As we continue to oscillate between “it’s over” and “it’s all over again”, those intraday fluctuations have the power to make the average person feel mentally overwhelmed if you stare at the charts all day. From violent sell-offs to strong CPIs, sentiment continues to fluctuate. When we look back on these emotions in a few months, they will seem minor in the macroeconomic picture.

Such sentiment stems from concerns that assets could suffer further losses and worries that they have not earned enough in the current economic cycle, but these concerns are largely unfounded.

It’s becoming particularly annoying at this stage as we seem to inevitably encounter a breakdown in standard curve clearing at times of heightened market uncertainty.

Still, it’s important to make sure you don’t get caught up in the psychological tactics your mind may be using. Having a firm belief that you can easily handle the fluctuations in your investments seems to be the best strategy.

Okay, with that out of the way, let’s take a look at what happened this week.

Market Summary:

- Fierce arbitration and game subsidy incidents occurred one after another.

- Trump wants remaining Bitcoins to be mined in the United States.

- Tapioca DAO finally launched their TGE two years later and is still active.

- Friend Tech announced that they are building their own chain.

- ZKsync announces the launch of the ZK token and airdrop checker.

- Cheese Chain launched the latest L3.

- Ionet and Aethir launched their tokens.

- Symbiotic Fi is released, becoming another competitor to Eigenlayer.

- Norway returns $6 million in funds stolen from Axie Infinity.

- UwU Lend was exploited.

