Key Takeaways

- The crypto industry is cyclical in nature, with periods of rapid growth, often spurred by sustained market rallies, leading to huge advances in adoption, awareness, and education. This will undoubtedly be the case with the 2024 market cycle.

- Cryptocurrency adoption and awareness have surged this year, with metrics ranging from the number of vendors accepting digital currencies to survey responses reflecting the assets’ growing mainstream appeal.

- Binance has welcomed a large number of new users and trading activity has continued to increase, reflecting the continuous improvement of platform adoption and users' trust in our platform.

No longer limited to trading and investing, digital assets are increasingly integrated into our daily lives, revolutionizing the way we transact, interact, and create. Cryptocurrency adoption has made tangible progress over the past year. The industry moves in cycles, with periods of rapid growth often spurred by sustained market rallies, leading to huge advances in adoption, awareness, and education.

Recent industry developments, such as the approval of a spot BTC ETF in the U.S. and major regulatory developments around the world, have catalyzed a massive demand and interest in blockchain and digital assets. However, this momentum is not simply a product of recent events; it is the result of years of gradual adoption, investment, and efforts in education, security, and compliance by the community and industry leaders like Binance. Forward-looking players in the space understand the cyclical nature of the industry and are always preparing for the next wave. Here are some of the areas where digital assets have made new progress over the past year.

