Source: Central Research

Project Description

zkSync Era is a Layer 2 scaling solution based on Ethereum that uses zero-knowledge proofs and Rollup architecture to provide a faster and more economical transaction experience. By moving most activities to the Layer 2 network, zkSync Era effectively reduces network congestion and reduces transfer fees while maintaining the security and finality of the Ethereum mainnet. As the 2.0 version of zkSync, zkSync Era has significant improvements in performance and functionality compared to version 1.0 (i.e. zkSync Lite).

Highlights of zkSync Era include mainnet level security, which ensures transaction reliability without relying on third parties. It supports transfers of ETH and ERC20 tokens, with instant confirmation on Layer 1 and can be completed within ten minutes. Transaction fees are extremely low, with ERC20 token fees being about one percent of the mainnet and ETH transfer fees being about one thirtieth of the mainnet. No registration is required to receive funds, and payments can be made to existing Ethereum addresses (including smart contracts). In addition, zkSync Era also supports multi-signature and permissionless smart contracts, and can withdraw funds back to the mainnet in about ten minutes, achieving an efficient and flexible user experience.

Core Components

zkEVM

zkEVM is a technology that uses the Ethereum Virtual Machine (EVM) as a smart contract engine to run on ZK Rollup. Its main goal is to fully replicate the Ethereum experience on Layer 2 while retaining the performance advantages of Rollup, providing users with a familiar development environment and operating mode.

Account Abstraction

Account abstraction introduces a new account type that separates transaction verification and transaction execution by treating accounts as smart contracts. This allows each account to have its own logic and achieve seamless compatibility, which not only protects user autonomy but also provides a safer and smoother user experience.

zkPorter

zkPorter solves the problem of zkRollup scalability being limited by Ethereum block size through the availability of off-chain data. It does not rely on data release from the Ethereum base layer, thus breaking through the scalability bottleneck and achieving more efficient data processing and greater expansion space.

Team and financing

team

Matter Labs is the German company behind zkSync. Founded in 2018, it currently has more than 50 employees and is committed to developing efficient, low-cost and secure Ethereum transaction solutions. The company is led by CEO Alex Gluchowski, who has more than 15 years of development experience and is passionate about personal freedom and decentralized technology. The team's CTO also has a rich technical background and development experience, and works with other core members to promote the innovation and development of zkSync.

Financing

Since 2018, zkSync has completed 5 rounds of financing, raising a total of US$458 million, making it the most funded project in the Layer 2 expansion plan. The latest round of Series C financing has brought its valuation to US$2 billion. These funds come from top investors and venture capital firms, including Binance, Aave, Curve, Coinbase Ventures, a16z Crypto, Dragonfly, and Blockchain Capital. In 2022, zkSync received a commitment of US$200 million from BitDAO, further ensuring sufficient funds for project development and infrastructure construction.

Token Economics

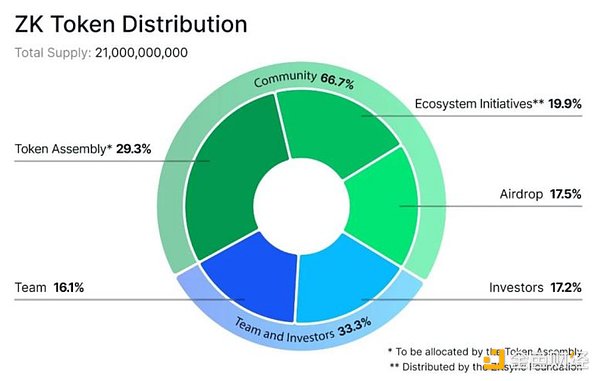

The native token of zkSync is $ZK, with a total supply of 21 billion.

Distribution: Token Assembly 29.3%, Ecosystem Initiatives 19.9%, Airdrops 17.5%, Team 16.1%, Investors 17.2%.

