Author: Yano

Compiled by: TechFlow

Spent a day at the Coinbase State of Crypto summit.

Many pension funds, endowment funds, brokerage firms, asset managers, banks, etc. attended the meeting, and the mood of the participants was very optimistic when they left.

I took shorthand notes during some of the talks and share them here:

Brett Tejpaul (Institution Head) opened the event.

There is a generation of huge wealth ($70 trillion) from old to young. 90% of the younger generation is disappointed with the financial system

One-third of the world's top 100 hedge funds have joined Coinbase

First panel discussion with Alesia Haas (CFO of Coinbase) and b (CIO of ETF/Index Investing at BlackRock)

A really great panel discussion, probably my favorite.

Samara:

Five years ago, someone suggested a Bitcoin ETF, and they said it was unnecessary. Now institutional demand for Bitcoin forces them to do so.

Today, 80% of their Bitcoin ETF is purchased by self-directed investors through their own brokerage firms, and the wave of institutional capital remains huge.

Financial advisors remain vigilant, but it’s their job to be vigilant.

Unable to comment on Ethereum ETF as it is actively being filed.

Also excited about tokenization There is growing demand for tokenized funds (tokenized short-term money management funds) from crypto-native companies engaged in money management.

We’ve seen the digitization of every asset. Now, we’ll see the tokenization of every asset.

Tokenized Treasuries should not compete with stablecoins. Stablecoins are for payments. Money market funds are a liquid investment strategy.

A few years ago, we thought private permissioned blockchains would lead the way. Now we realize that public blockchains are better so that we don’t fragment liquidity.

Cryptocurrency has a branding problem. The term RWA means something completely different in the banking world. It also implies that cryptocurrencies are not real-world assets. The use of "RWA" needs to stop.

Alesia:

40% of institutional clients adopted 3+ products in Q1

Net inflow of US$12 billion in 3 months, the fastest growth rate in history

Coinbase and Blackrock both have many customers waiting on the sidelines, awaiting regulatory clarification

Does Binance support Trump? We support the 52 million Americans who hold crypto and can vote however they want

Payment panels from St Jude, PayPal, EY, Google and OpenAI

Google is taking cryptocurrency very seriously, thinking everyone is “sleeping” on it and many people don’t seem to be paying enough attention to it.

Regulatory Group

Many of Coinbase’s activities have been conducted through litigation, which finally saw progress in Congress today.

Simon O'Brien, ADGM

Abu Dhabi. In 2018/2019, we leaned in. We thought that if we got it wrong then our investor community would be angry. We published the rules and not much changed. It is important for regulators not to change the rules all the time but to always improve.

There is a risk with regulators, they issue rules and then change the rules every 12 months.

The only way to establish good regulation is to engage with industry.

The mistake that regulators make is to have regulatory rules and then not have a good operating team and not have enough funds.

4b People heading into election season.

Cryptocurrency is high on the agenda and will remain high.

There is a renewed awareness that cryptocurrencies will become part of the global economy.

Lisa Cameron

Cryptocurrency helps those left behind by the financial system, and now it’s more important than ever for politicians

Nice chat with @brian_armstrong (Coinbase CEO) and @CathieDWood (Cathie Wood)

This is the biggest economic revolution of my lifetime. It’s as important as artificial intelligence, and it’s likely that cryptocurrencies and artificial intelligence will merge.

Economic freedom is the foundation of global progress. We want to increase economic freedom around the world.

Our biggest hurdle is regulatory clarity.

Brian just got back from Washington: The Senate is excited about moving forward with cryptocurrency legislation.

The turf war between the FCA and the SEC over whether investment contracts are securities and tokens are commodities requires Congress to step in and take action.

Retail investors led the industry, but now institutions are coming too.

56% of Fortune 500 companies are developing on-chain products.

Regulatory clarity will increase the proportion of institutions from 1-2% to 5-10%.

Cathie said that the ETF’s flows are mainly retail money, as the platform has not yet been approved (interestingly, the same as Blackrock).

We haven't seen real demand for ETFs yet because Morgan Stanley, UBS, etc. haven't started pushing it yet.

