Written by Shao Shiwei, senior lawyer at Shanghai Mankiw LLP

On June 12, 2024, the Shanghai Procuratorate released the " 2023 Shanghai Financial Procuratorate White Paper " and related cases. It mentioned that the methods of foreign exchange and illegal payment and settlement crimes have been renewed, and the risks of using "virtual currency" to transfer assets across borders have become more prominent.

Lawyer Shao also mentioned in previous articles that illegal business operations involving virtual currencies are manifested as "payment settlement type" and "foreign exchange trading type". By comparing the annual "Shanghai Financial Prosecution White Paper" released by the Shanghai Procuratorate from 2021 to 2023, we can vertically feel the judicial organs' punishment of such cases.

01 Three-year overview

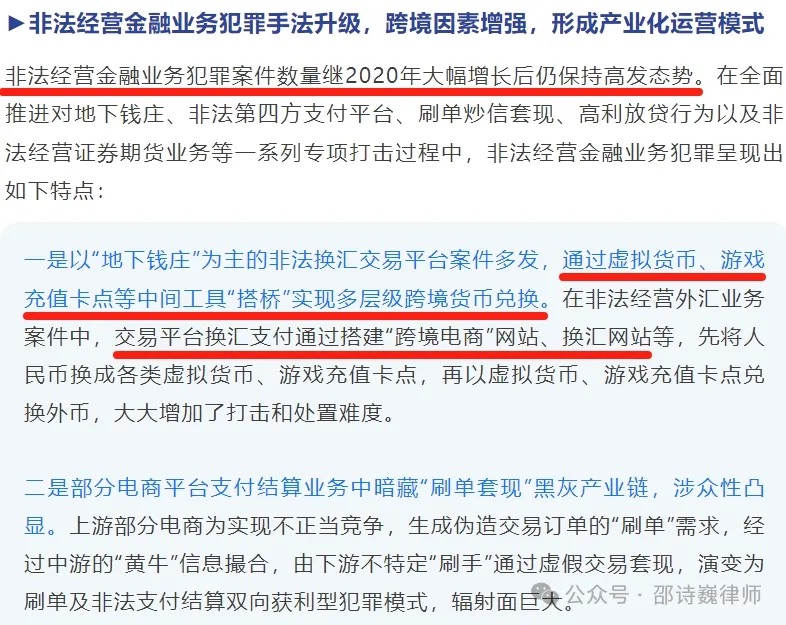

The "2021 Shanghai Financial Prosecution White Paper" mentioned that illegal business-related financial crimes have the characteristics of "building bridges through intermediary tools such as virtual currency and game recharge points to achieve multi-level cross-border currency exchange."

In other words, e-commerce platforms are not only seen by criminals as a tool for "money laundering", but are also used for currency exchange. Therefore, the white paper concludes that e-commerce platforms have evolved into a "two-way profit-making criminal model of fake orders and illegal payment settlements."

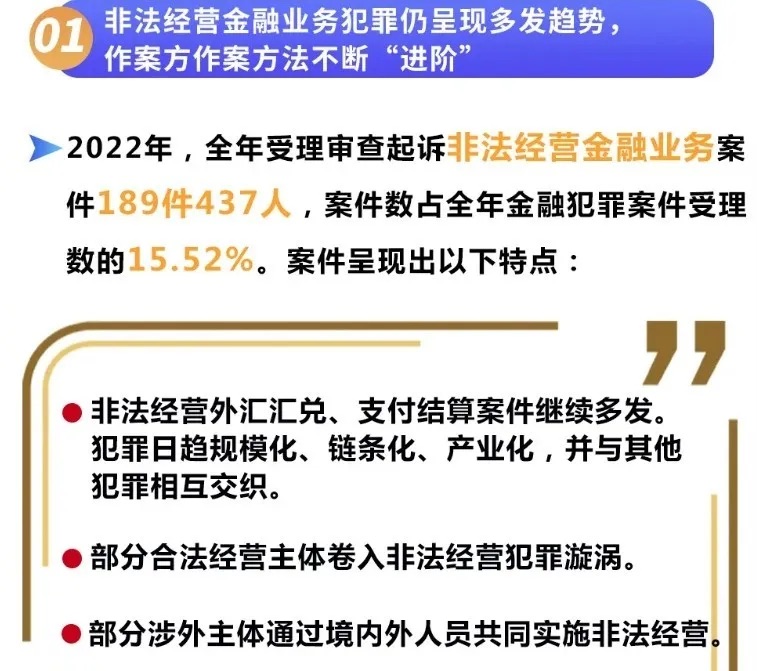

The "2022 Shanghai Financial Prosecution White Paper" mentioned that the number of illegal business financial crime cases continued to increase, and the methods of committing crimes continued to upgrade, gradually forming an industrial chain, and causing some legal business entities to be implicated.

In the "2023 Shanghai Financial Prosecution White Paper" released on June 12, 2024, special emphasis was placed on the hidden dangers of using "virtual currency" to transfer assets across borders.