Secondary market performance

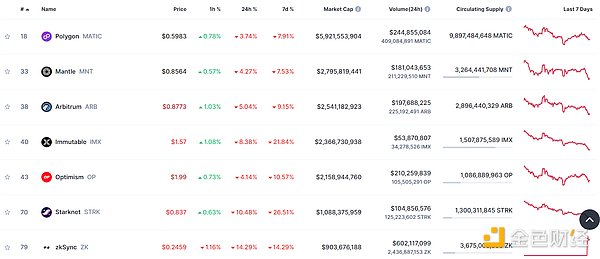

The $ZK token is currently priced at about $0.25. It was opened for claiming on June 11 and has been listed on multiple cryptocurrency exchanges including Binance. On June 17, the market capitalization of $ZK exceeded $900 million, and the fully diluted market capitalization was about $5.2 billion. According to CoinMarketCap data, $ZK ranks 79th in the global cryptocurrency market capitalization and 7th among all Layer 2 projects, between Starknet and Aevo.

Ecological Construction

Since the launch of zkSync mainnet on March 24, 2023, although its overall scale remains at the forefront, user participation willingness and profit capture capabilities are declining significantly. This phenomenon is closely related to the insufficient number of ecological projects and the lack of attention to the community.

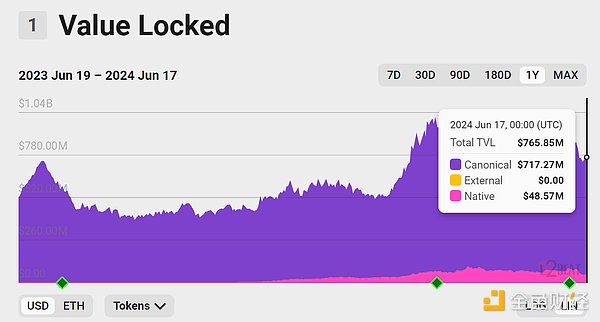

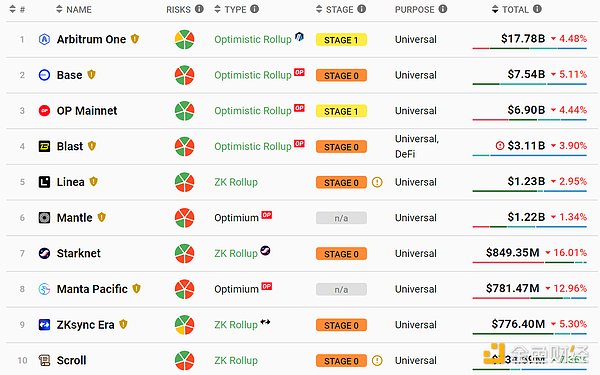

As of June 17, 2024, according to L2 BEAT data, the total locked volume of zkSync Era was US$765 million, down from approximately US$990 million on March 12.

Although the total amount of locked positions in zkSync ecosystem projects is high, the number and diversity of projects are still insufficient. According to zkSync-dappradar data, as of June 17, there were 205 ecosystem projects covering DeFi, games, trading markets, NFT, social, wallets, and DEX. However, data from DeFiLlama shows that only 5 zkSync projects have a TVL of more than 10 million US dollars, accounting for 58.5% of the total locked positions. Among the top 10 projects in TVL, they are mainly concentrated in the DEX and lending tracks, and well-known high-quality projects are rarely deployed on zkSync.

