There has been a lot of discussion about which altcoin could receive exchange-traded fund (ETF) approval next. Among the candidates, Solana (SOL) is gaining attention as it has significant market share and a strong following.

Solana, the fifth largest cryptocurrency with a market capitalization of over $66 billion, is also called the “Ethereum killer.” Due to this reputation and popularity, it is considered a strong candidate for ETF approval. However, significant hurdles must be overcome to obtain approval.

Obstacles to Solana’s ETF Approval

Solana's main challenge is the lack of a regulated futures contract market. Unlike Bitcoin or Ethereum, whose futures products are listed on major U.S. exchanges such as the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE), Solana has not yet reached this stage.

At the end of May, there were rumors that the Chicago Mercantile Exchange (CME) had refused to list the Solana futures fund. Bloomberg ETF analyst James Seipart says the lack of regulation of the futures market is a significant barrier that could take years to overcome.

“Given current precedent and need, a CFTC-regulated futures market will likely emerge within a few years. But it could happen sooner if Congress and market structure legislation like FIT21 were passed,” says Seyfat.

Another major hurdle is approval from the Commodity Futures Trading Commission (CFTC), which oversees the futures market.

Additionally, the U.S. Securities and Exchange Commission (SEC) classified Solana as a security in its lawsuit against Coinbase and Kraken. Neither Bitcoin nor Ethereum have been designated as securities by the SEC, so this classification poses a major obstacle to receiving ETF approval.

Industry experts remain skeptical

Some industry experts are skeptical about the viability of Solana and other cryptocurrency ETFs.

For example, Nikolaos Panigirzoglu, managing director and global market strategist at JPMorgan, expressed doubts about the approval of the Solana ETF, citing the SEC's unclear stance on the status of various cryptocurrency assets.

“I doubt it. With uncertainty surrounding whether Ethereum should be classified as a security, the SEC's decision to approve the Ethereum ETF is already delayed. “I don’t think the SEC will go further in approving Solana or any other token ETF because there is a stronger opinion (compared to Ethereum) that tokens other than Bitcoin and Ethereum should be classified as securities,” Panigirzo said. Glu said:

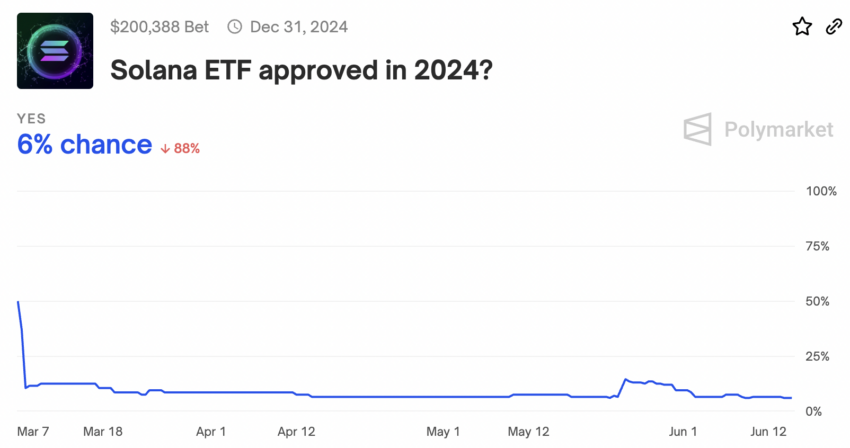

On the other hand, according to Polymarkets, there is only a 6% chance that the SEC will approve the Solana ETF by the end of 2024. Meanwhile, no major U.S. company has yet officially applied for Solana ETF approval from the SEC.

Current Solana-based financial products in the U.S. include the Grayscale Solana Trust, which is listed on European stock exchanges, and 21Shares' Solana Staking ETP (ASOL).

“I think Solana will surpass Ethereum in the future. So far, I think that's true, but I've never heard of a Solana ETF in the U.S.,” said Anthony Pompliano, an investor at Pomp Investments.

The approval of Bitcoin and Ethereum ETFs has fueled speculation about Solana-based ETFs, but significant regulatory challenges remain. Nonetheless, the Solana community is hopeful for positive results in the near future.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.