The rise of cryptocurrencies in everyday transactions

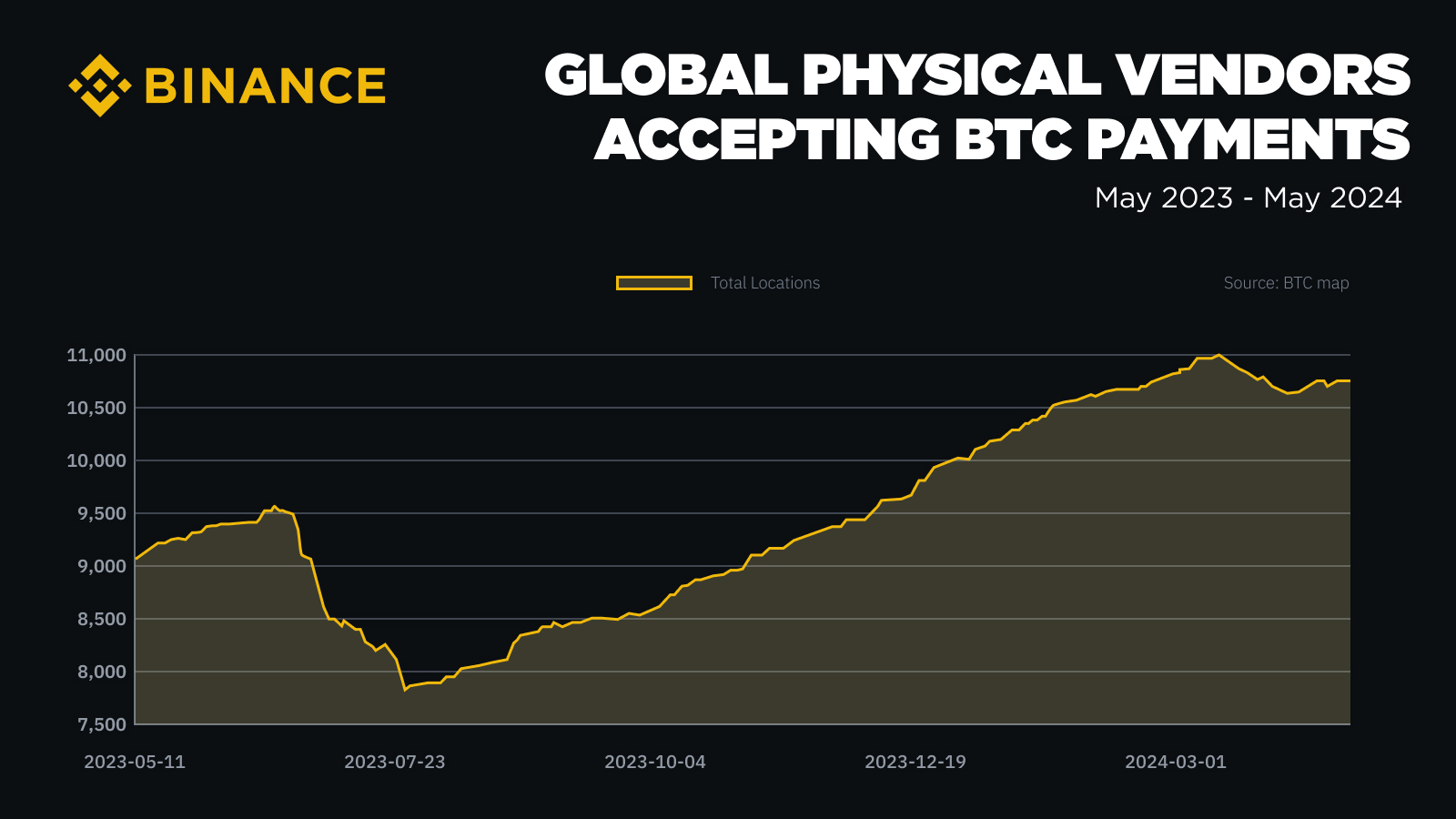

The growing number of vendors accepting digital currencies as a direct form of payment speaks volumes about the mainstream appeal of cryptocurrency. From small businesses to large enterprises, the adoption curve is steepening as merchants recognize the benefits of crypto payments, including attracting new customers and reducing transaction fees, according to a recent Deloitte survey. This shift in acceptance is more than just anecdotal; it’s backed by data showing a significant increase in the number of vendors accepting crypto payments. According to community-driven tracker BTC Map, the total number of vendors accepting cryptocurrencies increased from 7,731 in October 2022 to 10,952 in April 2024, a 42% increase in less than two years.

Another clear sign of cryptocurrency’s integration into everyday life is the proliferation of cryptocurrency ATMs. Once rare, these machines can now be found in many locations around the globe, providing users with a tangible means to interact with digital assets in their daily lives. The surge in the global cryptocurrency ATM market highlights the growing preference for cryptocurrency as a method of payment. In fact, the global cryptocurrency ATM market soared from $115 million in 2022 to $181 million in 2023 , a 64% increase in just one year. With benefits such as bypassing high exchange rates during travel and facilitating remittances, cryptocurrency ATMs create a bridge between the digital and physical realms.

