Author: Dilin Massand Source: unchainedcrypto Translation: Shan Ouba, Jinse Finance

At a recent budget hearing, SEC Chairman Gary Gensler told senators that approval of a U.S. spot Ethereum ETF should be completed by the end of summer. So, how does the market see Ethereum's price heading before and after that?

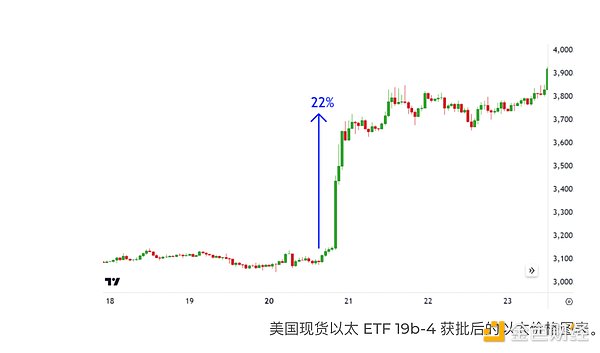

When the U.S. Securities and Exchange Commission approved Form 19b-4 for eight different spot Ethereum exchange-traded funds (ETFs), the price of Ethereum surged nearly 20% in a matter of hours.

Now, ETF applicants are filing their S-1 registration forms, which require approval from securities regulators before they can begin trading on an exchange. Gensler told the Senate Appropriations Committee on Thursday that process is expected to be completed by the end of the summer.

Gensler said the registrations are being reviewed at a “staff level” and remain subject to the issuer and how responsive they are to any comments. With the decision in the hands of the ETF issuer, how does the market see Ethereum’s price moving forward before and after this?

Investment management firm VanEck, whose spot Ethereum ETF application was one of eight approved on Form 19b-4, recently raised its 2030 Ethereum price target to $22,000. But Katie Talati, head of research at crypto asset management firm Arca, said in an email to Unchained that recently “Ethereum has had a harder time building a strong narrative than other first- and second-layer solutions have had with the rise of the market.”

Ethereum short-term price prediction (before launch)

In the short term, this lack of narrative could give Ethereum some lift — though probably not as high as $22,000 — as traders were lower positioned on the asset at the time of the approval announcement.

“Coinbase Institutional has seen an increase in buying in Ethereum since the 19b-4 approval,” David Duong, head of Coinbase Institutional’s trading desk, said in an email. “It is not as aggressive as we saw prior to the launch of a spot Bitcoin ETF in the U.S. This leads us to believe that the market remains under-positioned.”

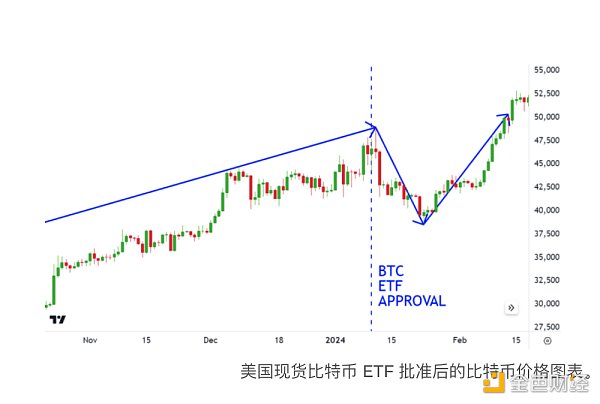

For Bitcoin, it was a “buy the rumor, sell the news” event, as there was a lot of speculation ahead of the Bitcoin ETF approval in January. In Ethereum’s case, Glen Goodman (author of the book “Crypto Trader”) said in an email to Unchained that “traders didn’t sell the news — they bought it” because the approval was unexpected.

