As the cryptocurrency market undergoes major changes, many analysts are cautioning against investing in altcoins.

Historically, in bull markets, Bitcoin and Ethereum rise first, followed by altcoins. However, current circumstances suggest a change in this pattern.

Why Buying Altcoins Now Is Dangerous

Quinn Thompson, founder of cryptocurrency hedge fund Recker Capital, advised against investing in altcoins at this time. He pointed out several indicators of market instability, including high leverage and open interest, lack of panic buying, and stagnant stablecoin supply.

He believes there is increasing selling pressure, especially on venture capital funds that need to raise capital, which is causing more selling than buying. This situation, combined with low summer trading volumes, makes it difficult for altcoins to gain traction.

“I think there are serious knock-on risks to cryptocurrencies, especially most altcoins, which I expect to take a step back. The market appears to have lost the ability to bounce back even in the majors, while leverage and open interest remain high,” says Thompson.

Thompson gave two main reasons for this position. First, the impact of Bitcoin and Ethereum exchange-traded funds (ETFs) and the issue of altcoin supply inflation.

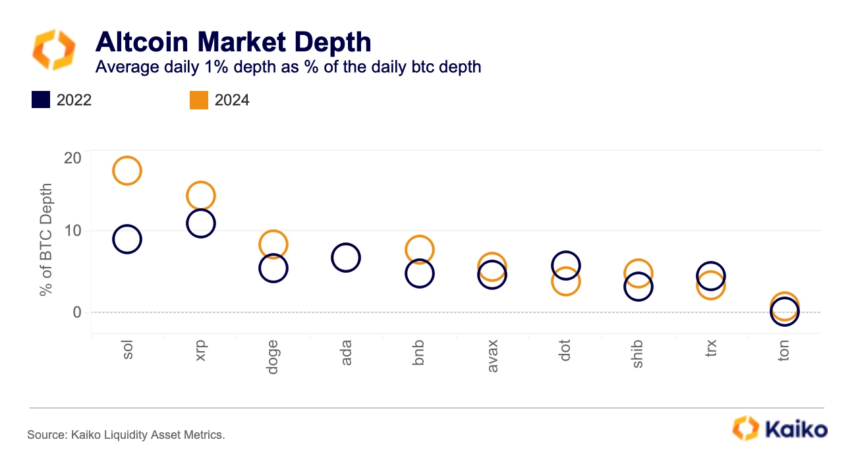

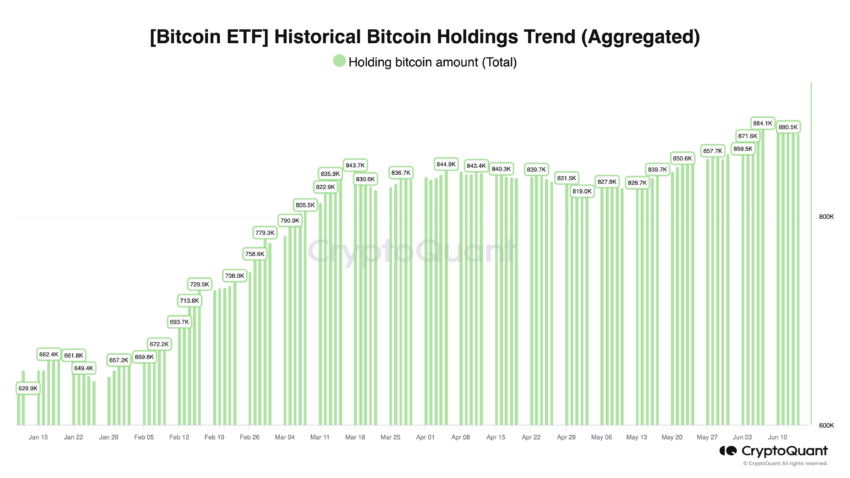

The introduction of Bitcoin and Ethereum ETFs has changed the market structure. In the past, during bull markets, capital flowed into altcoins from major cryptocurrencies such as Bitcoin and Ethereum. However, the fund, which currently has more than $50 billion invested in Bitcoin ETFs, does not have a similar mechanism for investing in altcoins.

These changes have limited the capital that can be invested in altcoins, making it more difficult for them to rise in value. Traditional market participants are increasingly focusing on Ethereum for tokenization , which is further turning away from altcoins, according to Samara Epstein-Cohen, chief investment officer for ETFs at BlackRock.

Read more: How to Invest in Real Crypto Assets (RWA)?

The rapid release of new altcoins is flooding the market with supply, creating significant inflationary pressures. Many projects have aggressively launched large quantities of tokens, resulting in supply far exceeding demand.

Thompson noted that there is not enough demand to support the expected monthly increase in altcoin supply of about $3 billion over the next year or two. Some altcoins may still perform well, but identifying these successful tokens will be more difficult than before.

“Altcoins are under constant selling pressure. As we head into the summer months, which already have low trading volumes, the combination of significant token supply unlocks and selling pressure from venture capitalists will give most tokens an uphill battle,” Thompson concluded.

Meanwhile, Will Clemente, co-founder of Reflexivity Research, reflected on how the market has matured. Investing in high-beta altcoins has been a profitable strategy in 2020, with these assets outperforming Bitcoin. However, this approach is no longer effective.

Many altcoins have underperformed Bitcoin in recent months, indicating a shift in market dynamics.

“As the risk spectrum grows in 2020, we will see higher betas for Bitcoin, all steam engines and all assets will rise. That didn't happen this time. Many altcoin and Bitcoin pairs have been hemorrhaging for months, and it has not been as simple as buying some vaporware altcoin and it will outperform Bitcoin,” Clemente emphasizes.

Technical analyst Michael van de Poppe emphasized that while Bitcoin is close to or reaching all-time highs, most altcoins have not reached previous peaks. This discrepancy indicates a lack of trust in altcoins, which continue to struggle in the current market environment, and suggests that the era of easy profit from altcoins is over.

Read more: 10 Best Altcoin Exchanges in 2024

Investors should be aware of the increased risks and consider new conditions before making decisions in the cryptocurrency market.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.