Capital flows

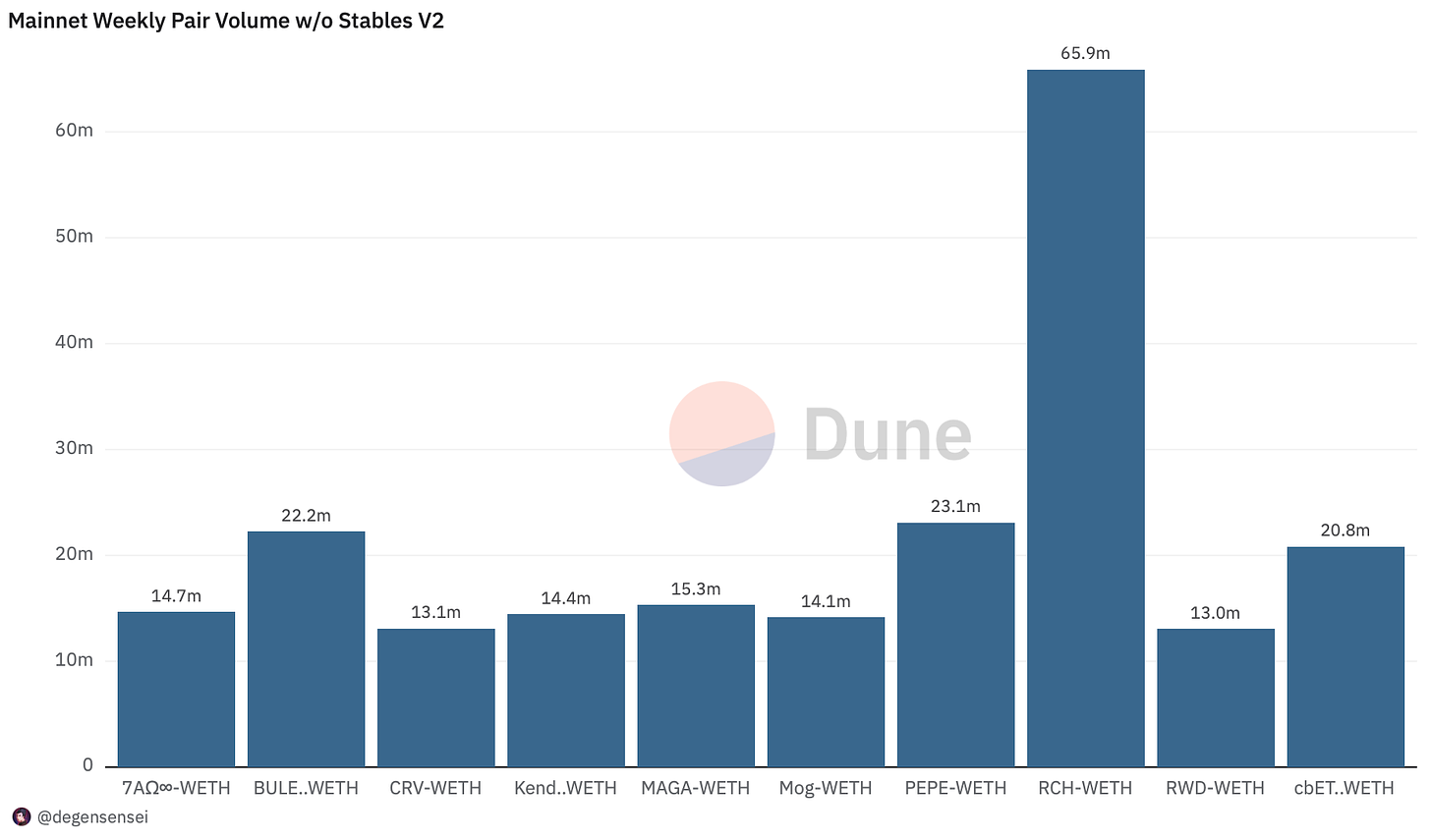

Solana is pulling money from every other ecosystem, with a lot of activity concentrated on this platform because that’s where retail traders currently live. If you’re “waiting for retail” during this cycle and not on Solana, you’re probably in the wrong place.

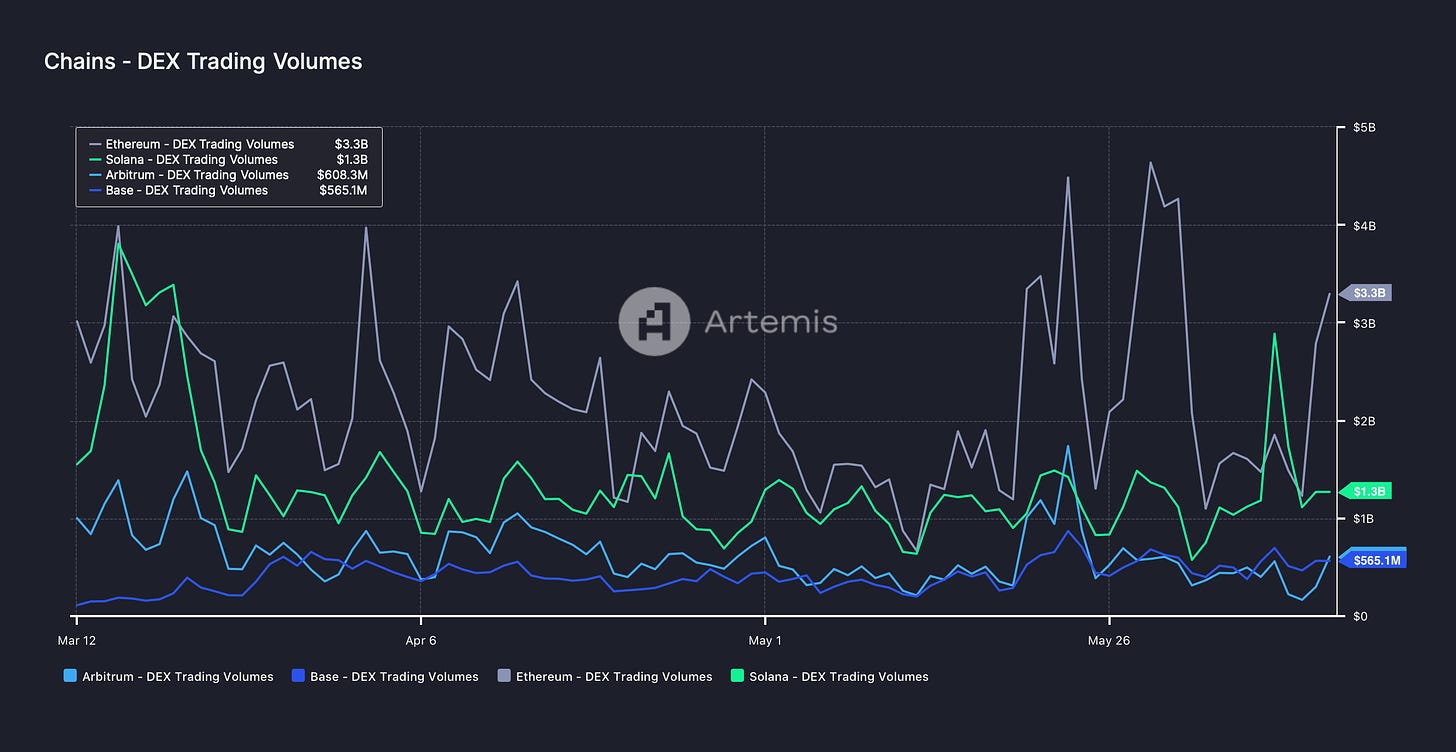

DEX Volume

While major currencies (BTC and ETH) are seeing a significant drop in volume, DEX volumes are still up compared to last week. Ethereum mainnet and Solana appear to have seen a surge in activity as on-chain degens engage in PvP battles with each other. If you are not on-chain, the current market environment is certainly unbearable.