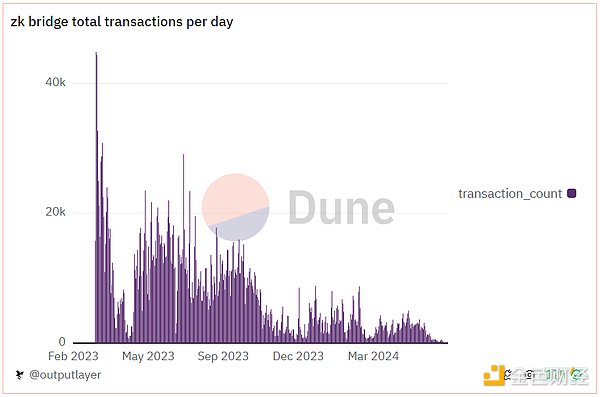

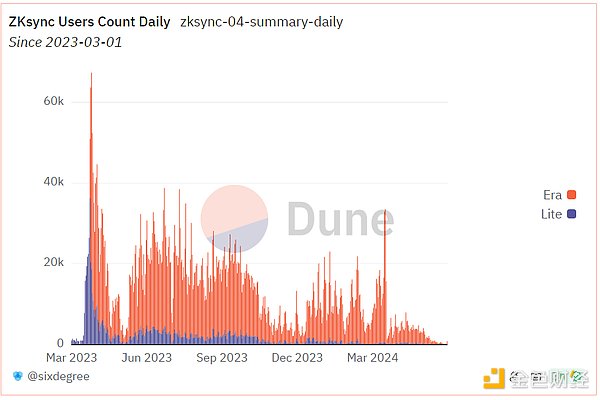

In terms of the number of users and the scale of funds, as of June 17, the total number of zkSync Era users was 3,434,121, the number of bridged users was 2,382,454, and the total amount of ETH bridged was 3,878,944, an increase of about 66.8% from the beginning of the year, but the average number of bridges per wallet address was low, only 1.031 ETH. In the past two months, the activity on the zkSync chain has decreased significantly, and the number of daily bridge transactions has dropped sharply. For example, there were only 160 bridges per day on June 16, and only dozens of transactions from June 12 to 15. The number of daily users of zkSync has also dropped sharply. On June 16, the number of daily active users of zkSync Era was 183, and Lite was 12, a total of 195. On January 15, 2024, this number was 15,320, a decrease of about 98.73%.

Data source: Dune @outputlayer

Data source: Dune @sixdegree

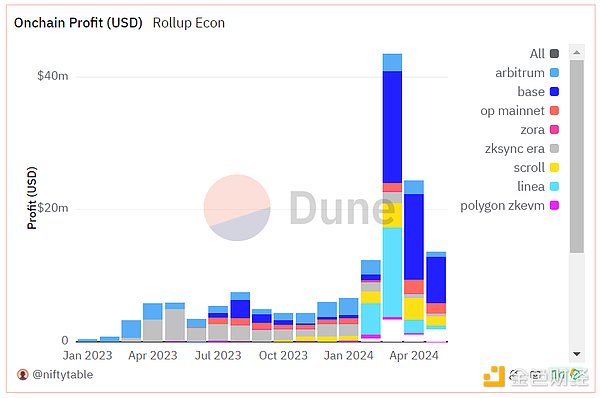

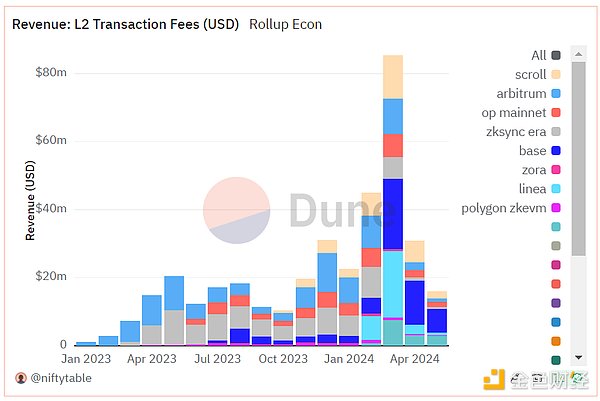

Before the airdrop rules were announced, the participation of a large number of "rollup parties" brought huge benefits to zkSync Era, but also affected the healthy development of its overall ecology. As of May 1, zkSync Era's profit from Gas fees in the past four months was about 1,848 ETH, accounting for 10.3% of the total profit of the Rollup chain, but there is still a significant gap compared with Base, Arbitrum and Scroll chains, and the monthly profit is showing a downward trend.

