The launch of the Bitcoin exchange-traded fund (ETF) last January marked an important milestone. However, financial advisors are approaching this new investment vehicle with caution.

Samara Cohen, BlackRock's Chief Investment Officer for ETFs and Index Investments, provided insights at the Coinbase State of Crypto Summit in New York.

Why Financial Advisors Are Avoiding Bitcoin ETFs

Cohen explained that about 80% of Bitcoin ETF purchases are currently made by self-directed investors using online brokerage accounts. Hedge funds and brokerages were also active buyers, according to last quarter's 13-F filings . But registered investment advisers remain hesitant.

“I would tell them to be cautious,” Cohen said. “Because that’s their job.” She emphasized that advisors have a fiduciary responsibility to their clients, noting that Bitcoin’s historical price volatility has sometimes reached 90%, necessitating thorough risk analysis and due diligence.

Financial advisors meticulously evaluate data and risk analysis to determine the appropriate role for Bitcoin in your investment portfolio, considering factors such as risk tolerance and liquidity needs.

“Now is the time to use critical data and risk analysis to determine what role Bitcoin can play in a portfolio and what type of allocation is appropriate given an investor’s risk tolerance and liquidity needs. “This is exactly the right journey we’re on because that’s what advisors are supposed to do, and I think advisors are doing their part,” Cohen added.

Read more: How to Trade Bitcoin ETF: A Step-by-Step Approach

While financial experts remain cautious, some analysts are optimistic about Bitcoin's future .

Bernstein, a large asset management company that manages $725 billion in assets, predicts that the price of Bitcoin could reach $1 million by 2033. According to new forecasts, it is expected to reach its cycle high of $200,000 by 2025. This prediction follows unprecedented demand for spot ETFs and limited supply of Bitcoin.

Bernstein's previous estimate was $150,000 in 2025, reflecting growing optimism about Bitcoin's potential.

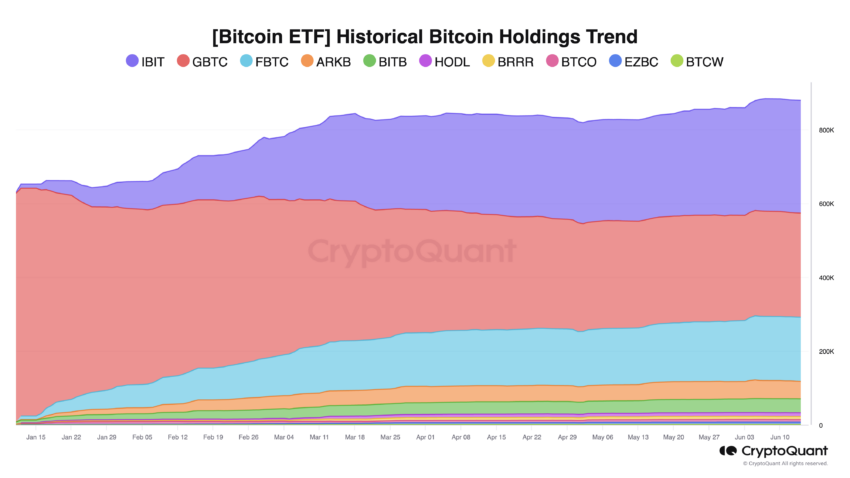

“ETFs brought in about $15 billion of net new capital. We expect Bitcoin ETFs to represent approximately 7% of Bitcoin in circulation by 2025 and approximately 15% of Bitcoin supply by 2033,” Bernstein analysts wrote.

Read more: Bitcoin (BTC) price prediction for 2024/2025/2030

WAX co-founder William Quigley also commented on the proliferation of ETFs for other cryptocurrencies such as Solana . “Wall Street is greedy,” Quigley said, predicting that the success of the Bitcoin ETF will spur similar products.

But he warned that if momentum slows, ETF providers could close underperforming ETFs or shift focus due to lack of demand.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.