Author: Willy Woo, Crypto Analyst; Translation: 0xjs@ Jinse Finance

ETFs are buying…institutions are buying…who is actually selling?

In 2024, a large number of commentators began to focus on ETF flows, as if that was all that mattered.

What matters is aggregate demand and aggregate supply.

This article tells you the basics about how the Bitcoin market works today.

First, let me tell you who is selling. The OGs. They are selling.

They own more BTC than all ETFs combined… 10x more. And they sell in every bull run.

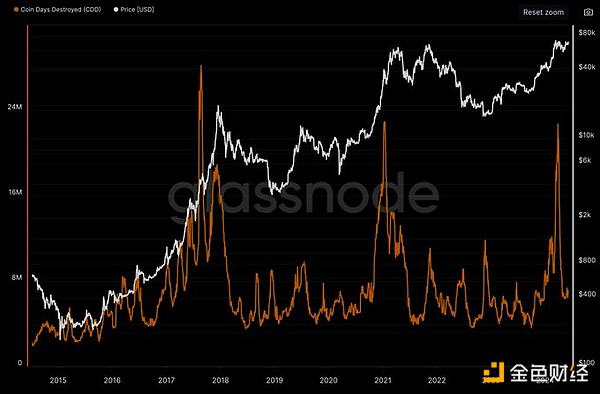

This pattern is as old as the Genesis Block. Below: Age x number of tokens being sold.

We are now in the modern era of BTC.

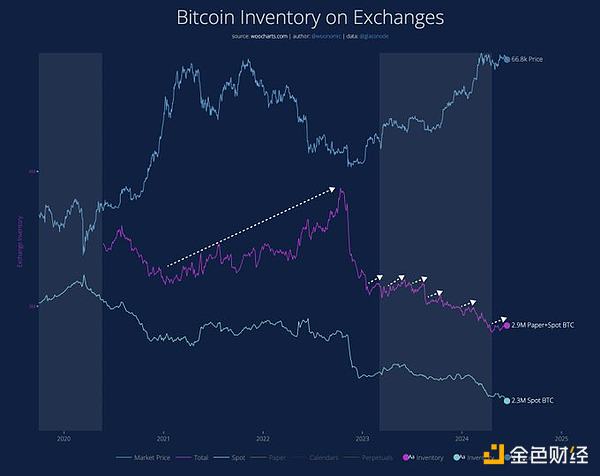

Paper BTC has flooded the market since 2017. Futures Market.

If you want to buy BTC, previously you had to buy real BTC. Now you can buy paper BTC.

So the no-coiner can sell you that paper BTC. Together you have minted a synthetic BTC.

Potential demand for BTC is shifted to paper BTC, which is met by OTC traders who have no BTC to sell and only have USD to back their bets.

In the past, BTC would grow exponentially because the only sellers were the trickle from OGs and an even smaller amount of newly mined coins from miners.

Today, the magic of paper BTC is what you want to focus on.

The 2022 bear market was determined by a massive influx of paper BTC when spot holders did not actually sell.

In the current bull run, I marked places where paper BTC went up, these were times when the price did not go up. We are in one of those times right now.

So…focusing solely on ETF purchases is not a good idea.

On-chain data… derivatives data… price technical indicators… all of these add to the demand and supply picture.

Putting it all together is an art, not a quantifiable science.

Everyone is just making educated guesses.

Alan Knitowski ∞/21M: Awesome. The 21 million bitcoin supply cap doesn't matter... or doesn't apply at all. If you have a fixed BTC supply as monetary policy, it doesn't matter when you can print an unlimited amount of paper BTC. Same as the gold market... price will react the same way. Bitcoin is now legal tender. Awesome.

Not exactly. When the BTC cap exceeds the USD cap, there is limited firepower to short BTC with USD collateral. Now you understand why Biden's SEC assholes want to enable futures ETFs and block spot ETFs. This is a war going on.