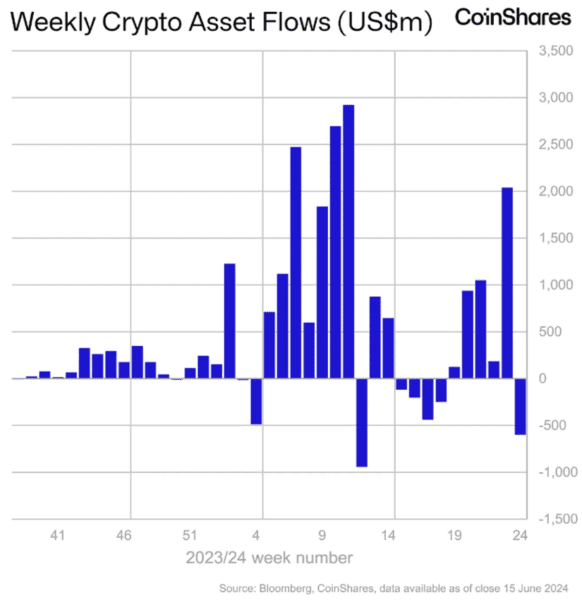

According to data released by crypto asset management company CoinShares on Monday (17th), digital asset investment products experienced a net outflow of US$600 million last week, the largest outflow since March 22, 2024. CoinShares believes that last week’s outflows may have been caused by the impact of the Federal Open Market Committee (FOMC) interest rate dot plot.

CoinShares wrote:

“This is happening in a similar context: After a period of large inflows, a more hawkish-than-expected FOMC meeting prompted investors to scale back exposure to fixed supply assets. These outflows and the recent price sell-off have led to total asset management Size (AuM) fell from over $100 billion to $94 billion in one week.”

The trading volume of digital asset ETPs last week was US$11 billion, still lower than this year's weekly average of US$22 billion, but well above last year's weekly level of US$2 billion. The trading volume of digital asset ETPs accounts for 31% of the total number of global trusted exchanges.

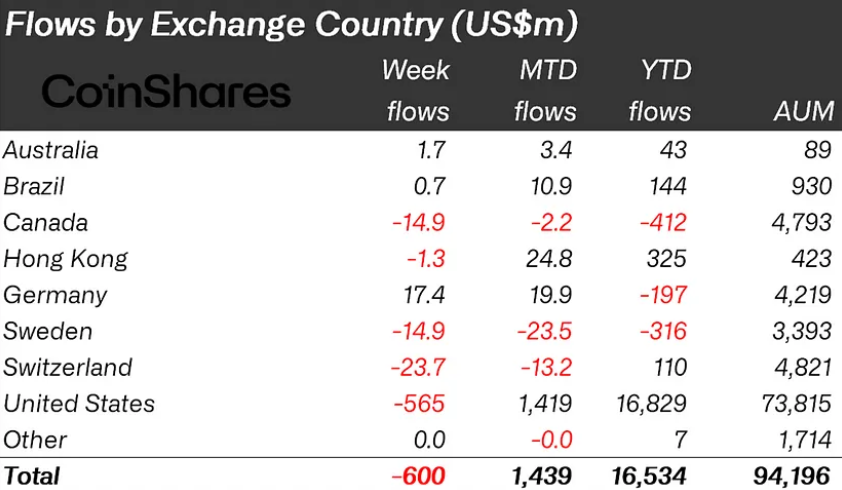

From a regional perspective, although the U.S. digital asset ETP had the largest outflow, totaling $565 million, negative sentiment was not limited here. Canada, Switzerland, and Sweden also saw outflows of $15 million, $24 million, and $15 million respectively. Dollar. Germany bucked the trend with a net inflow of US$17 million.

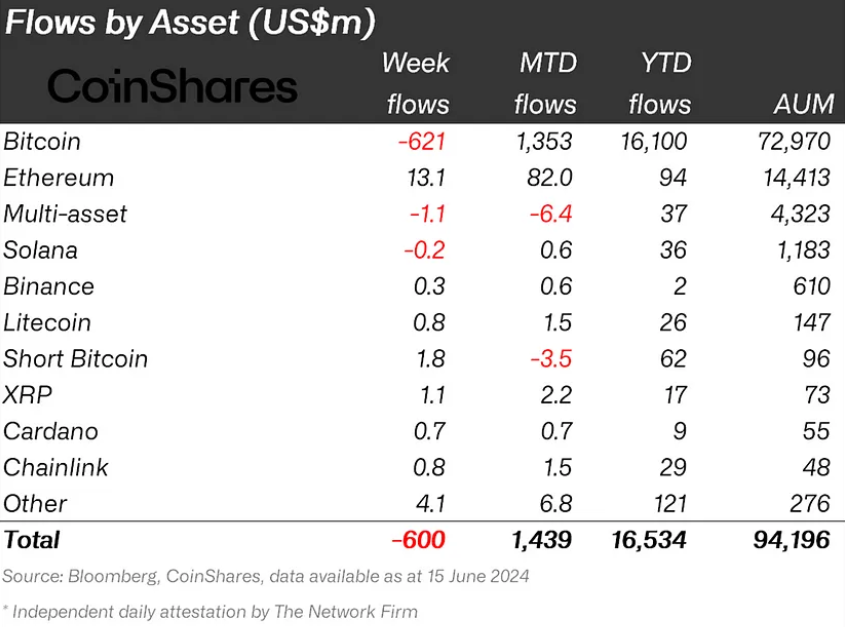

From an asset class perspective, capital outflows were entirely concentrated on Bitcoin, with net outflows totaling US$621 million. Bearish sentiment also prompted a net inflow of US$1.8 million in short Bitcoin investment products. In terms of altcoins investment products, Altcoin, LIDO and XRP saw inflows of approximately US$13 million, US$2 million and US$1 million respectively.