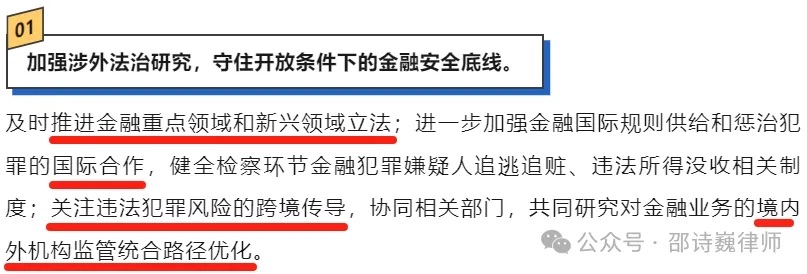

In addition, the White Paper also puts forward relevant suggestions for such issues, such as promoting legislation in emerging areas, studying the supervision of domestic and foreign institutions in financial business, strengthening the analysis and judgment of financial crimes committed using new technologies and new business models, and increasing the prosecution of people related to funds, technology, intermediaries, etc. in the financial crime chain.

02 Some thoughts

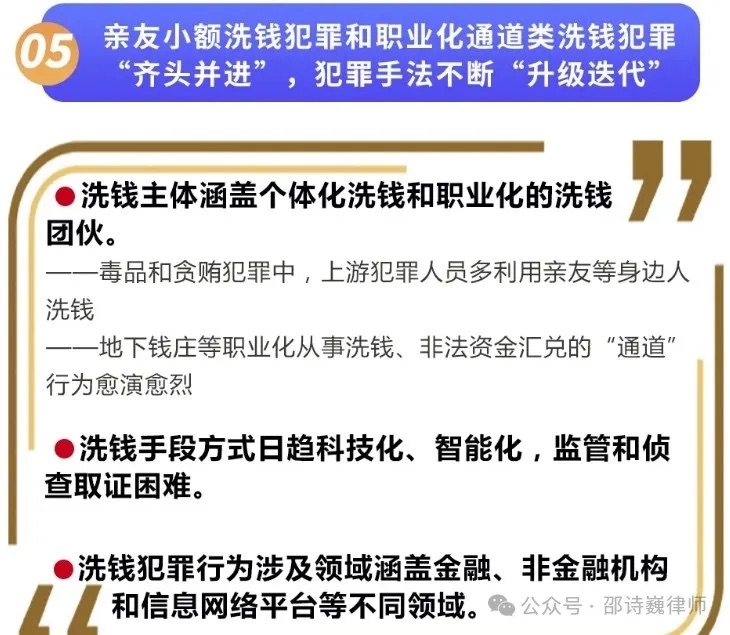

From the white papers released by the Shanghai Procuratorate in the past three years, it can be seen that illegal business-related financial crimes have always been the focus of punishment for judicial organs, and this type of black and gray industry has also formed a large-scale industrial chain.

In practice, judicial authorities across the country have continuously published many similar cases of using virtual currency to exchange currency in disguise and make fund payment and settlement, so as to achieve the purpose of cross-border asset transfer. However, in this year's white paper, such criminal acts are only described as "risk hazards". Isn't this a bit of an understatement?

On December 24, 2023, the State Administration of Foreign Exchange and Qingdao, Shandong Province, released a case involving a total amount of 15.8 billion yuan, involving a major underground money house case involving 17 provinces and municipalities across the country. Article Comment: " The State Administration of Foreign Exchange has taken action! More and more U merchants may be convicted of illegal business operations! ——Qingdao police cracked an underground money house case involving 15.8 billion yuan " On December 27, 2023, the Supreme People's Procuratorate and the State Administration of Foreign Exchange jointly released typical cases involving virtual currency. Article Comment: " Is it illegal to buy and sell U? Lawyer's interpretation: The Supreme People's Procuratorate and the State Administration of Foreign Exchange jointly released criminal cases involving virtual currency " On April 7, 2024, the Beijing police cracked a 2 billion virtual currency serial case. After counting by the police, the case involved a total of more than 2 billion yuan in funds, and more than ten virtual currency wallets were used for illegal transactions. Article Comment: " From the perspective of the police cracking down on 2 cases of virtual currency buying and selling personal information, what enlightenment can be gained from the loan assistance industry? 》 On May 16, 2024, Chengdu Public Security also released a virtual currency case, cracking an underground money laundering case involving 13.8 billion yuan. →《 The amount involved is 13.8 billion yuan! Chengdu Public Security cracked a major underground money laundering case 》

In addition, the white paper's recommendations mention "increasing the prosecution of people involved in the financial crime chain, such as funds, technology, and intermediaries," promoting legislation, studying supervision, and strengthening analysis... These statements seem to be able to sense the judicial authorities' "powerlessness" in dealing with transnational crimes involving virtual currencies.

