Bitcoin (BTC) saw a sharp price correction last week, sparking fear among investors. But things may soon change as there are high chances of the trend reversing as BTC is mimicking its 2017 price trend.

BTC price chart – 1 day | Source: TradingView

The Nasdaq Composite edged higher on Friday to close at a record for the fifth straight session.

The tech-heavy index inched up 0.12%, ending the session at 17,688.88. The S&P 500 decreased slightly by 0.04%, closing at 5,431.6 and the Dow Jones slid 57.94 points, or 0.15%, to close at 38,589.16.

The University of Michigan Consumer Survey showed consumer sentiment falling to 65.6 in June from 69.1 in May. This was also below the Dow Jones estimate of 71.5.

Eight of the 11 S&P 500 sectors slid during the session, with communications services, information technology and consumer staples the only gains.

Hopes of continued cooling in inflation boosted the S&P 500 and Nasdaq this week, as both ended the week about 1.6% and 3.2% higher, respectively.

Wholesale inflation unexpectedly fell 0.2% last month, while economists polled by Dow Jones expected the index to rise 0.1%. This comes after the monthly consumer price index remained unchanged in May.

Elsewhere, shares of software giant Adobe rose 14.5% on Friday after second-quarter financial results beat Wall Street estimates. In contrast, declines in Caterpillar and Boeing weighed on the Dow, while Carnival and Norwegian Cruise Line were the S&P 500's biggest decliners.

Bitcoin has dropped more than 7% in the past 7 days, pushing its price once again below the $67,000 mark. Bears brought the price close to $65,000 , before buying emerged, pulling BTC back to just above $66,000 at the moment.

Meanwhile, Milkybull, a famous crypto analyst, recently posted a tweet highlighting the interesting development. Accordingly, BTC is mimicking the trend it followed in 2017 before initiating a bull run.

The tweet revealed that, BTC is about to hit a market Dip , after which, if history repeats itself, the leading asset could launch a bull run. Additionally, an indicator is also showing a bullish divergence, just like in 2017.