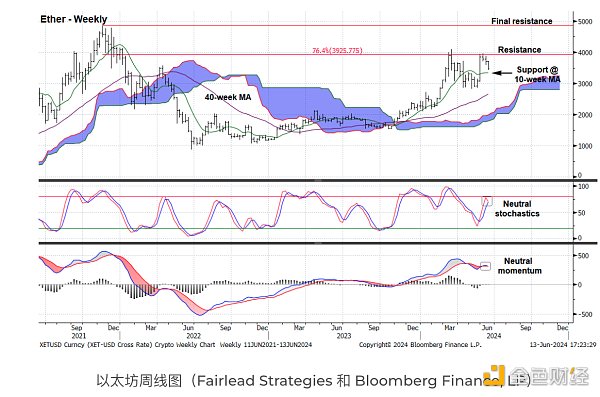

Investors still need to be cautious, Katie Stockton's Fairlead Strategies noted in a June 10 report that Ethereum has given up some of its outperformance relative to Bitcoin since the news of the spot Ethereum ETF. Analysts expect Bitcoin to continue to outperform Ethereum in the short term, and their analysis of Ethereum's weekly MACD and stochastic indicators is neutral, adding that they will take a bullish stance once Ethereum breaks through the $3,925 resistance level on a consecutive weekly closing basis.

Ethereum Long-term Price Prediction (Post-launch)

After a correction following the ETF’s approval, “Bitcoin rallied from $39,201 to $67,339, ultimately setting a new all-time high in March 2024, a gain of 72%,” said Teddy Fusaro, president of Bitwise, the company that launched a spot Bitcoin ETF in the United States.

If that happens, Ethereum would need to rise more than 35% from its current price to reach its November 2021 all-time high of $4,867, Fusaro said.

While this may be plausible, Arca’s Katie Talati does not believe a spot Ethereum ETF would have a substantial long-term impact on Ethereum prices because institutional demand is not as high as it is for Bitcoin.

In a previous interview with Unchained, Ophelia Snyder, co-founder and president of crypto ETP provider 21Shares, which manages the 21Shares Ethereum Staking ETP (AETH) in Europe and a spot Bitcoin ETF (ARKB) in the U.S., mentioned that institutions are far less aware of Ethereum than Bitcoin.

Talati also noted that “Grayscale Ethereum Trust, which manages $10 billion in assets, may also experience sustained outflows, creating daily selling pressure in the Ethereum market.”

A similar view was expressed in the latest report from crypto research firm Kaiko. “Once the Ethereum ETF is launched, it is expected that there will be outflows or redemptions from Grayscale’s ETHE, leading to selling pressure on Ethereum. Over the past three months, ETHE has traded at a discount of between 6% and 26%.”

Nonetheless, Vetle Lunde, a senior analyst at crypto research firm K33, predicted in a recent report that the U.S. spot Ethereum ETF will attract $4 billion in net inflows in the first five months after its launch. In a message to Unchained, Vetle explained that he expects about 20% of the $4 billion to come from institutional investors, who are expected to have assets under management of $700 million to $800 million.

While some have questioned whether the lack of collateralization in Ethereum ETFs will limit investor interest in the funds due to the lack of APY (annual percentage yield), Lunde does not see this as a problem, writing: “99.1% of AUM in Canadian Ethereum ETFs is held in non-collateralized products, while 97.9% of AUM in Europe is held in non-collateralized ETPs. This suggests that collateralization is not a major issue among ETP investors.”

In April, the Hong Kong Securities and Futures Commission approved the trading of spot Ethereum ETFs alongside Bitcoin ETFs. Using the Hong Kong market as a reference, Noelle Acheson, an economist and author of Crypto Is Macro Now, wrote in a recent newsletter, “When/if an Ethereum spot ETF is finally launched, we should be prepared for a poor response.” Acheson’s prediction is based on the fact that Ethereum accounts for less than 15% of total spot crypto ETF AUM since these securities began trading in Hong Kong.

Pranav Kanade, portfolio manager of VanEck’s Digital Asset Alpha Fund, also believes that interest in a spot Ethereum ETF may not explode as much as Bitcoin’s, writing in an email to Unchained that “the Bitcoin narrative fits perfectly in the U.S. in particular… Ethereum ETFs do not have the same constellation.”

Nonetheless, Kanade said their bullish forecast for Ethereum in 2030 assumes that an ETF will serve as a catalyst for further attention to the Ethereum network and its various applications, such as stablecoins and other tokenized financial assets. “This in turn will drive increased activity on Ethereum or its second-layer solutions, leading to more Ethereum being destroyed and the total supply decreasing,” Kanade said.