This week's on-chain transaction volume appears more concentrated than last week. Among them, the newly launched token RCH performed particularly well, with its price soaring from 0.2 to 4 in just two days over the weekend, and is currently in a resting phase. In addition, it has spread among memecoin and CRV as degens on the chain are trying to catch the next hot topic.

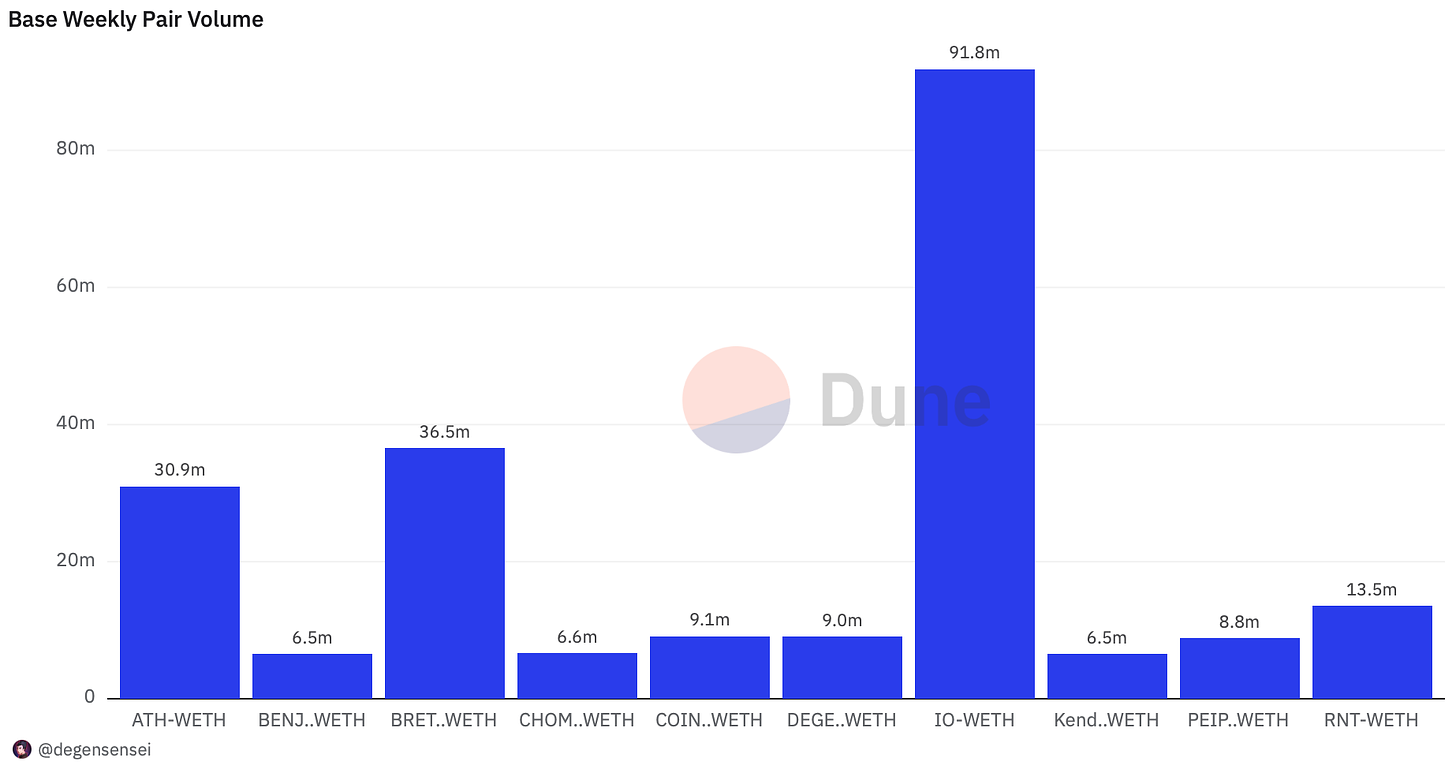

On the Base platform, the Ionet token is a scam that should be ignored, but the real focus remains on those tokens launched on Solana last week. At the time of writing, the Base platform is dominated by Brett, with the leading memecoin reaching 1.3B, still performing well in the red market. Meanwhile, strong low-cap/mid-cap memecoins such as Chomp and Benji are competing fiercely, while DEGEN is underperforming.