It has been more than ten years since the "Notice on Preventing Bitcoin Risks" was issued by five ministries in 2013. Apart from the notices, announcements, risk warnings, etc. issued every few years, there have been no higher-level laws, administrative regulations or other documents. Conservative estimates show that it may be difficult to see them in the next few years. In practice, the judicial disposal of virtual currencies also faces many practical difficulties.

Why does the suggestion mention increasing the tracing of related personnel such as "technology" and "intermediaries"? That's because servers and principal offenders are generally abroad. Although China's judicial organs have stipulated territorial jurisdiction and personal jurisdiction for extraterritorial crimes, compared with the hegemony of the United States' long-arm jurisdiction over other countries, China has always been relatively negative about transnational law enforcement based on the principle of respecting the sovereignty of other countries. Another reason is that these behind-the-scenes personnel are really difficult to catch. For example, the two cases previously analyzed by Lawyer Shao → " An acquaintance introduced foreign exchange, and the 'middleman' was convicted of being the principal offender and sentenced to 8 years in prison. Is it unfair? - Don't introduce others to buy and sell foreign exchange, be careful of being convicted of illegal business operations! (Part 1) " " From the perspective of the police cracking down on 2 cases of virtual currency buying and selling personal information, what enlightenment can we get from the loan assistance industry? ".

If the main culprit who is physically abroad cannot be caught, then those who provide technical support in China and charge fees for introducing business can be arrested (according to the criminal cases handled by Lawyer Shao in recent years, many such people have been arrested). There is always one crime that can be applied, such as illegal business operation, aiding and abetting, concealing, etc.

03 Live Cases

At the same time as the release of the "2023 Shanghai Financial Prosecution White Paper", the Shanghai Procuratorate also released 9 cases. This article discusses 2 typical cases (they are indeed very typical, and are both high-incidence case types in practice).

Illegal business operation case involving Zhan Moumou and others (illegal business operation crime involving payment settlement)

The defendant Zhan had no payment and settlement qualifications, and was fully aware that the source of the relevant funds was gambling and fraudulent. He acquired a shell company and cooperated with Shanghai H Company (which had an Internet payment and settlement license) to connect the upstream gambling fund channel and the downstream false merchant settlement channel, and engaged in illegal fund settlement business. Upon investigation, the account involved in the case settled more than 4 billion yuan of gambling funds.

Lawyer Shao’s comments:

It is also mentioned in the above-mentioned 2022 white paper that "some legal business entities are also involved in the vortex of illegal business crimes." It is not easy to obtain an Internet payment settlement license, and H Company's payment business traffic is nearly 100 billion, so there is no need to commit crimes. But "it's hard to guard against thieves in the house" is the truth. H Company has indeed neglected to supervise the legality and compliance of the cooperation between corporate executives and company customers. This case occurred precisely because of the cooperation of Yang, the business development director of H Company. Knowing that Zhan was engaged in illegal business, he still helped him register merchants, circumventing H Company's daily supervision of the merchants involved, and preventing the merchants involved from being closed down and reduced for engaging in illegal fund settlement business.

Case of Xiao Moumou and others concealing and hiding the proceeds of crime

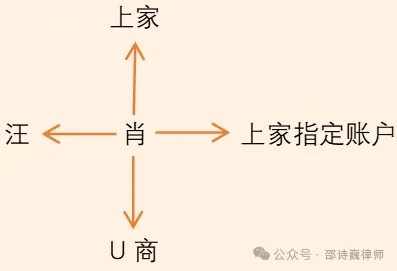

Xiao used overseas encrypted chat software to communicate with his upstream supplier and transfer the money obtained from the crime for his upstream supplier. The specific flow of funds is as follows: Xiao contacted U merchants to purchase USDT and paid it to the upstream supplier's designated account. After receiving it, the upstream supplier sent the corresponding amount of digital RMB account to Xiao, and Xiao arranged for "driver" Wang and others to withdraw the money from the ATM. In addition, Xiao also registered a digital RMB account for his upstream supplier to use.

Through the above methods, Xiao withdrew more than 10 million yuan from more than 900 digital RMB accounts, of which more than 800,000 yuan were fraudulent funds.

Lawyer Shao’s comments:

This case is the first case of money laundering using digital RMB. The characteristic of this case is that the USDT virtual currency, which is not recognized as legal tender in my country, is "linked" with the digital RMB, the legal digital currency launched by the central bank. The rest is no different from money laundering crimes involving currency.

In conclusion:

A vertical comparison of the white papers issued by the Shanghai Procuratorate over the past three years, combined with Lawyer Shao’s daily case handling experience, shows that my country’s punishment of currency-related money laundering crimes and currency-related illegal business crimes has been ongoing.

From the perspective of ordinary people, we should pay special attention to the "strengthening of prosecution of people related to funds, technology, intermediaries, etc. in the financial crime chain" mentioned in this year's white paper. In daily life, we need to strengthen our awareness of risk prevention to avoid becoming the "white gloves" of others' illegal crimes.