Data source: Dune @niftytable

ETH Layer2 Track

The total daily transaction volume of Layer2 has significantly exceeded that of the Ethereum mainnet. Currently, Layer2 mainly includes six solutions: state channel, side chain, Plasma, Optimistic Rollup, Validium and zkRollup.

Among these solutions, Optimistic Rollup occupies the main market share of Layer2. Arbitrum, as the representative project of Optimistic Rollup, has a TVL of 40.4% of the Layer2 market; Base and OP account for 17.12% and 15.67% respectively. In contrast, zkRollup's zkSync only accounts for 1.76% of the Layer2 market.

Optimistic Rollup projects such as Arbitrum and OP launched mainnet early, taking the lead in ecological construction. Arbitrum's ecological quality is significantly higher than other Layer2 solutions, and its native ecological projects are more well-known, such as Radiant Capital, GMX, Camelot and Treasure DAO. In comparison, zkSync's ecological construction is relatively weak.

According to L2 Beat data, zkSync Era's TVL ranks 9th among Layer2 projects, behind Manta. The market share of Layer2 is mainly occupied by Rollup, among which Arbitrum's TVL is $2.4 billion, accounting for 51.6%; Optimism's TVL is $1.43 billion, accounting for 30.56%.

Regarding the stages shown in the figure above: To better distinguish and define Rollup, Vitalik et al. divided Rollup into three levels: Stage 0, Stage 1, and Stage 2, based on the degree of dependence of the Rollup project on training wheels/human intervention. The zkSync Era is classified as Stage 0, which means it is completely dependent on training wheels and meets the minimum standards of a Rollup.

Community Building

Community size

zkSync has a large community with a total size of over 2 million people. It has 1.4 million followers on the X platform and 779,000 members in the Discord community. This large user base demonstrates zkSync's influence in the market and the activity of the community.

Airdrop controversy

Recently, zkSync released the airdrop rules, which caused widespread dissatisfaction in the community. The airdrop rules set important weights on on-chain interactions, on-chain asset value and time, but the Sybil detection method is relatively simple. In the end, only 10% of the more than 6 million wallet addresses were eligible for airdrops, far below expectations. In addition, many ecological projects were also excluded from the airdrop list, which aroused many questions. Chinese community members expressed disappointment with the leadership of Matter Labs, believing that it was unbalanced in considering the interests of the community.

NFT market Elemen also tweeted that as the largest NFT market on ZKsync, they did not receive any airdrops and questioned whether this was a joke; zkApes also tweeted that the platform generated $15 million in gas fees but failed to receive any airdrops.

Ecological Rug Event

The airdrop incident is not the first time that zkSync officials have ignored community interests. Several previous Rug incidents have caused damage to user rights, and the community is dissatisfied with the official inaction. For example, zkSync lending protocol Eralend suffered a loss of $3.4 million due to a flash loan attack, xBank Finance lost $550,000 due to a hacker attack and its liquidity was close to zero, and the ZKasino incident. Although some projects were sold or attackers were arrested, zkSync officials failed to effectively protect user interests. Community members believe that the zkSync team has not fulfilled its responsibilities in ecological construction, but is more concerned about gas income. This mismanagement and disregard for user rights will bring greater challenges to zkSync.

Summarize

zkSync is an Ethereum Layer 2 scaling solution developed by Matter Labs, which enables faster and lower-cost transactions through zero-knowledge proofs and Rollup architecture. Its core components include zkEVM, account abstraction, zkPorter, etc., highlighting its innovations in security and usability. However, due to the complexity of technical implementation, zkSync requires more time and resources than the Optimistic Rollup project. Despite having a large community and sufficient financing support, its ecosystem construction and user participation still face challenges, especially in the dispute over airdrop allocation and Rug event handling, which affects the community's trust and market performance.