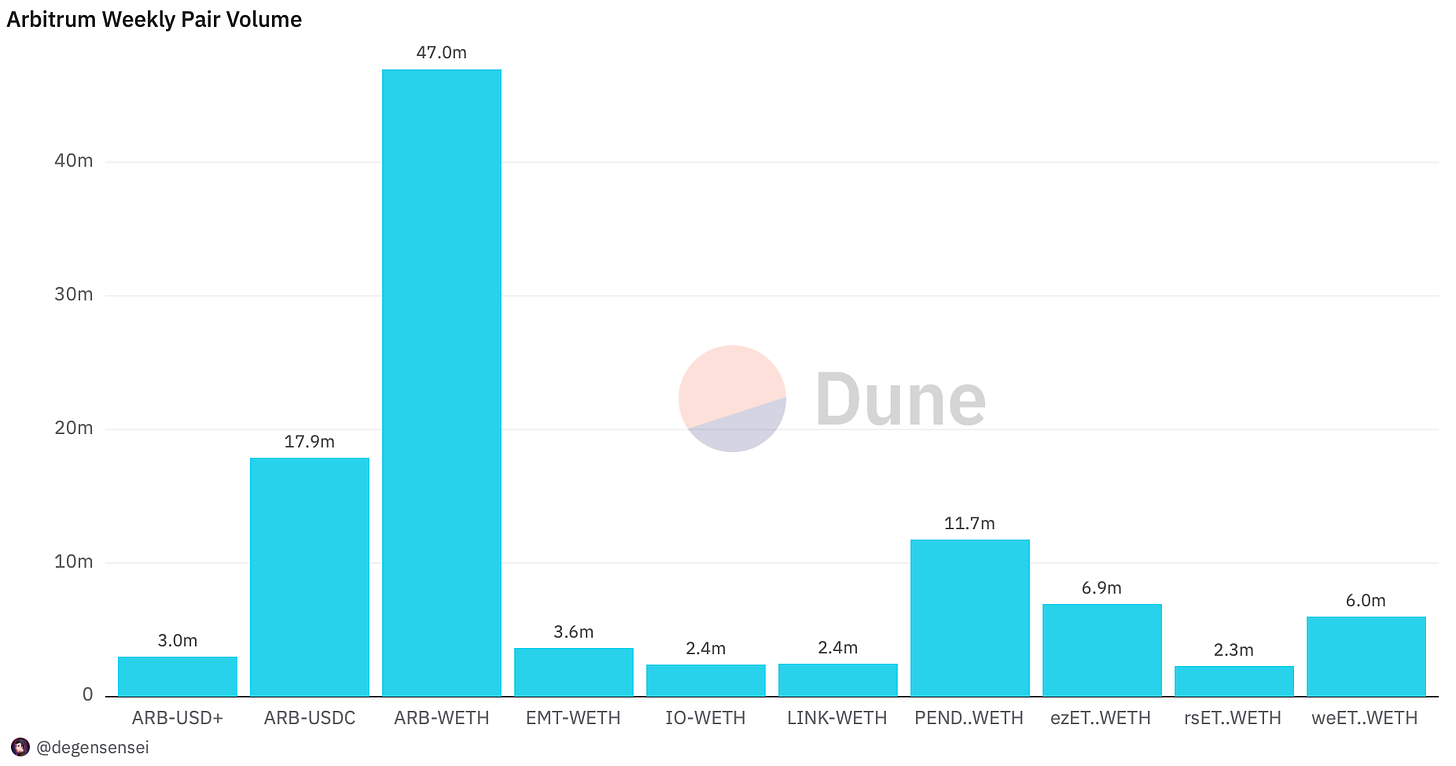

On-chain activity in the Arbitrum ecosystem remains tepid, currently supported mainly by ARB, DMT, and PENDLE, with the rest largely dormant. The ecosystem primarily gains rewards as a settlement layer through the growing number of L3s built on top of Arbitrum Orbit.

