New whales are aggressively accumulating Bitcoin, while existing whales are reducing their holdings slightly .

This behavior suggests a mix of bullish sentiment from new market entrants and strategic positioning from long-term holders. Additionally, large holders are showing strong accumulation, supporting Bitcoin's medium-term outlook.

New Whales Accumulating BTC

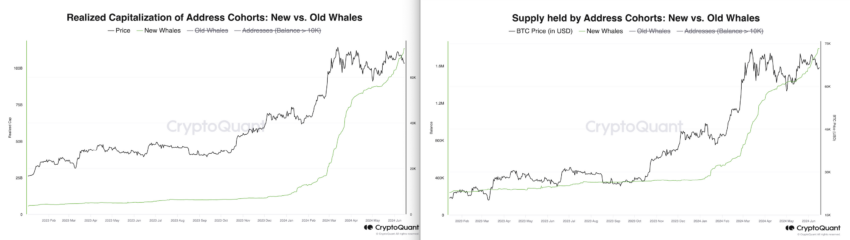

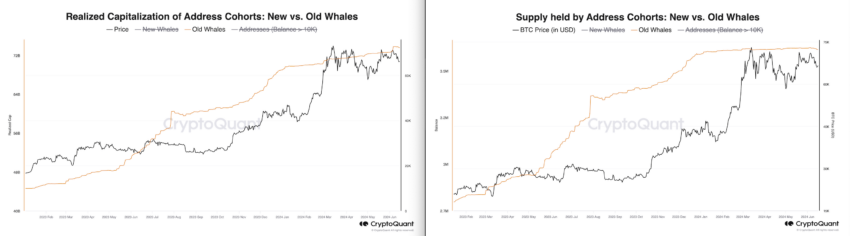

There has been a significant increase in supply held by new whales, defined as addresses holding more than 1,000 BTC and with an average holding period of less than six months.

The total supply of this cohort increased by 206,783 BTC, from approximately 1,577,544 BTC to 1,784,327 BTC.

In addition, the market capitalization of the new whale continued to rise, increasing from approximately $98.44 billion to $131.2 billion, an increase of $14.68 billion.

Read more: Bitcoin Halving History : Everything you need to know

Bitcoin's market capitalization provides a snapshot of its actual value, taking into account the price at which each Bitcoin was last traded. Unlike traditional market capitalization, which only looks at the current market price, realized market capitalization takes a deeper look, reflecting past transaction prices on the blockchain.

The aggressive influx of new whales is a sign of confidence in Bitcoin’s near-term potential . Therefore, their increasing presence and higher market capitalization suggest that recent entrants to the market are optimistic about future price increases and are willing to buy BTC at higher prices.

Declining reserves of older whales

On the other hand, the holdings of older whales with more than 1,000 BTC and an average holding period exceeding 6 months have decreased slightly. Their holdings decreased from approximately 3,621,388 BTC to 3,614,122 BTC, a decrease of 7,266 BTC.

On the other hand, Old Whale's market capitalization remained relatively stable, slightly increasing from approximately $72.62 billion to $73.56 billion. It recorded a slight increase of $940 million.

A slight decline in holdings of older whales may indicate a strategic rebalancing to take advantage of recent price increases or hedge against market volatility.

Stable market capitalization suggests that these long-term holders are maintaining their positions with minimal net selling or buying activity, indicating strong confidence in the market.

Bitcoin accumulation by large holders

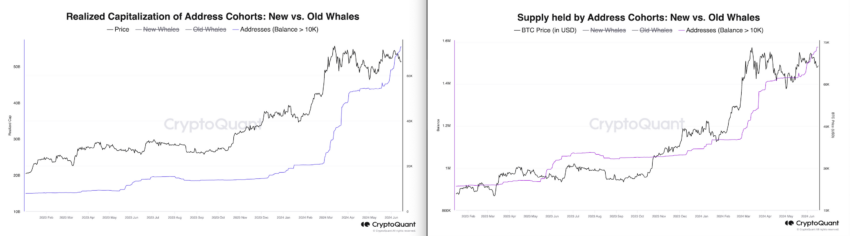

Strong support from large holders: Addresses with balances exceeding 10,000 BTC have seen a noticeable increase in supply. The group's total holdings increased from 1,494,362 BTC to 1,568,702 BTC, reflecting an increase of 74,340 BTC.

The market capitalization of these large holders also increased significantly, increasing by $6.37 billion from $49.06 billion to $55.43 billion.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

The increase in supply and market capitalization of addresses holding more than 10,000 BTC reflects the strong confidence of large market participants . This accumulation phase highlights a significant bullish sentiment, providing solid support levels for Bitcoin and mitigating downside risks.

Given the accumulation patterns observed among new whales and large holders, Bitcoin is likely to target $80,000 in the near term .

Bullish sentiment from new entrants and strong support from large holders suggest a positive outlook for Bitcoin price action. The increase in the realization limit reflects growing confidence and the entry of new capital, supporting the potential for an increase to $80,000 in the medium term.

If short-term whales stop buying or long-term whales start selling heavily, it could indicate a possible price reversal. Short-term whales have been driving the recent upward momentum. When these whales stop buying, it is a sign that they are losing confidence or that market sentiment is changing. This decline in demand could weaken price support and increase downward pressure on prices.

Long-duration whales, on the other hand, generally provide market stability. If these whales begin selling heavily, it could signal a strategic exit or a reaction to an expected market downturn. Therefore, their selling pressure could flood the market with BTC, increasing supply and driving the price below $60,000.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.