The price of Ethereum (ETH) disappointed investors, falling from $4,000 to below $3,500.

Due to this, many Ethereum holders are moving to exchanges to minimize their losses.

Loss of trust among Ethereum investors

Ethereum's price decline is causing Ethereum holders to become increasingly skeptical, with many selling their holdings to offset losses.

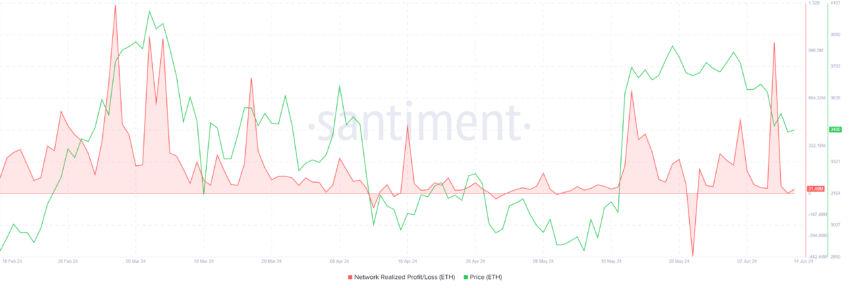

Looking at the Network Take Profit and Loss metric, there has been a surge in take profit over the past few days. The surge in this indicator is the largest in three months, and this selling trend was also observed during the Ethereum rally in March. However, this is happening because the optimization for additional returns is decreasing.

The sellers that caused the most concern on the network were long-term holders. These investors tend to hold their assets for more than a year. Hodling in a bear market signals confidence and confidence in a recovery. On the other hand, their selling causes the bears to rise sharply, causing prices to fall further.

This can be seen in Ethereum consumption, where spikes indicate an increase in supply within an address. This tends to indicate a decline in confidence among investors.

In the case of Ethereum , a surge in this indicator is not a good sign for the cryptocurrency asset. This shows that long-term holders are uncertain about the future recovery.

Read more: What is the Ethereum Cancun-Deneb (Dencun) upgrade ?

Ethereum Price Prediction: Another Drop

Ethereum price, trading at $3,578, is facing resistance at the 50% Fibonacci retracement level. As investor weakness increases, this resistance may become stronger, causing Ethereum to fail to break through .

The possibility of a downside would stop at $3,400, just above the 38.2% Fibonacci level, which has been tested as support several times in the past.

Read more: Ethereum (ETH) price prediction 2024/2025/2030

On the other hand, a successful break above the 50% Fibonacci line of $3,582 and turning into support would invalidate the bearish logic. If this happens, the price of Ethereum could recover its losses and rise back up to $3,800;

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.