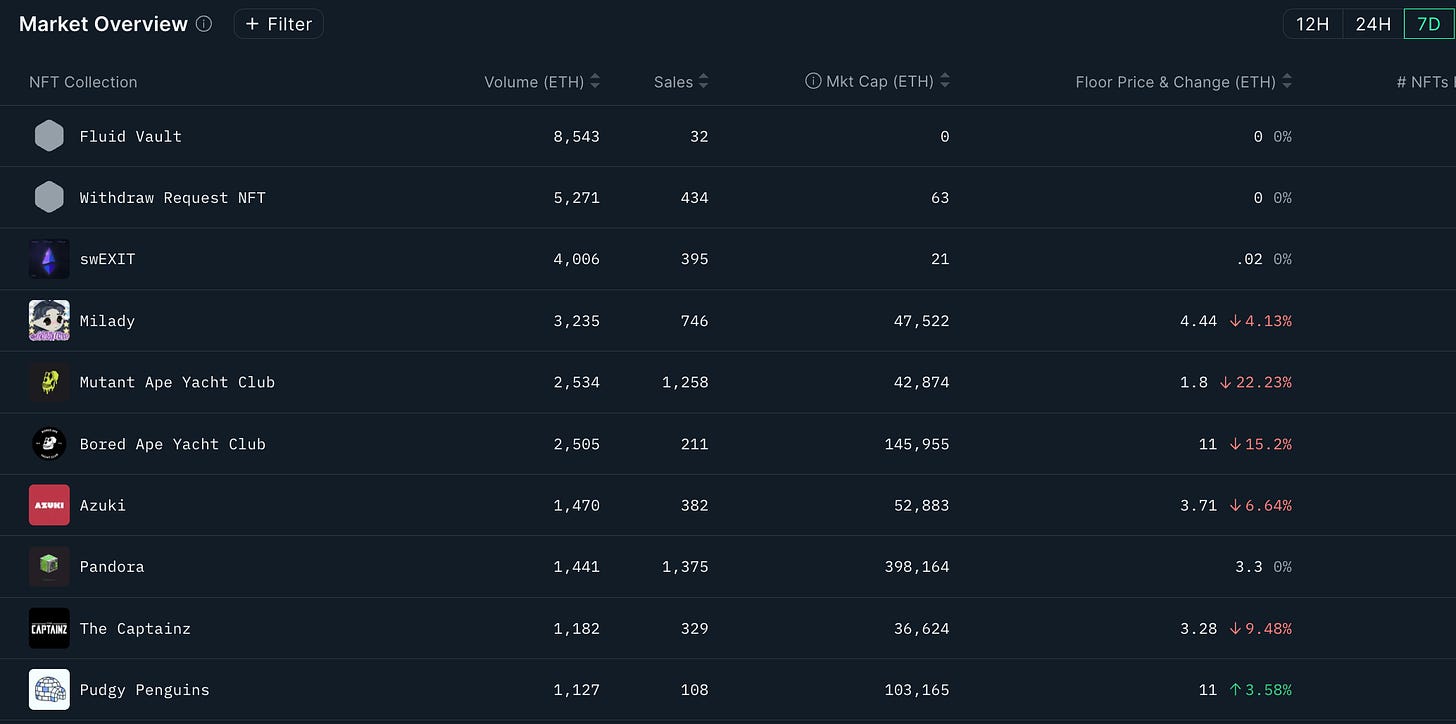

NFT Trading Volume

Compared to the rest of the NFT market, Pudgy Penguins, while not as influential, has shown some strength and continues to lose value. I firmly believe they will only revalue when the market cycle ends and people want to show off their gains by buying expensive NFTs after making great returns elsewhere.

Furthermore, the same weakness is visible in multiple serial numbers. However, if you minted the NFT of FU Studio that I mentioned earlier, then the airdrop of FU is coming soon.