Brian said the most exciting thing about the company is Base.

Also exciting: derivatives and our Smart Wallet (making it easier to join).

Cryptocurrencies started as an asset class and are now transitioning to real-world utility.

Centralized exchanges will be fine for a while, but it’s only a matter of time. Everything will be peer-to-peer, without middlemen, and on-chain.

Coinbase is moving our products on-chain.

Payments are like water, they flow to the place of least resistance.

We want adjusted Ebitda to be positive in any market. That means a shift away from transaction fees and toward subscription and service fees, which are more predictable.

Dramatically reduce costs while investing in innovation.

The last big piece of the puzzle is international expansion. It currently accounts for 17% of revenue. We have selected 10 markets to go deeper into.

In the first quarter, international markets grew faster than the U.S. market.

With self-custodial wallets, we have a “broad coverage” strategy.

A group of people growing up today will never have a bank account, their phone is their wallet.

While Coinbase as a company will not disrupt giants like Visa, the protocols we build and participate in can do that.

CIO Perspective

Sebastian (Coinbase Asset Management)

Coinbase: This is the first real institutional cycle.

As an industry, we have invested $50 billion in venture capital, and next is hedge fund participation.

Due to the lack of regulatory standards, there is still no unified valuation standard, and the market is inefficient, making valuation discussions difficult.

RWA is a terrible term.

Eventually, all assets will rely on crypto rails and be fully exposed to crypto assets.

Each pension fund has a Digital Asset Working Group (DAWG) and while the first attempt was unsuccessful, this is a second chance. But it’s coming soon, with full adoption expected by 2025.

Matt Halstead (Teachers Retirement System of Texas)

Cryptocurrency is just that. It is just a format and standard for how things move.

Cryptocurrency is a merger of communication networks and financial networks.

There is nothing controversial about allocating funds to emerging technologies, but people have struggled with using cryptocurrencies due to branding issues.

It is not right to discuss the issue of cryptocurrency going to zero. We should focus on liquidity and speed. Cryptocurrency has a 10-fold upside and a 25-50% downside risk. This opportunity is extremely rare globally. Institutions will realize this.

Tokens are confused with cryptocurrencies and Bitcoin, which causes damage to the brand image.

The biggest challenges facing institutional investing are issues with outdated advisors and portfolio structures.

The adoption rate is expected to be 5% within five years and reach 100% in the long term.

Blue Macellari (T Rowe Price)

Bitcoin is the first currency that people come into contact with, but it is also the most difficult currency to understand. Let’s start with the most difficult one.

ETFs have brought the discussion of cryptocurrencies into the mainstream.

If you don’t buy cryptocurrencies, you are short the market.

The topic has shifted from "why do this" to "how to do it".

A 1% allocation is not reasonable, it should be higher, perhaps 3% or more. This requires psychological adaptation and is a paradigm shift.

If someone says blockchain is good but tokens are a scam, that’s cognitive dissonance.

We still have people internally saying it’s just a Ponzi scheme or it’s just for illegal activities. Others say it’s interesting but it doesn’t have cash flow so it can’t fit into a traditional framework.

When Soros short the pound and caused it to collapse, we did not see it as the end of the pound.

Institutional investors are over-allocated to venture capital and are now shifting their focus to liquid assets.

Institutions are essentially short cryptocurrencies because they have the buying power but are not actually doing it.

On how to value Bitcoin: Bitcoin provides a wealth storage service that does not rely on the government or existing institutions, no different from the services provided by any company. The higher the demand, the higher the value.

We have 20,000 meetings a year. The slide that used to be the most common slide was “Cryptocurrency is not blockchain”. It has not been used for several years now. This is progress.

In the past we were talking about 1% allocation. Now we are talking about 3-5%.

Many people start with venture capital because of career risk or because they don’t know how to research tokens. Illiquid and liquid returns will start to diverge.