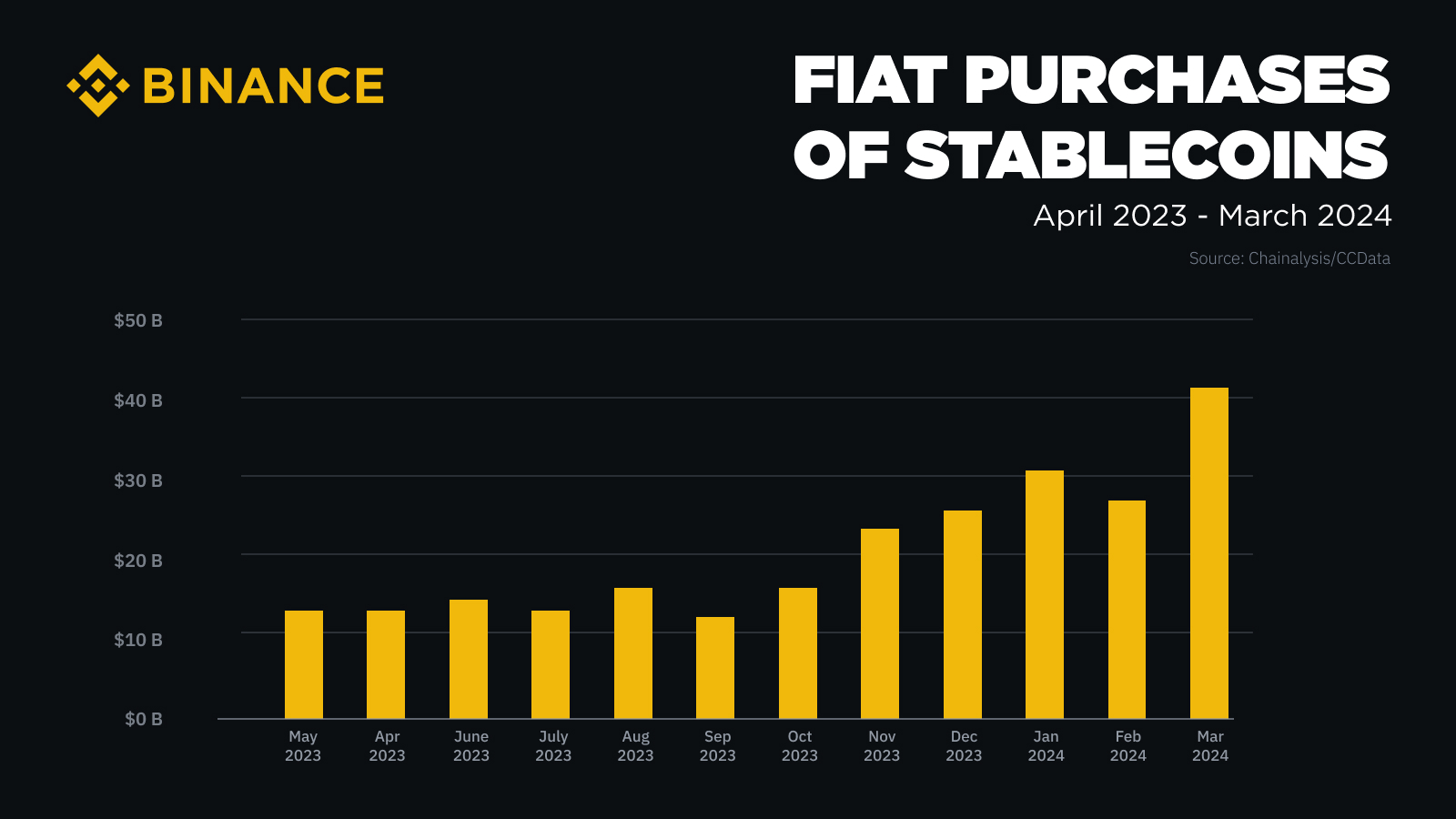

Stablecoins are one of the most important digital asset classes with great transaction utility. These assets are usually pegged to the US dollar and are widely used in daily transactions, especially for preserving value and facilitating cross-border transfers in the event of a national currency depreciation.

A recent Chainalysis report shows that the use of stablecoins has surpassed all other types of cryptocurrencies. The report also shows that the number of fiat currency purchases of stablecoins has been steadily increasing over the past year, including in countries where the national currency has depreciated significantly and those where capital flows are severely restricted. It is undeniable that stablecoins play a key role in facilitating daily crypto transactions.

Knowledge and trust: key drivers of adoption

The widespread adoption of any new technology depends not only on technological advancement and increased use cases, but also on knowledge and trust. High-profile industry events and recent market uptrends have helped to increase public awareness and understanding of cryptocurrencies.

According to a recent survey conducted by Consensys and YouGov across 15 countries, with 15,000 respondents, 92% of people worldwide have heard of cryptocurrencies, and 50% claim to understand what cryptocurrencies are. Organizations such as Binance Academy play a vital role in spreading accurate information about blockchain technology and promoting more informed discussions around digital assets.

Additionally, the same survey highlighted the changing narrative of cryptocurrencies. Globally, 16% of respondents said they see cryptocurrencies as the "future of money," while 11% said they are an alternative to the traditional financial system and the future of digital ownership. Confidence in the industry has clearly increased compared to previous years. These shifts can largely be attributed to increased investments in compliance and security measures by industry players such as Binance, clearer global regulatory frameworks, growing institutional adoption, and broader user education.

Another recent survey conducted by Paradigm found similar results among American voters, with 19% of American voters holding cryptocurrencies. This group accounts for about one-fifth of registered voters and is far from a niche group. According to the same survey, 69% of Americans are dissatisfied with the current financial system, which may mean an increased demand for alternative financial methods and tools.

In sync with these trends, the education landscape is also evolving to accommodate the growing interest in blockchain technology. An increasing number of higher education institutions around the world are offering blockchain-focused courses and majors to prepare the next generation of professionals for the complexities of the cryptocurrency industry. According to the Global Blockchain Business Council’s database of cryptocurrency higher education courses , there are currently 1,970 courses offered in more than 70 countries, covering blockchain, cryptography, compliance, business, supply chain, and more.

Binance: A snapshot of rising interest

Binance's latest data also vividly depicts the surge in interest in digital assets. So far in 2024, more than 30 million new users have registered to trade on Binance, and the platform's daily visits have doubled since the beginning of 2024, and the number of users participating in transactions per month has also increased significantly. In addition, Binance has also experienced a large inflow of crypto assets, bringing the value of customer assets held on the platform to more than $100 billion for the first time .

The surge in trading activity is reflected in a significant increase in spot trading volumes. According to CCData, in March 2024, the metric rose 121% to $1.12 trillion, the highest spot trading volume since May 2021. Similarly, derivatives trading volumes increased 89.7% to $2.91 trillion, also the highest level since May 2021.

The data speaks for itself: cryptocurrencies are no longer limited to investments, but have permeated every aspect of our lives. From daily transactions to education and institutional inflows, cryptocurrency adoption is increasing, marking a fundamental shift in the way we view and interact with money and digital assets.

While uncertainty may persist as the industry matures, the trajectory of cryptocurrency adoption appears unstoppable. As more individuals, businesses, and institutions embrace cryptocurrencies, they lay the foundation for a more inclusive, transparent, and decentralized financial system.