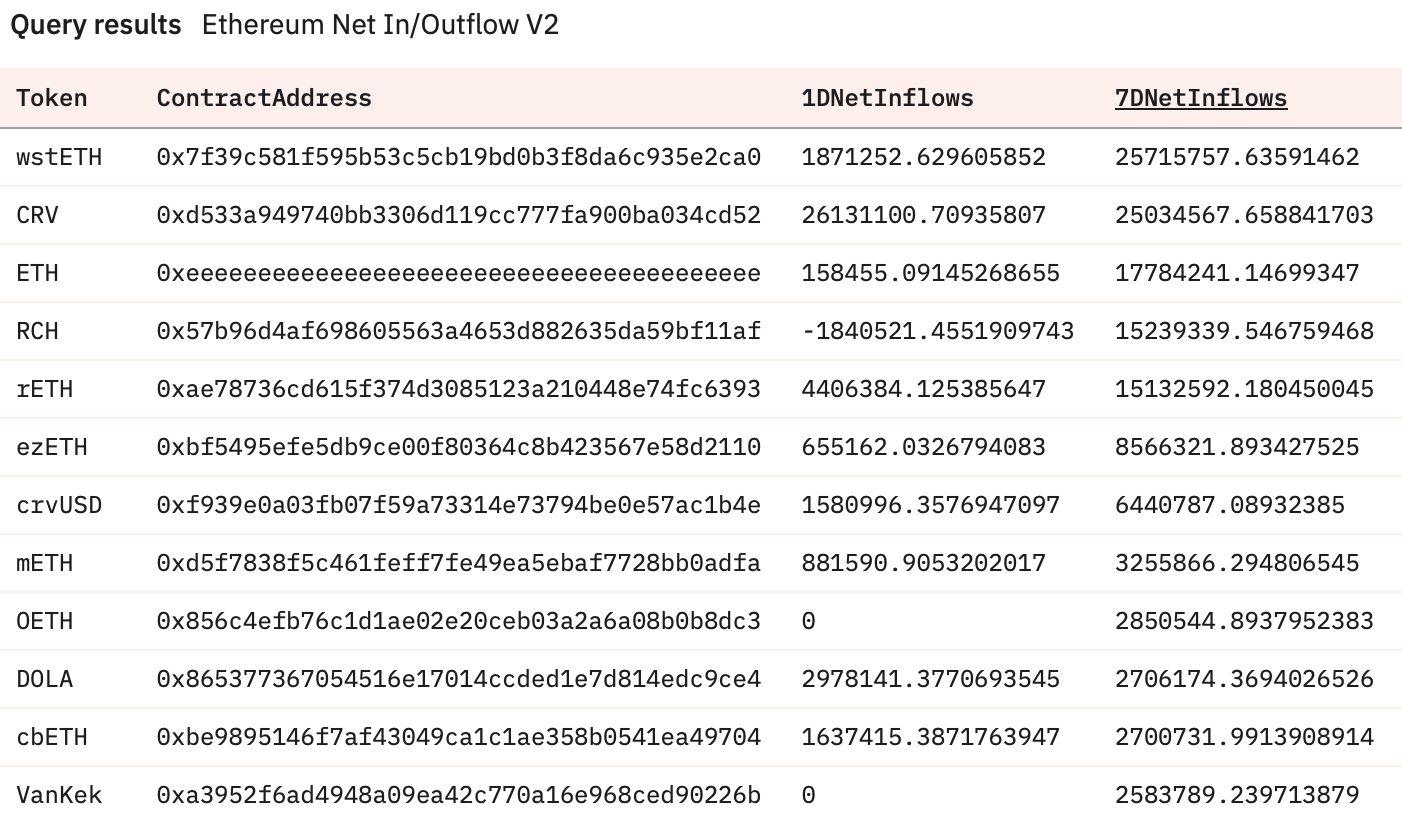

Net Inflow

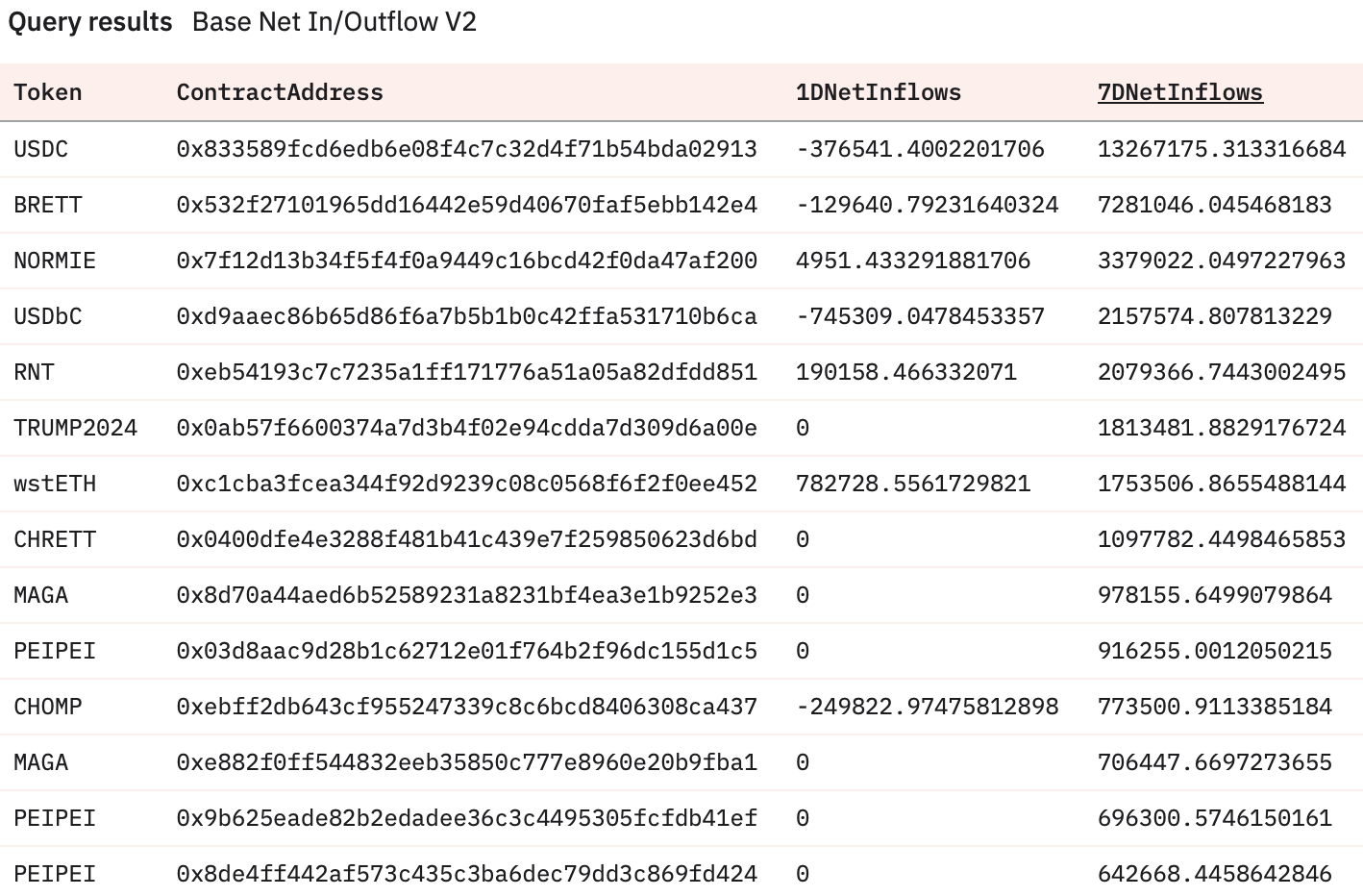

Given the general weakness or uncertainty in the market, we are almost used to being affected by the FUD of CRV loans from founder Michael Egorov, which may have caused multiple protocols to be hit by bad loans. Although RCH has seen huge trading volume on the weekend, it has seen a large sell-off in recent days. In addition, it is usually seen in this chart that people are de-risking based on the assets purchased in the past 7 days, and there are positive capital inflows.

Brett continues to lead the accumulation flow, followed closely by Normie, which has been doing well so far despite the recent unfortunate exploit, and time will tell if it can recover to its previous heights. Nonetheless, it is very telling that USDC has been the main source of inflows over the past 7 days as memecoin has experienced a sell-off.