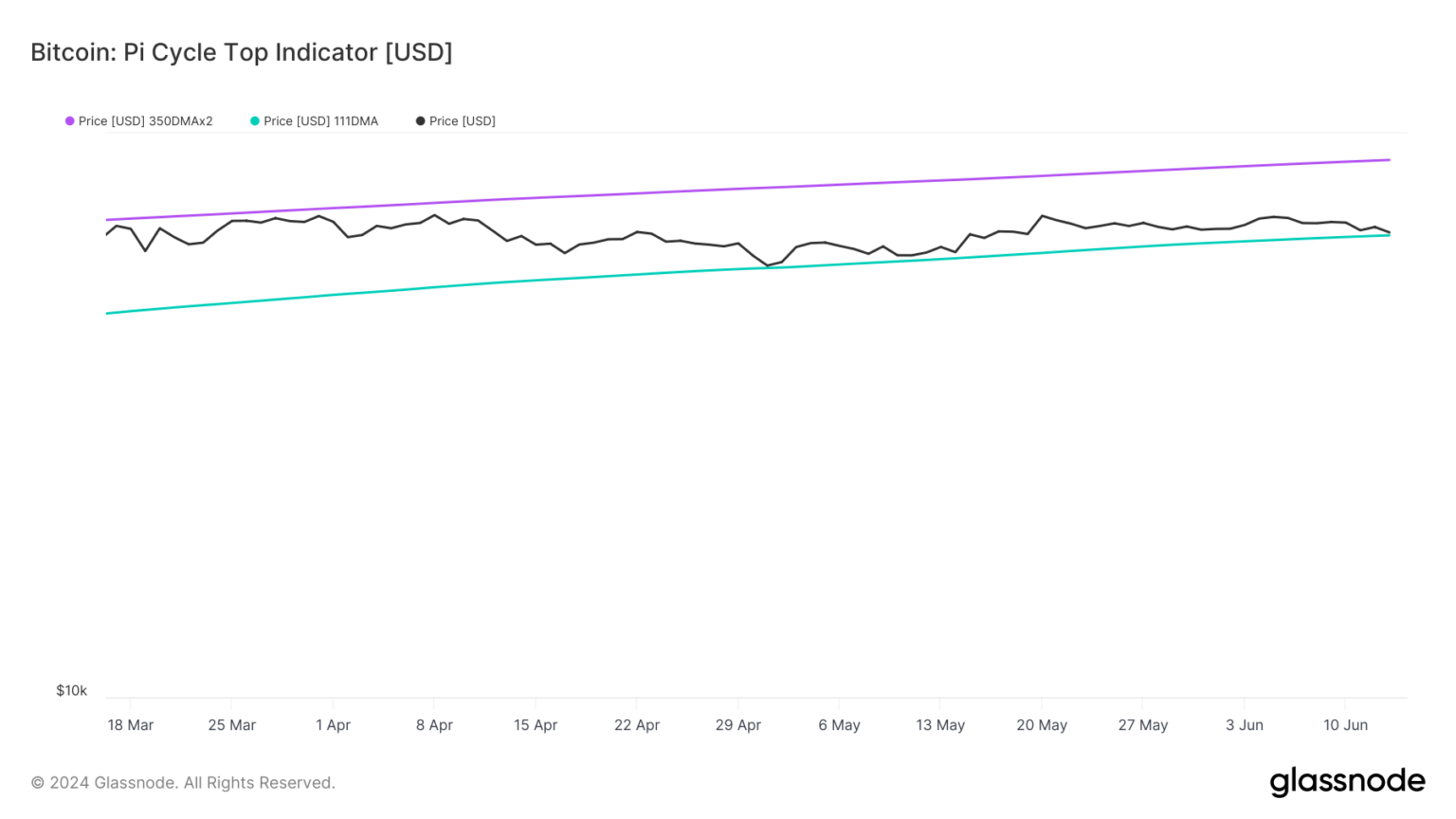

Even Glassnode data analysis shows a bullish indicator.

According to the Pi Cycle Top indicator, Bitcoin price is at a market Dip and if a trend reversal occurs it could soon reach the $89,000 mark.

Source: Glassnode

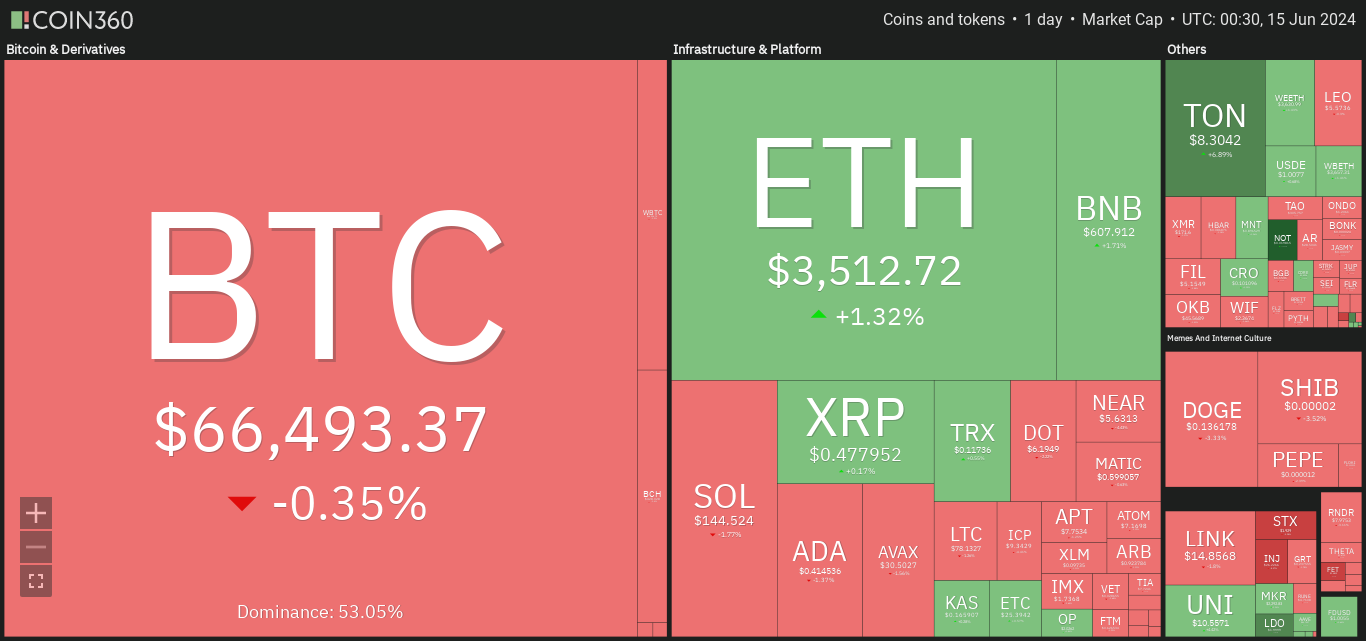

The altcoin market had mixed movements yesterday.

On the upside, Notcoin (NOT) is the best performing project, erasing all losses over the past 7 days with an impressive growth of more than 14%.

Followed by Lido DAO (LDO) and Toncoin (TON) as both Token simultaneously increased by 6% on the day.

Other projects such as Akash Network (AKT), Core (CORE), Uniswap (UNI), Ethena (ENA), GateToken (GT), Gnosis (GNO), Maker (MKR), BNB (BNB)... increased slightly from 1 -3%.

In contrast, Injective (INJ), Ronin (RON), Fetch.ai (FET), Stacks (STX), SingularityNET (AGIX), Conflux (CFX), Bonk (BONK), Worldcoin (WLD), DYDX (DYDX), NEAR Protocol (NEAR), Sei (Sei)… lost 4-9% of their value.

Source: Coin360

Bears continue their efforts to pull Ethereum (ETH) lower, establishing a local Dip around $3,362. However, buying pressure has since appeared, pushing the price back close to the $3,500 area at the moment.

ETH Price Chart – 1 Day | Source: TradingView

You can XEM coin prices here.

Join Bitcoin Magazine's Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

Bitcoin Magazine