Consumer Panel

@benleventhal + @sid_coelho + @js_horne + @lay2000lbs

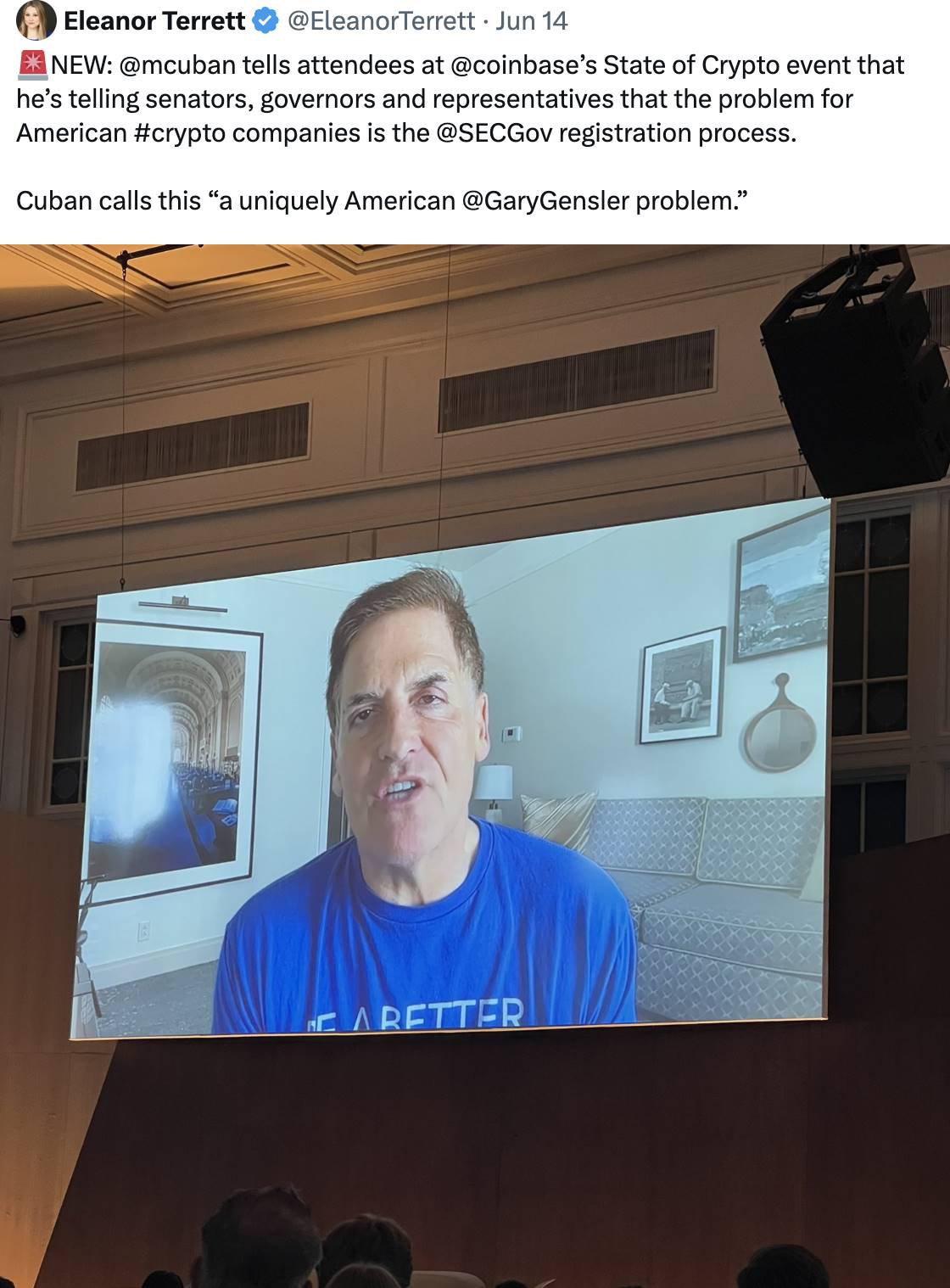

Special guest Mr.Mark

( See tweet for details)

The last group of the day

Including @WileyNickel @faryarshirzad

Despite the gloomy market sentiment, the reality is not so pessimistic. Those who have attended the recent events will realize that now is a good time to buy high-quality tokens at low prices, and the third phase is about to arrive.