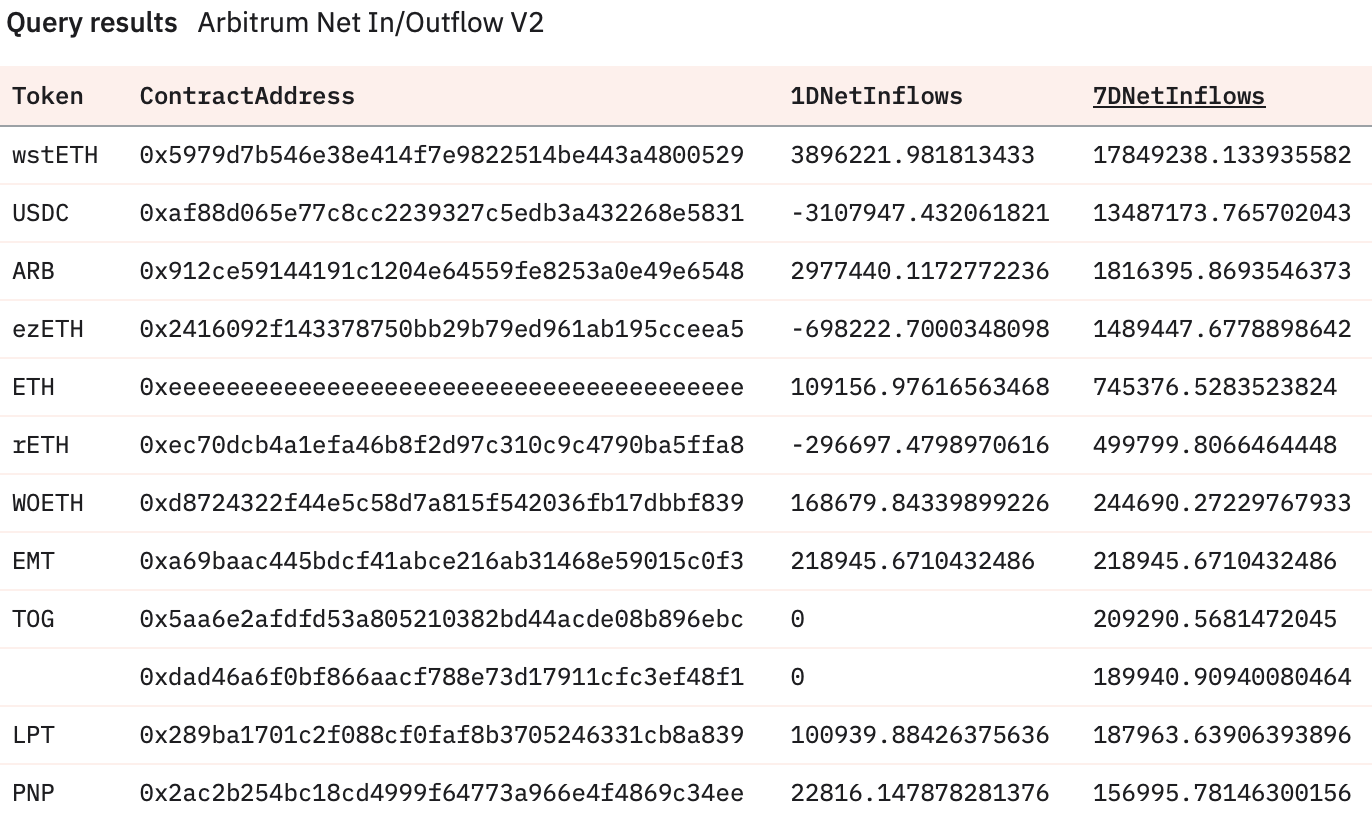

Nothing exciting happening here except people are accumulating a lot of wstETH and USDC, most likely for de-risking or farming now that the LTIPP incentives have kicked in. While the market is moving sideways, if you are willing to take on smart contract risk in exchange for some extra yield, then parking your funds in DeFi farming is indeed a good option.

Investigation

A wallet that suffered great pain when trading FRIEND, presumably belonging to Machi. Things get complicated when high conviction goes wrong.

You can view the details here: https://debank.com/profile/0xf0ea13334d6f74044ec7332de1c6ec194179df3d/

Token Unlock

Here are a few important dates and their corresponding token unlocking amounts and values:

- IMX: 1.72% unlocked on June 14, worth $47.23 million

- CYBER: 3.96% unlocked on June 14, worth $6.57 million

- STRK: 4.92% unlocked on June 15, worth $64.7 million

- RNDR: 0.20% unlocked on June 16, worth $6.59 million

- ARB: 3.20% unlocked on June 16, worth $86.92 million

- APE: 2.48% unlocked on June 17, worth $16.85 million

- NYM: 0.37% unlocked on June 17, worth $414,080

- MANTA: 2.05% unlocked on June 18, worth $9.27 million

- ZetaChain: 2.33% unlocked on June 18, worth $573.88 million

At this stage of the economic cycle, the most important thing is to stay alive. The bull market may seem fun, but it is not easy, contrary to common expectations. It feels great to get more done, look back on the experience, and finally get the expected results at the finish line.

Stay strong and good luck.