As the cryptocurrency market has recently experienced great turmoil, questions are being raised as to whether the current bull market for Bitcoin and altcoins can continue.

Analysts and industry insiders offer diverse perspectives on the future of Bitcoin and altcoins, reflecting market trends, macroeconomic factors, and investor behavior.

Analyst predictions for Bitcoin and altcoins

Bitcoin investor Murad Mahmudov showed two possible scenarios for Bitcoin's future. He said the bull market could continue as per its typical four-year cycle if prices remain above $60,000.

However, depending on macroeconomic conditions, a global economic downturn may cause the price of Bitcoin to fall to $30,000.

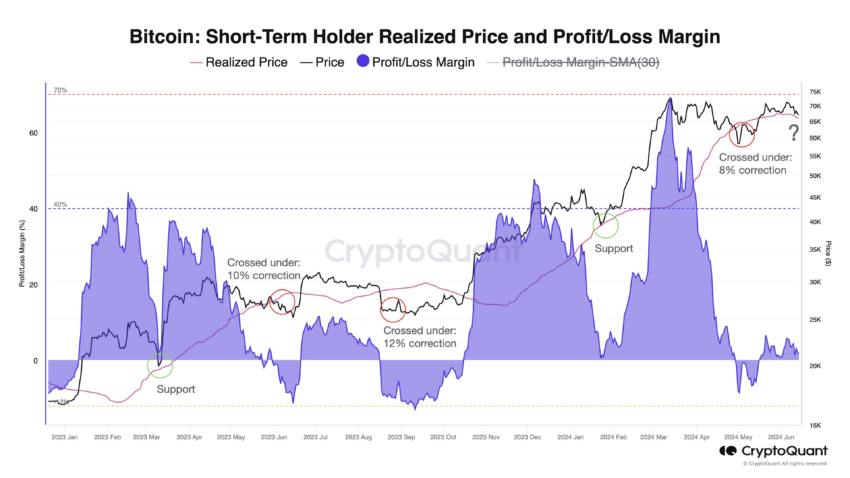

Likewise, Julio Moreno, head of research at CryptoQuant, pointed out that there is a high probability that Bitcoin will reach $60,000. He said Bitcoin is at a critical price level around $62,800, the realized price for short-term holders.

This indicator could provide support or lead to an 8% to 12% correction if Bitcoin falls below this level, with Bitcoin likely to fall to around $60,000.

From a technical perspective, trading veteran Peter Brandt warned that a break above the $60,000 support line could lead to further declines. He noted that a drop below $60,000 could send Bitcoin down to $48,000.

Read more: Bitcoin (BTC) price prediction for 2024/2025/2030

Meanwhile, market analyst Bob Lucas took a more dovish stance, predicting a bottom similar to last summer. He highlighted the likelihood of this pattern repeating itself and said patience may be needed until the market stabilizes.

“The bottom of last summer was clearly visible this summer. That’s not to say it will be repeated, but it serves as a reminder of what can happen and what patience may be required,” says Lucas.

Will Clemente, co-founder of Reflexivity Research, also predicts a bottoming out phase. He has adjusted his investment strategy to maintain only his core Bitcoin holdings and a few other positions.

Clemente believes Bitcoin could move sideways over the summer, but the price is likely to rise in the fourth quarter, influenced by economic indicators and Federal Reserve action.

Andrew Kang, co-founder of Mechanism Capital, expressed a cautious stance on altcoins. He said he was not sure if the momentum from the approval of the Bitcoin exchange-traded fund (ETF) would extend to altcoins, particularly Ethereum. His opinion is that Bitcoin may see increased interest, but it is questionable whether the same will happen to the Ethereum ETF .

Read more: What is altcoin season ? Comprehensive Guide

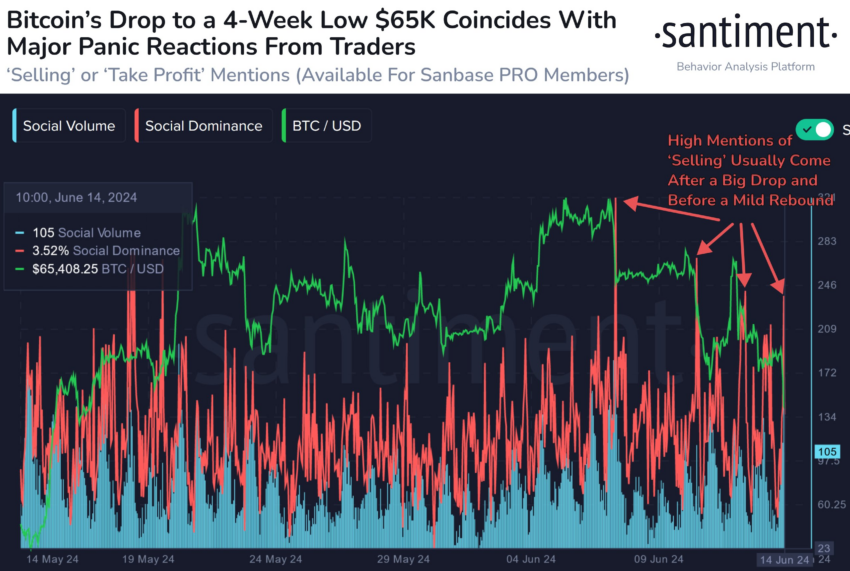

Despite the pessimistic outlook, analysts at blockchain analytics firm Santiment noted the current market sentiment. They say fears are growing among investors as the price of Bitcoin falls to $65,000. If panic selling continues, this fear could lead to a temporary bounce and buying opportunity.

“It is common to see a surge in talk of selling or profit-taking following a decline, and if FUD and panic among small traders persists, a temporary bounce and buying opportunity may form,” Santiment explained.

In summary, the future of the Bitcoin and altcoin bull market is uncertain. Potential outcomes range from a significant correction to a period of bottoming out. The direction will vary greatly depending on macroeconomic factors and changes in investor sentiment.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.