows for 2024 will continue through the end of this year.

Bitcoin was trading at $66,750 as of 1:15 p.m. Singapore time on Friday. Bitcoin prices have risen fourfold since the beginning of last year, recovering from a bear market in 2022. The coin's biggest supporters believe prices of $100,000 or more will be achieved over time, while critics say the cryptocurrency lacks intrinsic value.

Bitcoin rose 67% in the three months to March, far ahead of an index of traditional assets. This quarter, the Bloomberg Global Bond, Stock and Commodity Index went from being essentially flat to rising more than 5%, enough to outperform Bitcoin.

Acheson said selling of bitcoin by bitcoin miners in response to tougher conditions could be another reason for bitcoin’s recent lackluster performance. Miners receive bitcoin as a reward for operating powerful computers that underpin the digital ledger. The reward is halved every four years, and the latest halving in April created a more challenging environment for mining operations.